Capital Gains Tax Rental Property California

Includes short and long-term Federal and State Capital Gains Tax Rates for 2020 or 2021. California taxes all capital gains as regular income.

How To Avoid Capital Gains Tax When Selling Property Finder Com

How To Avoid Capital Gains Tax When Selling Property Finder Com

Depreciation is taxed at 25 and capital gains are taxed based on your tax bracket.

Capital gains tax rental property california. The capital gains tax rate is 15 if youre married filing jointly with. Capital gains tax generally applies when you sell an investment or asset for more than what you paid for it. Long-term gains typically end up being taxed at either 15 or 20 depending on your income for the year.

In the case of real estate this is known as capital gains tax and it applies to the profit made on a real estate property sale. The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property. Capital gains that are taxable that is capital gains beyond what is exempted for a principal home sale will be included in your federal AGI which transfers to the California tax return.

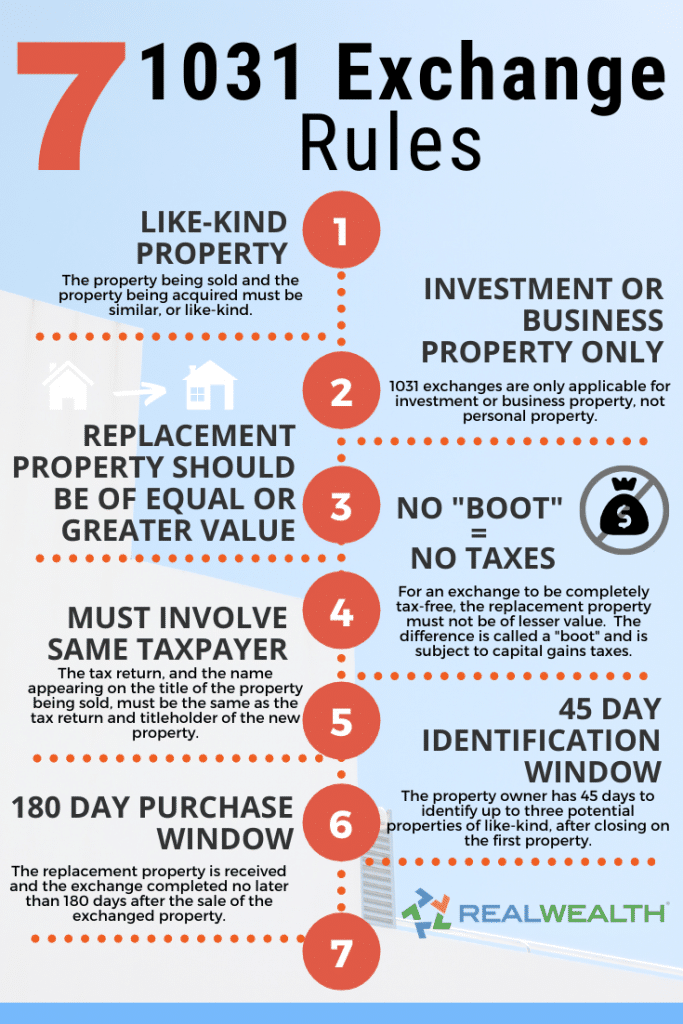

This is generally true only if you have owned and used your home as your main residence for at least two out of the five years prior to the sale. A 1031 exchange can help you avoid taxes when you sell That sounds. Capital Gains Tax on Your Investment Property.

So for 2020 the maximum you could pay for short-term capital gains on rental property is 37. By Ellen Chang Contributor Jan. Finding 2020 California Income Tax Rates.

Capital Gains Tax Selling Price of Rental Property - Adjusted Cost Basis Capital Gains x Tax Rate Depreciation x 25 Tax Rate. Move in for Two Years If youve lived in a property for at least two of the last five years capital gains tax on the sale of that property is exempt up to 250000 for single filers and 500000 for married couples. The short-term capital gains tax rate is whatever your normal income tax rate is and it applies to investments you hold for less than one year.

Unlike your primary residence you will likely face a capital gains tax if you sell for a profit. The tax rate can vary from 0 to 396 depending on two factors - Your income bracket and whether it is considered as a short or long term capital gains. California has no long term capital gains rates and no depreciation recapture.

Assuming that you held the house for over a year and made a profit your capital gains tax rate depends on your income. If your income falls in the lowest two tax brackets your capital gains rate is zero percent. The three long-term capital gains tax rates of 2019 havent changed in 2020 and remain taxed at a rate of 0 15 and 20.

Understanding Capital Gains Tax on a Real Estate Investment Property Real estate properties generate income for investors but taxes play a factor in returns. When you sell your primary residence 250000 of capital gains or 500000 for a couple are exempted from capital gains taxation. Calculate the capital gains tax on a sale of real estate property equipment stock mutual fund or bonds.

The tax rate is about 15 for people filing jointly and incomes totalling less than 480000. Also known as a 1031 like-kind exchange this tax regulation essentially allows the rental property owner to swap one investment property for another on a tax-deferred basis meaning that any. Capital gains tax in California is due to both federal the IRS and state tax agencies the Franchise Tax Board or FTB so its common to feel like one is being double-taxed in the process of a home sale.

When you start paying taxes in the third bracket the capital gains tax rate goes up to 15 percent. This means you will pay a California income tax rate anywhere from 1 to 133 percent depending on your tax bracket. Selling rental properties can earn investors immense profits but may result in significant capital gains tax burdens.

It can jump to 20 if your combined income exceeds this amount. The IRS allows 250000 of tax-free profit on a primary residenceWhat this means in a simplified sense is if you bought your primary residence for 300000 in 2010 lived in it for 8 years and then sold it in 2018 for 550000 you wouldnt have to pay any capital gains tax. Adding your depreciation recapture tax to your capital gains tax shows a total tax bill of 14973 on the sale of the property.

However there are specific rules pertaining to rental properties requiring recapture or including in the gain the depreciation. Subtract that from the sale price and you get the capital gains. Depreciation recapture however is taxed at a flat rate of 25 on any part of the gain that is attributable to depreciation.

The gain will be taxed at ordinary income rates which can range from 1 up to 123. The capital gains rates are lower than ordinary income tax rates. Which rate your capital gains will be taxed depends on your taxable.

San Diego 3 Down Conventional Home Loan Q A 2020 2021 Rental Property San Diego Real Estate Mortgage Loans

San Diego 3 Down Conventional Home Loan Q A 2020 2021 Rental Property San Diego Real Estate Mortgage Loans

5 Unsettling California Tax Rules

5 Unsettling California Tax Rules

Pin By Sonia Cordero On Tax Information Real Estate Investor Capital Gains Tax Capital Gain

Pin By Sonia Cordero On Tax Information Real Estate Investor Capital Gains Tax Capital Gain

Do You Pay Capital Gains Tax On Property Sold Out Of State Clever Real Estate

Do You Pay Capital Gains Tax On Property Sold Out Of State Clever Real Estate

How High Are Capital Gains Taxes In Your State Tax Foundation

How High Are Capital Gains Taxes In Your State Tax Foundation

California Taxes A Guide To The California State Tax Rates

California Taxes A Guide To The California State Tax Rates

12 Ways To Beat Capital Gains Tax In The Age Of Trump

12 Ways To Beat Capital Gains Tax In The Age Of Trump

California S 13 3 Tax On Capital Gains Inspires Move Then Sell Tactics

California S 13 3 Tax On Capital Gains Inspires Move Then Sell Tactics

The Incredible Tax Benefits Of Real Estate Investing Real Estate Investing Estate Tax Investing

The Incredible Tax Benefits Of Real Estate Investing Real Estate Investing Estate Tax Investing

How To Avoid Capital Gains Tax When You Sell A Rental Property

How To Avoid Capital Gains Tax When You Sell A Rental Property

What Is The Capital Gains Tax On Real Estate Thestreet

What Is The Capital Gains Tax On Real Estate Thestreet

Capital Gains Tax Calculator Real Estate 1031 Exchange

Capital Gains Tax Calculator Real Estate 1031 Exchange

Rent Vs Imputed Rent Go Curry Cracker Health Insurance Cost Rent Free Health Insurance

Rent Vs Imputed Rent Go Curry Cracker Health Insurance Cost Rent Free Health Insurance

1031 Exchange Rules Success Stories For Real Estate Investors 2021

1031 Exchange Rules Success Stories For Real Estate Investors 2021

How To Reduce Or Avoid Capital Gains Tax On Property Or Investments Capital Gains Tax Real Estate Investing Rental Property Capital Gain

How To Reduce Or Avoid Capital Gains Tax On Property Or Investments Capital Gains Tax Real Estate Investing Rental Property Capital Gain

Capital Gains Tax Brackets 2021 What They Are And Rates

Capital Gains Tax Brackets 2021 What They Are And Rates

Tax Implications Of Selling Commercial Real Estate 2021 Guide Property Cashin

Tax Implications Of Selling Commercial Real Estate 2021 Guide Property Cashin