Personal Use Property Hst

Currently there is no computation validation or verification of the information you enter and you are still responsible for entering all required information instructions may require some information to be handwritten on the form. HST on Services Related to Tangible Personal Property The application of HST depends on whether or not the tangible personal property stays in the same provinces while the service is performed.

A supply of real property made by way of sale of personal use property ie.

Personal use property hst. The biggest reason is that personal use property owned by a corporation will result in taxable benefits being applicable to the individual shareholder s. If a registered individual acquires a newly constructed home from a builder and intends to use 25 of it for the individuals exempt medical practice lease 30 of it to a dentist and use the remaining 45 as the individuals personal residence the individual is able to claim ITCs of 30 the commercial use of the GSTHST paid with respect to the acquisition of the residence because even though the total use is not primarily commercial neither is the total use primarily personal. If a farmer sells or transfers ownership of farmland to a related individual who after the transfer uses the land for their own personal use and enjoyment that sale or transfer is exempt from GSTHST.

HST will NOT be payable on the price if the property sold by the seller and bought by the buyer is personal use property. These exemptions are very fact specific as there are often narrow distinctions between farmland used residential property and personal use recreational property. However the acquisition of vacant land may be exempt from HST in certain situations such as personal use recreational property or lands acquired from charitable organizations.

Sale to a relative or former spouse for their personal use of a parcel of land created by subdividing another parcel As a general rule. Vacant land by an individual or a personal trust where. However if the seller had been renting out the property more than 50 of the time during the sellers ownership then it will be deemed to a commercial property the price will likely be subject to HST.

If you are a seller ensure the price you are willing to accept is before HST. HST will not be payable on the price if the property sold by the seller and bought by the buyer is personal use property. However if the seller had been renting out the property more than 50 of the time during the sellers ownership the price will likely be subject to HST.

This is because this type of property usually does not increase in value over the years. Personal-use property When you sell personal-use property such as cars and boats in most cases you do not end up with a capital gain. Vendors often rely on the used residential housing or personal use property exemptions.

If the property being sold was part of a rental pool HST will apply. Provided the vendor is an individual or a personal trust a real property transaction that does not fall into any of the above categories should be subject to an HST exemption. As a result you may end up with a loss.

These may include personally-owned cars homes appliances apparel food items and so on. The exemption may also apply where a farmer changes the use of farmland and begins to use the land for their own personal use. Personal use property is used for personal enjoyment as opposed to business or investment purposes.

Fill-in forms use the features provided with Acrobat 50 products. For GSTHST purposes the term individual s does not include a partnership consisting of individuals. Sale by a Partnership Trust or Corporation to a Partner Beneficiary Shareholder or Related Person for their personal use and enjoyment where immediately before the transfer all or substantially all this generally means 90 or more of the property of the partnership trust or corporation is used in the business of farming and the partner beneficiary shareholder or spouse or child of that individual is actively engaged in the business of the partnership trust or corporation.

It focuses on sales of personal use land rather than land sold in a business and provides examples of how the GSTHST applies to common situations involving these sales. If you are a purchaser ensure the price you are willing to pay includes HST. For the purposes of the capital property subdivision the Act provides authority by regulation to prescribe property to be personal property and not real property.

A land parcel was subdivided or severed into two parts and the individual trust or settlor did not subdivide or sever that parcel from another parcel of land or. Similarly where an individual was not entitled to claim an ITC for the GSTHST paid or payable on the purchase of a vacation property ie the property was purchased primarily for personal use the individual may be entitled to claim an ITC under the change-in-use rules if at a later date the individuals personal use of the vacation property decreases so that the property is no longer used primarily for personal purposes ie the extent of use in making taxable short-term rentals. Where a vendor provides a purchaser with a certificate indicating that their transaction is not subject to GST but this status is later determined to be false or incorrect section 194 of the ETA provides the purchaser with some protection.

The application of the HST is based on the use immediately before a sale so if the seller has used it exclusively in short term rentals similar to a hotel motel etc where HST was applied to the rentals then they must collect HST on the sale of the property Given your changing the use of the property by using it for personal use and enjoyment the HST paid on the property is not recoverable by you and becomes part of the purchase price. A registrant determines the amount of an ITC claimable on taxable capital property based on intended use in its commercial activities. The relevant provision under the Income Tax Act that requires a taxable benefit is subsection 15 1 which reads as follows.

Vacant land that is intended for personal use will usually meet this standard. For instance if you provide automobile repair services in Ontario the vehicles are staying in Ontario while you make the repairs and subject to HST at a rate of 13.

How To Use Your Home Equity To Build A Comfy Retirement Real Estate Investing Books Real Estate Investment Fund Equity

How To Use Your Home Equity To Build A Comfy Retirement Real Estate Investing Books Real Estate Investment Fund Equity

How To Track Record Gst Hst Vat Payments Bookkeeping Software Mortgage Payment Records

How To Track Record Gst Hst Vat Payments Bookkeeping Software Mortgage Payment Records

New Residential Rebate Information Renting Out Your House First Apartment First Apartment Tips

New Residential Rebate Information Renting Out Your House First Apartment First Apartment Tips

A New Day Quilt Pdf Pattern Traditional Quilts New Day Quilts

A New Day Quilt Pdf Pattern Traditional Quilts New Day Quilts

Infographic Costs You Ll Encounter When You Buy A Home Rew Ca Buying First Home Home Buying Buying Your First Home

Infographic Costs You Ll Encounter When You Buy A Home Rew Ca Buying First Home Home Buying Buying Your First Home

Hst Issues In Commercial Real Estate Transactions Potential Bad Bargains Pallett Valo Llp

Hst Issues In Commercial Real Estate Transactions Potential Bad Bargains Pallett Valo Llp

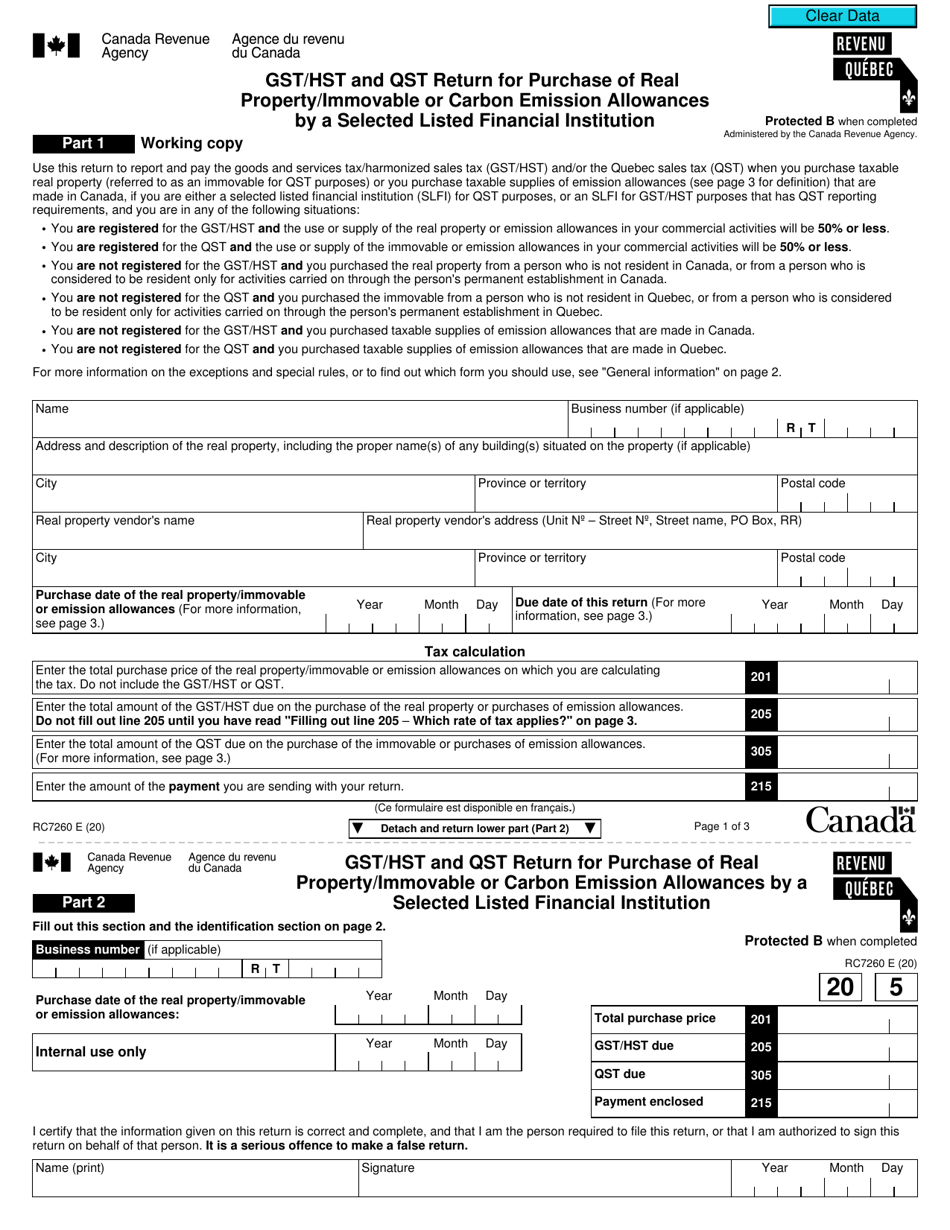

Form Rc7260 Download Fillable Pdf Or Fill Online Gst Hst And Qst Return For Purchase Of Real Property Immovable Or Carbon Emission Allowances By A Selected Listed Financial Institution Canada Templateroller

Form Rc7260 Download Fillable Pdf Or Fill Online Gst Hst And Qst Return For Purchase Of Real Property Immovable Or Carbon Emission Allowances By A Selected Listed Financial Institution Canada Templateroller

Mac Rushmetal Pigment Rare Mac Pigment Makeup Cosmetics Makeup Eyeshadow

Mac Rushmetal Pigment Rare Mac Pigment Makeup Cosmetics Makeup Eyeshadow

The Accounting And Tax In Canada Personal Financial Planning Financial Financial Education

The Accounting And Tax In Canada Personal Financial Planning Financial Financial Education

The Tax Impact Of Buying Back Gold And Silver Jewellery Srj Chartered Accountants Professional Corporation

The Tax Impact Of Buying Back Gold And Silver Jewellery Srj Chartered Accountants Professional Corporation

Christmas Tree Mini Quilt Pattern From Laundry Basket Quilts Laundry Basket Quilts Mini Quilt Patterns Christmas Quilt Patterns

Christmas Tree Mini Quilt Pattern From Laundry Basket Quilts Laundry Basket Quilts Mini Quilt Patterns Christmas Quilt Patterns

What Has To Be On Invoices For Canadian Small Business Owners Invoice Sample Small Business Canada Invoice Template

What Has To Be On Invoices For Canadian Small Business Owners Invoice Sample Small Business Canada Invoice Template

5 Common Hst Questions When Renovating A Property

5 Common Hst Questions When Renovating A Property

Real Property Investors Gst Hst Implications When Change Of Use Occurs Djb Chartered Professional Accountantsdjb Chartered Professional Accountants

Real Property Investors Gst Hst Implications When Change Of Use Occurs Djb Chartered Professional Accountantsdjb Chartered Professional Accountants

How To Calculate Hst On New Homes In Ontario

How To Calculate Hst On New Homes In Ontario

How Does Gst Hst Work When Purchasing A Rental Home Property Jmhca

How Does Gst Hst Work When Purchasing A Rental Home Property Jmhca

Do I Have To Pay Hst Upfront On A Rental Income Property In Canada

How To Make A Perfect Friendship Star Quilt Block Star Quilt Patterns Quilt Block Patterns Free Quilt Block Patterns

How To Make A Perfect Friendship Star Quilt Block Star Quilt Patterns Quilt Block Patterns Free Quilt Block Patterns