Nyc Property Tax Due Date Covid

Bills are generally mailed and posted on our website about a month before your taxes are due. For general and filing information visit the New York State Department of Taxation and Finance.

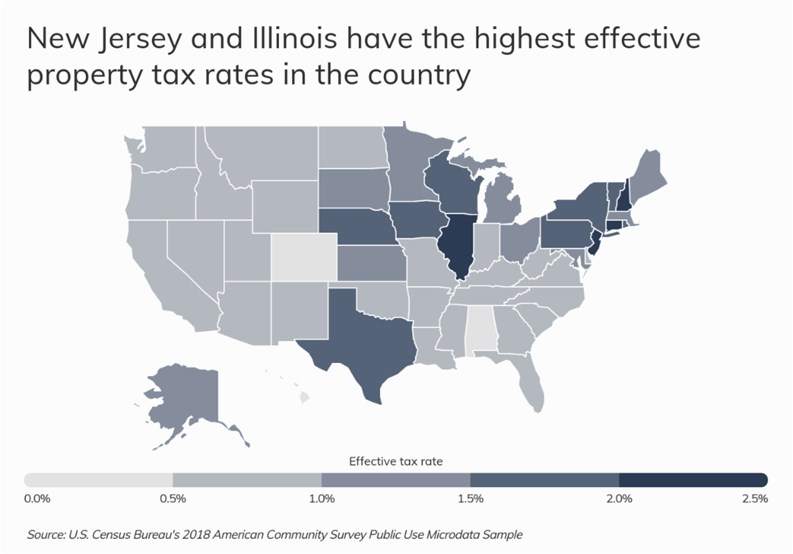

City Ranks Sixth Highest In The Nation Nyc Residents Pay 5 633 In Annual Property Taxes The New York Cooperator The Co Op Condo Monthly

City Ranks Sixth Highest In The Nation Nyc Residents Pay 5 633 In Annual Property Taxes The New York Cooperator The Co Op Condo Monthly

Please return this bill with your payment.

Nyc property tax due date covid. The average property tax bill on a single-family home in 2019 was about 3600 but average bills are three to five times higher in some areas of the country including parts of New York New. Cuomo declared a State Disaster Emergency for all of. Announcement Regarding Relief from Certain Filing and Payment Deadlines due to the Novel Coronavirus COVID-19.

Filing due dates for your 2020 personal income tax return Income tax return April 15 2021 Request for extension of time to file April 15 2021. Payment date - Taxpayers that scheduled their Income Tax IIT BIT PTE FDT or Business Privilege Tax payment due 4152020 when they e-filed. NYS Tax Department issues sales tax guidance related to COVID-19 tax relief.

Property tax amounts are established on the lien date of January 1 of each year. Data and Lot Information. For more information see the Alabama Department of Revenue Coronavirus COVID-19 Outbreak Updates.

If you pay your own taxes you will receive an original bill in mid-December. Finance mails property tax bills four times a year. The New York City Council recently passed legislation that reduces the late payment interest rate for property taxes due on July 1 2020 for eligible property owners who have been impacted by COVID-19 and who apply to DOF by September 30 2020.

For property taxes due July 1 2020 The New York City Council recently passed legislation that reduces the late payment interest rate for property taxes due on July 1 2020 for eligible property owners who have been impacted by COVID-19. For NYC business and excise tax returns due between March 16 2020 and June 25 2020 penalties for late filing late payment and underpayment will be waived if the delay in filing was caused by COVID-19-related issues. However penalty and interest may be waived if you were unable to file and pay on time and are principally engaged in business as a restaurant or other food service establishment in New York City that had to suspend indoor dining due to Executive Order 20281 or as a.

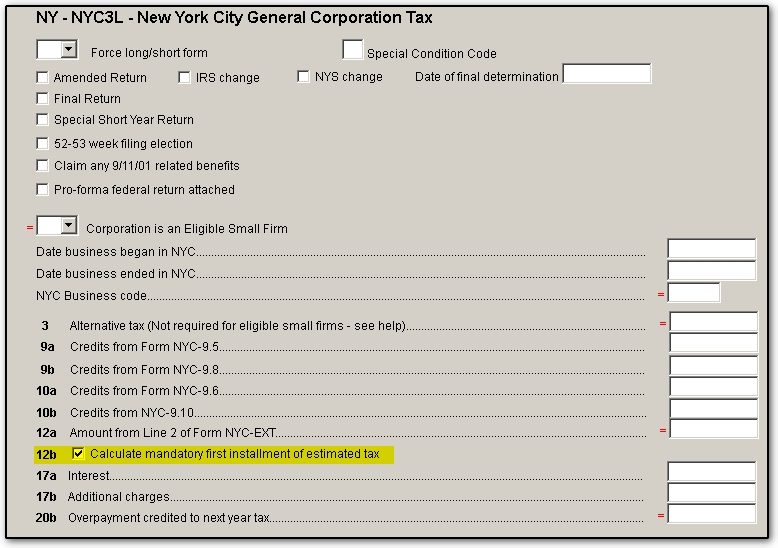

The late interest fee on deferred taxes would match the. NYCs Property Tax Fiscal Year is July 1 to June 30. Mandatory first installment MFI of estimated tax is due with Form CT-300 on or before the 15th day of the third month following the close of each fiscal year.

Among them is Washington one of the centers of the coronavirus pandemic which gave counties the ability to delay their property tax deadlines beyond their traditional April 30 due date. On March 7 2020 Governor Andrew M. Sales tax returns and payments for the period September 1 through November 30 were due December 21 2020.

The Following New York City Taxes are collected by New York State instead of New York City. All tax types - April 15 filing and payment deadlines extended to July 15. Quarterly withholding tax and wage reporting returns Forms NYS-45 and NYS-45-ATT are due Monday February 1 2021.

If the bank pays your taxes you will receive an informational bill from this office around the middle of July. You either pay your property taxes two or four times a year depending on the propertys assessed value. The property tax amounts currently due for the 2019-2020 Annual Secured Property Taxes have a lien date of January 1 2019 and therefore no reduction will be made to the current bill.

Property Taxes Due July 1 2020. Property owners allowed to defer their taxes due July 1 would have to pay a quarter of the bill by Oct. Beer and Liquor Tax.

Property Tax Bills. New York S corporation fiscal year filers. W A Harriman Campus Albany NY 12227 wwwtaxnygov N-20-2 Important Notice March 2020.

Taxes are collected in accordance with New York State Real Property Tax Laws and the Suffolk County Tax Act. 1 and the remainder by May 1. Will property tax amounts be reduced due to economic impact of COVID-19.

Estimated tax payments are due on or before the 15 th day of the 6 th and 9 th and 12 th month of the fiscal year. NYC is a trademark and service mark of the City of New York. Property Bills Payments.

Interest waived through July 15 for tax payments due March 15. Property Taxes Due July 1 2020. The New York City Council recently passed legislation that reduces the late payment interest rate for property taxes due on July 1 2020 for eligible property owners who have been impacted by COVID-19 and who apply to DOF by September 30 2020.

Tax payment due dates have not changed which means that interest will accrue on late payments. Property Records ACRIS Deed Fraud Alert. The bill would authorize localities to extend the application renewal and filing deadline from March 15 to June 15 for certain real property tax abatement programs.

Covid 19 Guidance For Business Owners And Faqs Sbs

Covid 19 Guidance For Business Owners And Faqs Sbs

The Top 10 Biggest Real Estate Projects Coming To Nyc Real Estate Estates Nyc Design

The Top 10 Biggest Real Estate Projects Coming To Nyc Real Estate Estates Nyc Design

Find Food Food Bank For New York City

Find Food Food Bank For New York City

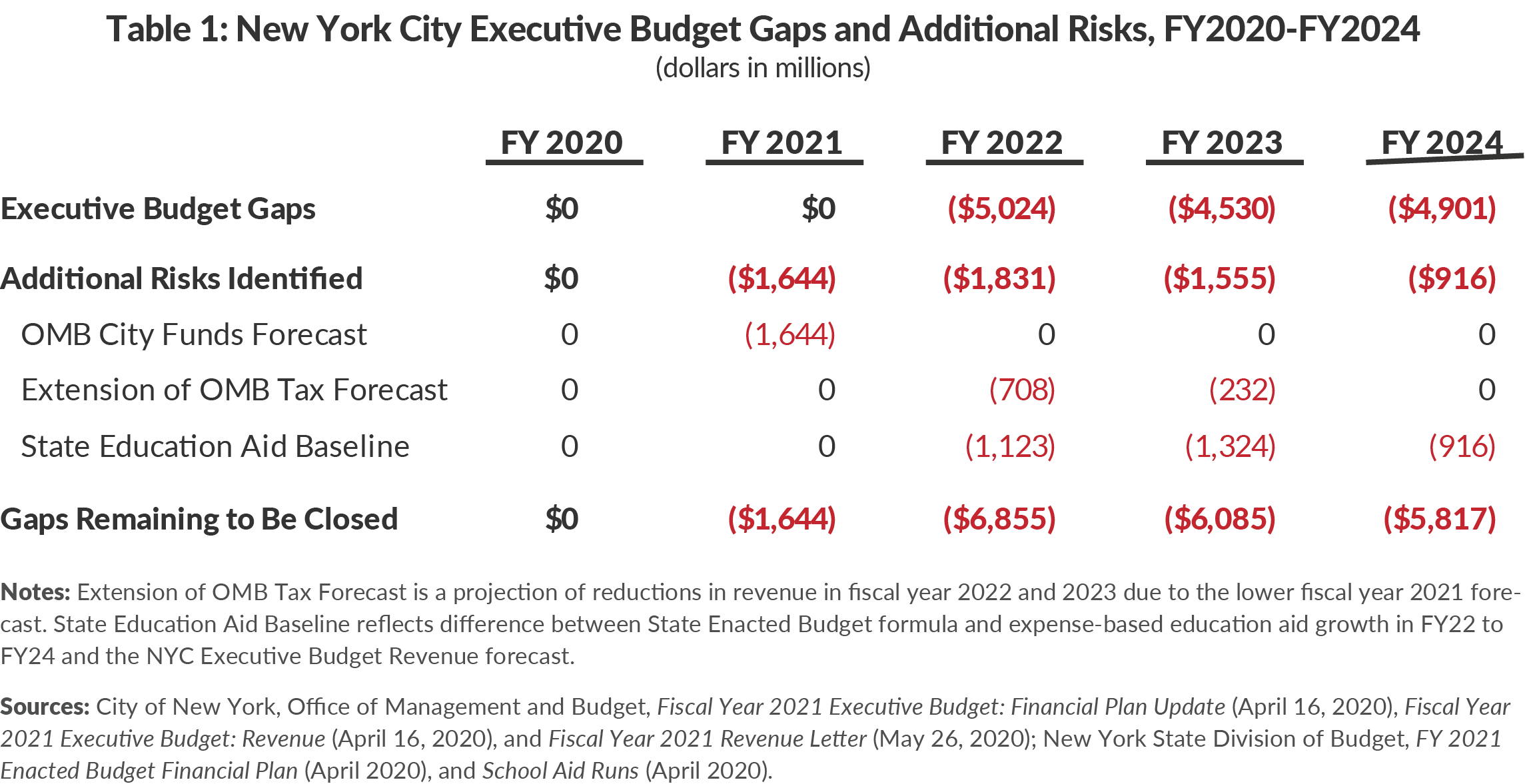

Nyc May Lose 9 7b In Tax Revenue 450k Jobs Due To Coronavirus

Nyc May Lose 9 7b In Tax Revenue 450k Jobs Due To Coronavirus

Hard Choices That Can Balance New York City S Budget Cbcny

Hard Choices That Can Balance New York City S Budget Cbcny

Comments On New York City S Fiscal Year 2021 Adopted Budget Office Of The New York City Comptroller Scott M Stringer

Comments On New York City S Fiscal Year 2021 Adopted Budget Office Of The New York City Comptroller Scott M Stringer

Overview Office Of The New York City Comptroller Scott M Stringer

Overview Office Of The New York City Comptroller Scott M Stringer

How Do Taxes In The United States Compare Https Taxfoundation Org Country United States In 2020 The Unit Inheritance Tax Capital Investment

How Do Taxes In The United States Compare Https Taxfoundation Org Country United States In 2020 The Unit Inheritance Tax Capital Investment

Privately Owned Public Space Overview Dcp

Privately Owned Public Space Overview Dcp

New York Taxes A Guide To Real Estate Taxes For Nyc Apartment Owners Cityrealty

New York Taxes A Guide To Real Estate Taxes For Nyc Apartment Owners Cityrealty

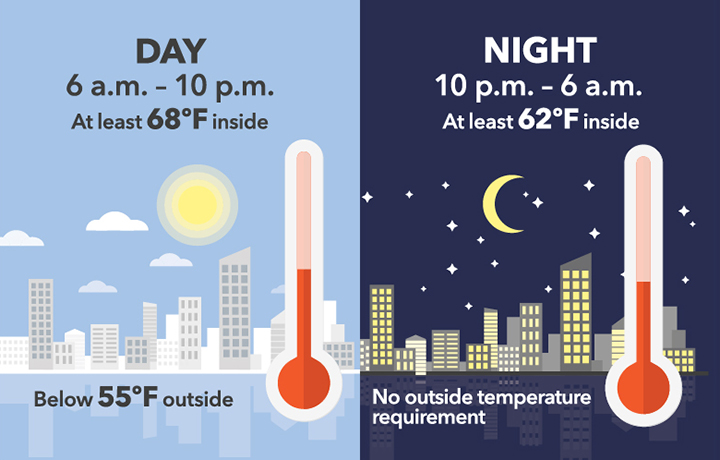

Heat And Hot Water Information Hpd

Heat And Hot Water Information Hpd

Https Www1 Nyc Gov Assets Finance Downloads Pdf 20pdf Business Penalties Waved Covid19 Pdf

What Is A 421a Tax Abatement In Nyc Streeteasy

What Is A 421a Tax Abatement In Nyc Streeteasy

Ny State And City Payment Frequently Asked Questions

Ny State And City Payment Frequently Asked Questions

Nyc Median Sale Price Hits Yearly Low At 665 000 Propertyshark

Nyc Median Sale Price Hits Yearly Low At 665 000 Propertyshark