Property Assessment West Virginia

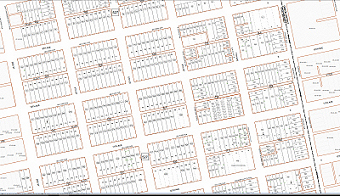

The Assessor oversees the process of placing fair market value on real property and personal property and maintains property records such as transactions and mapping. Go here to find out more information on how to pay.

Low Income West Virginians Pay Far More In Taxes As A Percent Of Income Than Wealthiest West Virginians West Virginia Center On Budget Policy

Low Income West Virginians Pay Far More In Taxes As A Percent Of Income Than Wealthiest West Virginians West Virginia Center On Budget Policy

The Tax Commissioner must issue a ruling by the end of February of the calendar tax year.

Property assessment west virginia. The office makes every effort to produce the most accurate information possible. County Assessors Office will NOT be making telephone calls this year to remind citizens to fill out their 2019 Personal Property Assessment Forms. It is the primary responsibility of our office to find the fair market value of your property so that you pay only your fair share of the tax burden.

The Logan County Assessors office is pleased to make assessment data available online and free of charge. The Assessor mails your assessment form preprinted to you every assessment season providing you have filed the previous year. Main Street Clarksburg WV 26301 P.

About This WV Property Assessment portal is designed for searching and displaying property ownership and location information for all 55 counties in West Virginia through the Property Search and Property Viewer Applications. Every Marion County Citizen is required by law to file an annual Personal Property Assessment as of the first day of July of each year. Official Berkeley County West Virginia Assessors Office.

Petersburg West Virginia 26847 Phone. There is no greater obligation of an assessor than to assess all property honestly fairly and accurately. Address Harrison County Assessors Office 301 W.

Lying just to the west of the great Valley of Virginia Hampshire County West Virginia has a rich and varied history. Welcome to Fairfax Countys Real Estate Assessment Site This site provides assessed values and physical characteristics for all residential and commercial properties. You can search our site for a wealth of information on any property in Hampshire County.

Assessor - Establishes a fair market value for all real and personal property and provides it to the levying bodies. Welcome to the Official Berkeley County Assessors Office web site. The goal of the Hampshire County Tax Assessor is to provide the people of Hampshire County with a web site that is easy to use.

Learn more about Real Estate Property Assessments and Taxes. 243 High Street Room 335 Morgantown WV 26505 Phone. Dog Sheep and Goat Tax.

304 257-4117 Greenbrier County Mr. The FAQ and Resources have been provided to help answer questions. Joe Darnell Assessor of Greenbrier County Greenbrier County Courthouse Assessors Direct Line 647-6613.

Levying Bodies - West Virginia Legislature Board of Education City Councils and County Commission all provide the components that make up the total levy rate to be applied to assessed values. The purpose and role of the Assessors Office is clear and concise. No warranties expressed or implied are provided for the data herein its use or interpretation.

1 Online Filing of individual personal property return to avoid long lines 2 Department of Motor Vehicles DMV link allowing renewal of vehicle registration and other online services 3 Assessor seamless GIS Tax Maps on-line with. To place a fair market value on real estate and personal property for both residences and businesses. Download the various forms and applications offered by the Assessors Office.

Click on one of the property search links above to search by address by tax map reference number or by doing a. When the owner of property and the county assessor disagree over the classification of property or the taxability of property the question may be submitted to the Tax Commissioner for ruling as provided in West Virginia Code 11-3-24a. Dog taxes are collected annually starting on July 1.

Fayette County West Virginia Assessor. The Wood County Assessor oversees the process of placing fair market value on real property and personal property and maintains property records such as transactions tax maps and sale of dog tags. Property Search Search Options.

If you have not turned yours in please do so as soon as possible. Hide Basic AppraisalSales Advanced Prior Ownership Hover over input fields to view help County. The Personal Property Department has eight full- time Deputy Assessors who have received their Basic Assessment Training Certification from the West Virginia State Tax Department.

While the Assessor does not determine the tax rate or collect taxes the office does handle certain resident disagreements.

West Virginia State Tax Information Support

West Virginia State Tax Information Support

Resolving Tangible Personal Property Tax West Virginia Forward West Virginia University

The Ultimate Guide To West Virginia Real Estate Taxes Clever Real Estate

The Ultimate Guide To West Virginia Real Estate Taxes Clever Real Estate

![]() Home Page Wv Real Estate Assessment

Home Page Wv Real Estate Assessment

West Virginia State Tax Department

West Virginia State Tax Department

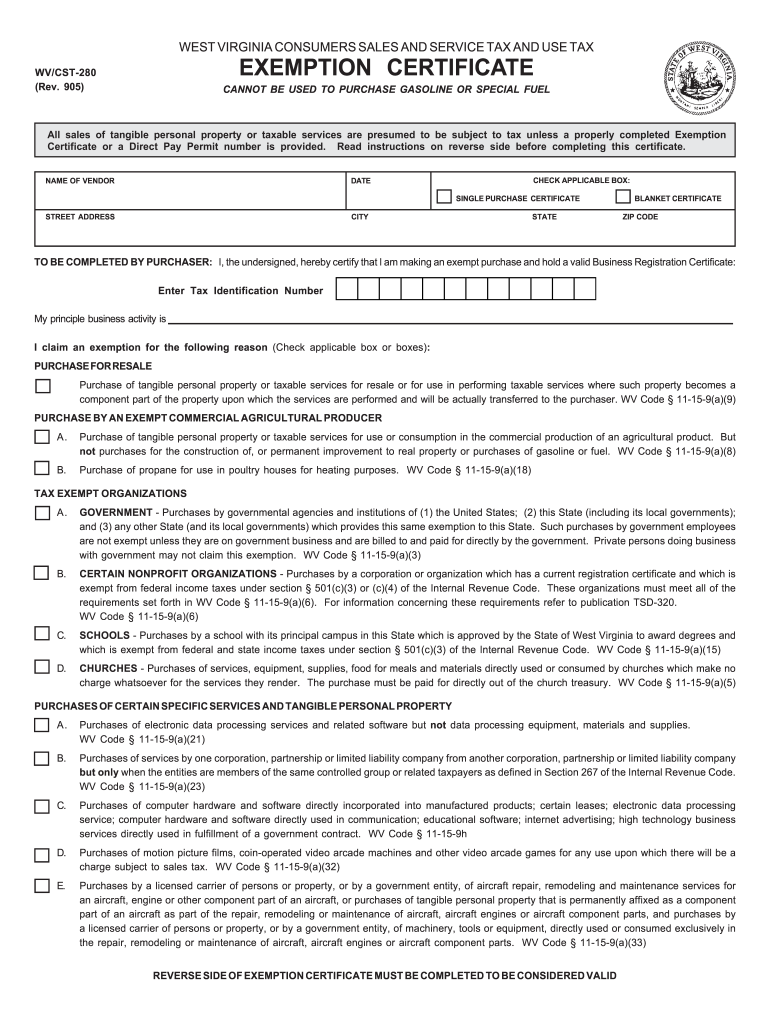

Wv Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

Wv Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

Filing West Virginia State Tax Things To Know Credit Karma Tax

Filing West Virginia State Tax Things To Know Credit Karma Tax

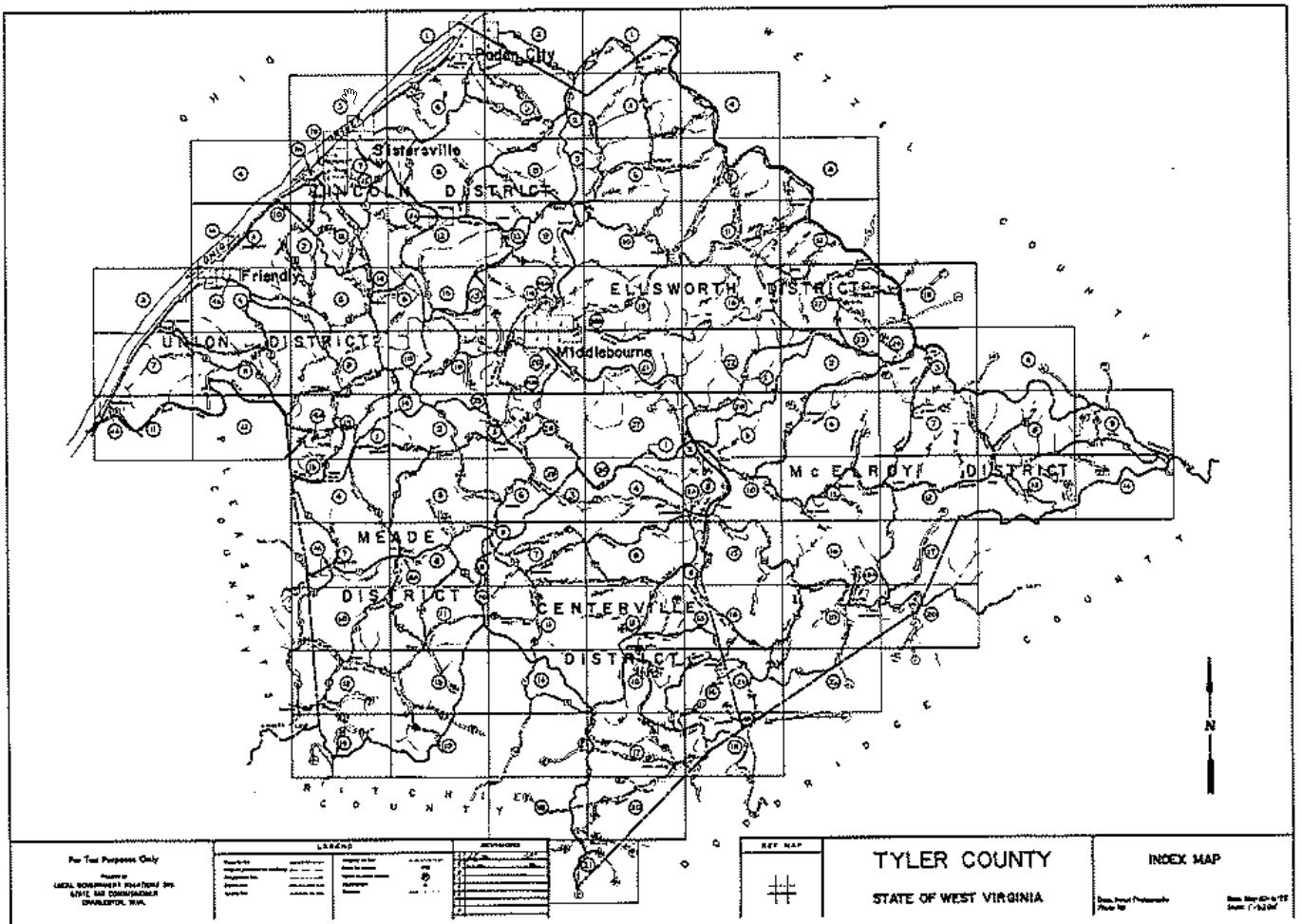

Tyler County Assessor Tyler County Government Services

Tyler County Assessor Tyler County Government Services

West Virginia Property Tax Calculator Smartasset

West Virginia Property Tax Calculator Smartasset

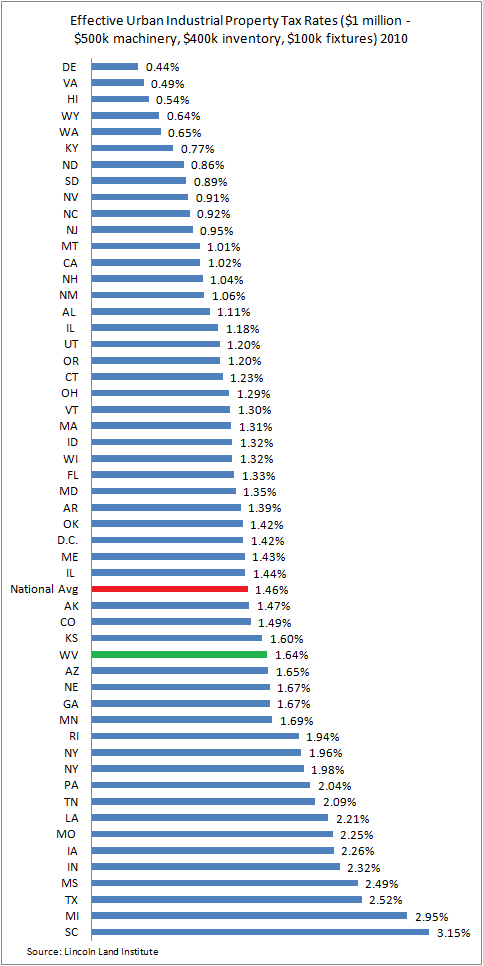

How High Are West Virginia S Property Taxes West Virginia Center On Budget Policy

How High Are West Virginia S Property Taxes West Virginia Center On Budget Policy

Welcome To The Office Of Tax Appeals

Welcome To The Office Of Tax Appeals

Http Epohoa Org Wp Content Uploads 2016 05 2014 1025 Snowdenmurphyhoaslegaloptionsatemptingtocollectdebt Pdf

West Virginia Tax Forms And Instructions For 2020 Form It 140

West Virginia Tax Forms And Instructions For 2020 Form It 140