New Zealand Property Tax Calculator

This income tax calculator will allow you to quickly and easily see your tax or government deductions based on your salary. We hope you find our tax calculator and tools useful.

The World S Most Competitive Tax Systems Infographic

The World S Most Competitive Tax Systems Infographic

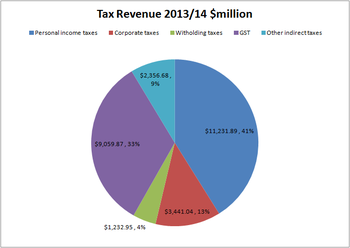

The taxes are collected at a national level by the Inland Revenue Department IRD on behalf of the Government of New Zealand.

New zealand property tax calculator. For everything you need to know about COVID-19 go to. KiwiSaver Student Loan Secondary Tax Tax Code ACC PAYE. You can get a tailored tax rate for income you get from.

The bright-line property rule does not apply to properties bought before 1 October 2015. If you have a tax agent theyll be able to help. Here they are in a nutshell.

What was your household income before tax. Estate and inheritance taxes for example are due upon the death of an individual and the passing of his or her estate to an heir respectively. Crime Politics Health.

Tax calculators These handy calculators are designed to help you with GST income tax and hourly rates. Learn more about how to file an income tax return. In New Zealand currently there is no general capital gains tax as yet as a blanket system however income tax can and may be charged on the profits from the sale of property and land that was acquired with the purpose of resale.

A Capital Gains Tax is taxation on capital gains from assets such as stocks bonds precious metals or most likely real estate. Taxation in New Zealand Income Tax is a gradual tax that has four brackets. Property taxes pay for local services such as street cleaning lighting and subsidies paid to local public transport companies.

If you sell a residential property you have owned for less than 5 years you may have to pay income tax. If we approve your application well let you know what your tailored tax rate is. This is a powerful calculator designed specifically for New Zealand conditions.

It could be up to 655. Calculate your take home pay from hourly wage or salary. Early on tax deductions mean that the property pays no tax but because the mortgage is large the high cost of servicing the mortgage keeps the rate of.

Most annual property taxes include a computation based on a percentage of the assessed value. Goods and services tax GST Tāke mō ngā rawa me ngā ratonga Non-profits and charities Ngā umanga kore-huamoni me ngā umanga aroha. Capital gains tax CGT to apply after the sale of residential.

This rule also applies to New Zealand tax residents who buy overseas residential properties. Tailored tax rates for salary wages and pensions. Your average tax rate is 1749 and your marginal tax rate is 3146This marginal tax rate means that your immediate additional income will be taxed at this rate.

Business and organisations Ngā pakihi me ngā whakahaere. You need to apply for a tailored tax code first. Sir Michael Cullens working group has recommended a swathe of changes to New Zealands tax system.

New Zealand Government Te Kawanatanga o Aotearoa. Your free Westpac Property Report. If you sell a property that falls under the bright-line rule then youll need to complete an income tax return and a Property sale information form - IR833 at the end of the tax year.

The states average effective rate is 242 of a homes value compared to the national average of 107. They usually include rubbish collection although an extra charge is levied in some areas recycling collection and water although in some areas such as Auckland water is billed separately. Calculate property taxes including California property taxes.

IRD numbers Ngā tau IRD. To use this income tax calculator simply fill in the relevant data within the green box and push Calculate. States such as California increase the assessment value by up to 2 per year.

Whatever your home and property goals are having an idea of the value of a property is a huge step forward to planning your next move. This calculator is an estimating tool and does not include all taxes that may be included in. If you make 50000 a year living in New Zealand you will be taxed 8745That means that your net pay will be 41255 per year or 3438 per month.

Property Taxes in New Zealand. We can help with that with a free property report. Property taxes apply to assets of an individual or a business.

Please ask us if you would like to see any new calculators added here. Use the calculator to work out what you might get. Income tax Tāke moni whiwhi mō ngā pakihi.

The income tax in New Zealand starts at 105 for incomes up to 14000 NZD and ends at 33 for wages greater than 70000 NZD. Use it to compare your after-tax return from two different investment choices. New Zealands Best PAYE Calculator.

KiwiSaver for employers. Schedular payment tax rates. Overall homeowners pay the most property taxes in New Jersey which has some of the highest effective tax rates in the country.

Taxes On Foreigners Real Estate Rental Income In New Zealand

Taxes On Foreigners Real Estate Rental Income In New Zealand

Tax Planning For Ownership Of Us Real Estate Us Uk Tax Frank Hirth

Tax Planning For Ownership Of Us Real Estate Us Uk Tax Frank Hirth

New Zealand Tax Income Taxes In New Zealand Tax Foundation

New Zealand Tax Income Taxes In New Zealand Tax Foundation

Cost To Live In New Zealand Will You Feel Rich Or Desperatly Broke

Cost To Live In New Zealand Will You Feel Rich Or Desperatly Broke

Taxation In New Zealand Wikipedia

Taxation In New Zealand Wikipedia

Lisa Marriott Contrasts Our Broad Base Low Rate Philosophy To Tax Policy With The Reality That There Are Significant Exceptions And These All Benefit The Wealthy Interest Co Nz

Lisa Marriott Contrasts Our Broad Base Low Rate Philosophy To Tax Policy With The Reality That There Are Significant Exceptions And These All Benefit The Wealthy Interest Co Nz

Smart Feasibility Calculator By Property Development System

Smart Feasibility Calculator By Property Development System

New Zealand Inflation Rate 2025 Statista

New Zealand Inflation Rate 2025 Statista

Japan Plans To Cut Corporate Tax Rate Leaving U S Further Behind Tax Foundation

Japan Plans To Cut Corporate Tax Rate Leaving U S Further Behind Tax Foundation

How To Get New Zealand Citizenship The Ultimate Guide Nomad Capitalist

How To Get New Zealand Citizenship The Ultimate Guide Nomad Capitalist

Salaries In New Zealand How Do They Compare For Your Industry Move To Nz

Salaries In New Zealand How Do They Compare For Your Industry Move To Nz

Calculating Taxable Gains On Share Trading In New Zealand Sharesight

Calculating Taxable Gains On Share Trading In New Zealand Sharesight

New Zealand Paye Tax Rates Moneyhub Nz

New Zealand Paye Tax Rates Moneyhub Nz

File Us Expat Tax In New Zealand

File Us Expat Tax In New Zealand

How To Calculate Capital Gains Tax H R Block

How To Calculate Capital Gains Tax H R Block

How Do Taxes In New Zealand Work New Zealand Property Guides

How Do Taxes In New Zealand Work New Zealand Property Guides

How To Report Rental Income On Foreign Property A Guide For Expats

How To Report Rental Income On Foreign Property A Guide For Expats