What Is The Property Tax Rate In New Mexico

The New Mexico State Tax Tables for 2020 displayed on this page are provided in support of the 2020 US Tax Calculator and the dedicated 2020 New Mexico State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state. You can learn more about how the New Mexico income tax compares to other states income taxes by visiting our map of income taxes by state.

Here S Who Pays The Most And Least In Property Taxes Property Tax Tax Property

Here S Who Pays The Most And Least In Property Taxes Property Tax Tax Property

For example Illinoiswhich has the second-highest tax rate at 227has a low median home price of only 194500 resulting in annual property taxes hovering around 4419.

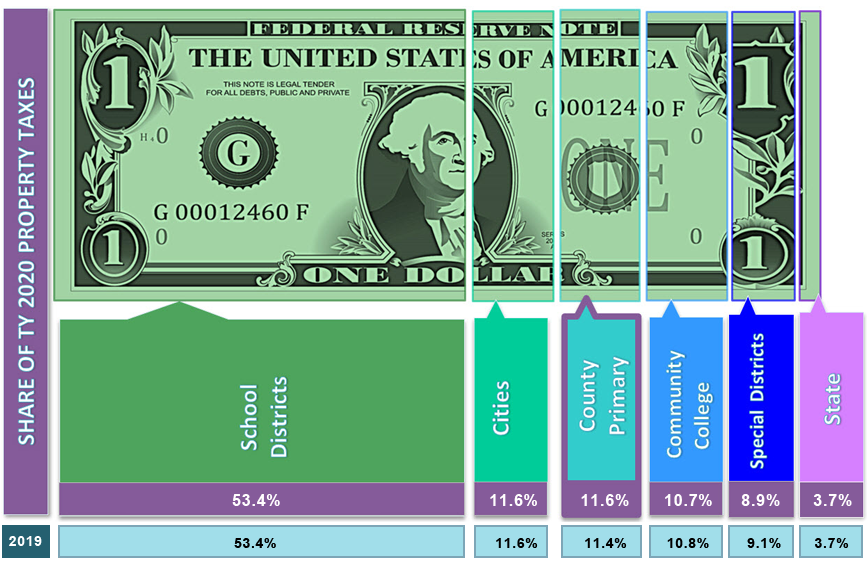

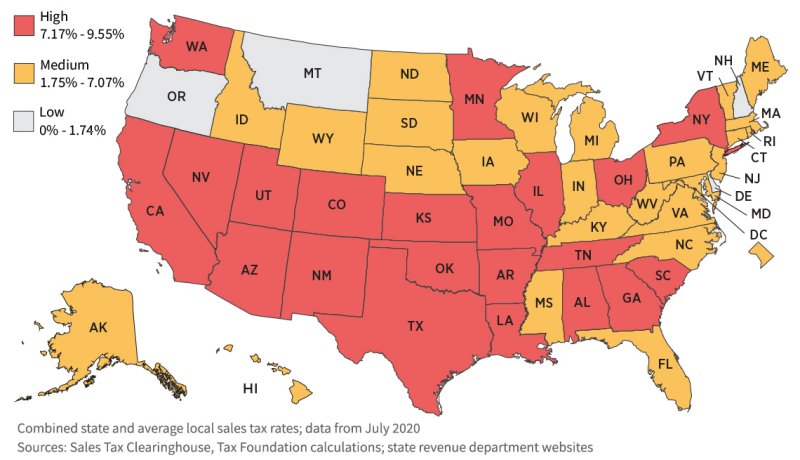

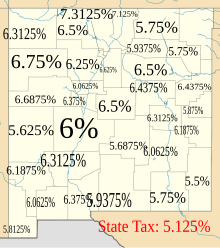

What is the property tax rate in new mexico. New Mexicos maximum marginal income tax rate is the 1st highest in the United States ranking directly below New Mexicos. The state does not collect a sales tax but rather a gross receipts tax on businesses that often gets passed to consumers. New Mexico Gross Receipts Map - July to December 2017.

The states average effective property tax rate is 078. Property in New Mexico is classified as residential or non-residential and is taxed at different rates. Colfax County collects on average 044 of a propertys assessed fair market value as property tax.

New Mexicos progressive income tax with rates ranging from 170 to 490 applies to retirement income in excess of that deduction. The average effective rate is just 076. New Mexico 1188 062 Why are my property taxes so highor low.

Looking at the tax rate and tax brackets shown in the tables above for New Mexico we can see that New Mexico collects individual income taxes differently for Single versus Married filing statuses for example. Online Services - NM Taxation and Revenue Department 10031. Select the New Mexico city from the list of popular cities below to see its current sales tax rate.

Gross Receipts Tax Rates - NM Taxation and. New Mexico has some of the lowest property tax rates in the US. Tax amount varies by county The median property tax in New Mexico is 88000 per year for a home worth the median value of 16090000.

New Mexico Tax Brackets 2020 - 2021. The state sales tax rate in New Mexico is 51250. New Mexico has recent rate changes Wed Jan 01 2020.

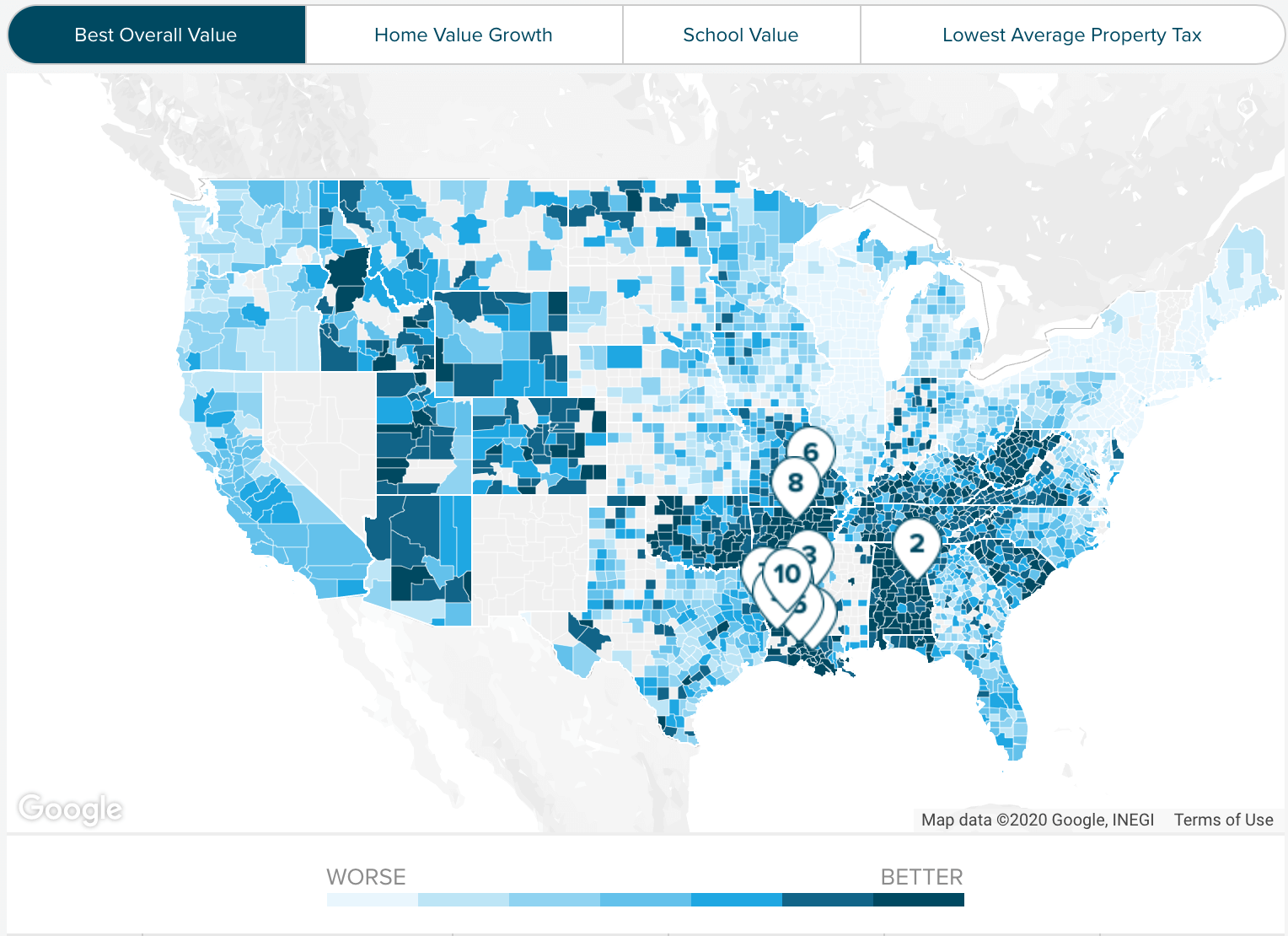

While property taxes may be high in some states lower home prices may offset this tax burden. Counties in New Mexico collect an average of 055 of a propertys assesed fair market value as property tax per year. In many parts of the state annual property taxes for homeowners equal less than 1500.

The New Mexico Property Tax Division PTD prepares appraisals for all the state assessed or. With local taxes the total sales tax rate is between 51250 and 92500. The New Mexico Department of Revenue is responsible for publishing the latest New Mexico.

The median annual property tax paid by homeowners in New Mexico is 1403 about 1200 less than the national median. How high are property taxes in New Mexico. New Mexico has a progressive income tax with rates that rank among the 20 lowest in the country.

New Mexico Property Tax Rate Districts - Tax Year 2018 with local insets New Mexico Gross Receipts Map - July to December 2018. The states average effective property tax rate is the 18th-lowest rate in the country. Not in New Mexico.

Nationally the average tax rate is assessed at 112. Taxation in New Mexico comprises the taxation programs of the US state of New MexicoAll taxes are administered on state- and city-levels by the New Mexico Taxation and Revenue Department a state agencyThe principal taxes levied include state income tax a state gross receipts tax gross receipts taxes in local jurisdictions state and local property taxes and several taxes related to. First DFA needs to know the value of the property to be taxed.

New Mexico Payments in Lieu of Taxes for FY2018. Property taxes in New Mexico are low. New Mexico Gross Receipts Map - January to June 2018.

Tax rates are determined by The New Mexico Department of Finance Administration DFA There are 2 essential factors for determining a tax or mill levy rate. To search for all information about individual parcels use Real Property Search. That makes New Mexico the 13th lowest state in terms of property taxes in the country.

The median property tax in Colfax County New Mexico is 458 per year for a home worth the median value of 103100. Property Tax Levy Certificate. New Mexicos average effective property tax rate is 078 which is fairly low.

New Mexico NM Sales Tax Rates by City. Welcome to New Mexico Taxation. In New Mexico its only 072.

The biggest exceptions to New Mexicos generally low property taxes are Bernalillo County and Los Alamos County. Seniors also get an 8000 deduction for retirement account and pension income. Online Services - NM Taxation and Revenue Department 15498.

Use the 2020 tax rates when calculating estimated property tax. Search Unclaimed Property - NM Taxation and Revenue Department 14377. Bernalillo County collects the highest property tax in New Mexico levying an average of 153000 081 of median home value yearly in property taxes while Harding County has the lowest property tax in the state collecting an average tax of 25500 036 of median home value per year.

To check taxes due use Pay Property Taxes. Forms. We can also see the progressive nature of New Mexico state income tax rates from the lowest NM tax rate bracket of 17 to the highest NM tax rate.

Its average effective property tax rate is 076.

New Mexico Property Tax Calculator Smartasset

New Mexico Property Tax Calculator Smartasset

The Best And Worst States For Retirement All 50 States Ranked Bankrate Com Retirement Locations Best Retirement Cities Retirement

The Best And Worst States For Retirement All 50 States Ranked Bankrate Com Retirement Locations Best Retirement Cities Retirement

Which States Have The Lowest Property Taxes Property Tax History Lessons Moving To Florida

Which States Have The Lowest Property Taxes Property Tax History Lessons Moving To Florida

7 States Without An Income Tax And An 8th State On The Way Income Tax Tax Rate Tax Free States

7 States Without An Income Tax And An 8th State On The Way Income Tax Tax Rate Tax Free States

States With Highest And Lowest Sales Tax Rates

States With Highest And Lowest Sales Tax Rates

State By State Guide To Taxes On Retirees Kiplinger Retirement Locations Income Tax Retirement Planning

State By State Guide To Taxes On Retirees Kiplinger Retirement Locations Income Tax Retirement Planning

New Hampshire Property Tax Calculator Smartasset

New Hampshire Property Tax Calculator Smartasset

States That Dont Tax Social Security Retirement Strategies Retirement Best Places To Retire

States That Dont Tax Social Security Retirement Strategies Retirement Best Places To Retire

The Best States For An Early Retirement Health Insurance Early Retirement Life Insurance For Seniors

The Best States For An Early Retirement Health Insurance Early Retirement Life Insurance For Seniors

Map The Most And Least Tax Friendly States Yahoo Finance Best Places To Retire Retirement Locations Map

Map The Most And Least Tax Friendly States Yahoo Finance Best Places To Retire Retirement Locations Map

Taxation In New Mexico Wikipedia

Taxation In New Mexico Wikipedia

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

North Dakota Property Tax Calculator Smartasset

North Dakota Property Tax Calculator Smartasset

Compare Property Tax Rates In Each State Property Tax Tax Rate Map

Compare Property Tax Rates In Each State Property Tax Tax Rate Map

Surprising Data Reveals Top 25 Tax Friendly States To Retire Retirement Tax Money Choices

Surprising Data Reveals Top 25 Tax Friendly States To Retire Retirement Tax Money Choices