Property Taxes In Perry County Ohio

These records can include Perry County property tax assessments and assessment challenges appraisals and income taxes. In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property.

Topographical Map Of Ross County Ohio Library Of Congress

Click HERE to go to the new Perry County Online Tax Viewer.

Property taxes in perry county ohio. Fifth Third Bank German American Bank Old National Bank. Perry County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Perry County Ohio. When a Perry County OH tax lien is issued for unpaid past due balances Perry County OH creates a tax-lien certificate that includes the amount of the taxes owed plus interest and penalties.

Perry County Ohio First Half 2020 Real Estate Taxes and First Half 2021 Manufactured Home Taxes are due Friday March 12 2021. All property lines should be verified on-site by a licensed surveyor to determine legitimate. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Perry County Tax Appraisers office.

In-depth Perry County OH Property Tax Information. As of February 20 Perry County OH shows 20 tax liens. The exemption which takes the form of a credit on property tax bills allows qualifying homeowners to exempt up to 25000 of the market value of their homes from all local property taxes.

Perry County collects on average 107 of a propertys assessed fair market value as property tax. The median property tax in Perry County Ohio is 1070 per year for a home worth the median value of 100400. Browse Perry County OH real estate.

We accept payment by cash check money order credit or debit card. House Number Low House Number High Street Name. Perry County Property Records are real estate documents that contain information related to real property in Perry County Ohio.

How does a tax lien sale work. Interested in a tax lien in Perry County OH. There is a 275 convenience fee charged by the creditdebit card service provider.

The AcreValue Perry County OH plat map sourced from the Perry County OH tax assessor indicates the property boundaries for each parcel of land with information about the landowner the parcel number and the total acres. The median property tax on a 10040000 house is 107428 in Perry County. Finally property tax payments may be made at the following local banks during tax season if you have your tax coupon.

The maps and boundary data contained on this website are maintained for Tax purposes only and represent approximate boundariesThe property deed is the legal document which delineates and describes all property boundary lines. To provide the very best solution and tools available to assist the citizens of Perry County regarding property tax collection. Box 756 Tell City IN 47586.

Perry County property records for real estate brokers Residential brokers can inform their clients by presenting user-friendly property reports that include property characteristics recent sales property tax records and useful property maps. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. New Lexington Ohio 43764 740 342-2074 740 342-1627.

Find 82 homes for sale in Perry County with a median listing price of 129000. All tax payments are due by midnight of the date listed on the tax remittance coupon. The median property tax in Perry County Ohio is 107000 All of the Perry County information on this page has been verified and checked for accuracy.

Perry County Treasurer PO. AcreValue helps you locate parcels property lines and ownership information for land online eliminating the need for plat books. If you have any questions or concerns involving your tax bill please contact us at 606-439-4523 during our normal office hours.

Perry County Online Tax Map Viewer. Click HERE for. If any of the links or phone numbers provided no longer work please let us know and we will update this page.

The median property tax on a 10040000 house is 136544 in Ohio. Perry County Property Tax Inquiry. Ohio is ranked 1381st of the 3143 counties in the United States in order of the median amount of property taxes collected.

For example through the homestead exemption a home with a market value of 100000 is billed as if it is worth 75000.

Map Of Hamilton County Ohio Exhibiting The Various Divisions And Sub Divisions Of Land With The Name Of The Owners Number Of Acres In Each Tract Together With The Roads

Center Township Wood County Ohio Wikipedia

Center Township Wood County Ohio Wikipedia

Lake County Ohio Treasurer Real Estate Taxes Due

Lake County Ohio Treasurer Real Estate Taxes Due

Perry County Job And Family Services County Jobs Family Child Care Nurturing Children

Perry County Job And Family Services County Jobs Family Child Care Nurturing Children

Indiana Cotton Mill Cannelton Indiana National Register Of Historic Places National Historic Landmark Indiana

Indiana Cotton Mill Cannelton Indiana National Register Of Historic Places National Historic Landmark Indiana

Exploring Almost Forgotten Gravesites In The Great State Of Ohio Spotlighting Cincinnati S Mount Washington Cemetery Mount Washington Cincinnati Washington

Exploring Almost Forgotten Gravesites In The Great State Of Ohio Spotlighting Cincinnati S Mount Washington Cemetery Mount Washington Cincinnati Washington

Perry Township Montgomery County Ohio Wikipedia

Perry Township Montgomery County Ohio Wikipedia

Henry County Ohio 1901 Map Napoleon Holgate Malinta Hamler New Bavaria Okolona Deshler Mcclure Gerald Colton Oh Ohio Map Napoleon County Map

Henry County Ohio 1901 Map Napoleon Holgate Malinta Hamler New Bavaria Okolona Deshler Mcclure Gerald Colton Oh Ohio Map Napoleon County Map

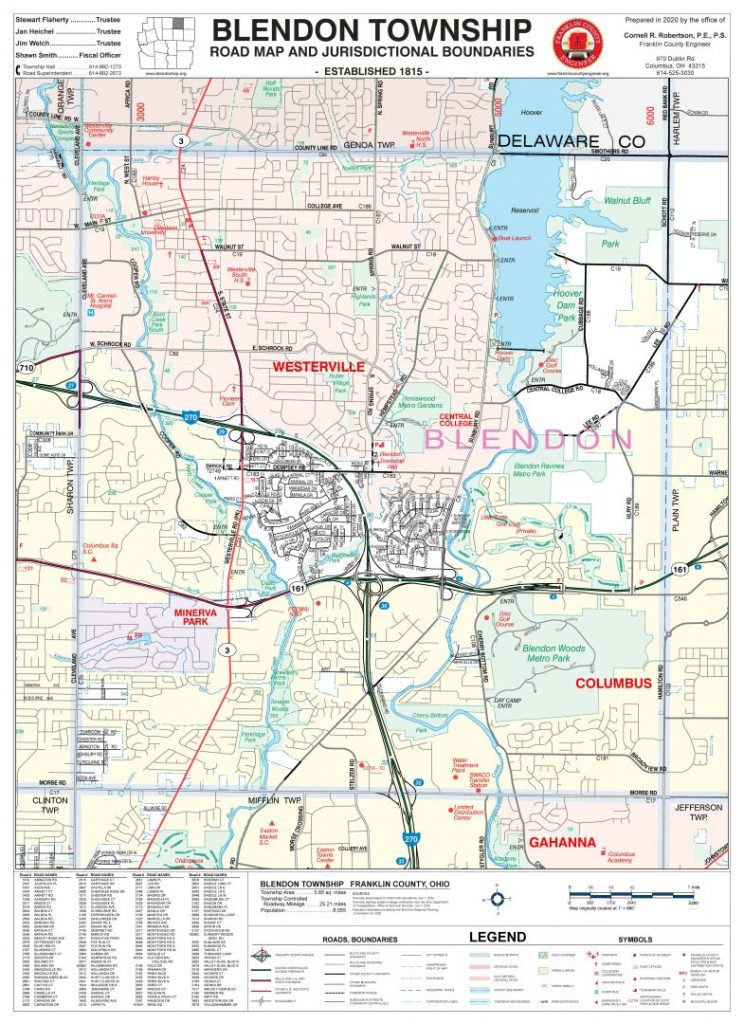

Township Maps Franklin County Engineer S Office

Township Maps Franklin County Engineer S Office

Painesville Township Lake County Ohio Wikipedia

Painesville Township Lake County Ohio Wikipedia

Perry Township Stark County Ohio Wikipedia

Perry Township Stark County Ohio Wikipedia

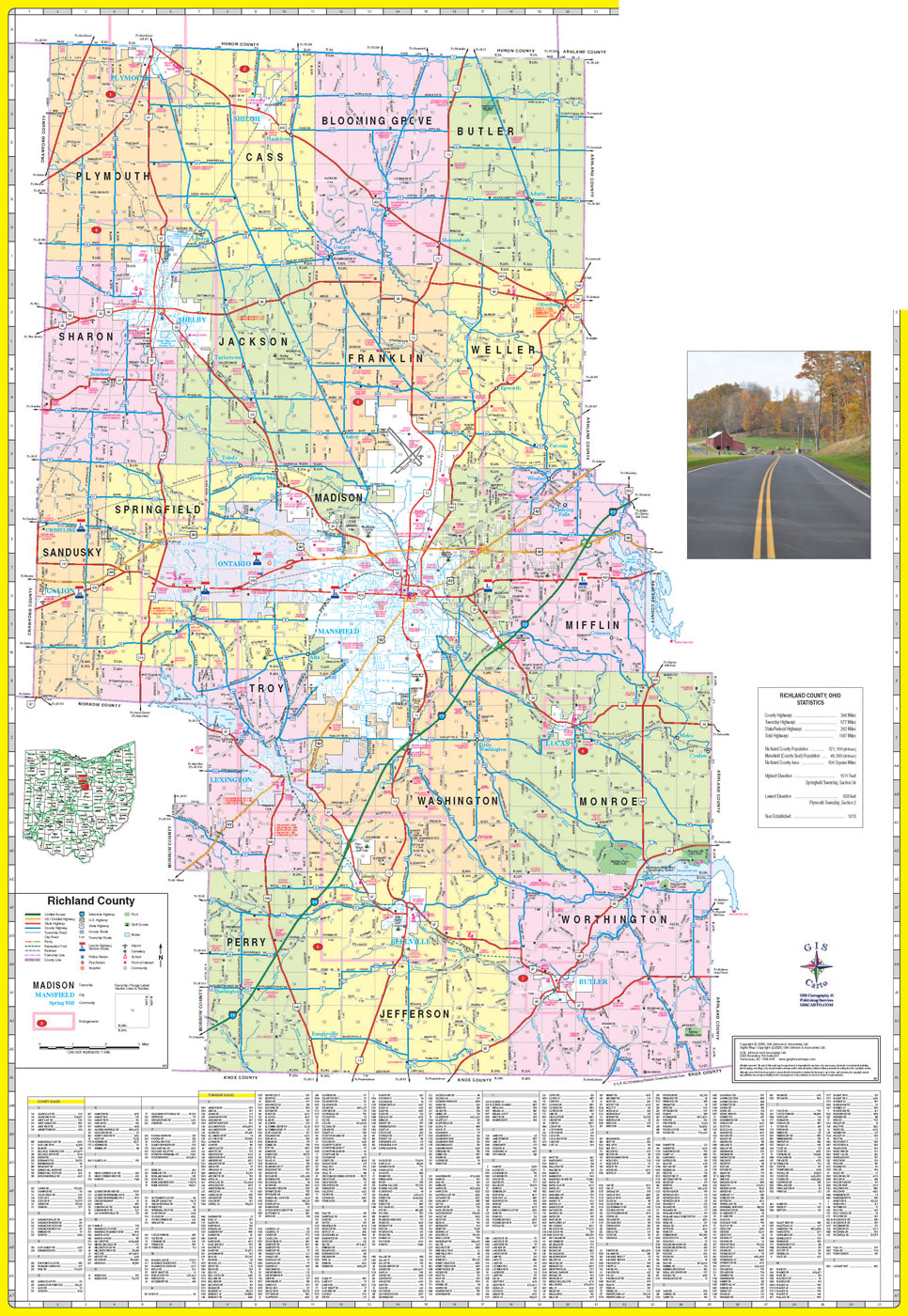

County Map Richland County Engineer

County Map Richland County Engineer

Map Of Mahoning County Ohio Showing The Original Lots And Farm Library Of Congress

Map Of Hamilton County Ohio Library Of Congress

National Register Of Historic Places Listings In Licking County Ohio Wikipedia

National Register Of Historic Places Listings In Licking County Ohio Wikipedia

Liberty Township Union County Ohio Wikipedia

Liberty Township Union County Ohio Wikipedia

Monday Creek Township Perry County Ohio Wikipedia

Monday Creek Township Perry County Ohio Wikipedia

Burlington Township Licking County Ohio Wikipedia

Burlington Township Licking County Ohio Wikipedia

Fredericktown Ohio Train Station Image Ohio Architecture Train Station

Fredericktown Ohio Train Station Image Ohio Architecture Train Station