Capital Gains Tax Investment Property Victoria

Main Residence Your main residence is exempt from capital gains tax as long as there is a dwelling on the property. Besides sales tax excise tax property tax income tax and payroll taxes individuals who buy and sell personal and investment assets must also contend with the capital gains tax system.

Capital Gains Tax And Your Property In Portugal My Guide Algarve

Capital Gains Tax And Your Property In Portugal My Guide Algarve

Capital losses can be offset against capital gains and net capital losses in a tax year may be carried forward indefinitely.

Capital gains tax investment property victoria. Under the new Capital Gains Tax legislation which came into effect on the 30th of September 1999 it is possible for an individual to calculate the CGT they will have to pay in one of two ways. You can sell a property and defer taxes using a proprietary trust using Section 453. Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income.

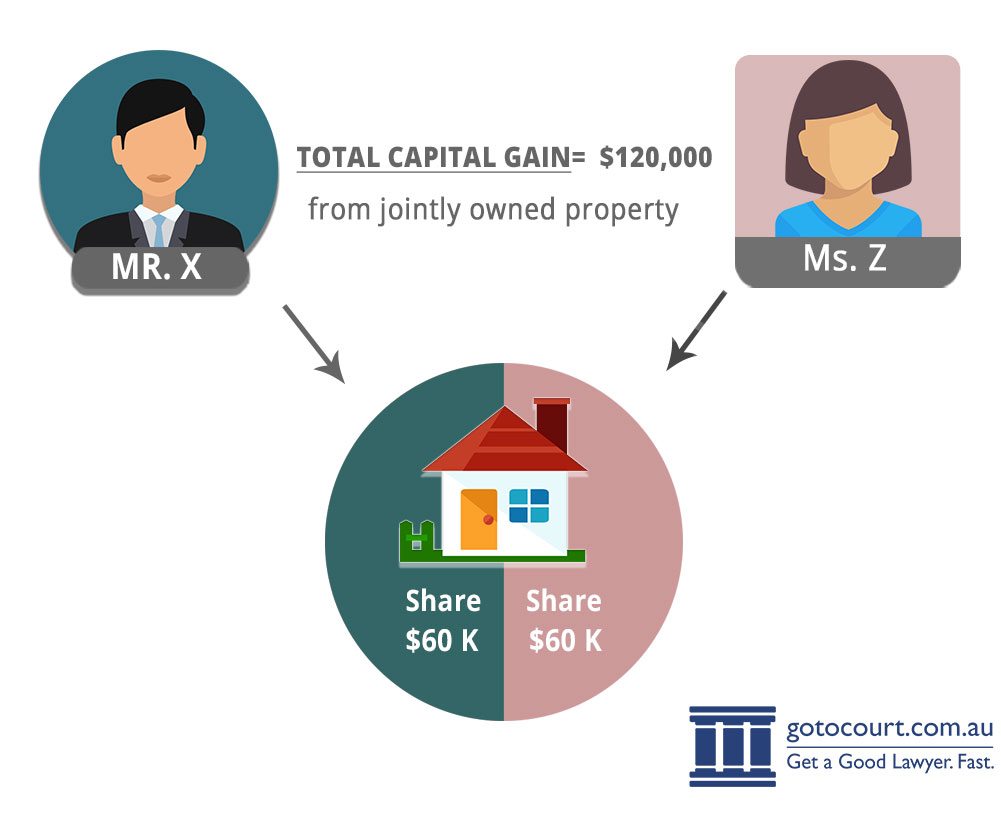

205000 x 15 30750 capital gains taxes. It applies to property shares leases goodwill licences foreign currency contractual rights and personal use assets purchased for more than 10000. If you sell a capital asset such as real estate or shares you usually make a capital gain or a capital loss.

By Ellen Chang Contributor Jan. If you sell assets like vehicles stocks bonds collectibles jewelry precious metals or real estate at a gain youll likely pay a capital gains tax on. The IRS allows 250000 of tax-free profit on a primary residenceWhat this means in a simplified sense is if you bought your primary residence for 300000 in 2010 lived in it for 8 years and then sold it in 2018 for 550000 you wouldnt have to pay any capital gains tax.

According to the ATO most personal assets are exempt from CGT including your home car and most personal use assets such as furniture. You can defer the capital gains tax state tax depreciation recapture and the Obamacare tax on the gain on the sale of an investment property and you can also defer all of the taxes except the depreciation recapture on the sale of a luxury residential property that creates a large tax liability. About the Capital Gains Tax Estimator.

The amount of capital gains taxes you pay varies depending on the profit made and your specific situation. For instance if you lived in the property for two years and rented it out for eight years then 20 of the time it wasnt for investment purposes so you may get a 20 exemption on the capital gains tax and only pay the 80 for when it was an investment. Using the Capital Gains Tax Calculator.

Capital Gains Tax on Your Investment Property. Generally the property needs to be nominated as either a main residence or investment at the time of sale as this is when capital gains tax is normally calculated. However capital losses cannot be offset against normal income.

Capital gains tax CGT is the levy you pay on the capital gain made from the sale of that asset. 12 Months Property Ownership If you are an Australian resident and have owned the property for more than 12 months you are able to claim a 50 discount on the capital gains tax payable. Weve got all the 2020 and 2021 capital gains tax rates in one.

When you make a profit in any business the government takes a share of the gains you make by charging you with tax. If you sell rental or investment property you can avoid capital gains and depreciation recapture taxes by rolling the proceeds of your sale into a similar type of investment. The Capital Gains Tax Estimator provides an indication of the amount of capital gains tax you may be required to pay on an investment property.

Sourced from the Australian Tax Office. Capital Gains Tax Calculator Values. Capital gains taxes are taxes you pay on profit from selling your real estate investment property.

A capital gain or loss is the difference between what you paid for an asset and what you sold it for less any fees incurred during the purchase. Elaine is a single-filing taxpayer with an annual income of 100000. In some circumstances you can roll over capital gains tax until a later date.

The capital gains tax rate is 15 if youre married filing jointly with. Capital gains tax CGT for those who are new to this is the levy you pay on the capital gain made from the sale of that asset. Because she earns more than 78750 per year Elaine will be taxed on 15 percent of her total capital gain.

Selling rental properties can earn investors immense profits but may result in significant capital gains tax burdens. Understanding Capital Gains Tax on a Real Estate Investment Property Real estate properties generate income for investors but taxes play a factor in returns. Using the example above lets calculate the capital gains taxes on Elaines investment property.

This is the difference between what it cost you to acquire the asset and what you receive when you dispose of it. For example if you had 53000 in capital gains from selling your investment property and in the same tax year had 50000 in losses from a bad stock investment your capital gains would be. The same goes with property investments when you record a profit or gain after selling your investment property you are expected to paying your share of capital gains tax.

For successful investors selling a property can result in significant capital gains tax if you dont take action to prevent. You need to report capital gains and losses in your income tax return and pay tax on your capital gains.

Increase Your Eco Friendly Lifestyle To Prevent Climate Change And Increase Your Financial Iq Investing Real Estate Investing Finance Investing

Increase Your Eco Friendly Lifestyle To Prevent Climate Change And Increase Your Financial Iq Investing Real Estate Investing Finance Investing

What Is The Six Year Rule For Capital Gains Tax

What Is The Six Year Rule For Capital Gains Tax

How To Avoid Capital Gains Tax When You Sell A Rental Property

How To Avoid Capital Gains Tax When You Sell A Rental Property

Rsus Restricted Stock Units Essential Facts Key Dates Stock Options Capital Gains Tax

Rsus Restricted Stock Units Essential Facts Key Dates Stock Options Capital Gains Tax

Flipping Houses Taxes Flipping Houses Buying A Rental Property Capital Gain

Flipping Houses Taxes Flipping Houses Buying A Rental Property Capital Gain

Calculating Capital Gains Tax Cgt In Australia

Calculating Capital Gains Tax Cgt In Australia

Real Estate Or Stocks Which Is A Better Investment

Real Estate Or Stocks Which Is A Better Investment

Real Estate Buyer Tip Understanding A 1031 Exchange A 1031 Exchange Allows Investors To Defer Capital Gai Capital Gains Tax Real Estate Buyers Capital Gain

Real Estate Buyer Tip Understanding A 1031 Exchange A 1031 Exchange Allows Investors To Defer Capital Gai Capital Gains Tax Real Estate Buyers Capital Gain

Using A 1031 Exchange To Turn A Rental Property Into A Primary Residence In 2020 Rental Property Property Investment Property

Using A 1031 Exchange To Turn A Rental Property Into A Primary Residence In 2020 Rental Property Property Investment Property

Investment Property Tax Capital Gains Tax Deductions On Property Uno

Investment Property Tax Capital Gains Tax Deductions On Property Uno

How To Avoid Capital Gains Tax When Selling Property Finder Com

How To Avoid Capital Gains Tax When Selling Property Finder Com

How To Avoid Paying Capital Gains Tax Cgt When Selling A Property

How To Avoid Paying Capital Gains Tax Cgt When Selling A Property

How Do You Avoid Capital Gains Tax On Real Estate Realtor Com Capital Gains Tax Capital Gain Tax

How Do You Avoid Capital Gains Tax On Real Estate Realtor Com Capital Gains Tax Capital Gain Tax

11 Strategies To Minimise Your Capital Gains Tax

11 Strategies To Minimise Your Capital Gains Tax

The Beginner S Guide To Capital Gains Tax Infographic With Images Capital Gains Tax Capital Gain Investment Companies

The Beginner S Guide To Capital Gains Tax Infographic With Images Capital Gains Tax Capital Gain Investment Companies

Common Misconception In Strata Living Owners Corporations Owners Corporation Management Companies Or Not Connect W Management Company Management Corporate

Common Misconception In Strata Living Owners Corporations Owners Corporation Management Companies Or Not Connect W Management Company Management Corporate

How To Calculate Capital Gains Tax H R Block

How To Calculate Capital Gains Tax H R Block

How To Calculate Capital Gains Tax Cgt Echoice Guides

How To Calculate Capital Gains Tax Cgt Echoice Guides

1031 Property Exchange Faq Real Estate Investor Panel Discussion Real Estate Investor Real Estate Real Estate Investing

1031 Property Exchange Faq Real Estate Investor Panel Discussion Real Estate Investor Real Estate Real Estate Investing