Property Tax Percentage Ontario

In 2018 the average commercial property tax rate was 2421 per 1000 of property value. For 2018 and previous tax years you can find the federal tax rates on Schedule 1For 2019 2020 and later tax years you can find the federal tax rates on the Income Tax and Benefit ReturnYou will find the provincial or territorial tax rates on Form 428 for the.

If You Are Planning To Buy A Land Property Or Buy An Interest For A Land In Ontario Canada Then You Mortgage Rates Mortgage Interest Mortgage Interest Rates

If You Are Planning To Buy A Land Property Or Buy An Interest For A Land In Ontario Canada Then You Mortgage Rates Mortgage Interest Mortgage Interest Rates

London property tax rates are the 39th lowest property tax rates in Ontario for municipalities with a population greater than 10K.

Property tax percentage ontario. In a two-tiered municipality a component of the rate is set by the upper-tier and a component is set by the lower-tier municipality. Canandaigua NY 14424 Map Ph. California has one of the highest average property tax rates in the country with only nine states levying higher property taxes.

Every four years the Municipal Assessment Corporation MPAC conducts an evaluation of properties all over Ontario and submits assessed values for. Ontario Tax Rates - Current Marginal Tax Rates- Ontario Personal Income Tax Rates Ontario 2021 and 2020 Personal Marginal Income Tax Rates. Real Property Tax Department 20 Ontario St.

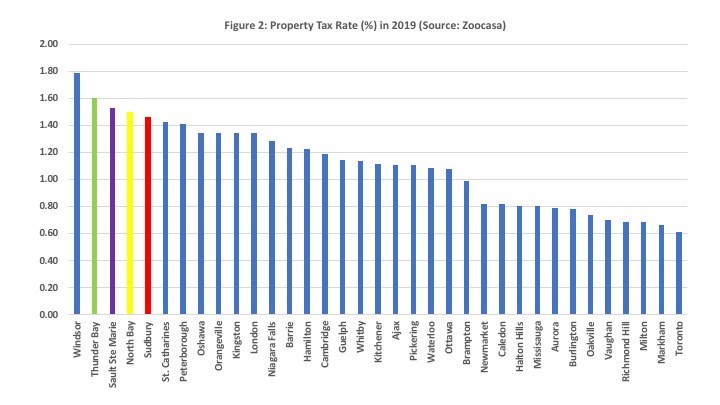

Below is the 2019 edition of Ontario Cities with the Highest and Lowest Property Tax Rates report originally published August 1 2019. Meanwhile homeowners in Windsor Ont. An assesment value of 455 500 the property tax rate of Toronto.

Realtors say Ontario government should ban so-called bully offers This means that if you owned a home valued at 500000 in Windsor which has a property tax rate of 1789394 per cent. Counties in California collect an average of 074 of a propertys assesed fair market value as property tax per year. The rates for the municipal portion of the tax are established by each municipality.

Living in a city with a low property tax rate doesnt always mean you pay lower taxes if average home prices are higher. Property Tax Calculator 2021 WOWA Trusted and Transparent. In fact the property tax bills you receive may come in a City envelope but less than 30 per cent of property taxes are used by the City of Vaughan.

Statistics compiled by Zoocasa offer a snapshot of how much property taxes can vary throughout Canada and show that Toronto residents paid nearly three times more in property taxes for a home of the same value. Visit our 2020 Ontario property tax rate ranking for the most recent findings published November 12 2020. Property taxes are levies that governments use as a source of tax revenue.

Tax rates for previous years 1985 to 2020 To find income tax rates from previous years see the Income Tax Package for that year. Property tax has two components. Notice Chart for Small Claims.

Decal number for Boat Aircraft or Mobile Home. Montreal and Quebec City rates are particularly high. The propertys listing price as well as the.

For example as real estate prices and property assessment values increased in Toronto the largest city in Ontario so do property tax revenues giving council the ability to keep the rate low. The median property tax in California is 283900 per year for a home worth the median value of 38420000. For example the Toronto tax rate is 063551 per cent.

London property tax is based on the assessed value of your home. If youre one of the many Canadian homeowners who just paid their annual property tax heres an eye-opening look at how much others are paying in different regions of the country. Or community optional Parcel Number.

Torontos tax rate is the lowest in the province at 0614770 per cent meaning that people owning a home valued at 500000 will pay approximately 3074 in property taxes. The Federal tax brackets and personal tax credit amounts are increased for 2021 by an indexation factor of 1010. How Much You Need To Earn To Afford A Home In These GTA Cities.

Although commercial property values in Montreal are going up property tax rates remain high and are increasing. Are saddled with the provinces highest property tax rate of 1789394 per cent with taxes on a 500000 home coming in at 8947. Percentage of Home Value Median Property Tax in Dollars A property tax is a municipal tax levied by counties cities or special tax districts on most types of real estate - including homes businesses and parcels of land.

The Interim billing is an amount equal to 50 of the previous years property tax. The amount of property tax owed depends on the appraised fair market value of the property as determined by the property tax assessor. Cities east of Toronto tend toward higher rates.

A municipal portion and an education portion. 13 characters - no dashes. This translates into 5532 of property taxes based on the average June 2018 home value of 870559.

Toronto had the lowest property tax rate out of 35 municipalities at 0599704 in 2020. Please read the article Understanding the Tables of Personal Income Tax Rates. Other taxes Assesment value x Other taxes rate 100 Property tax Municipal tax Education tax Other taxes.

The tax rate for that class set annually by your City Council the tax rate for the Education school support portion of that class set annually by the Province of Ontario The amount owing in February and April is charged on the Interim Billing. They can be calculated using the assessed value of the property and the property tax rate of a certain region or municipality. Municipal tax of 0451568 education tax of 0161000 and other taxes of 0002202 for a total in property tax of 0614770.

Assessors in Attendance Dates. Property taxes are collected by the City of Vaughan for services provided by the City York Region and local school boards. For those considering a new home purchase the decision is generally ruled by their home buying budget.

Understanding Your Property Tax Bill City Of Hamilton Ontario Canada

Understanding Your Property Tax Bill City Of Hamilton Ontario Canada

Property Management Euless Best Real Estate Websites Selling House We Buy Houses

Property Management Euless Best Real Estate Websites Selling House We Buy Houses

Ontario Property Tax Rates Lowest And Highest Cities

Ontario Property Tax Rates Lowest And Highest Cities

How To Calculate Land Transfer Tax Know The Land Transfer Tax With Land Transfer Tax Calculator Click Here To C First Time Home Buyers Provincial First Time

How To Calculate Land Transfer Tax Know The Land Transfer Tax With Land Transfer Tax Calculator Click Here To C First Time Home Buyers Provincial First Time

Property Taxes Smooth Rock Falls

Pre Construction Condos For Sale Master Planned Community Condos For Sale New Condo

Pre Construction Condos For Sale Master Planned Community Condos For Sale New Condo

Best Mortgage Rate Calculator Ontario Canada For Adjustable Rate Mortgages And Fixed Mortgage Ontario Second Mortgage Mortgage Reverse Mortgage

Best Mortgage Rate Calculator Ontario Canada For Adjustable Rate Mortgages And Fixed Mortgage Ontario Second Mortgage Mortgage Reverse Mortgage

The Average Cost Of Rent For Apartments Across Ontario Ontario Rent Refinance Mortgage

The Average Cost Of Rent For Apartments Across Ontario Ontario Rent Refinance Mortgage

Statistics Canada Property Taxes

Statistics Canada Property Taxes

Understanding Your Property Tax Bill And The Services Supported

Understanding Your Property Tax Bill And The Services Supported

Kentucky First Time Home Buyer Programs For Home Mortgage Loans Frequently Asked Questions For Kentucky First First Home Buyer Buying First Home Home Mortgage

Kentucky First Time Home Buyer Programs For Home Mortgage Loans Frequently Asked Questions For Kentucky First First Home Buyer Buying First Home Home Mortgage

Pnp Points Calculator Calculator Pointe Ontario

Pnp Points Calculator Calculator Pointe Ontario

Provincial Land Tax Reform Overview Of The Provincial Land Tax Open Houses

Provincial Land Tax Reform Overview Of The Provincial Land Tax Open Houses

Car Insurance Calculator Ontario Auto Insurance Estimator Debt Management Debt Relief Debt Settlement

Car Insurance Calculator Ontario Auto Insurance Estimator Debt Management Debt Relief Debt Settlement

Zoocasa Ranked Sudbury Poorly For Property Taxes But Economist Says It S All In How You Use The Data Sudbury Com

Zoocasa Ranked Sudbury Poorly For Property Taxes But Economist Says It S All In How You Use The Data Sudbury Com

Excited Because It Is March And It Is Tax Time Thrilled To Get Your Receipts Ready Calculator Out And Grab The Tax Accountant Business Tax Accounting Firms

Excited Because It Is March And It Is Tax Time Thrilled To Get Your Receipts Ready Calculator Out And Grab The Tax Accountant Business Tax Accounting Firms

Ontario Land Transfer Tax Who Pays Calculator Exemptions Rebates Investing In Land Ontario First Time Home Buyers

Ontario Land Transfer Tax Who Pays Calculator Exemptions Rebates Investing In Land Ontario First Time Home Buyers