Property Tax Refund Nyc

Request a Property Refund online - Use this form to request a refund if you have a credit balance on your tax account. Check your refund status online 247.

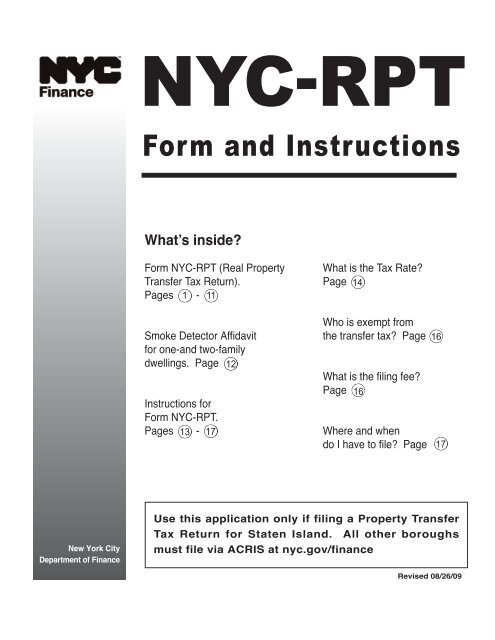

Https Www1 Nyc Gov Assets Finance Downloads Pdf 07pdf Nyc204 06i2 Pdf

Property Tax Refund Minnesota Department of Revenue COVID-19 Penalty Relief.

Property tax refund nyc. Enter your Social Security number. For New York purposes the deductions are not subject to the Federal limit she says. Property Tax Bills.

You may check whether your property has been issued a property tax refund by accessing the files below. Unemployment insurance UI recipients. Credit balances on your tax account must be used or refunded within 6 years.

The file below lists refund checks that were issued within the last 30 days. The following security code is necessary to prevent unauthorized use of this web site. Income Tax Refund Status.

You may need to report this information on your 2020 federal income tax return. The official sale date is typically listed on the settlement statement you get at closing. If you are using a screen reading program select listen to have the number announced.

But this year the state is only giving one STAR handout. The property tax relief credit was approved four years by Cuomo and the Legislature to reimburse middle-class homeowners for a portion of their school taxes based on their household income. The Department of Finance issues property refund checks by request if there are tax credits on a property tax account.

Assessed Value History by Email. Please complete this form to request a refund of property taxes or other property-related charges. New York City Income Tax New York City has a separate city income tax that residents must pay in addition to the state income tax.

Find Property Borough Block and Lot BBL Payment History Search. You may check the file to see whether your property has been issued a refund check recently. Property Refunds List - 2018.

If you have questions contact the Refunds Unit at httpwwwnycgovpropertyrefunds. Description STAR or Property Tax Relief credit year. Your prior-year New York State income tax return Form IT-201 IT-201-X IT-203 or IT-203X filed for one of the past five tax years and.

See Refund amount requested to learn how to locate this amount. The Department of Finance applies most property tax credits towards your next bill unless you request a refund. Sign in with an external account Facebook Google Azure AD LinkedIn Microsoft Twitter Yahoo.

You can ask for the credits to be applied to other tax periods or you can request a refund by completing a Property Refund Request form. To be eligible in a prior year you must have. You have to file a federal return.

The Total payments amount from the return you use for verification. Generally you must file a New York State resident income tax return if you are a New York State resident and meet any of the following conditions. Visit Department of Labor for your unemployment Form 1099-G.

This includes property taxes you pay starting from the date you purchase the property. Lived in a school district that is complying with the New York State property tax cap. Exemptions.

Enter the amount of the New York State refund you requested. Please allow 8 weeks to process your claim. As an example if you had a lawyer challenge your property assessment your property tax refund will be sent to your lawyer.

Enter the security code displayed below and then select Continue. You did not have to file a federal return but your federal adjusted gross income plus New York additions was more than 4000 3100 if you are single and can be. Select the tax year for the refund status you want to check.

Homeowners in New York state got used to receiving a second STAR property tax break check in the fall. Before you begin youll need. The refund provides property tax relief depending on your income and property taxes.

City Register Recording Fee Refund Request - Use this form to request a refund of City Register recording fees due to overpayment. The New York State STAR exemption for owner-occupied housing is also available as well as property tax abatements or reductions for certain individuals. Data and Lot Information.

Homeowners who itemize their tax returns can deduct property taxes they pay on their main residence and any other real estate they own. The property tax relief credit directly reduced your property tax burden if you are a qualifying homeowner. The amount of the credit is a percentage of your STAR savings.

Some credits are treated differently. You may ask us to cancel or reduce filing or payment penalties if you have a reasonable cause or are negatively affected by the COVID-19 pandemic. After 6 years any credit balances left on your tax account will become the property of the City of New York.

Property Tax Refunds and Credits. For more information read about Refunds and Credits. Choose the form you filed from the drop-down menu.

But the total tax deductions including state and local taxes are capped at 10000 50000 if married filing separately on the Federal side. If you received an income tax refund from us for tax year 2019 view and print New York States Form 1099-G on our website. Wang notes that if you pay real estate tax or property tax you can add that to your itemized deduction for a potential tax refund.

Get Form 1099-G for tax refunds.

Https Www Brooklyn Usa Org Wp Content Uploads 2017 10 Nystaxincentives17 Pdf

Nyc S Property Tax Reforms Are Pitting Homeowners Against Renters Commercial Observer

Nyc S Property Tax Reforms Are Pitting Homeowners Against Renters Commercial Observer

Petition Call For Property Tax Strike By Nyc Landlords

Petition Call For Property Tax Strike By Nyc Landlords

Did You Know Tax Breaks For Second Home Owners Nyc Tax Accounting Services George Dimov Cpa

Did You Know Tax Breaks For Second Home Owners Nyc Tax Accounting Services George Dimov Cpa

Property Tax Assessment See If You Re Paying Too Much

Nyc Department Of Finance Property Tax Payment Financeviewer

Nyc Department Of Finance Property Tax Payment Financeviewer

Tax Refund Advice For Nyc Homeowners Renters Streeteasy

Tax Refund Advice For Nyc Homeowners Renters Streeteasy

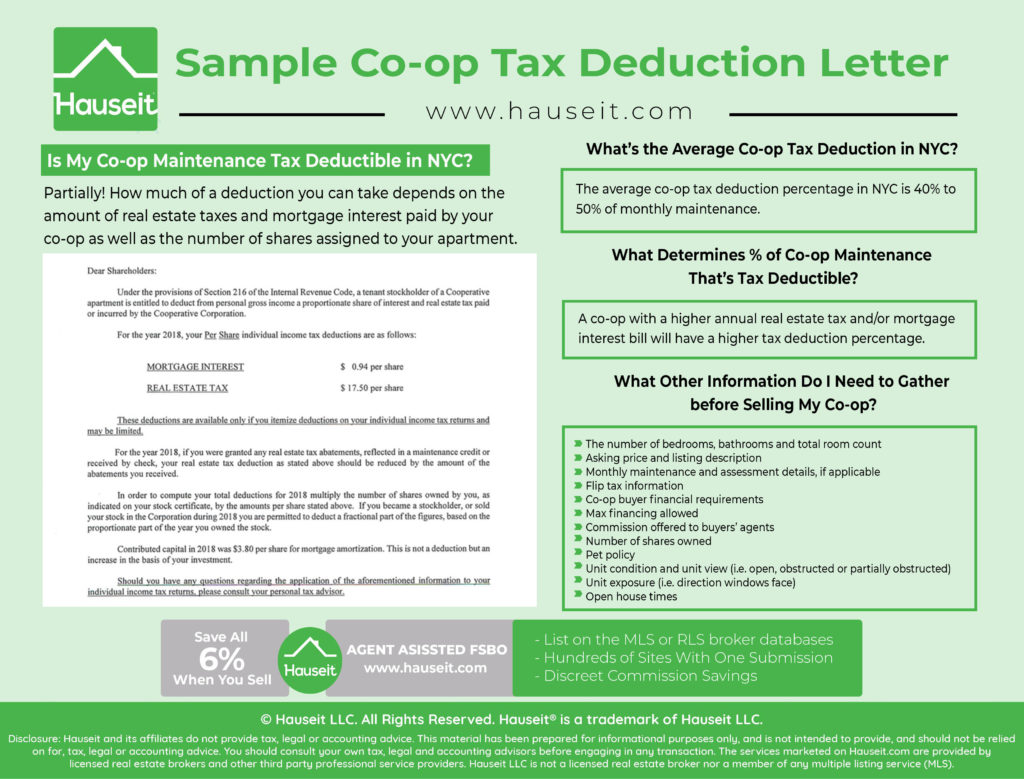

Sample Co Op Apartment Tax Deduction Letter For Nyc Hauseit

Sample Co Op Apartment Tax Deduction Letter For Nyc Hauseit

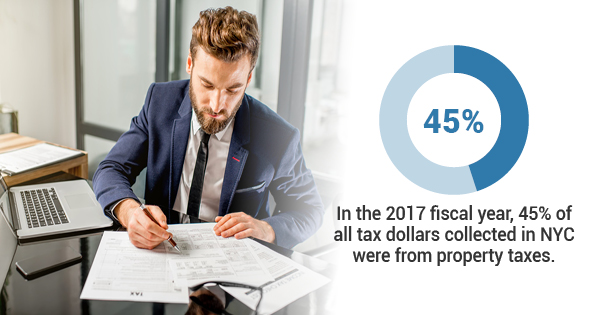

Nyc Property Taxes All You Need To Know Blocks Lots

Nyc Property Taxes All You Need To Know Blocks Lots

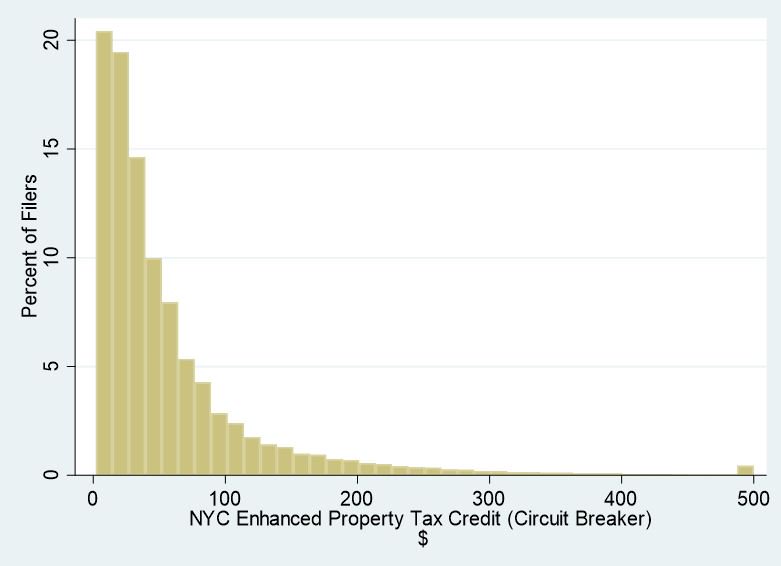

Growing Unfairness The Rising Burden Of Property Taxes On Low Income Households Office Of The New York City Comptroller Scott M Stringer

Growing Unfairness The Rising Burden Of Property Taxes On Low Income Households Office Of The New York City Comptroller Scott M Stringer

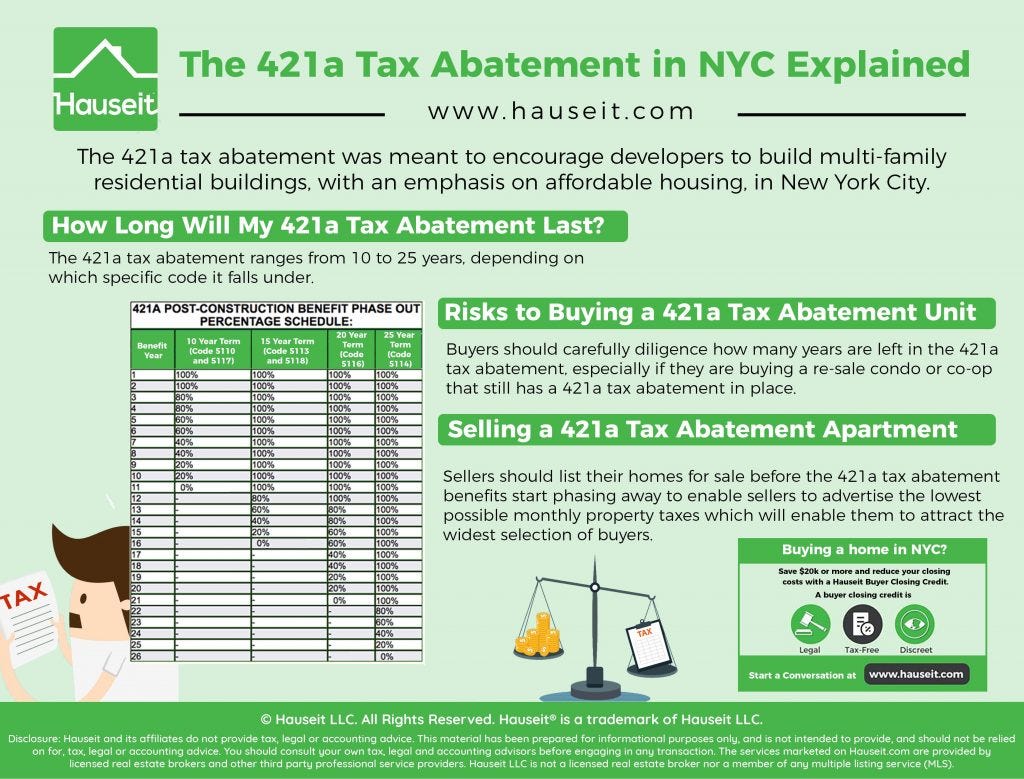

Everything You Need To Know About Nyc S 421 A Tax Program By Hauseit Medium

Everything You Need To Know About Nyc S 421 A Tax Program By Hauseit Medium

Https Www Lincolninst Edu Sites Default Files Pubfiles Gates Wp19mg1 Pdf

Nyc 208 2020 Fill Online Printable Fillable Blank Pdffiller

Nyc 208 2020 Fill Online Printable Fillable Blank Pdffiller

New York City Business And Civic Leaders Are Now Pushing For Property Tax Relief

New York City Business And Civic Leaders Are Now Pushing For Property Tax Relief

The Complete Guide To Closing Costs In Nyc Hauseit

The Complete Guide To Closing Costs In Nyc Hauseit

Https Www1 Nyc Gov Assets Finance Downloads Pdf Lien Sale 2016 Checklist Pdf

How Much Is The Coop Condo Tax Abatement In Nyc Hauseit

How Much Is The Coop Condo Tax Abatement In Nyc Hauseit

What Are The Tax Abatements For Coops And Condos In Nyc Propertynest

What Are The Tax Abatements For Coops And Condos In Nyc Propertynest

Poor Donald Trump S Property Tax Break Take 2 Don T Mess With Taxes