Lakewood Ohio Property Tax Calculator

Tax Year 2020Collection Year 2021. The following chart shows how the average residential property tax bill for Lakewood residents compares to other cities in Pierce County.

Real Property Tax Homestead Means Testing Department Of Taxation

Real Property Tax Homestead Means Testing Department Of Taxation

Lakewood OH 44107 216 521-7580.

Lakewood ohio property tax calculator. Lakewood receives approximately 72 of the property taxes paid by Lakewood residents or 09140 per 100000 of assessed value. Ohio has a progressive income tax system with six tax brackets. Child care and Taxes with details on state and local sales.

2021 Cost of Living Calculator. Penalty and Interest Ohio Revised Code section 323121. A salary of 96000 in Lakewood Ohio should increase to 99792 in United States assumptions include Homeowner no Child Care and Taxes are not considered.

To participate all taxes must be paid up to date or on a valid delinquent payment agreement. For all filers the lowest bracket applies to income up to 22150 and the highest bracket only applies to income above 221300. Real property tax on median home.

Factors in Your Ohio Mortgage Payment. Sales Tax State Local Sales Tax on Food. Rates vary by school district city and county.

The city of Lakewood has a tax rate of one and one-half percent 15 but allows a credit of up to one-half of one percent 05 for a tax withheld for other localities by the employer. Our Premium Calculator Includes. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Lakewood OH 44107 216 521-7580. Your actual property tax may be more or less than the value calculated in the estimator.

Ohios property tax rates are higher than the national average with an effective rate of 148. Tax Year 2019Collection Year 2020. 800 AM to 430 PM.

Lakewood Ohio vs United States Change Places. Property tax rates in Ohio are expressed as millage rates. Counties in Ohio collect an average of 136 of a propertys assesed fair market value as property tax per year.

Rates range from 0 to 4797. 800 AM to 430 PM. The Ohio Department of Taxation is dedicated to providing quality and responsive service to you our individual and business taxpayers our state and local governments and the tax practitioners in Ohio.

Overview of Ohio Taxes. Lakewood OH 44107 216 521-7580. Because of the differences in assessed value described above millage rates in one county cannot be directly compared to another.

There is no city sale tax for Lakewood. Average value of home in Lakewood is 378347. Lakewood OH 44107 216 521-7580.

800 AM to 430 PM. How 2021 Sales taxes are calculated in Lakewood. Thanks for visiting our site.

Ohio is ranked number twenty two out of the fifty states in order of the average amount of property taxes collected. The Lakewood Ohio general sales tax rate is 575The sales tax rate is always 8 Every 2021 combined rates mentioned above are the results of Ohio state rate 575 the county rate 225. - Compare Cities cost of living across 9 different categories - Personal salary calculations can optionally include Home ownership or rental Child care and Taxes with details on state and local sales income property and automobile taxes - Includes the cost of Child Care for toddlers or infants at a day.

EasyPay is a convenient and secure program that allows taxpayers to have property tax payments automatically withdrawn from a checking or savings account on a monthly annual or semi-annual basis. Property Tax Estimator Use this tool to estimate the current level of full year property taxes based on your opinion 2020 value associated with your property. The median property tax in Ohio is 183600 per year for a home worth the median value of 13460000.

Ohio Property Tax Rates. One mill is equal to 1 of tax for every 1000 in assessed value. Our goal is to help make your every experience with our team and Ohios tax system a success.

In addition to your monthly mortgage payment youll have property taxes and insurance to deal with as associated homeowner costs. Our Ohio Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Ohio and across the entire United States. Property taxes in the Buckeye State pay for county services such as parks.

800 AM to 430 PM.

Https Tax Ohio Gov Static Forms Ohio Individual Individual 2019 Pit It1040 Booklet Pdf

Compare New Property Tax Rates In Greater Cleveland Akron Part Of South Euclid Now Has Top Rate In Northeast Ohio Cleveland Com

Compare New Property Tax Rates In Greater Cleveland Akron Part Of South Euclid Now Has Top Rate In Northeast Ohio Cleveland Com

Ohio Property Tax Calculator Smartasset

Ohio Property Tax Calculator Smartasset

Ohio Property Taxes By County 2021

1633 Cordova Ave Lakewood Oh 44107 Zillow

1633 Cordova Ave Lakewood Oh 44107 Zillow

Mortgage Down Payment Infographic Fha Loans Real Estate Infographic Usda Loan

Mortgage Down Payment Infographic Fha Loans Real Estate Infographic Usda Loan

States With Highest And Lowest Sales Tax Rates

States With Highest And Lowest Sales Tax Rates

Penalties And Fees For Paying Ohio Income Tax Late Gudorf Tax Group

Penalties And Fees For Paying Ohio Income Tax Late Gudorf Tax Group

Ohio Paycheck Calculator Smartasset

Ohio Paycheck Calculator Smartasset

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

1612 Orchard Grove Ave Lakewood Oh 44107 Zillow

1612 Orchard Grove Ave Lakewood Oh 44107 Zillow

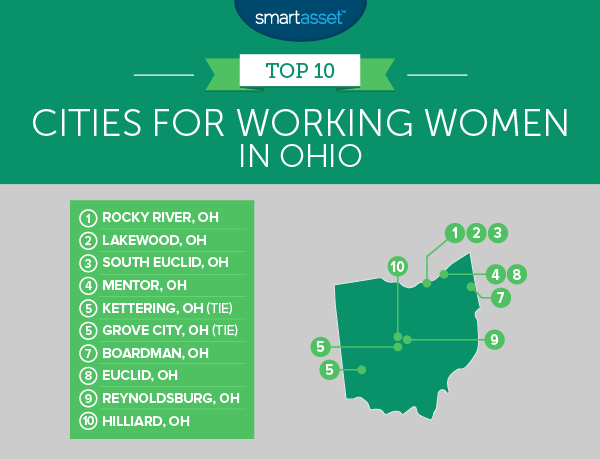

The Best Cities For Working Women In Ohio Smartasset

The Best Cities For Working Women In Ohio Smartasset

16811 16813 Seneca Ave Lakewood Oh 44107 Zillow

16811 16813 Seneca Ave Lakewood Oh 44107 Zillow

2163 Elbur Ave Lakewood Oh 44107 Zillow

2163 Elbur Ave Lakewood Oh 44107 Zillow

Not All Senior Citizens Still Qualify For Ohio Property Tax Discounts Homestead Savings Calculator Cleveland Com

Not All Senior Citizens Still Qualify For Ohio Property Tax Discounts Homestead Savings Calculator Cleveland Com

Https Www Reveretitle Com Wp Content Uploads 2020 03 Cuyahoga County 2019 Payable 2020 Tax Rates Revere Ind Pdf

The Official Site Of The Cuyahoga County Fiscal Officer

The Official Site Of The Cuyahoga County Fiscal Officer

Property Tax Estimator Fiscal Officer

Property Tax Estimator Fiscal Officer