Impairment Of Property Plant And Equipment Meaning

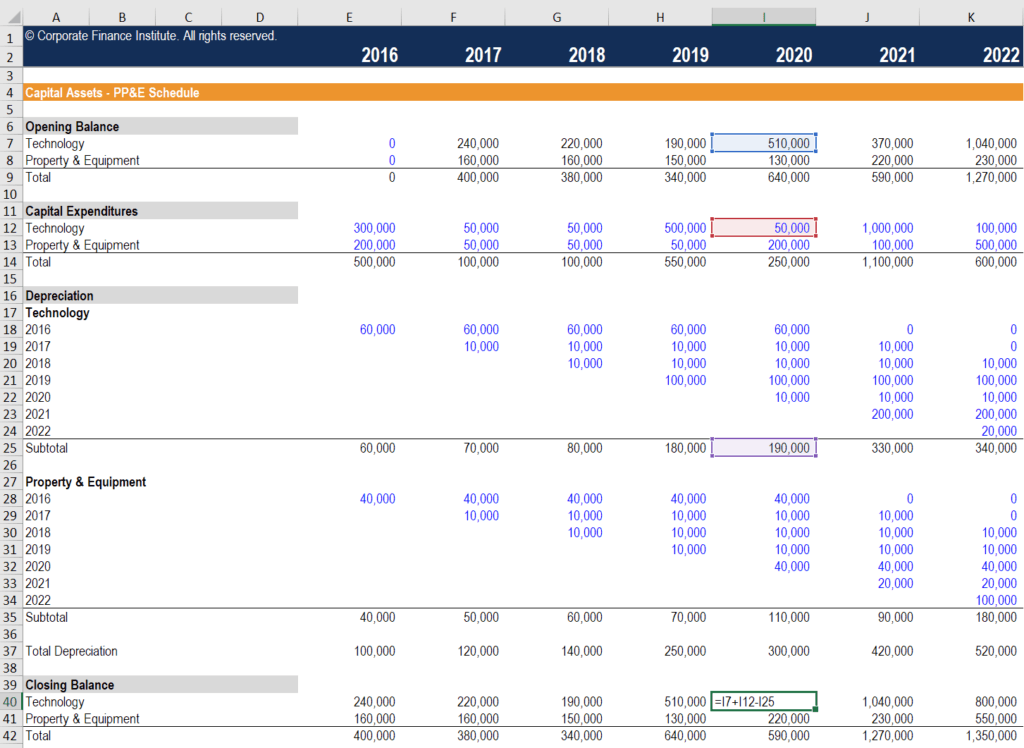

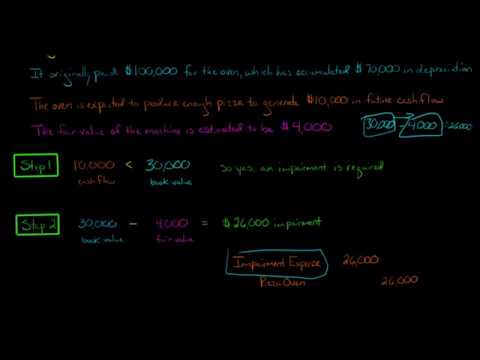

An impairment loss is recognized through a journal entry that debits Loss on Impairment debits the assets Accumulated Depreciation and credits the Asset to reflect its new lower value. In this article we are going to take a look at depreciation and impairment of property plant and.

Property Plant And Equipment Pp E Youtube

Property Plant And Equipment Pp E Youtube

Accounting for property plant and equipment mostly deals with initial recognition depreciation revaluation impairments and derecognition of an asset.

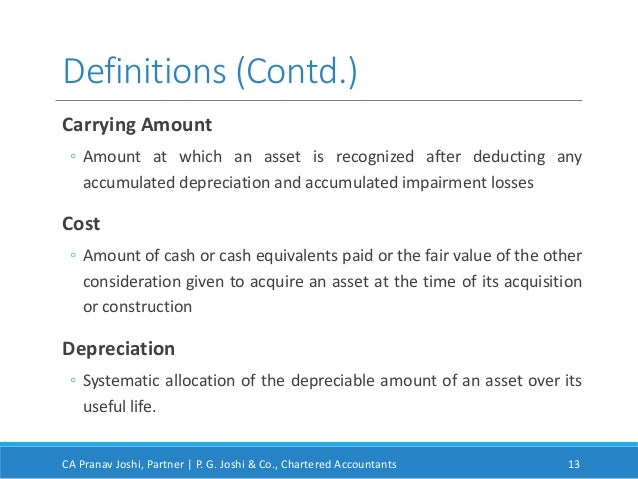

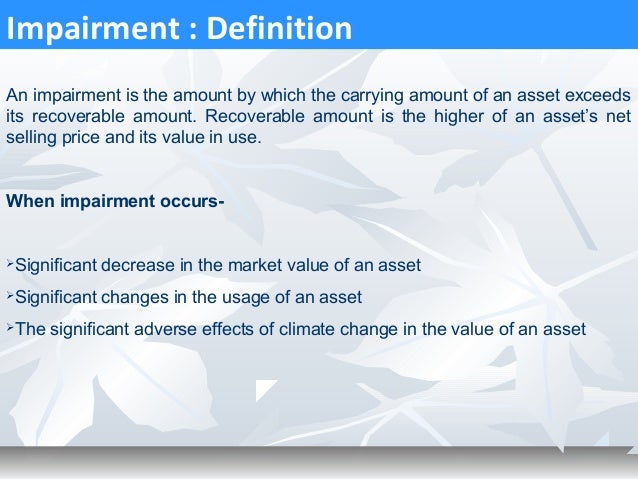

Impairment of property plant and equipment meaning. As the impairment is the difference between the carrying amount and that value. Impairment is recognized by reducing the book value of the asset in the balance sheet and recording impairment loss in the income statement. The amount by which the carrying amount of an asset or cash-generating unit exceeds its recoverable amount Carrying amount.

Compensation from the third party for PPE impairment shall be included in PL when compensation is receivable. Such a difference if found to exist for sure is accounted for in the books. When testing an asset for impairment the total profit.

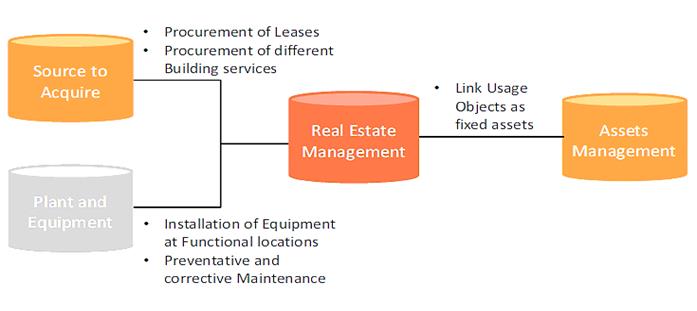

Specifically we are interested in how assets are recognized and accounted. IAS 16 Property Plant Equipment The meaning of PPE and its cost Depreciation Impairment of assets Able to compute A depreciation charge Revised carrying amount Contents and learning objectiv es. Real estate companies that prepare financial statements in accordance with generally accepted accounting principles in the US.

Indicators of Impairment Test. It can happen to property equipment vehicles or other fixed assets. The amount at which an asset is recognised in the balance sheet after deducting accumulated depreciation and accumulated impairment losses.

These assets are the most likely to experience impairment which may be caused by several factors. Recoverable amount is higher of an assets fair value reduced by its selling cost and its utility. Must follow the rules and principles of asset impairment under the.

What is an impairment of assets. IAS 16 Property Plant and Equipment requires impairment testing and if necessary recognition for property plant and equipment. Fixed assets commonly known as PPE Property Plant.

Physical damage to the asset a permanent reduction in market value legal issues against the asset and early asset disposal. This decline in value or impairment may result from several causes including damage obsolescence due to advances in technology or changes in the legal code. Definition of Impairment An asset is impaired when its value in the market is less than its value recorded on the balance sheet of the company.

It may also result from a decrease in the expected cash flow the equipment will bring to the business. Recoverable amount is the higher of an assets fair value less costs to sell and its value in use. Property plant and equipment should not be valued higher than its the recoverable amount.

Impairment losses can occur for a variety of reasons. Property plant and equipment PPE are tangible assets held by an entity for their own use or. Basically when youre dealing with property plant and equipment in line with IAS 16 or intangible assets in line with IAS 38 then you need to look to IAS 36 too.

In accordance with the policy on impairment assets are tested for impairment to ensure that they are not carried in the balance sheet at a value more than their recoverable amount. Identify an asset that might be impaired. An asset is impaired when its carrying amount exceeds its recoverable amount.

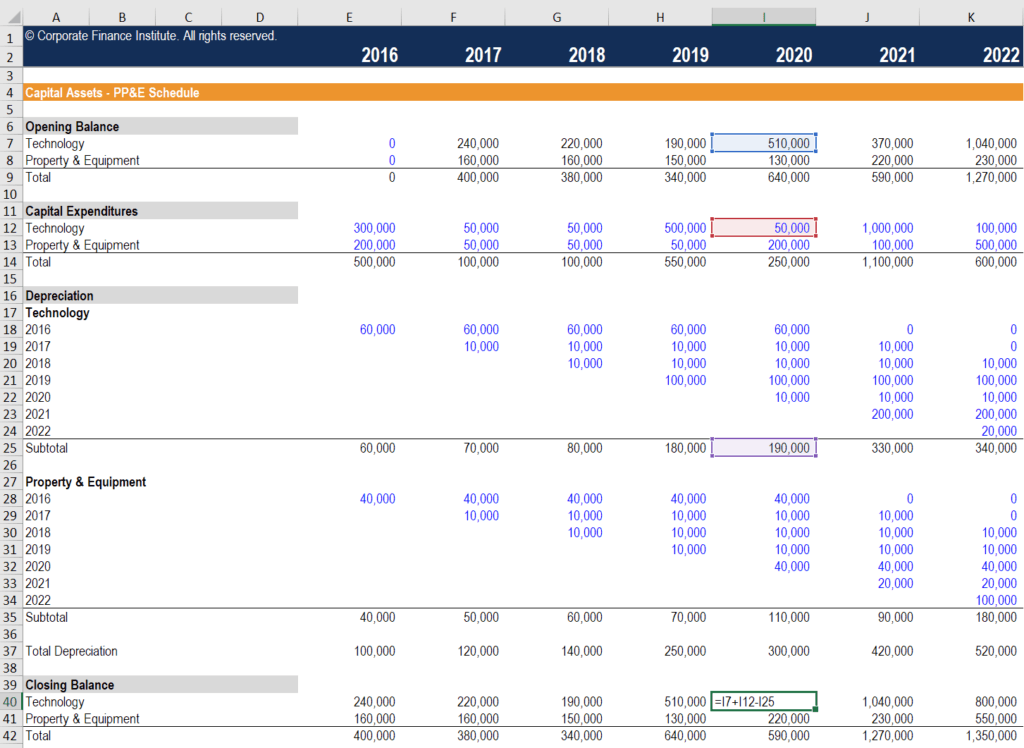

21 Property Plant Equipment and. For rental to others. PPE is impacted by Capex furniture and fixtures etc whereas intangible assets can be goodwill patent license etc.

In accounting impairment describes a permanent reduction in the value of a companys asset typically a fixed asset or an intangible asset. An item of property plant or equipment shall not be carried at more than recoverable amount. A tangible asset can be property plant and machinery PPE PPE Property Plant and Equipment PPE Property Plant and Equipment is one of the core non-current assets found on the balance sheet.

The value of the asset is written down to its current market price. Under US GAAP and IFRS property plant and equipment can be treated using either the cost model or revaluation model. Impairment of a fixed asset refers to an abrupt decrease in the economic benefits that an asset can generate due to damage obsolescence etc.

Of course selling property plant and equipment to fund business operations is a signal that a company might be in financial trouble. Impairment of assets is the diminishing in quality strength amount or value of an asset. Under IFRS an impairment loss is recognized if the carrying amount exceeds the recoverable amount of the asset which is the higher of its fair value minus costs of disposal 80000 15000 or its value in use 90000.

Ias 16 Property Plant Equipment Ppe

Ias 16 Property Plant Equipment Ppe

Property Plant Equipment Ias 16

Property Plant Equipment Ias 16

Test Bank Chapter 4 Af210 Usp Studocu

Test Bank Chapter 4 Af210 Usp Studocu

Cost Model In Accounting Definition Ias 16 Ifrs Us Gaap Journal Entries Depreciation Example

Pp E Property Plant Equipment Overview Formula Examples

Pp E Property Plant Equipment Overview Formula Examples

Depreciation And Impairment Of Property Plant And Equipment Morgan International

Depreciation And Impairment Of Property Plant And Equipment Morgan International

Http Uir Unisa Ac Za Bitstream Handle 10500 19405 Hemus C 086981950x Section3 Pdf Sequence 3 Isallowed Y

Property Plant And Equipment Pp E Formula Calculations Examples

Property Plant And Equipment Pp E Formula Calculations Examples

:max_bytes(150000):strip_icc()/dotdash_Final_Property_Plant_and_Equipment_PPE_Sep_2020-01-dd61e2f2fdb7481d81e95bc90b5c61d8.jpg) Property Plant And Equipment Pp E Definition

Property Plant And Equipment Pp E Definition

Mfrs 116 Property Plant And Equipment By Aliah Azman

Mfrs 116 Property Plant And Equipment By Aliah Azman

Property Plant And Equipment Net Financial Edge Training

Property Plant And Equipment Net Financial Edge Training

Https Www Aer Gov Au System Files Pn 201 20property 20plant 20and 20equipment Pdf

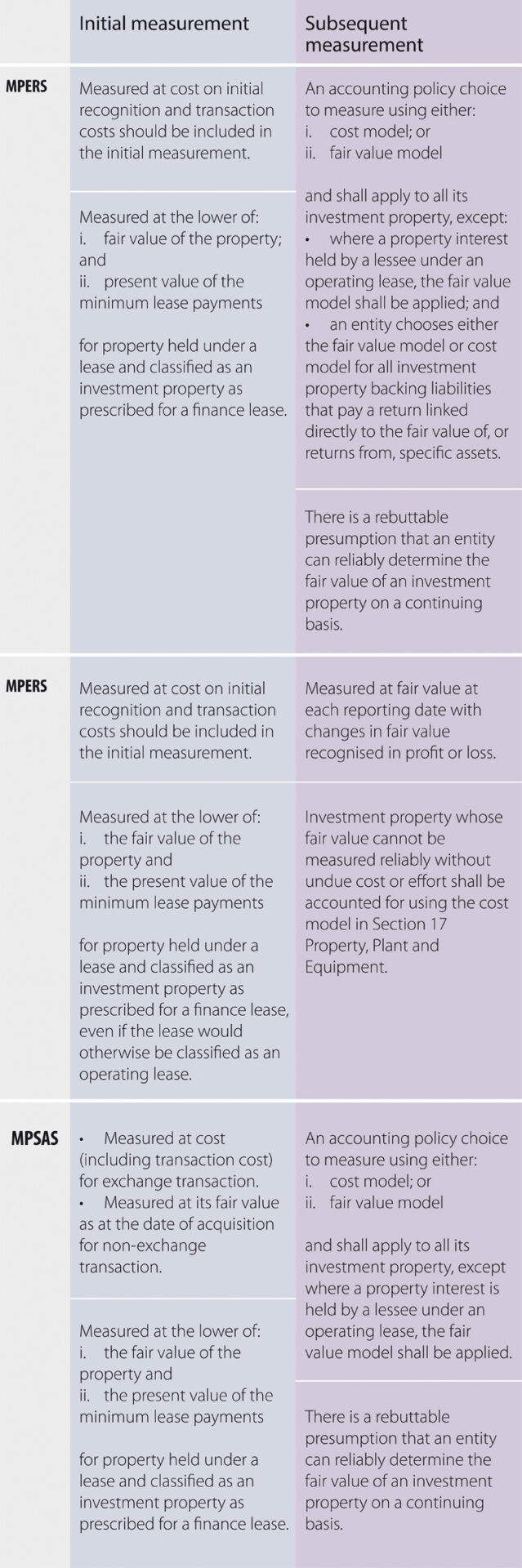

Comparison Between Mpsas Mpers And Mfrs Investment Property Accountants Today

Comparison Between Mpsas Mpers And Mfrs Investment Property Accountants Today

Impairment Of Property Plant And Equipment Youtube

Impairment Of Property Plant And Equipment Youtube

Mfrs 140 Investment Property Ppt Download

Mfrs 140 Investment Property Ppt Download

Frs 102 Examining Section 16 And Section 17 Aat Comment

Frs 102 Examining Section 16 And Section 17 Aat Comment

Derecognition Of Property Plant And Equipment Open Textbooks For Hong Kong