Capital Gains Tax Australia Property Sale

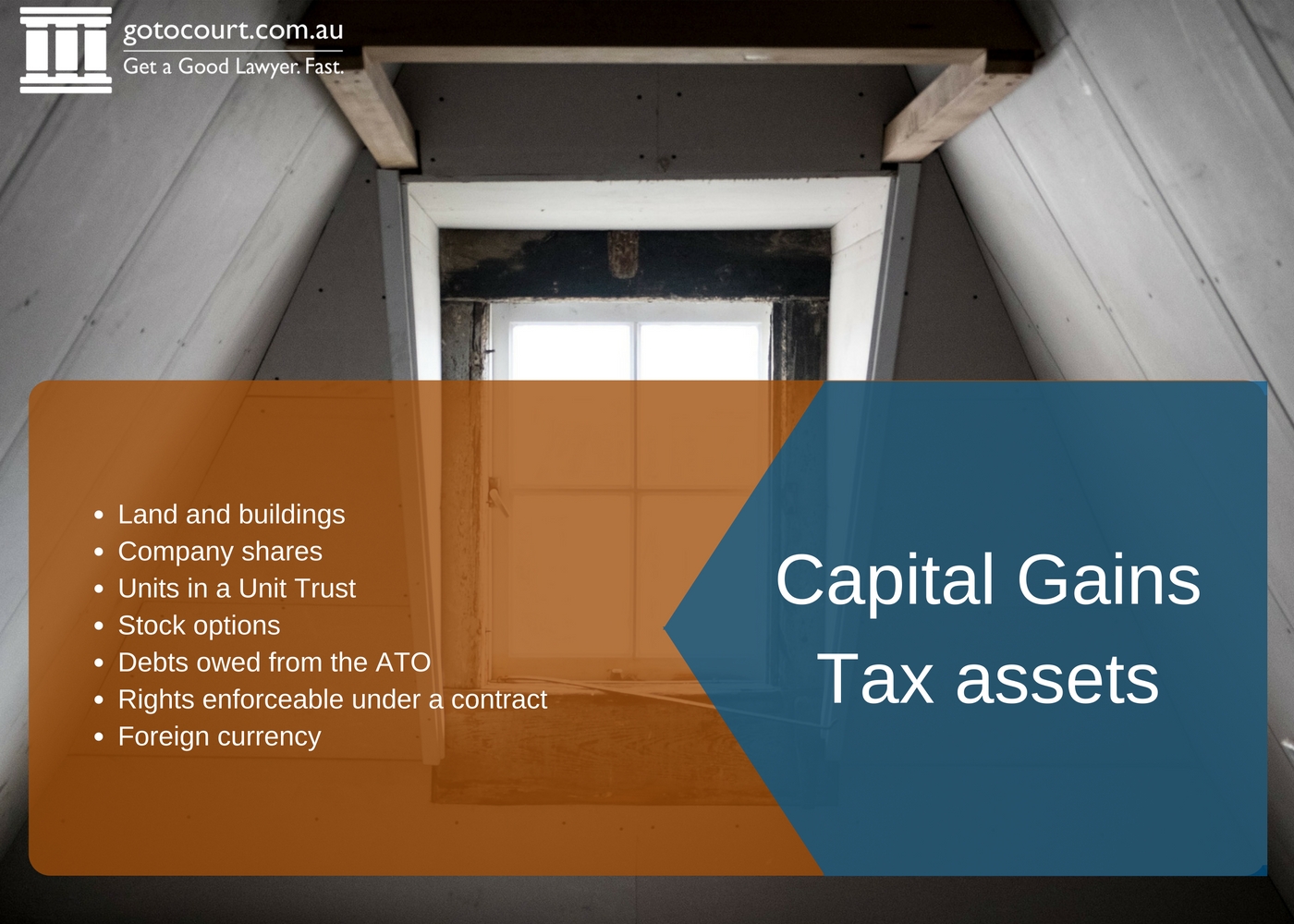

If so from which period to which period. It applies to property shares leases goodwill licences foreign currency contractual rights and personal use assets purchased for more than 10000.

CGT will apply if the asset is transferred under the will to a tax-advantaged entity such as a charity or to a foreign resident.

Capital gains tax australia property sale. This includes vacant land business premises rental properties holiday houses and hobby farms. You must report all 1099-B transactions on Schedule D Form 1040 Capital Gains and Losses and you may need to use Form 8949 Sales and Other Dispositions of Capital Assets. Capital gains tax CGT for those who are new to this is the levy you pay on the capital gain made from the sale of that asset.

12 Months Property Ownership If you are an Australian resident and have owned the property for more than 12 months you are able to claim a 50 discount on the capital gains tax payable. If you hold the shares for less than 12 months You will pay tax on the full amount of profit. Applies resident and non-resident capital gains tax rates and allowances in 2021 to produce a capital gains tax calculation you can print or email.

How the cost is being calculated. The date of the persons death may be relevant when you calculate the capital gain. Suppose you lost money on the sale of your asset.

Exclusion for Sale of Primary Residence Special rules apply to the capital gains when you sell your primary residence. This is added to your assessable income for the year. Capital gains tax or CGT is a hefty tax you pay when selling a property for a profit.

A superb online calculator for individuals and business to calculate capital gains tax in australia. Residents in Australia are expected to pay capital gains tax on an investment property they sell. You must account for and report this sale on your tax return.

Capital gains tax CGT does not apply when you acquire the asset it may apply if you later dispose of the asset. It forms part of your income tax and is payable to the Federal Government. So if you sign a contract to sell an investment property in June 2017 and settle in August 2017 you need to report the capital gain or loss in your 201617 tax return.

Gains on the sale of collectibles are taxed at 28. A capital gain or loss is the difference between what you paid for an asset and what you sold it for less any fees incurred during the purchase. According to the Australian Tax Office ATO when you sell your property the difference between how much you paid for it and how much you sold it for is known as capital gains.

Generally you dont pay capital gains tax CGT if you sell the home you live in under the main residence exemption. Capital Gains Tax is calculated at either 100 of the capital gains amount or 50 of the capital gains amount depending on the length of time you have owned the asset. Do I need to get a market valuation for this.

For Norfolk Island residents CGT applies to assets acquired from 23 October 2015. Fortunately you dont have to pay CGT on your own home if you meet certain criteria which applies to most people. If I did not acquire the second property but rented the first property from 2005 to 2018 what are the CGT Consequences.

In that case the difference will be a capital loss. You also cant claim income tax deductions for costs associated with buying or selling your home. Your main residence your home is generally exempt from CGT unless youve used it to earn rent or run a business or its on more than two hectares of land.

Current tax rates for long-term capital gains can be as low as 0 and top out at 20 depending on your income. This is the amount you have made on top of your initial investment earnings. Capital gains tax CGT is the levy you pay on the capital gain made from the sale of that asset.

If youre an Australian resident CGT applies to your assets anywhere in the world. How to use the Capital Gains Tax Calculator. Capital gains on the sale of a co-owned rental property Karl and Louisa bought a residential rental property in November 2015 for a purchase price of 750000.

If you sell the property now for net proceeds of 350000 youll owe long-term capital gains tax on your 100000 net profit plus depreciation recapture on 90900 which is taxed at your marginal. Do I have to pay capital gains tax on the sale of the pre-CGT Asset. They incur costs of purchase including stamp duty and legal fees of 30000.

Main Residence Your main residence is exempt from capital gains tax as long as there is a dwelling on the property. For example if your annual salary is AUD70000 and your capital gain is AUD40000 your total assessable income for the year is AUD110000. This tax applies to not just to property but to several assets such as shares leases goodwill licenses foreign currencies and contractual rights.

Your home and other real estate Most real estate is subject to capital gains tax CGT. Capital gains tax is the tax you pay on any capital gain profit you make from the sale of certain assets including investment properties. Sourced from the Australian Tax Office.

You have indicated that you received a Form 1099-B Proceeds From Broker and Barter Exchange Transactions. Capital Gains Tax Calculator Values. How much is capital gains tax.

It was charged on any capital gains from the sale and disposal of any assets bought or acquired after September 1985. If so on what date. With the exception of your family home most property sales are subject to the tax.

How To Calculate Capital Gains Tax Cgt Echoice Guides

How To Calculate Capital Gains Tax Cgt Echoice Guides

Https Www Pwc Com Gx En Hr Management Services Newsletters Global Watch Assets Pwc Australia Removes Capital Gains Tax Discount Pdf

Can You Avoid Capital Gains Tax When Selling A House Canstar

Can You Avoid Capital Gains Tax When Selling A House Canstar

Capital Gains Tax Spreadsheet Shares Capital Gains Tax Capital Gain Spreadsheet Template

Capital Gains Tax Spreadsheet Shares Capital Gains Tax Capital Gain Spreadsheet Template

How To Calculate Capital Gains On Sale Of Gifted Property Examples

How To Calculate Capital Gains On Sale Of Gifted Property Examples

Capital Gains Tax Does It Apply To You Etax Online Tax Agents

Capital Gains Tax Does It Apply To You Etax Online Tax Agents

How To Reduce Or Avoid Capital Gains Tax On Property Or Investments Capital Gains Tax Capital Gain Investing

How To Reduce Or Avoid Capital Gains Tax On Property Or Investments Capital Gains Tax Capital Gain Investing

How To Avoid Paying Capital Gains Tax Cgt When Selling A Property

How To Avoid Paying Capital Gains Tax Cgt When Selling A Property

How High Are Capital Gains Taxes In Your State Tax Foundation

How High Are Capital Gains Taxes In Your State Tax Foundation

How To Avoid Capital Gains Tax When Selling Property Finder Com

How To Avoid Capital Gains Tax When Selling Property Finder Com

What S Tax Deductible When I Sell A House Upside Realty

What S Tax Deductible When I Sell A House Upside Realty

In Depth The Race To Beat Australia S Capital Gains Tax Deadline

In Depth The Race To Beat Australia S Capital Gains Tax Deadline

The Beginner S Guide To Capital Gains Tax Infographic Transform Property Consulting Capital Gains Tax Capital Gain Investing

The Beginner S Guide To Capital Gains Tax Infographic Transform Property Consulting Capital Gains Tax Capital Gain Investing

Capital Gains Tax On Shares In Australia Explained Sharesight

Capital Gains Tax On Shares In Australia Explained Sharesight

Flipping Houses Taxes Flipping Houses Buying A Rental Property Capital Gain

Flipping Houses Taxes Flipping Houses Buying A Rental Property Capital Gain

How To Save Capital Gains Tax On Property Sale Capital Gain Capital Gains Tax Tax

How To Save Capital Gains Tax On Property Sale Capital Gain Capital Gains Tax Tax

Will We Have To Pay Capital Gains Tax If Selling Our House In Ireland

Will We Have To Pay Capital Gains Tax If Selling Our House In Ireland

Capital Gains Tax Cgt In Australia Go To Court Lawyers

Capital Gains Tax Cgt In Australia Go To Court Lawyers