Capital Gains Tax Ireland House Sale

These assets can include land and residential and non-residential buildings¹¹. When you sell your primary residence 250000 of capital gains or 500000 for a couple are exempted from capital gains taxation.

Harvesting Capital Gains Vs Roth Conversions At 0 Tax Rates

Harvesting Capital Gains Vs Roth Conversions At 0 Tax Rates

This article explains how Capital Gains Tax can arise on the disposal of properties and shares and the rules applying in the calculation of the gain or loss on a sale of an asset.

Capital gains tax ireland house sale. Capital Gains Calculator Ireland If you sell a property that is not your primary residence for more than you paid for it you will have a capital gain which is taxable. You must account for and report this sale on your tax return. For example 3 years ago you bought a property worth 100000.

You must report all 1099-B transactions on Schedule D Form 1040 Capital Gains and Losses and you may need to use Form 8949 Sales and Other Dispositions of Capital Assets. The total capital gains is. What should I know about paying capital gains tax for my property in Ireland.

Long-term capital gains taxes apply to profits from selling something youve held for a year or more. You can sell your primary residence exempt of capital gains taxes on the first 250000 if you are single and 500000 if married. Certain periods of absence from living in the property can be deemed to be periods of occupation or residence making the owner eligible for full relief from Capital Gains Tax.

The only time you are going to have pay capital gains tax on a home sale is if you are over the limit. Capital gains tax is paid when you gain from the sale gift or exchange of an asset. The chargeable gain is calculated on the gain arising on disposal not the sales price so for example if you but property for 50000 and sell for 100000 then your gain will be clearly 50000.

After holding it for 3 years the propertys value went up to 250000. Question We are an. If you sell your home for a net gain of more than 500000 couples filing jointly or 250000 singles the gain in excess of the threshold is subject to capital gains tax.

In that case the long-term capital gains tax rates would be applicable. There are other rates for specific types of gains. When selling your primary home you can make up to 250000 in profit or double that if you are married and you wont owe anything for capital gains.

Long-term capital gains come into the picture when you sell an asset the house in this case after one year. Your gain is essentially the sales price of the property minus the present value of purchase price as well as any other allowable expenses. Work out your gain and pay your tax on buy-to-let business agricultural and inherited properties.

How Much is Capital Gains Tax on the Sale of a Home. If you make a gain on the disposal of an asset you may have to pay Capital Gains Tax on the gain. Capital Gains Tax when you sell a property thats not your home.

This exemption is only allowable once every two years. If you sell the property now for net proceeds of 350000 youll owe long-term capital gains tax on your 100000 net profit plus depreciation recapture on 90900 which is taxed at your marginal. The three long-term capital gains tax rates of 2019 havent changed in 2020 and remain taxed.

You have indicated that you received a Form 1099-B Proceeds From Broker and Barter Exchange Transactions. Generally a company that has such a gain will not pay capital gains tax it will pay corporation tax unless the sale is of development land. Principal Private Residence PPR Relief If the house is your only or main home you may be able to claim PPR Relief.

The rate of CGT is 33 for most gains. A rate of 40 however can apply to the disposal of certain foreign life assurance policies and units in offshore funds. Selling a house When you sell a house you may have to pay Capital Gains Tax CGT on the proceeds of the sale.

Calculating capital gains tax on your foreign rental property. Rate and payment of Capital Gains Tax The standard rate of Capital Gains Tax is 33 for disposals made on or after 5 December 2012. This is generally true only if you have owned and used your home as your main residence for at least two out of the five years prior to the sale.

If you lived in the residence for at least two out of the last five years the property is considered a primary residence and you may qualify for a 250000 deduction 500000 for married couples from any gain you had on the sale of the property. The current rate of Capital Gains Tax is 33.

Quotations Can Be Comparables For Arms Length Pricing Determination Http Taxworry Com Cup Method Can Quotation Quotations Determination Capital Gains Tax

Quotations Can Be Comparables For Arms Length Pricing Determination Http Taxworry Com Cup Method Can Quotation Quotations Determination Capital Gains Tax

Capital Gains Tax Calculator Real Estate 1031 Exchange Capital Gains Tax Capital Gain Gain

Capital Gains Tax Calculator Real Estate 1031 Exchange Capital Gains Tax Capital Gain Gain

Taxing Questions On Second Homes Houseopedia In 2020 Sell My House Home Buying We Buy Houses

Taxing Questions On Second Homes Houseopedia In 2020 Sell My House Home Buying We Buy Houses

The Tax Impact Of The Long Term Capital Gains Bump Zone

The Tax Impact Of The Long Term Capital Gains Bump Zone

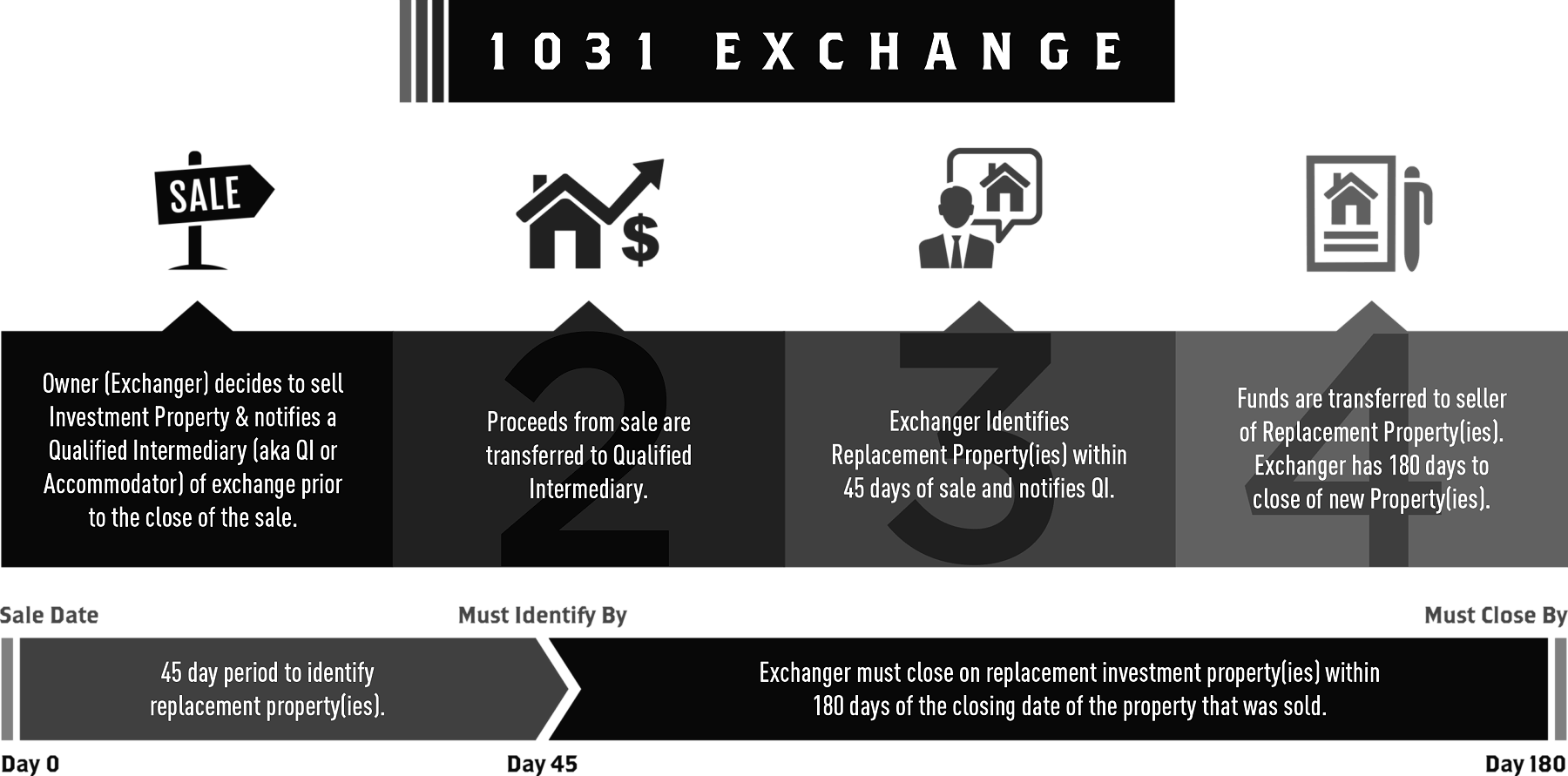

Real Estate Buyer Tip Understanding A 1031 Exchange A 1031 Exchange Allows Investors To Defer Capital Gai Capital Gains Tax Real Estate Buyers Capital Gain

Real Estate Buyer Tip Understanding A 1031 Exchange A 1031 Exchange Allows Investors To Defer Capital Gai Capital Gains Tax Real Estate Buyers Capital Gain

How To Save Capital Gains Tax On Sale Of Property Section 54 54f 54ec

How To Save Capital Gains Tax On Sale Of Property Section 54 54f 54ec

Will We Have To Pay Capital Gains Tax If Selling Our House In Ireland

Will We Have To Pay Capital Gains Tax If Selling Our House In Ireland

How Capital Gains Tax On Real Estate Can Be Reduced Or Deferred When Selling Property

How Capital Gains Tax On Real Estate Can Be Reduced Or Deferred When Selling Property

12 Ways To Beat Capital Gains Tax In The Age Of Trump

12 Ways To Beat Capital Gains Tax In The Age Of Trump

How To Make 80 000 In Crypto Profits And Pay Zero Tax

How To Make 80 000 In Crypto Profits And Pay Zero Tax

Is Capital Gain Tax Incapable Of Levying Upon Registration Of Sale Deed Know How Capital Gains Tax Capital Gain Gain

Is Capital Gain Tax Incapable Of Levying Upon Registration Of Sale Deed Know How Capital Gains Tax Capital Gain Gain

How To Save Capital Gains Tax On Property Sale Capital Gain Capital Gains Tax Tax

How To Save Capital Gains Tax On Property Sale Capital Gain Capital Gains Tax Tax

Steps To Take In Calculating Capital Gains For Selling Foreign Property

Steps To Take In Calculating Capital Gains For Selling Foreign Property

The Pcmc I E The Pimpri Chinchwad Municipal Corporation Has Generated Decent Revenue From The Property Ta Property Tax Property Management Investment Property

The Pcmc I E The Pimpri Chinchwad Municipal Corporation Has Generated Decent Revenue From The Property Ta Property Tax Property Management Investment Property

How High Are Capital Gains Taxes In Your State Tax Foundation

How High Are Capital Gains Taxes In Your State Tax Foundation

Capital Gains And Losses 10 Things You Must Know Virtually Everything You Possess And Use For Personal Or Inves Capital Gain Capital Gains Tax Paying Taxes

Capital Gains And Losses 10 Things You Must Know Virtually Everything You Possess And Use For Personal Or Inves Capital Gain Capital Gains Tax Paying Taxes

How To Avoid Capital Gains Taxes When Selling Your House 2020

How To Avoid Capital Gains Taxes When Selling Your House 2020

The Beginner S Guide To Capital Gains Tax Infographic Transform Property Consulting Capital Gains Tax Capital Gain Investment Companies

The Beginner S Guide To Capital Gains Tax Infographic Transform Property Consulting Capital Gains Tax Capital Gain Investment Companies