Property Tax Calculator Atlanta

The DeKalb County Tax Commissioners Office mails out property tax bills in August. The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state.

Georgia Property Tax Calculator Smartasset

Georgia Property Tax Calculator Smartasset

Counties in Georgia collect an average of 083 of a propertys assesed fair market value as property tax per year.

Property tax calculator atlanta. The tax must be paid at the time of sale by Georgia residents or within six months of establishing residency by those moving to Georgia. Just click Click to Edit button at the top of the sheet. Ad valorem tax receipts are distributed to the state county schools and.

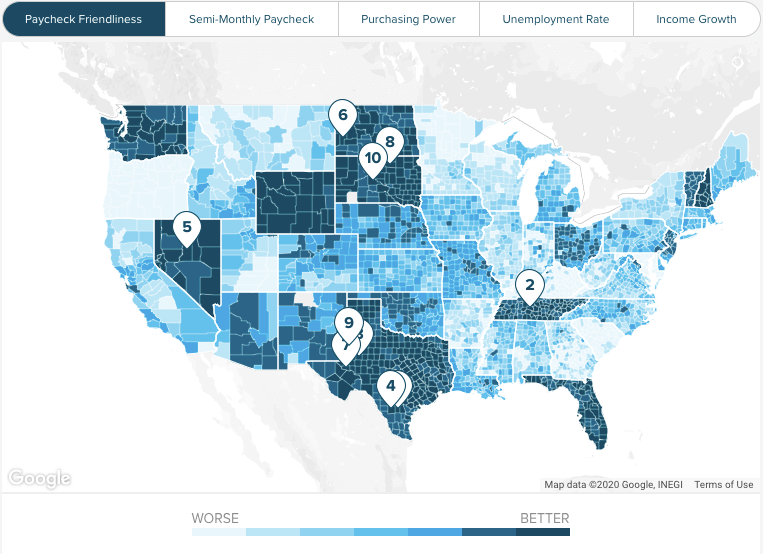

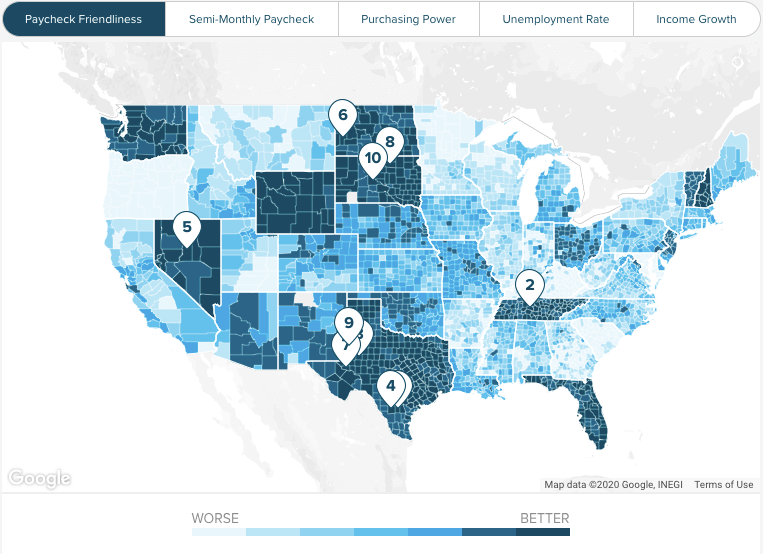

First we used the number of households median home value and average property tax rate to calculate a per capita property tax collected for each county. More about Property Tax. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

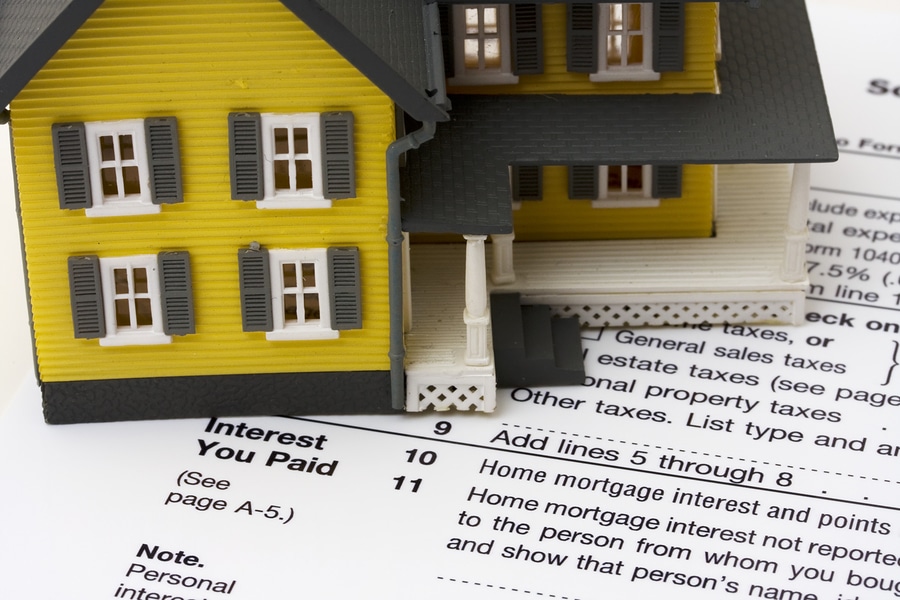

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. While the exact property tax rate you will pay for your properties is set by the local tax assessor you can estimate your yearly property tax burden by choosing the state and county in which your property is located and entering the approximate Fair Market Value of your property into the calculator. You can find out the property taxes for your property or.

These vary by county. Annual Ad Valorem Tax Estimator Calculator. The Tax Commissioner takes the appraised value and the exemption status provided by the Board of Tax Assessors along with the millage rates set.

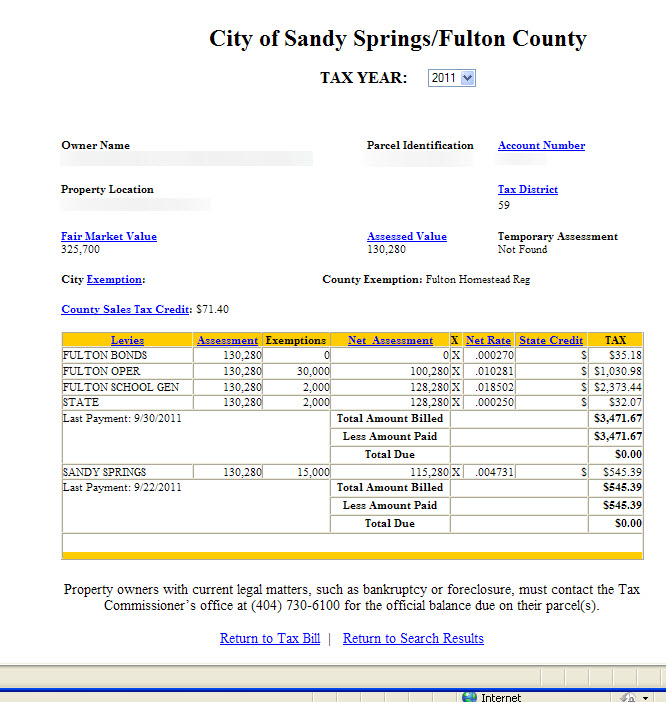

Estimate Property Tax Our Fulton County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Georgia and across the entire United States. Georgia is ranked number thirty three out of the fifty states in order of the average amount of property taxes collected. The statewide exemption is 2000 but it applies only to the statewide property tax which is a relatively small slice of the overall property taxes in most areas.

To get it back to the original numbers just refresh the page. The median property tax in Georgia is 134600 per year for a home worth the median value of 16280000. The Atlanta Georgia general sales tax rate is 4Depending on the zipcode the sales tax rate of Atlanta may vary from 4 to 89 Every 2021 combined rates mentioned above are the results of Georgia state rate 4 the county rate 2 to 4 the Atlanta tax rate 0 to 15 and in some case special rate 0 to 1.

Most property owners in DeKalb County can pay their property tax bills in two installments. In general all products in Georgia are subject to the full amount of the rates listed above but there are some exceptions. Georgia Property Tax Rates.

The Tax Commissioner takes the appraised value and the exemption status provided by the Board of Tax Assessors along with the millage rates set by the Board of Commissioners and other Governing Authorities to calculate taxes for each property and mails bills to owners at the addresses provided by the Board of Tax Assessors. Property Taxes The Fulton County Tax Commissioner is responsible for collecting property taxes on behalf of Fulton County Government two school systems and some city governments. As a way to measure the quality of schools we analyzed the math and readinglanguage arts proficiencies for every school district in the country.

This spreadsheet is interactive. Fulton County Property Tax Calculator Atlanta City Property Tax Spreadsheet. How 2021 Sales taxes are calculated in Atlanta.

Our Georgia Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Georgia and across the entire United States. At this site users can view property information pay property taxes for the current tax year apply for the basic homestead exemption make address changes view tax sale information apply for excess funds and receive other general information regarding property. Atlanta Area Property Tax Rates Beacham Company does not warrant the following information which may contain errors and omissions and is subject to change and may not be current.

Before relying on this information you should verify its accuracy with the appropriate city or county municipality. Property tax rates in Georgia can be described in mills which are equal to 1 of taxes for every 1000 in assessed value. County Property Tax Facts Property Tax Returns and Payment Property Tax Homestead Exemptions Freeport Exemption Property Tax Appeals Property Tax Valuation Property Tax Millage Rates Property Tax Online Property Tax Forms Laws.

Tax amounts vary according to the current fair market value of the vehicle and the tax district in which the owner resides. This is set up for a standard homestead exemption. If you live in the city of Atlanta however you can only pay your property tax bill in one installment thats due on Nov.

This tax is based on the value of the vehicle. Property Tax Proposed and Adopted Rules. Overview of Georgia Taxes Georgia has a progressive income tax system with six tax brackets that range from 100 up to 575.

Taxes must be paid by the last day of your registration period birthday to avoid a 10 penalty. Calculated from tax bills where millage rates are broken down and various homestead exemptions are applied to the proper portions of the millage rate HOST credits taken into account sanitation fees and stormwater fees included. Note that Atlanta is the only city with its own sales tax and when combined with state and county sales taxes the total sales tax there is 890.

Atlanta GA 30303.

Easyknock The Guide To Georgia Property Tax Rates And Options

Easyknock The Guide To Georgia Property Tax Rates And Options

Https Cslf Gsu Edu Files 2014 06 Property Tax Ingeorgia Pdf

Your Guide On Property Taxes In Atlanta Georgia Atlanta Dream Living

Your Guide On Property Taxes In Atlanta Georgia Atlanta Dream Living

Property Taxes In Atlanta And Decatur What You Should Know Minerva Planning Group

Property Taxes In Atlanta And Decatur What You Should Know Minerva Planning Group

Georgia State Sales Tax Visit Georgia Tax Holiday States

Georgia State Sales Tax Visit Georgia Tax Holiday States

Sandy Springs Georgia Property Tax Calculator Millage Rate Homestead Exemptions

Sandy Springs Georgia Property Tax Calculator Millage Rate Homestead Exemptions

How To Calculate Capital Gains Tax On Real Estate Investment Property

How To Calculate Capital Gains Tax On Real Estate Investment Property

Median Property Taxes By County Tax Foundation

Median Property Taxes By County Tax Foundation

Https Www Atlantaga Gov Home Showdocument Id 18844

Dekalb County Ga Property Tax Calculator Smartasset

Dekalb County Ga Property Tax Calculator Smartasset

Georgia Paycheck Calculator Smartasset

Georgia Paycheck Calculator Smartasset

Atlanta Georgia Property Tax Calculator Fulton County Millage Rate Homestead Exemptions

Understanding Local Taxes Sandy Springs Ga

Property Tax Calculator Real Estate Investing Books Estate Tax Tax Attorney

Property Tax Calculator Real Estate Investing Books Estate Tax Tax Attorney

Atlanta Georgia Property Tax Calculator Fulton County Millage Rate Homestead Exemptions

Assessor Douglas County Government

Assessor Douglas County Government