How Much Is Capital Gains Tax In Qld

What Is Capital Gains Tax CGT. Using the Capital Gains Tax Calculator.

Long Term Capital Gains Tax Rate How Much Tax Will I Owe

Long Term Capital Gains Tax Rate How Much Tax Will I Owe

Capital gains tax may apply to the sale of some assets in a deceased estate.

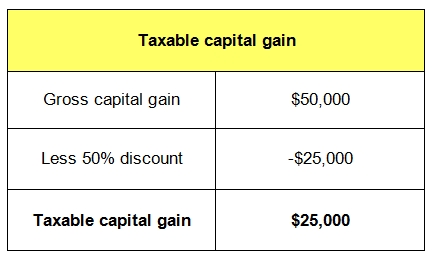

How much is capital gains tax in qld. You also cant claim income tax deductions for costs associated with buying or selling it. That means our investors tax on the capital gain would reduce from 9620 to 4810 ie. Effective Tax Rate This is the rate at which you are taxed for the capital gains and depends on your income during the financial year.

What is capital gains tax. That makes it exempt from CGT. If you own a small business you can reduce your capital gain on active business assets you have owned for 12 months or more by 50.

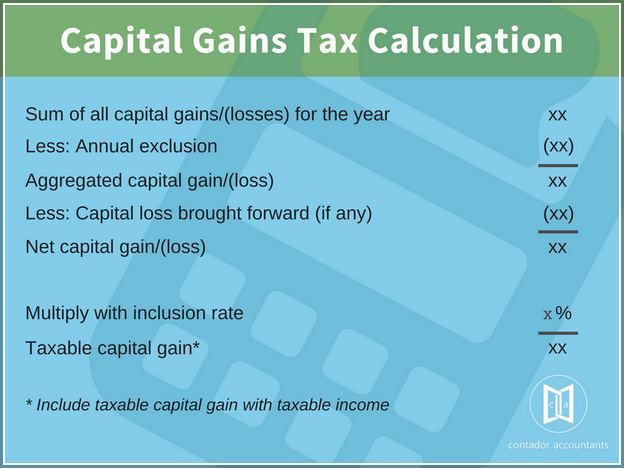

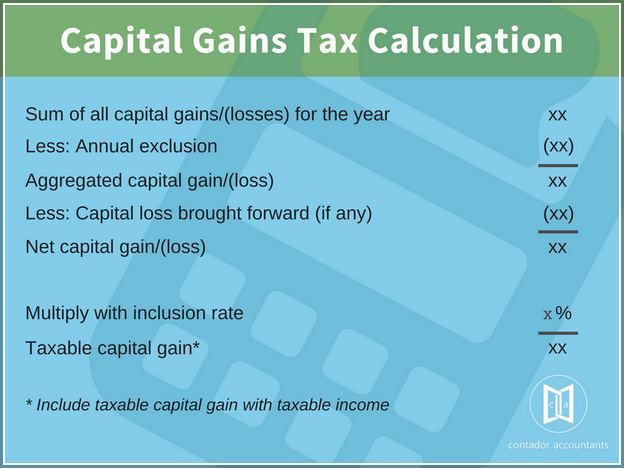

You pay tax on your capital gains which forms part of your income tax and is not considered a separate tax though its referred to as CGT. If youre a company youre not entitled to any capital gains tax discount and youll pay 30 tax on any net capital gains. In that case the difference will be a capital loss.

Calculate the capital gains tax on a sale of real estate property equipment stock mutual fund or bonds. Small business retirement exemption If you sell a business asset capital gain from the sale is exempt up to a lifetime limit of 500000. The IRS taxes capital gains at the federal level and some states also tax capital gains at the state level.

The same goes with property investments when you record a profit or gain after selling your investment property you are expected to paying your share of capital gains tax. CGT is a tax that is levied on the profits you make when you dispose of or sell an asset. Lets say you didnt have a trading plan in place or opted for a less than stellar trading.

It applies to assets that were purchased on or after 20 September 1985. But keep all the records relating to your home so that if things change for example you rent it out you dont pay more tax than necessary. If you hold the shares for less than 12 months You will pay tax on the full amount of profit.

The Capital Gains Tax Estimator provides an indication of the amount of capital gains tax you may be required to pay on an investment property. The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property. Capital Gains Tax is calculated at either 100 of the capital gains amount or 50 of the capital gains amount depending on the length of time you have owned the asset.

Generally you dont pay capital gains tax if you sell your home under the main residence exemption. Suppose you lost money on the sale of your asset. Take advantage of being an owner-occupier.

There are short-term capital gains and long-term capital gains and each is taxed at different rates. About the Capital Gains Tax Estimator. It is probably somewhere between 30 to 50.

If you live in the property right after acquiring it the asset can be listed as your Primary Place Of Residence PPOR. According to the Australian Tax Office ATO when you sell your property the difference between how much you paid for it and how much you sold it for is known as capital gains. Capital gains tax CGT is the levy you pay on the capital gain made from the sale of that asset.

If youre an individual the rate paid is the same as your income tax rate for that year. All assets youve acquired since tax on capital gains started on 20. If you inherit a dwelling as part of a deceased estate you may be exempt or partially exempt from capital gains tax if you sell the property.

How to avoid capital gains tax in Australia 1. This discount is usually available to our investors as we have long-term value-add property strategies and are not in the business of quickly buying and selling properties for a capital gain. When you make a profit in any business the government takes a share of the gains you make by charging you with tax.

Includes short and long-term Federal and State Capital Gains Tax Rates for 2020 or 2021. No Capital Gains or Losses. A capital gain is the difference between what it cost to acquire an asset and the payment received when the asset is sold.

For SMSF the tax rate is 15 and the discount is 333 rather than 50 for individuals. Under the new Capital Gains Tax legislation which came into effect on the 30th of September 1999 it is possible for an individual to calculate the CGT they will have to pay in one of two ways. If you make a capital loss you cant claim it against your other income but you can use it to reduce a capital gain.

If an asset is held for at least one year then any gain is first discounted by 50 per cent for individual taxpayers or by 333 per cent for superannuation funds. But not with M2M. Capital Gains Tax Estimate An approximation of the amount of capital gains tax you need to pay to the government for the sale of your property.

If youre a kick-ass trader making bank you usually would have to claim those profits as capital gains. It applies to property shares leases goodwill licences foreign currency contractual rights and personal use assets purchased for more than 10000. As tax is not withheld for capital gains you may want to work out how much tax you will owe and set aside sufficient funds to cover the relevant amount.

That is much more palatable. Short-term capital gains are. The tax rate you pay on your capital gains depends in part on how long you hold the asset before selling.

This is the amount you have made on top of your initial investment earnings. If you opt for this scenario any of your wins or losses are treated as ordinary income and losses.

Tax Returns In Townsville Bundaberg Itp Queensland Tax Return Income Tax Return Us Tax

Tax Returns In Townsville Bundaberg Itp Queensland Tax Return Income Tax Return Us Tax

How To Avoid Capital Gains Tax When You Sell A Rental Property

How To Avoid Capital Gains Tax When You Sell A Rental Property

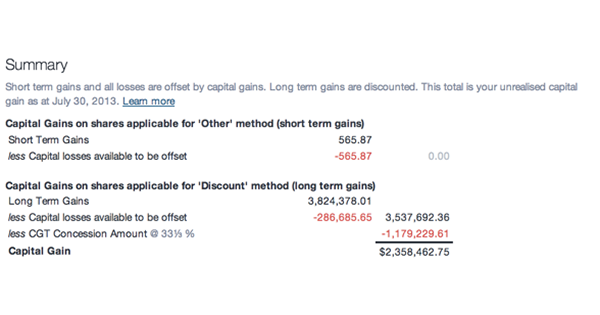

How Do I Run An Australian Capital Gains Tax Report Sharesight

How Do I Run An Australian Capital Gains Tax Report Sharesight

How To Calculate Capital Gains Tax Cgt Echoice Guides

How To Calculate Capital Gains Tax Cgt Echoice Guides

How To Save Capital Gains Tax On Property Sale Capital Gain Capital Gains Tax Tax

How To Save Capital Gains Tax On Property Sale Capital Gain Capital Gains Tax Tax

How To Make 80 000 In Crypto Profits And Pay Zero Tax

How To Make 80 000 In Crypto Profits And Pay Zero Tax

The Beginner S Guide To Capital Gains Tax Infographic Transform Property Consulting Capital Gains Tax Capital Gain Investment Companies

The Beginner S Guide To Capital Gains Tax Infographic Transform Property Consulting Capital Gains Tax Capital Gain Investment Companies

Did You Know A Non Resident Corporation Is Subject To Canadian Income Tax On Taxable Capital Gains Realized On The Disposition Tax Consulting Income Tax Blog

Did You Know A Non Resident Corporation Is Subject To Canadian Income Tax On Taxable Capital Gains Realized On The Disposition Tax Consulting Income Tax Blog

Business Standard Good Morning Here Is The Bsindia Frontpage For Today Read The Stories On Https T Co Zga Todays Reading Breaking News Capital Gains Tax

Business Standard Good Morning Here Is The Bsindia Frontpage For Today Read The Stories On Https T Co Zga Todays Reading Breaking News Capital Gains Tax

11 Ways To Reduce Your Capital Gains Tax Bill Face To Face Finance

11 Ways To Reduce Your Capital Gains Tax Bill Face To Face Finance

Capital Gains Tax Cgt What To Know Before You Sell Your Investment Property Rent Blog

Capital Gains Tax Cgt What To Know Before You Sell Your Investment Property Rent Blog

How To Avoid Capital Gains Tax When Selling Property Finder Com

How To Avoid Capital Gains Tax When Selling Property Finder Com

How To Calculate Capital Gains Tax H R Block

How To Calculate Capital Gains Tax H R Block

Capital Gains Tax Brackets For Home Sellers What S Your Rate Tax Brackets Capital Gains Tax Capital Gain

Capital Gains Tax Brackets For Home Sellers What S Your Rate Tax Brackets Capital Gains Tax Capital Gain

Pin On Can I Recycle Ink Cartridges At Walmart

Pin On Can I Recycle Ink Cartridges At Walmart

Visit Our Site Http Www Melbournevaluations Com Au For More Information On Deceased Estate Property Valuat Property Valuation Capital Gain Capital Gains Tax

Visit Our Site Http Www Melbournevaluations Com Au For More Information On Deceased Estate Property Valuat Property Valuation Capital Gain Capital Gains Tax

How To Avoid Capital Gains Tax On Your Investments Investor Junkie

How To Avoid Capital Gains Tax On Your Investments Investor Junkie