How Do I Estimate My Property Taxes

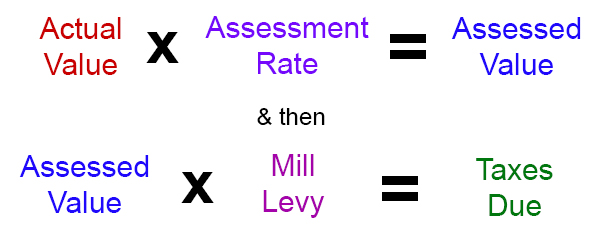

Property taxes are calculated by taking the mill rate and multiplying it by the assessed value of your property. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

Brecksville Finance Property Taxes

Brecksville Finance Property Taxes

To figure out how property taxes are calculated on a home before you buy look up the most recent assessed value of the property most counties assess homes every other year and the current property tax ratethen do the math your assessed value x your property tax rate the amount youll owe in property taxes.

How do i estimate my property taxes. Your actual property tax bill due in 2021 may also include items such as special. The value and property type of your home or business property is determined by the Salt Lake County Assessor. A good rule of thumb for California homebuyers who are trying to estimate what their property taxes will be is to multiply their homes purchase price by 125.

To estimate your real estate taxes you merely multiply your homes assessed value by the levy. Property Tax Estimator Use this tool to estimate the current level of full year property taxes based on your opinion 2020 value associated with your property. This incorporates the base rate of 1 and additional local taxes which are usually about 025.

Your actual property tax may be more or less than the value calculated in the estimator. Calculate property taxes including California property taxes. This calculator is an estimating tool and does not include all taxes that may be included in your bill.

To calculate your tax bill the tax office multiplies your propertys taxable value by the local millage rate or mill rate. So if your home is worth 200000 and your property tax rate is 4 youll pay about 8000 in taxes. Most state and local tax authorities calculate property taxes based on the value of the homes located within their areas and some agencies also tax personal property.

Most annual property taxes include a computation based on a percentage of the assessed value. How Do I Calculate Real Estate Taxes Using the Millage Rate. First we used the number of households median home value and average property tax rate to calculate a per capita property tax collected for each county.

If you pay either type of property tax claiming the tax deduction is a simple matter of itemizing your personal deductions on Schedule A of Form 1040. Residential property owners typically receive a 45 deduction from their home value to determine the taxable value which means you pay property taxes on 55 of your homes value. Municipalities collect real estate taxes also known as property taxes to fund municipal operations public schools roads police.

Calculating property tax Once you determine your homes assessed value and the tax rate your local government imposes multiply your homes assessed value by the tax rate to estimate your property tax bill for the year. To arrive at the assessed value an assessor first estimates the market value of. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

Our Texas Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Texas and across the entire United States. Our California Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in California and across the entire United States. For the purpose of this chart the tax levy has been converted to a levy amount per dollar of valuation.

To do this we looked at property taxes paid school rankings and the change in property values over a five-year period. States such as California increase the assessment value by up to 2 per year. However in some states the tax rate will be expressed as the amount of tax you must pay for each 1000 of assessed value.

Begin Estimating Property Taxes. To calculate the tax on your property multiply the Assessed Value by the Tax Rate. Typically the tax rate is expressed in terms of a certain number of.

The Millage Rate database and Property Tax Estimator allows individual and business taxpayers to estimate their current property taxes as well as compare their property taxes and millage rates with other local units throughout Michigan. Assume you have a house with an APPRAISED VALUE of 100000. 2020 State Rollback-Residential Class gross taxable value is rounded to the nearest 10.

The ASSESSED VALUE is 25000 25 of 100000 and the TAX RATE has been set by your county commission at 320 per hundred of assessed value.

Property Tax Calculation Boulder County

Property Tax Calculation Boulder County

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

Free Investment Property Spreadsheet For Tax This Spreadsheet Will Help You Calculate Your Income Expenses For A N Investment Property Spreadsheet Investing

Free Investment Property Spreadsheet For Tax This Spreadsheet Will Help You Calculate Your Income Expenses For A N Investment Property Spreadsheet Investing

Deducting Property Taxes H R Block

Deducting Property Taxes H R Block

Homes For Sale Real Estate Listings In Usa Property Tax Investment Property Real Estate Buying

Homes For Sale Real Estate Listings In Usa Property Tax Investment Property Real Estate Buying

States With The Highest And Lowest Property Taxes Property Tax States State Tax

States With The Highest And Lowest Property Taxes Property Tax States State Tax

Property Tax Your Mortgage Credit Com

Property Tax Your Mortgage Credit Com

Property Tax Definition Uses And How To Calculate Thestreet

Property Tax Definition Uses And How To Calculate Thestreet

Rental Property Roi And Cap Rate Calculator And Comparison Etsy In 2021 Rental Property Management Rental Property Real Estate Investing

Rental Property Roi And Cap Rate Calculator And Comparison Etsy In 2021 Rental Property Management Rental Property Real Estate Investing

What Happens To My Property Taxes When I Pay Off My Mortgage Thinkglink Property Tax Estate Tax My Property

What Happens To My Property Taxes When I Pay Off My Mortgage Thinkglink Property Tax Estate Tax My Property

Property Tax Proration Calculator Calculate Tax Per Diem Estate Tax Mortgage Payoff Property Tax

Property Tax Proration Calculator Calculate Tax Per Diem Estate Tax Mortgage Payoff Property Tax

How To Calculate Property Tax Without Losing Your Marbles Property Tax Calculator Morgage

How To Calculate Property Tax Without Losing Your Marbles Property Tax Calculator Morgage

Property Taxes Department Of Tax And Collections County Of Santa Clara

Mortgage 101 Comparing Loan Estimates Can Help You Decide Estimate My Mortgage Payment See How Flood Insurance Mortgage Payment Mortgage Flood Insurance

Mortgage 101 Comparing Loan Estimates Can Help You Decide Estimate My Mortgage Payment See How Flood Insurance Mortgage Payment Mortgage Flood Insurance

Maryland Property Tax Calculator Smartasset In 2020 Retirement Calculator Property Tax Retirement Strategies

Maryland Property Tax Calculator Smartasset In 2020 Retirement Calculator Property Tax Retirement Strategies

Stop Overpaying Use This Property Tax Information Guide To Dispute Taxes

Stop Overpaying Use This Property Tax Information Guide To Dispute Taxes

Use Smartasset S Paycheck Calculator To Calculate Your Take Home Pay Per Paycheck For Both Salary And Hourly Jobs Retirement Calculator Property Tax Financial

Use Smartasset S Paycheck Calculator To Calculate Your Take Home Pay Per Paycheck For Both Salary And Hourly Jobs Retirement Calculator Property Tax Financial