What Is The Property Tax Rate In Idaho

187723 You can find the average urban and rural tax rates for each Idaho county in the Annual Report. That means an Idaho homeowner can expect to pay about 630 in annual property taxes per 100000 in home value.

Some of the tourist towns limit their local sales tax to lodging restaurant food and alcohol by the drink max is 3.

What is the property tax rate in idaho. The total amount of property tax that George owes is calculated like this. With a population of more than 445000 Ada County is the most populous county in Idaho. 100 of the market value of his half-acre lot on which the house sits is 96000.

Median property tax is 118800 This interactive table ranks Idahos counties by median property tax in dollars percentage of home value and percentage of median income. Percentage of Home Value Median Property Tax in Dollars A property tax is a municipal tax levied by counties cities or special tax districts on most types of real estate - including homes businesses and parcels of land. For the definition of fixtures and an explanation of each factor see Idaho Code section 63-2019 and Property Tax Administrative Rule 35010320503.

In urban areas such as the city of Boise the average nominal tax rate is on average 1327. The average statewide urban tax rate stands at 1511 percent while the rural rate is 0994 percent. The median property tax in Idaho is 118800 per year based on a median home value of 17170000 and a median effective property tax rate of 069You can look up your recent appraisal by filling out the form below.

The Idaho State Tax Tables for 2020 displayed on this page are provided in support of the 2020 US Tax Calculator and the dedicated 2020 Idaho State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state. The rural rate is somewhat lower at 0893. Sales tax in Idaho is 6.

Property Taxes in Meridian Idaho Related Information Meridian Idaho Real Estate Market Report Justin Nagle December 16 2019. Line D times the total rate of 001352 is Georges property tax bill for that year. The amount of property tax owed depends on the appraised fair market value of the property as determined by the property tax assessor.

Counties in Idaho collect an average of 069 of a propertys assesed fair market value as property tax per year. You must return your personal property declaration to the county assessor by March 15. The states average effective rate is 063 well below the US.

Idahos rate is 6 statewide an d local sales taxes above the state tax are allowed as high as 3 but only in small resorttourist communities. This year the states with the best scores on the property tax component are New Mexico Indiana Utah Idaho Arizona and North Dakota. 100 of the market value of his house is 142900.

Georges property is a house located in the fictitious city of New Town Idaho. The Idaho Department of Revenue is responsible for publishing the latest Idaho State Tax Tables each. In fact the statewide average urban tax rate is 1327 while the rural rate is 0893.

The City of Boise Idahos largest city located in Ada County has a helpful breakdown that shows how each property tax dollar that comes to the city is spent. Idaho Property Taxes by County Since Idaho has several taxing districts tax rates often vary. The state oversees local property tax procedures to make sure they comply with Idaho laws.

The median property tax in Idaho is 118800 per year for a home worth the median value of 17170000. Important dates March 15. Idahos property taxes are the 12th lowest in the country with an average effective rate of just 076.

Canyon County collects relatively high property taxes and is ranked in the top half of all counties in the United States by property tax collections. Property tax rates in Idaho are relatively low. Contact your county treasurer for specific tax rate information.

Cities generally levy higher tax rates than rural areas. The median property tax also known as real estate tax in Canyon County is 132600 per year based on a median home value of 15130000 and a median effective property tax rate of 088 of property value. The list is sorted by median property tax in dollars by default.

States put themselves in a better position to attract business investment when they maintain competitive real property tax rates and avoid harmful taxes on intangible property wealth and asset transfers. Seniors who are 65 or older qualify for a property tax break of up to 1320 if they own and occupy a home with less than one acre of property and have an income of less than 30050 in 2017. What is the Idaho property tax reduction.

The countys median annual property tax rate is 1659 while the average effective property tax rate is 075 ranked as the 12th highest across the state of Idaho. Idaho Property Tax Rates How Are Idaho Property Tax Rates Calculated. Illinois Idaho.

The effective property tax rate here is 073. Property taxes are used to pay for schools cities counties local law enforcement fire protection highways libraries and more.

How To Become A Real Estate Appraiser In Idaho How To Become Work Experience Appraisal

How To Become A Real Estate Appraiser In Idaho How To Become Work Experience Appraisal

Hawaii Has The Lowest Property Tax Rates In The Us Wailea Realty Corp

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

New Hampshire Property Tax Calculator Smartasset

New Hampshire Property Tax Calculator Smartasset

Idaho Property Tax Calculator Smartasset

Idaho Property Tax Calculator Smartasset

Tax Day2015 Tax Day Real Estate Infographic Real Estate Fun

Tax Day2015 Tax Day Real Estate Infographic Real Estate Fun

Https Twinfallscounty Org Wp Content Uploads 2019 01 Property Tax For Homeowners Pdf

Detailed Crime Rates And Statistics Information From Cities Within Florida Find The Top 10 Safest Places To Live In Fl In 2020 Crime Rate Crime Florida Homes For Sale

Detailed Crime Rates And Statistics Information From Cities Within Florida Find The Top 10 Safest Places To Live In Fl In 2020 Crime Rate Crime Florida Homes For Sale

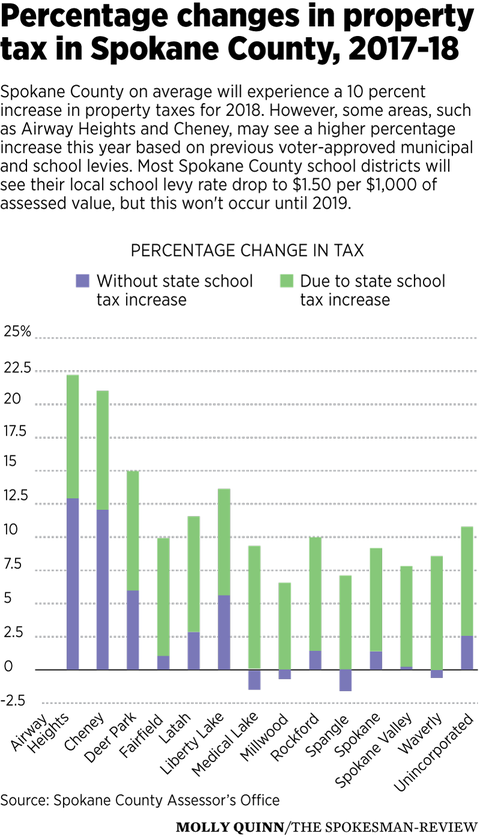

Spokane County Property Taxes To Rise Significantly In 2018 The Spokesman Review

Spokane County Property Taxes To Rise Significantly In 2018 The Spokesman Review

How Do Tax Rates On The Poor Compare To Taxes On The Rich In Your State Itep

How Do Tax Rates On The Poor Compare To Taxes On The Rich In Your State Itep

Need Help Finding Sellers In Your Area Talk With Our Team About How We Might Be Able To Help It Only Real Estate Marketing Real Estate Advice Moving To Idaho

Need Help Finding Sellers In Your Area Talk With Our Team About How We Might Be Able To Help It Only Real Estate Marketing Real Estate Advice Moving To Idaho

States With Highest And Lowest Sales Tax Rates

States With Highest And Lowest Sales Tax Rates

Property Tax Comparison Kootenai County Id

These Are The States With The Lowest Costs Of Living Cost Of Living Retirement Locations Financial Literacy Lessons

These Are The States With The Lowest Costs Of Living Cost Of Living Retirement Locations Financial Literacy Lessons

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

Idaho Property Taxes Everything You Need To Know

Idaho Property Taxes Everything You Need To Know

Idaho Retirement Tax Friendliness Retirement Calculator Property Tax Financial

Idaho Retirement Tax Friendliness Retirement Calculator Property Tax Financial