Property Tax Rate Calgary 2020

Property taxes are collected by municipalities to deliver services citizens use every day. The previously approved One Calgary Plan included a 303 increase to residential property taxes or about 510 per month for the typical single-family resident taxpayer.

Property Tax Rates Rocky View County

Property Tax Rates Rocky View County

2020 Property tax bills.

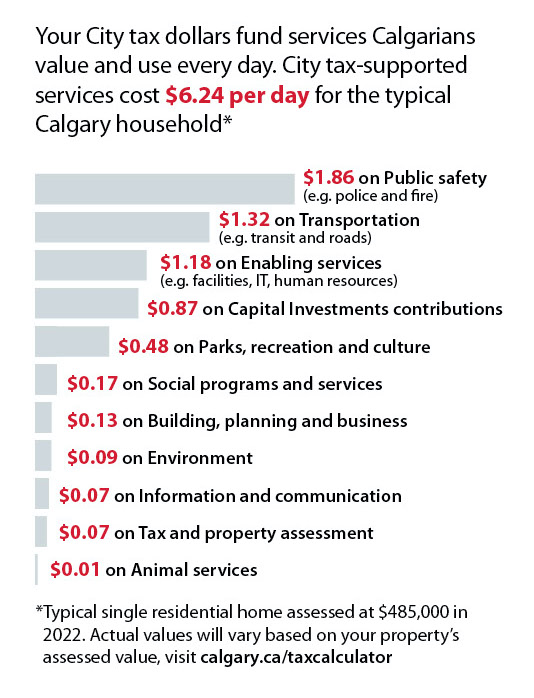

Property tax rate calgary 2020. Calgary homeowners already knew their property taxes were going up this year. Other taxes Assesment value x Other taxes rate 100 Property tax Municipal tax Education tax Other taxes. Property owners can go to the calgarycataxbreakdown to enter the amount of their property tax and see how their municipal property tax dollars are invested in City services that Calgarians rely on every day.

More than 19 billion in taxes needs to be collected by the City in 2020. Funds collected through property tax are split between the Alberta Government and The City of Calgary. Council also approved a 755 per cent tax hike for residential properties.

2020 property tax rates are set by Property Tax Bylaw 12M2020For information on how the tax rate is determined or how your tax bill is calculated visit Tax bill and tax rate calculation or visit the Property tax calculator to see a breakdown of your 2020 Property Tax. However property owners had until September 30 to pay their 2020 tax bill without penalty as the annual July 1 7 penalty was cancelled and the October 1 7 penalty was amended by Council to 35. City council approved a 345 per cent residential tax.

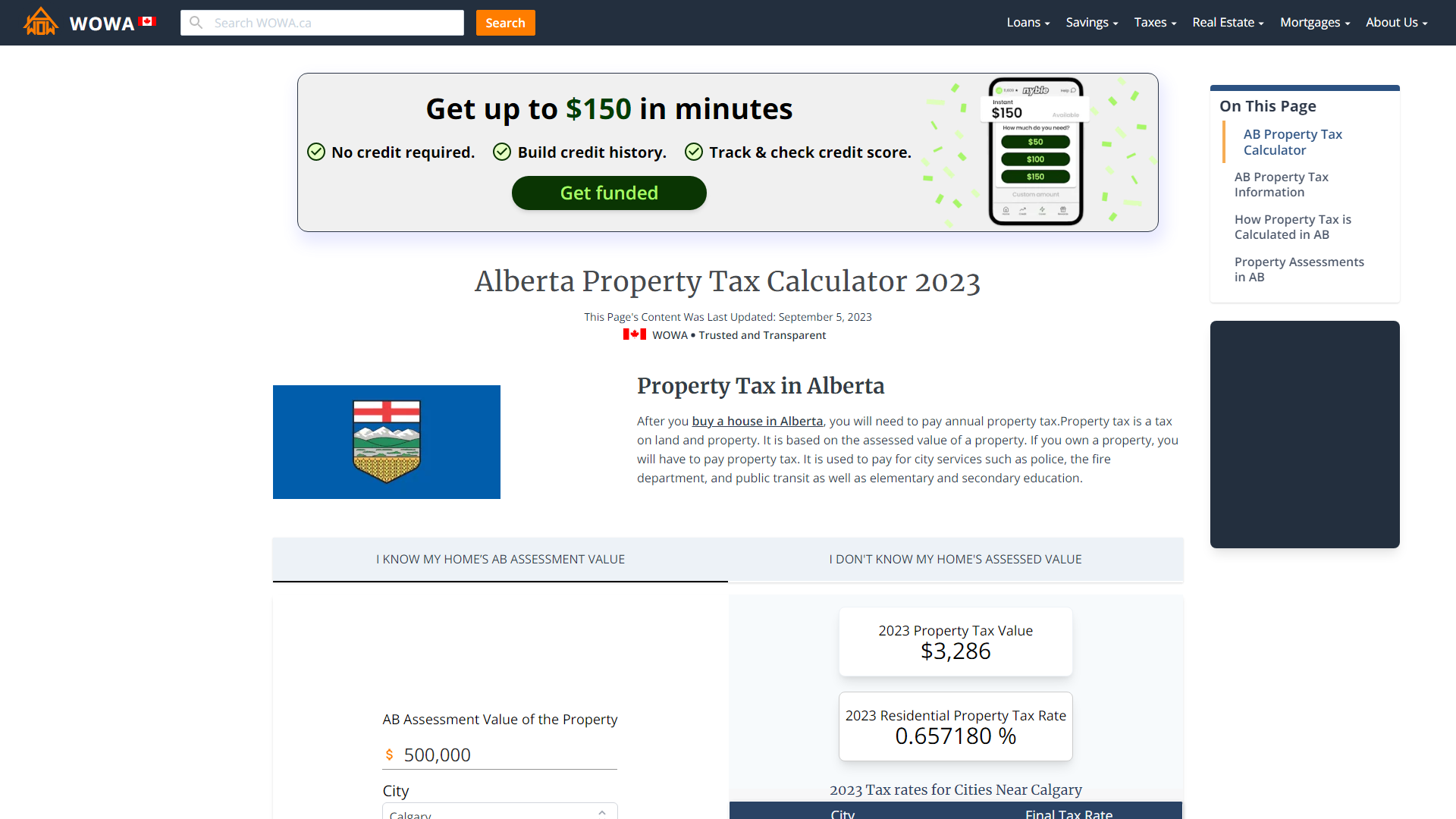

This calculator provides an estimate of the amount of property tax required based on the value of a property as of July 1 st the previous year. Through fair and equitable assessments the resulting property taxes support the essential City services provided to Calgarians. Canadian Property Tax Rate Benchmark Report 2020.

For the median-priced Calgary house of 455000 it. The Tax Instalment Payment Plan TIPP suspended its 2 filing fee for taxpayers who joined TIPP between January 1 2020 and January 1 2021. Living in a city with a low property tax rate doesnt always mean you pay lower taxes if average home prices are higher.

Calgaryproperty tax is based on the assessed value of your home. Property Assessments in Alberta. If your base provincial tax is between 4830 and 6182.

2020 Property tax rates. Similarly in Thunder Bay where the property tax rate is 1562626 the average home price was 226628 in September 2020. In 2020 the provincial education tax rate was set at 0255 of total residentialfarmland equalized assessment value and 0375 of total equalized assessment value for non-residential properties.

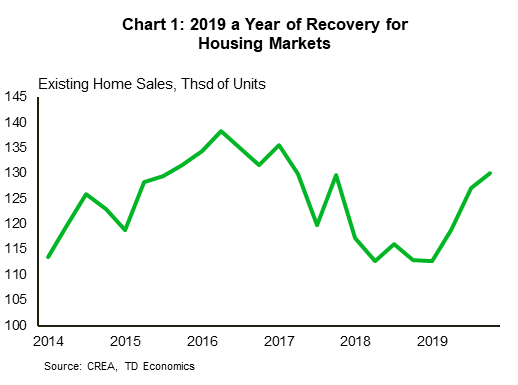

While real estate prices are subject to short-term volatility Calgary real estate prices have remained relatively stable in the long-term as the average house price in Calgary increased by 3 from October 2016 to October 2020. For 2020 the Ontario surtax is a bit more complicated see chart below. Taxes will be about 240 more this year for the.

Statistics compiled by Zoocasa offer a snapshot of how much property taxes can vary throughout Canada and show that Toronto residents paid nearly three times more in property taxes for a home of the same value. The City of Calgary issued a release prior to budget talks on Tuesday detailing possible 2020 adjustments to the One Calgary Service Plans and Budgets. Property taxes Calgary city council approved a 15 per cent tax hike in its November budget meaning owners of a median-priced home 456000 will pay approximately 150 extra in 2020.

2020 Residential property tax change Residential taxpayers will see a combined municipal and provincial tax increase of 755 or 240 per year for the typical assessed property of 455000 after the Council rebate. When blended with Calgarys approved 75 per cent tax hike it means homeowners are looking at a combined tax hike of 89 per cent for 2020. To ensure all Calgary property owners pay their fair share of municipal taxes The City conducts assessments each year that reflect the market value for property as of July 1 of the previous year as provisioned by.

If youre one of the many Canadian homeowners who just paid their annual property tax heres an eye-opening look at how much others are paying in different regions of the country. An assesment value of 455 500 the property tax rate of Toronto. This translates into 5532 of property taxes based on the average June 2018 home value of 870559.

For example the Toronto tax rate is 063551 per cent. Over the last 17 years we have benchmarked and analyzed property tax rates of major urban centres across Canada to identify the ratios of tax rates between commercial and residential properties. In most municipalities businesses pay at least double the amount of tax than homeowners with the Canadian average at 25.

Municipal tax of 0451568 education tax of 0161000 and other taxes of 0002202 for a total in property tax of 0614770. If your assessment class is not listed please contact us at 403-268-2888. Another factor is the citys commercial-to-residential tax ratio.

If your base provincial tax is below 4830 you pay no surtax. Now theres an answer to just how much higher theyll go.

Property Tax Hkay Professional Corporation In 2020 Business Rules Business Tax Tax Services

Property Tax Hkay Professional Corporation In 2020 Business Rules Business Tax Tax Services

Alberta Property Tax Rates Calculator Wowa Ca

Alberta Property Tax Rates Calculator Wowa Ca

Canadian Property Tax Rate Benchmark Report 2020 Altus Group

Canadian Property Tax Rate Benchmark Report 2020 Altus Group

Value Of Average Home Drops In Calgary As City Sends Out Property Assessments Ctv News

Value Of Average Home Drops In Calgary As City Sends Out Property Assessments Ctv News

2020 Housing Outlook Rising Sales And Tight Supply To Heat Up Prices

2020 Housing Outlook Rising Sales And Tight Supply To Heat Up Prices

Selling A House 21 Things House Real Estate 21 Things

Selling A House 21 Things House Real Estate 21 Things

Property Tax Tax Rate And Bill Calculation

Property Tax Tax Rate And Bill Calculation

Calgary Market Insider January 2020 Steven Lubiarz Greater Calgary Real Estate Calgary Estates Real Estate

Calgary Market Insider January 2020 Steven Lubiarz Greater Calgary Real Estate Calgary Estates Real Estate

Preparing 2021 Property Assessments During Covid 19

Preparing 2021 Property Assessments During Covid 19

The Us Real Estate Forecast 2017 To 2020 Most Real Estate Sales And Real Estate Investment Experts Are Predic Real Estate Usa Real Estate Real Estate Marketing

The Us Real Estate Forecast 2017 To 2020 Most Real Estate Sales And Real Estate Investment Experts Are Predic Real Estate Usa Real Estate Real Estate Marketing

Property Tax Decrease In The Works For Calgary Taxpayers Livewire Calgary

Property Tax Decrease In The Works For Calgary Taxpayers Livewire Calgary

This Is Nuts One Strategist Explains Why He Just Reduced Risk By Selling Apple Microsoft And More Marketwatch Explain Why Standard Deviation Explained

This Is Nuts One Strategist Explains Why He Just Reduced Risk By Selling Apple Microsoft And More Marketwatch Explain Why Standard Deviation Explained

Https Www Calgary Ca Content Dam Www Cfod Finance Documents Corporate Economics Calgary And Region Economic Outlook Calgary And Region Economic Outlook 2020 Spring Pdf

Latest Provincial Budget Factors In Stiff Property Tax Hike For Calgary Homeowners Ctv News

Latest Provincial Budget Factors In Stiff Property Tax Hike For Calgary Homeowners Ctv News

Experts Explain The Most Confusing Real Estate Terminology Real Estate Terms Real Estate Estates

Experts Explain The Most Confusing Real Estate Terminology Real Estate Terms Real Estate Estates