Property Name Transfer Charges In India

He thought all formalities for transfer of property were finally over once he successfully completed his home loan-related work registered the property in his name and paid the stamp duty on it. WAIVES STAMP DUTY ON TRANSFER OF LAND FLAT TO KIN or FAMILY MEMBERS.

What Are The Stamp Duty Registration Charges In Tamil Nadu

What Are The Stamp Duty Registration Charges In Tamil Nadu

If the conveyance deed is done and all dues are cleared then HUDA charges administrative charges of Rs5000- for transfer of the property otherwise transfer fee is charged by HUDA at the rate fixed from time to time.

Property name transfer charges in india. The buyer will also have to pay a premium of Rs 25000. Make sure the house is transferred to your name apply for mutation of. A property transfer to your family member or to a near and dear one is not as easy as you might think.

Transfer Of Application HUDA allows transfer the property from one owner to another owner. 500- stamp paper without paying stamp duty and registration fee. These fees will be increased to Rs 1000.

Can mutation of property directly done in nagar nigam. He announced that now immovable property such as land house or flat can be transferred to Owners Children or even to blood relatives simply by executing transfer deed on Rs. Indeed it is always safe that you seek legal help when it comes to property transfer.

The 2 CGHB charges are meant for the board for the purpose of transfer of name from leasehold to freehold. Legal requirements for gift deed As per the Transfer of Property Act the transfer of a house property under a gift has to be effected by a registered instrumentdocument signed by or on behalf of the person gifting the property and should also be attested by at least. It is really required to transfer the name in CGHB record.

What is property mutation and why is it important. Premium amount of Rs 25000. If the property tax amount goes beyond a limit Rs 500 then the civic administration charges an additional fee of Rs 15 for every Rs 100.

Transfer charges depend on the property tax charges. However in case the flat is being transferred among family member or to the legal heir of the actual owner after their death or mutual exchange of flats among the members this fee is not applicable. Payment of transfer fee of Rs 500 payable by the proposed transferee.

What do You Mean By Stamp Duty. The process of registration for a property transfer in India involves a payment of stamp duty and other registration costs. A conveyance deed is executed to transfer title from one person to another.

Rights in property can be transferred only on execution and registration of a sale deed in favour of the buyer. If the property is sold the title office will charge you a transfer fee based on the contract price listed on the Transfer of Land. If no money is changing hands such as a gift or change of ownership share the Title Office will charge you a 8730 fee in the 2018-2019 financial year.

And accordingly the House Registration Charges in AP will be levied. The property registration is mandatory in India as per the Indian Registration Act 1908. In most states in India 5 to 7 of the total market value of the property is charged as stamp duty while 1 is charged as registration fee.

I have heard that we can do this on 100rsstamp so plgude me how to do this. The original owner of the property is CGHB hence it is essential to transfer the name in the records of the board. If you own a property in India and wish to transfer it to another persons name you might as well think that your family member belongs to a similar group.

Conveyance Sale 7 of the market value of the property. Waives stamp duty on transfer of land or flat immovable property to Kin or family members. 4 of the market value of the property.

While transferring the title of your property to another person you will be charged property stamp duty. There are various circumstances in which one can. 7 of the market value on the property that has the greater value.

The buyer must also pay a transfer fee of Rs 500. The fees to transfer a property which has an annual property tax up to Rs 500 is Rs 500. 7 of the market value of the property.

You should have a valid legal document in your name to register your name for the property tax - Name transfer. Let us look at the process of property AP Registration. 4 of the market value of the property.

In this article we discuss the key aspects of gift of property in India. How to transfer house on sons name without stamp duty. The transfer of property is to be registered to obtain the rights of the property on the execution date of the deed.

Sahil Sharma did not know what mutation of property means. IStockPhoto 3 steps to take when you inherit a property 6 min read. This is the most popular method of property transfer in India.

Sale value then execution of SALE DEED can. 23 Dec 2015 0137 AM IST Ashwini Kumar Sharma. Honble Revenu Minister Eknath Khadase announced in Assembly on 25-032015 that Govt.

Sirji my father age 97wants to transfer his house on my namewe are 3 brothers-2 alive4 sistersnow is there any way to transfer without sale deedfather has given me the said property by willbut he wishes to get transfered in his presence. Fee levied on flat transfer. If you hold a possession and you might want to sell it outright for a consideration ie.

If it is from father then you should produce his will or settlement document document or partition document and then you request you. Generally an owner can transfer his property unless there is a legal restriction barring such transfer. The costs are based on a percentage of the commercial value of the real estate asset and these rates vary from one state to another.

The payment of premium is not applicable in case the flat has been transferred to a member of his family or to his nominee or his heir legal representative after his death and in case of mutual exchange of flats amongst the members.

What Are The Stamp Duty Registration Charges In West Bengal

What Are The Stamp Duty Registration Charges In West Bengal

Format Of Deed For Sale Of Plot Sale Agreement Of Immovable House Property Purchase Agreement Agreement Doctors Note Template

Format Of Deed For Sale Of Plot Sale Agreement Of Immovable House Property Purchase Agreement Agreement Doctors Note Template

Free Real Estate Agent Commission Invoice Template Pdf Word Invoice Template Real Estate Commission Invoice Template Word Invoice Template Statement Template

Free Real Estate Agent Commission Invoice Template Pdf Word Invoice Template Real Estate Commission Invoice Template Word Invoice Template Statement Template

Home Loans Home Loans Loan How To Apply

Home Loans Home Loans Loan How To Apply

1 How Do I Legally Change My Name In India How Long It Will Take To Get A New Name Quora Change My Name Good Essay Names

1 How Do I Legally Change My Name In India How Long It Will Take To Get A New Name Quora Change My Name Good Essay Names

Pin By Mycura Services On Property Management Services In Pune Property Management Legal Services Property Tax

Pin By Mycura Services On Property Management Services In Pune Property Management Legal Services Property Tax

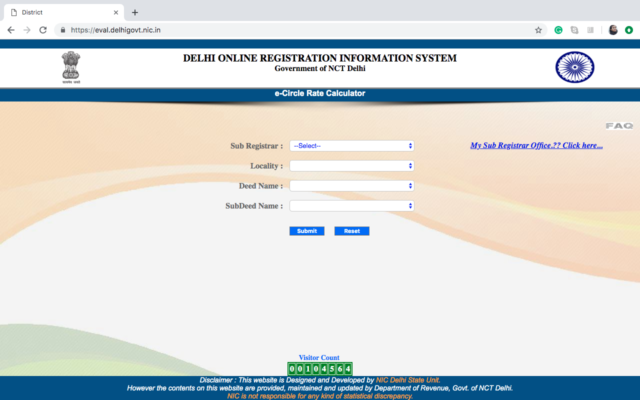

How To Do Property Registration In Delhi Online Step By Step Guide

How To Do Property Registration In Delhi Online Step By Step Guide

Online Property And Land Registration In India Process And Charges

Online Property And Land Registration In India Process And Charges

5 Ways Of Transferring Or Acquiring Real Estate Property Types Of Deeds

5 Ways Of Transferring Or Acquiring Real Estate Property Types Of Deeds

Bulk Sale Contract Agreement Template Sbb Contract Template Contract Contract Agreement

Bulk Sale Contract Agreement Template Sbb Contract Template Contract Contract Agreement

21 No Objection Certificate Templates Free Word Pdf Certificate Templates Letter Format Sample Lettering

21 No Objection Certificate Templates Free Word Pdf Certificate Templates Letter Format Sample Lettering

Government Rate Of Land Property In Jharkhand Minimum Valuation For While Registering A Property In Jharkhand Should Jharkhand Stamp Duty Paid Stamp

Government Rate Of Land Property In Jharkhand Minimum Valuation For While Registering A Property In Jharkhand Should Jharkhand Stamp Duty Paid Stamp

Profit Is Yours Loss Is Ours Mahagun Gipb Offer Offer Stamp Duty Loss

Profit Is Yours Loss Is Ours Mahagun Gipb Offer Offer Stamp Duty Loss

Property Transfer Procedure All Important Things To Know About It

Property Transfer Procedure All Important Things To Know About It

Pin On Real Estate And Finance Video Tutorials

Pin On Real Estate And Finance Video Tutorials

What Are The Stamp Duty Registration Charges In Patna

What Are The Stamp Duty Registration Charges In Patna

Property Management Agreement For Landlords Ez Landlord Forms Http Gtldworldcongress Com Enterpri Property Management Contract Template Being A Landlord

Property Management Agreement For Landlords Ez Landlord Forms Http Gtldworldcongress Com Enterpri Property Management Contract Template Being A Landlord