Property Tax Account Number Lookup

You are still responsible for payment of your property taxes even if you have not received a copy of your property tax statements. Property Tax Bills.

Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Apply for Business Tax account Edit Business Tax account Run a Business Tax report Run a Central Assessment report Run a Real Estate report Run a Tangible Property report Get bills by email.

Property tax account number lookup. Mobile Homes and Personal Property Commercial Property Tax 206-263-2844. Use the search tool above to locate your property summary or pay your taxes online. The property tax account is being reviewed prior to billing.

The Treasurer calculates the taxes due and sends out the tax notices using the taxing district information. The following links maybe helpful. The 2020 property taxes are due January 31 2021.

If you do not know the account number try searching by owner name address or property location. Find Property Borough Block and Lot BBL Payment History Search. In the example above the property account indentification number ACCT consists of the county code 01 the assessment district 02 and account number 123456.

Taxpayer Transparency Tool 2021 Taxes Tax Relief Commercial COVID Impact Electronic Valuation Notices Look up Property Info eReal Property eSales eMap Go Paperless eValuations Common Questions. Please note that each Account Transcript only covers a single tax year and may not show the most recent penalties interest changes or pending actions. Pay or view your account online do a property search or sign up for e-Reminder Notices via text or email.

Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Apply for Business Tax account Run a Business Tax report Run a Real Estate report Run a Tangible Property report. You will be able to find. If youre a business or an individual who filed a form other than 1040 you can obtain a transcript by submitting Form 4506-T Request for Transcript of Tax Return.

Details provided include account balance current and previous billing amounts payment details due dates and more. Information on this site was derived from data which was compiled by the Joliet Township Assessors office solely for the governmental purpose of property assessment. Easily look up your property tax account what you owe print a receipt and pay your property taxes online.

Small Tract Forestland Program ORS 321700-754. Once you search by PIN you can pay your current bill online or learn additional ways to pay by clicking More Tax Bill Information on the next page. If your property tax is paid through your mortgage you can contact your lender for a copy of your bill.

Billed Amounts Tax History. How property taxes work in Oregon. Forest Products Harvest Tax FPHT How forestland is taxed in Oregon.

The Property Tax Lookup is a convenient way to review your City of Toronto property tax account anytime anywhere from your computer or mobile device. The Assessor and the Treasurer use the same software to record the value and the taxes due. Convenience Fees are charged and collected by JPMorgan and are non-refundable.

This information should not be relied upon by anyone as a determination of ownership of property or market value. This is a summary of your property tax at the time of access and may not reflect recent updates. Exemptions.

This program is designed to help you access property tax information and pay your property taxes online. Enter owners last name followed by a space and the first name or initial. If you do not know the account number try searching by owner name address or property location.

The Cook County Treasurers Office provides payment status for current tax years and the ability to pay online. Enter owners last name followed by a space and the first name or initial. Search to see a 5-year history of the original tax amounts billed for a PIN.

118 North Clark Street Third Floor Room 320 Chicago IL 60602. Your property account identification number is located above your name and address on your assessment notice. Data and Lot Information.

2018 Harvest tax rates. Assessed Value History by Email. Look for the information in the following format.

Whether your taxes are paid or the balance that is due Your original current and previous years tax statements. Account numbers can be found on your Tarrant County Tax Statement. Notification of operation permit 2020 harvest tax rates.

Real Property Tax Real Estate 206-263-2890. This number is located on your county tax bill or assessment notice for property tax paid on your principal residence during the tax year for which you are filing your return. Account numbers can be found on your Tax Statement.

How To Obtain A Georgia State Tax Id Ehow Property Tax Last Will And Testament Tax

How To Obtain A Georgia State Tax Id Ehow Property Tax Last Will And Testament Tax

Pay Property Taxes Online Treasurer And Tax Collector

Pay Property Taxes Online Treasurer And Tax Collector

Real Estate Personal Property Tax Unified Government

Real Estate Personal Property Tax Unified Government

Look Up Your Property Tax Bill Multnomah County

Look Up Your Property Tax Bill Multnomah County

Property Tax Payment Faqs Multnomah County

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

Macon County Illinois Property Tax Parcel Search

Macon County Illinois Property Tax Parcel Search

Easy Way To Know The Ptin Property Tax Identification Number In Hyderabad Property Tax Tax Property

Easy Way To Know The Ptin Property Tax Identification Number In Hyderabad Property Tax Tax Property

Property Tax Information Lake County Il

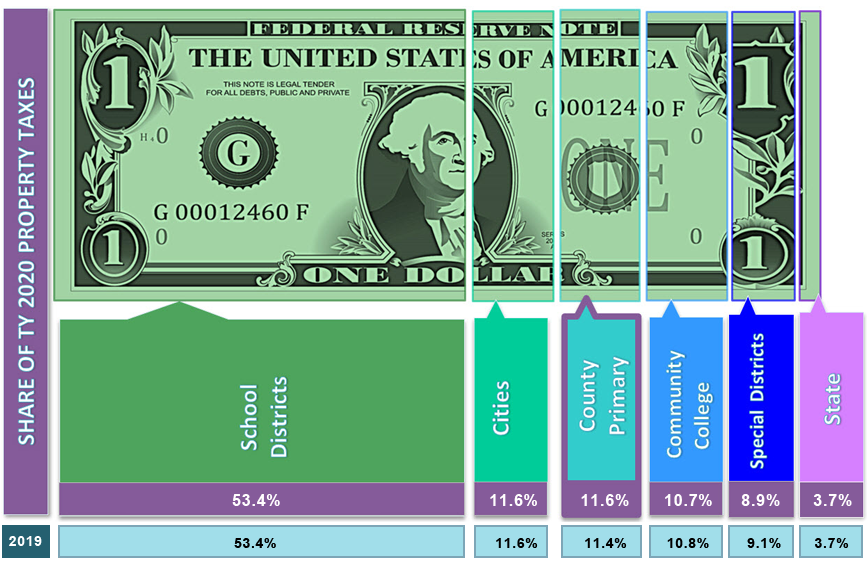

Property Tax Costs Official Website Surprise Arizona

Real Estate Property Tax Constitutional Tax Collector

Real Estate Property Tax Constitutional Tax Collector

Property Tax Credit Lookup Property Tax Tax Credits Tax

Property Tax Credit Lookup Property Tax Tax Credits Tax

Your Property Taxes Los Angeles County Office Of The Assessor

Your Property Taxes Los Angeles County Office Of The Assessor

Johnson County Property Tax A Secure Online Service Of Arkansas Gov

Johnson County Property Tax A Secure Online Service Of Arkansas Gov