Property Tax Calculator Hamilton

Situated along the Tennessee River Hamilton County has among the highest property tax rates in the state. To calculate the tax on your property multiply the Assessed Value by the Tax Rate.

Florida Property Tax H R Block

Florida Property Tax H R Block

A combination of high property tax rates and high home values in northeast New Jerseys Bergen County means that the median property tax bill is more than 10000 the highest the US.

Property tax calculator hamilton. You can calculate your property tax using either your homes MCAP assessed value or your homes most recent market price. Taxes on real estate are due in January and June of each year. The states average effective tax rate of 117 is higher than the national average.

210 Courthouse 625 Georgia Ave. You can use the Property Tax Calculator to find out how much you are paying in taxes for specific City services. Refer to your property tax bill for actual amounts.

The ASSESSED VALUE is 25000 25 of 100000 and the TAX RATE has been set by your county commission at 320 per hundred of assessed value. Looking to calculate your potential monthly mortgage payment. Every four years the Municipal Assessment Corporation MPAC conducts an evaluation of properties all over Ontario and submits assessed values for each of them.

The Property Tax Calculator can provide this breakdown based on your specific property information using your address or roll number or more generically by entering an assessment amount. Learn about personal property tax guidelines and access important forms for filing taxes. Hamilton County sits north of Indianapolis and is one of the fastest-growing counties in the country.

The Tax Calculator shows an example of how your tax dollars are allocated amongst City services. Assume you have a house with an APPRAISED VALUE of 100000. The tax is calculated by multiplying the current year property-value with the total tax rate which mainly consists.

32312 manufactured homes ORC. The Township of Hamilton Tax department collects property taxes on behalf of Northumberland County the School Boards and for the TownshipYou can choose to change your school support by filling out the Application for Direction of School Support form and submitting it to the Municipal Property Assessment Corporation The taxes we collect provide services which include roads parks and rec. Hamiltons property tax is based on the assessed value of the home.

The median annual property tax payment in the state is 4899. Chattanooga TN 37402 Phone. Check out our mortgage calculator.

The countys average effective tax rate is 089. Overview of Massachusetts Taxes. Change of Mailing or Property Address.

Estimating Your Taxes To estimate your tax bill please use the State Tax Bill EstimatorTo utilize the state tax bill estimator tool you will need to know your assessed value. Our Ohio Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Ohio and across the entire United States. While the exact property tax rate you will pay for your properties is set by the local tax assessor you can estimate your yearly property tax burden by choosing the state and county in which your property is located and entering the approximate Fair Market Value of your property into the calculator.

Your final property tax amount is calculated by multiplying the Hamilton final property tax rate for the year by the MCAP property assessed value. You can either enter your address and tax roll number or enter the assessment amount from MPAC to use the calculator. 450306 and personal property ORC.

Thats also higher than the rates in Kentuckys Kenton Boone and Campbell counties which are located across the river from Hamilton County. Bill Hullander - Hamilton County Trustee. The median annual property tax payment in Hamilton County was 2428.

In accordance with the Ohio Revised Code the Hamilton County Treasurer is responsible for collecting three kinds of property taxes. Estimate Property Tax Our Hamilton County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Ohio and across the entire United States. And taxes on manufactured homes are due in March and July.

Sign up to have your Tax Statement emailed to you instead of using traditional mail. It also has the highest property values of any county in Indiana with a median home value of 249400. Situated along the Ohio River in southwest Ohio Hamilton County has property tax rates higher than both state and national averages.

Property owners in the City of Hamilton can obtain a breakdown by service of the City tax portion of property taxes. The countys average effective property tax rate is 181. Massachusetts Property Tax Calculator.

You can calculate your property tax using either your homes MCAP assessed value or your homes most recent market price. As a result property tax payments are also higher. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

Your final property tax amount is calculated by multiplying the Halton Hillsfinal property tax rate for the year by the MCAP property assessed value. Homeowners in Massachusetts face some of the largest annual property tax bills of any state in the country. In Chattanooga the countys largest city the total mill rate is 22770 per 100 in assessed value which is equal to 25 of market value.

Calculate Landed Cost Excel Template For Import Export Inc Freight Cu Incodocs Import Exports Database Business B Excel Templates Excel Templates

Calculate Landed Cost Excel Template For Import Export Inc Freight Cu Incodocs Import Exports Database Business B Excel Templates Excel Templates

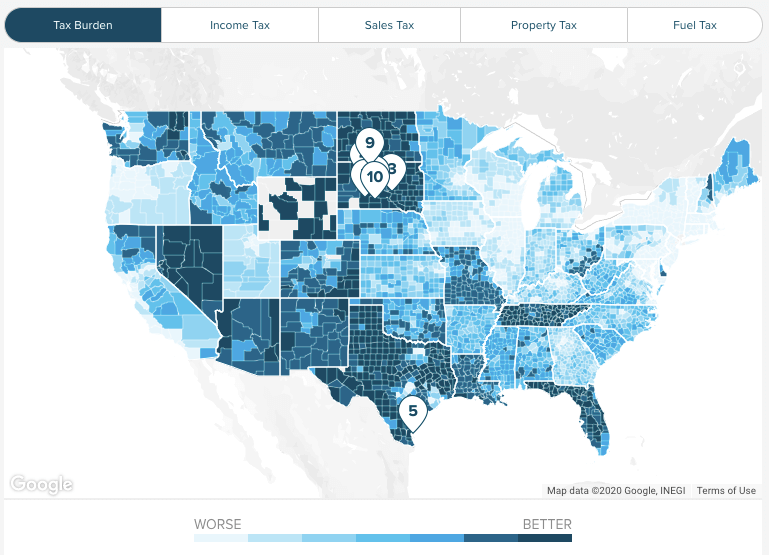

Property Tax Map Reforming Government

Property Tax Map Reforming Government

Indiana Income Tax Calculator Smartasset

Indiana Income Tax Calculator Smartasset

Indiana Property Tax Calculator Smartasset

Indiana Property Tax Calculator Smartasset

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

Why Are Nj Property Taxes So Incredibly High When It Is The Most Densely Populated State In The Country Shouldn T Nj Residents Pay Less Property Tax Since There Are More People Per

Easyknock The Guide To Georgia Property Tax Rates And Options

Easyknock The Guide To Georgia Property Tax Rates And Options

Mortgage Calculator Three Types Of Lending Approvals Infographics Mortgage Amortization Cal Real Estate Infographic Real Estate Buyers First Time Home Buyers

Mortgage Calculator Three Types Of Lending Approvals Infographics Mortgage Amortization Cal Real Estate Infographic Real Estate Buyers First Time Home Buyers

Ohio Property Tax Calculator Smartasset

Ohio Property Tax Calculator Smartasset

Real Estate Is One Of The Best Investments You Can Make For Long Term Growth And Whe Commercial Rental Property Rental Property Investment Investment Property

Real Estate Is One Of The Best Investments You Can Make For Long Term Growth And Whe Commercial Rental Property Rental Property Investment Investment Property

How To Calculate Your Tax Bill

How To Calculate Your Tax Bill

Use Smartasset S Paycheck Calculator To Calculate Your Take Home Pay Per Paycheck For Both Salary And Hourly Jobs Retirement Calculator Property Tax Financial

Use Smartasset S Paycheck Calculator To Calculate Your Take Home Pay Per Paycheck For Both Salary And Hourly Jobs Retirement Calculator Property Tax Financial

Here S How Tennessee S Property Taxes Stack Up Nationwide Nashville Business Journal

Wayne County Property Tax Records Wayne County Property Taxes Ny

Wayne County Property Tax Records Wayne County Property Taxes Ny

Property Tax Rates Across The State

If You Have Rental Properties In Canada Check Out This Helpful Infographic F Real Estate Investing Rental Property Rental Property Investment Rental Property

If You Have Rental Properties In Canada Check Out This Helpful Infographic F Real Estate Investing Rental Property Rental Property Investment Rental Property

New Investment Excel Template Exceltemplate Xls Xlstemplate Xlsformat Excelformat Microsoftexcel Spreadsheet Template Investing Investment Property

New Investment Excel Template Exceltemplate Xls Xlstemplate Xlsformat Excelformat Microsoftexcel Spreadsheet Template Investing Investment Property

How To Get Tax Return Copies From Irs Https Www Irstaxapp Com How To Get Tax Return Copies From Irs Tax Return How To Get Irs

How To Get Tax Return Copies From Irs Https Www Irstaxapp Com How To Get Tax Return Copies From Irs Tax Return How To Get Irs

Real Estate Lead Tracking Spreadsheet Fresh Tax Deduction Spreadsheet Paso Evolist Tax Deductions Music Business Cards Free Business Card Templates

Real Estate Lead Tracking Spreadsheet Fresh Tax Deduction Spreadsheet Paso Evolist Tax Deductions Music Business Cards Free Business Card Templates