Nyc Solar Property Tax Abatement Form

The abatement is spread equally over four years and may not exceed your property tax liability for any given year. Owners of cooperative units and condominiums who meet the requirements for the Cooperative and Condominium Property Tax Abatement can have their property taxes reduced.

Https Nysolarmap Com Media 2051 Stein Dob Solar Presentation Final Updated On 3 27 20 Compatibility Mode Pdf

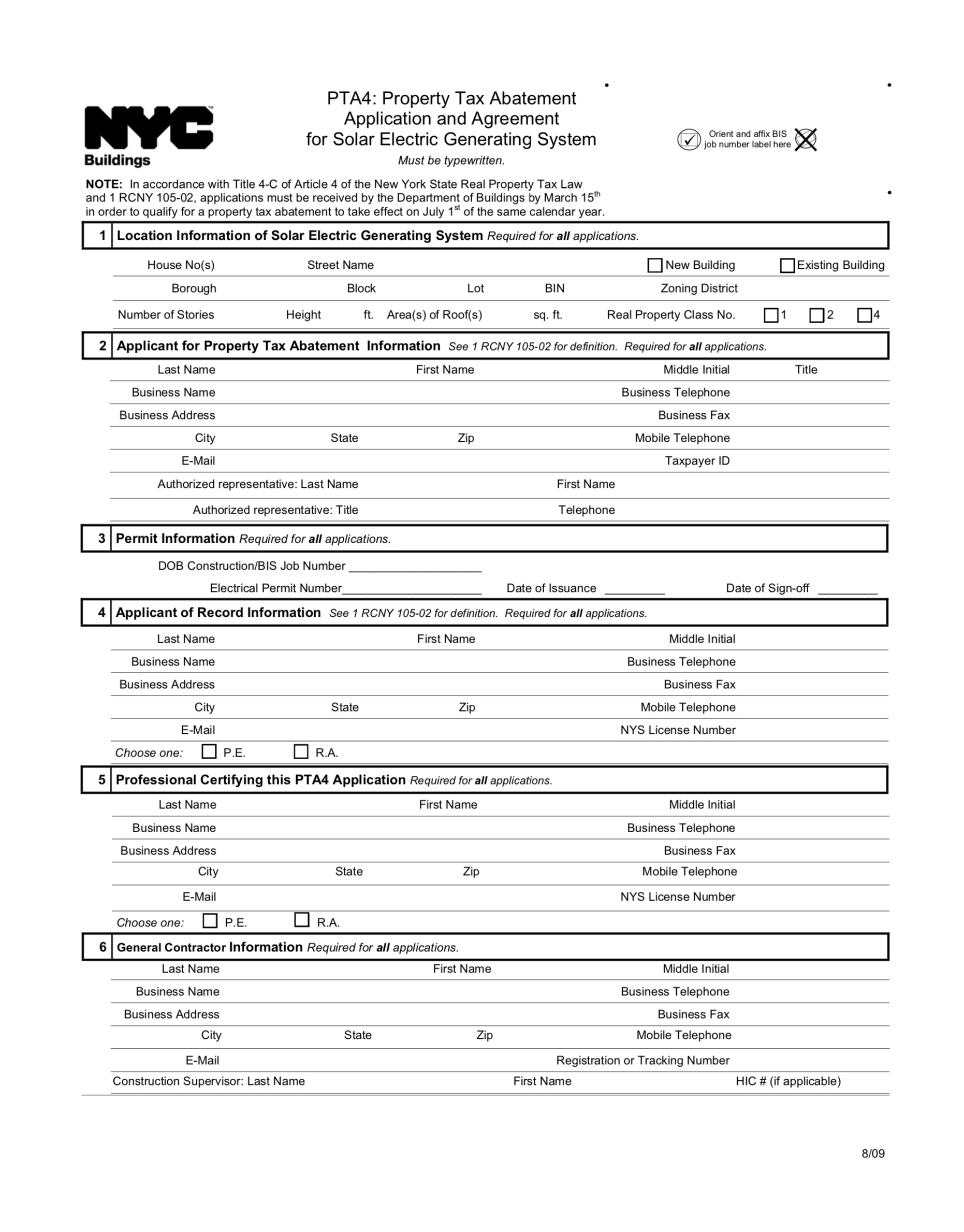

Enacted in 2008 the legislation dictates that buildings with rooftop solar PV in cities of 1 million or more people are eligible for tax abatements.

Nyc solar property tax abatement form. I the applicant for property tax abatement as represented on this form in section 2 and by my signature below certify and agree to the following. Office of Real Property Tax Services Application for Tax Exemption of Solar Wind or Certain Other Energy Systems Certification I we hereby certify that the information on this application and any. 2 Is the energy system installed on property owned or controlled by New York State a department or.

Provides a property tax abatement to properties that use solar power. New York City Property Tax Abatement PTA. Abatements are capped at 62500 per year or 250000 total.

The filing period for tax year 2021-2022 is now open. It will close February 16 2021. Using Solar power reduces demand on New York Citys electrical grid.

New York City offers property tax abatements to property owners that install solar electric-generating systems photovoltaic solar panels on their buildings. Building owners who place a grid-connected solar energy system into service from January 1 2014 to January 1 2024 are eligible for a four-year Tax Abatement of 5 per year of the installed cost of the system for a total of up to 20. Eligible system expenditures include.

File this form with your local property assessor. We share tips to help you through the process. New York City offers property tax abatements to property owners that install solar electric-generating systems photovoltaic solar panels on their buildings.

Tax abatements for solar panels. Solar power is a reliable renewable source of electricity. The NYC property tax abatement incentive is a program designed to encourage property owners to install solar PV systems for distributed electricity generation.

In order to pursue the property tax abatement projects must be filed along with a PTA4 Application at The HUB. Form RP-487 Application for Tax Exemption of Solar Wind or Certain Other Energy Systems The New York State Energy Research and Development Authority is authorized to establish definitions and guidelines for the eligibility for exemption of the solar and wind energy equipment and systems farm waste energy equipment and systems micro-hydroelectric equipment and. New York Citys property tax abatement allows residents who install solar systems before January 1 2019 to deduct an annual 5 off of system expenditures for the next four years thats a 20 system cost deduction.

This building has not been previously represented as an eligible building under Title 4-C of the New York State Real Property Tax Law. Address of any residential property owned in another state the legal name of the trust if applicable 2019 federal or state income tax returns for all owners. Form RP 487 from New York State Department of Taxation and Finance.

The Solar Electric Generating System SEGS Tax Abatement encourages NYC homeowners to install solar systems by offering a four-year tax abatement of 5 per year of the installed systems cost for a total of up to 20. A tax abatement is an incentive that allows building owners to deduct some or all of the cost of installing solar from their property taxes. NYC Solar Tax Abatement Program Details.

The program allows property owners to deduct 5 of the cost of a solar installation each year for four consecutive years from property tax bills up to 6250000. RP-420-ab-Vlg Fill-in Instructions on form Application for Real Property Tax Exemption for Property of Nonprofit Organizations in Villages Using Town or County Assessment Roll as the Basis for the Village Assessment Roll. Solar panels generate electricity recover thermal energy for reuse and act as a roof covering.

Total wages salaries and tips. An additional solar tax incentive. Visit the NYC Department of Buildings to download the PTA4 form and PTA4 instructions to get more information on the citys solar installations.

Instructions on form Application for Real Property Tax Exemption For Nonprofit Organizations II - Property Use. The amount of the abatement is based on the average assessed value of the residential units in the development. Some places like New York City have an additional tax incentive for solar installations.

Abatements are applied after the NY-Sun Incentive and capped at. Instead of the tax exemption property owners in New York City who go solar may apply for the Real Property Tax Abatement Program. In order to pursue the property tax abatement projects must be filed along with a PTA4 Application at The HUB.

Building owners who place a grid-connected solar energy system into service from January 1 2014 through January 1 2024 are eligible for a four-year Tax Abatement of 5 per year of the installed cost of the system for 4 years total of 20. If you were not required to file a 2019 income tax return you will need the following additional information for all property owners. The NYC property tax abatement is a powerful incentive for building owners to install solar systems.

New York City Property Tax Abatement PTA. Some municipalities and school districts have opted out and will include the value of the solar installation in your property tax assessment without the exemption. New York state government passed legislation allowing for a property tax abatement on solar PV equipment expenditures.

Nyc Solar Property Tax Abatement Pta4 Explained 2021

Nyc Solar Property Tax Abatement Pta4 Explained 2021

New York City S Solar Property Tax Abatement Ends Soon Solar Power House Solar Panel Installation

New York City S Solar Property Tax Abatement Ends Soon Solar Power House Solar Panel Installation

Nyc Solar Incentives And Property Tax Abatement For Solar Photovoltaics Hi Solar

Https Nysolarmap Com Media 1535 Updatedcunyptaoutreachdoc328 10516final Pdf

Http Www1 Nyc Gov Assets Buildings Pdf Solar Inspection Fact Sheet Rb Pdf

Shared Solar Nyc Gateway Participate Shared Solar Nyc Gateway

Shared Solar Nyc Gateway Participate Shared Solar Nyc Gateway

Nyc Solar Incentives And Property Tax Abatement For Solar Photovoltaics Summit Solar Energy We Offer Energy Efficient Cost Effective Industry Leading Equipment To Power Your Home With Clean Renewable Solar Energy

Nyc Solar Incentives And Property Tax Abatement For Solar Photovoltaics Summit Solar Energy We Offer Energy Efficient Cost Effective Industry Leading Equipment To Power Your Home With Clean Renewable Solar Energy

Http Www Cynthiaramirez Nyc Uploads 1 1 8 7 118704813 Class 1 Guide 1 Pdf

Http Www Nyc Gov Html Dob Downloads Rules 1 Rcny 105 02 Pdf

Leverage Four Disappearing Solar Incentives In 2020 Crauderueff Solar

Leverage Four Disappearing Solar Incentives In 2020 Crauderueff Solar

Https Www1 Nyc Gov Assets Buildings Rules 1 Rcny 105 02 Prom Details Date Pdf

Solar Property Tax Exemptions Explained Energysage

Solar Property Tax Exemptions Explained Energysage

New York City Solar Incentives Venture Solar Panel Installation

New York City Solar Incentives Venture Solar Panel Installation

Solar In Westchester County Venture Solar Solar Panel Power Installation

Solar In Westchester County Venture Solar Solar Panel Power Installation

State Renews And Revises Green Roof Tax Abatement Program

State Renews And Revises Green Roof Tax Abatement Program

Resources Updated Information About Solar Design Sologistics

Resources Updated Information About Solar Design Sologistics