How Can I Estimate My Property Taxes

To calculate yours simply multiply the assessed value of. If you pay either type of property tax claiming the tax deduction is a simple matter of itemizing your personal deductions on Schedule A of Form 1040.

Property Tax Calculation Boulder County

Property Tax Calculation Boulder County

The district numbers match the district number you receive on your bill.

How can i estimate my property taxes. Whats left is taxable income. So if your home is worth 200000 and your property tax rate is 4 youll pay about 8000 in taxes. Those numbers may not be the same but all of them are considered.

To calculate the exact amount of property tax you will owe requires your propertys assessed value and the property tax rates based on your propertys address. Estimate Property Tax Our Ohio Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Ohio and across the entire United States. Historically tax rates have fluctuated within a fairly narrow range.

This incorporates the base rate of 1 and additional local taxes which are usually about 025. Enter an assessed value for the property. For the purposes of this Estimator we use the tax rate from the immediately previous tax year.

In a nutshell to estimate taxable income we take gross income and subtract tax deductions. To arrive at the assessed value an assessor first estimates the market value of. A good rule of thumb for California homebuyers who are trying to estimate what their property taxes will be is to multiply their homes purchase price by 125.

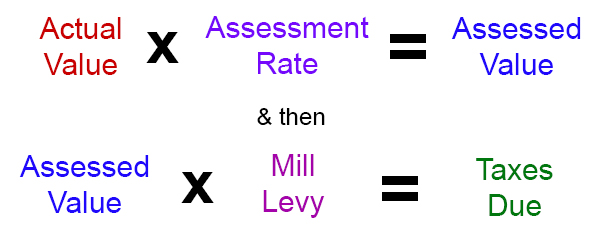

To estimate your real estate taxes you merely multiply your homes assessed value by the levy. To Calculate an Estimate of Your Bill. To figure out how property taxes are calculated on a home before you buy look up the most recent assessed value of the property most counties assess homes every other year and the current property tax ratethen do the math your assessed value x your property tax rate the amount youll owe in property taxes.

Select a tax district from the dropdown box at the top of the form. Take your total property tax rate and multiply it by the value of the property you are dealing with. The real property tax estimator will calculate the ad valorem portion of property taxes by multiplying the amount entered in Step 1 times the previous years adopted millage rates also known as the tax rate of the local governments that taxed the property in the previous year.

Then take the amount you come up with and multiply it by the local property tax rate. Once youve gathered your homes assessed value and your mill levy as a percentage assessing your property tax is actually pretty easy. While the exact property tax rate you will pay for your properties is set by the local tax assessor you can estimate your yearly property tax burden by choosing the state and county in which your property is located and entering the approximate Fair Market Value of your property into the calculator.

Once you determine the amount of the homestead exemption figuring out your property taxes is a matter of subtracting the amount of the homestead exemption from your homes assessed value determined by your municipal tax assessor. However in some states the tax rate will be expressed as the amount of tax you must pay for each 1000 of assessed value. Most state and local tax authorities calculate property taxes based on the value of the homes located within their areas and some agencies also tax personal property.

Please note that we can only estimate your property tax based on median property taxes in your area. The actual tax rate used to calculate property taxes is set every year by the various taxing authorities in Lee County. The answer you get is the amount of money you owe in property tax.

Property taxes are calculated by taking the mill rate and multiplying it by the assessed value of your property. You can use an appraisal an insurance agents estimate or a tax assessors report to set the value of your rental property. Calculating property tax Once you determine your homes assessed value and the tax rate your local government imposes multiply your homes assessed value by the tax rate to estimate your property tax bill for the year.

Dont forget that to multiply a percentage you must either first change the percentage back to its decimal form or else divide your answer by 100. Multiply by your property value. Estimating a tax bill starts with estimating taxable income.

:max_bytes(150000):strip_icc()/taxes_due-6bb60b22f93948bbb123e098ecbf5d21.jpg) How Property Taxes Are Calculated

How Property Taxes Are Calculated

Property Tax Your Mortgage Credit Com

Property Tax Your Mortgage Credit Com

States With The Highest And Lowest Property Taxes Property Tax States State Tax

States With The Highest And Lowest Property Taxes Property Tax States State Tax

How To Look At Property Tax Information Real Estate Software My Photos Property Tax

How To Look At Property Tax Information Real Estate Software My Photos Property Tax

Free Investment Property Spreadsheet For Tax This Spreadsheet Will Help You Calculate Your Income Expenses For A N Investment Property Spreadsheet Investing

Free Investment Property Spreadsheet For Tax This Spreadsheet Will Help You Calculate Your Income Expenses For A N Investment Property Spreadsheet Investing

Stop Overpaying Use This Property Tax Information Guide To Dispute Taxes

Stop Overpaying Use This Property Tax Information Guide To Dispute Taxes

What Happens To My Property Taxes When I Pay Off My Mortgage Thinkglink Property Tax Estate Tax My Property

What Happens To My Property Taxes When I Pay Off My Mortgage Thinkglink Property Tax Estate Tax My Property

Deducting Property Taxes H R Block

Deducting Property Taxes H R Block

States With The Highest And Lowest Property Taxes Social Studies Worksheets Property Tax States

States With The Highest And Lowest Property Taxes Social Studies Worksheets Property Tax States

How To Calculate Real Estate Property Taxes Appeal Your Assessment Property Tax Estate Tax Real Estate

How To Calculate Real Estate Property Taxes Appeal Your Assessment Property Tax Estate Tax Real Estate

How To Calculate Property Tax Without Losing Your Marbles Property Tax Calculator Morgage

How To Calculate Property Tax Without Losing Your Marbles Property Tax Calculator Morgage

Homes For Sale Real Estate Listings In Usa Property Tax Investment Property Real Estate Buying

Homes For Sale Real Estate Listings In Usa Property Tax Investment Property Real Estate Buying

Property Tax Calculator Real Estate Investing Books Estate Tax Tax Attorney

Property Tax Calculator Real Estate Investing Books Estate Tax Tax Attorney

Property Tax Definition Uses And How To Calculate Thestreet

Property Tax Definition Uses And How To Calculate Thestreet

Property Tax Proration Calculator Calculate Tax Per Diem Estate Tax Mortgage Payoff Property Tax

Property Tax Proration Calculator Calculate Tax Per Diem Estate Tax Mortgage Payoff Property Tax

Use Smartasset S Paycheck Calculator To Calculate Your Take Home Pay Per Paycheck For Both Salary And Hourly Jobs Retirement Calculator Property Tax Financial

Use Smartasset S Paycheck Calculator To Calculate Your Take Home Pay Per Paycheck For Both Salary And Hourly Jobs Retirement Calculator Property Tax Financial

Maryland Property Tax Calculator Smartasset In 2020 Retirement Calculator Property Tax Retirement Strategies

Maryland Property Tax Calculator Smartasset In 2020 Retirement Calculator Property Tax Retirement Strategies

Mortgage 101 Comparing Loan Estimates Can Help You Decide Estimate My Mortgage Payment See How Flood Insurance Mortgage Payment Mortgage Flood Insurance

Mortgage 101 Comparing Loan Estimates Can Help You Decide Estimate My Mortgage Payment See How Flood Insurance Mortgage Payment Mortgage Flood Insurance