Property Gains Tax Missouri

For most people this will only ever apply to the sale of their home. Below we have highlighted a number of tax rates ranks and measures detailing Missouris income tax business tax sales tax and property tax systems.

How To Reduce Or Avoid Capital Gains Tax On Property Or Investments Capital Gains Tax Real Estate Investing Rental Property Capital Gain

How To Reduce Or Avoid Capital Gains Tax On Property Or Investments Capital Gains Tax Real Estate Investing Rental Property Capital Gain

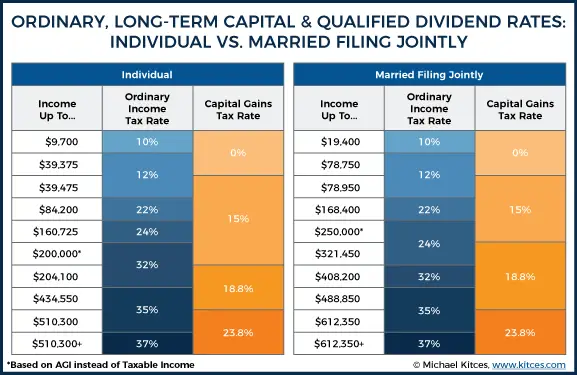

The tax rate is about 15 for people filing jointly and incomes totalling less than 480000.

Property gains tax missouri. The capital gains tax rate is 15 if youre married filing jointly with taxable income between 78750 and 488850. The Department collects or processes individual income tax fiduciary tax estate tax returns and property tax credit claims. When you sell your home the capital gains on the sale are exempt from capital gains tax.

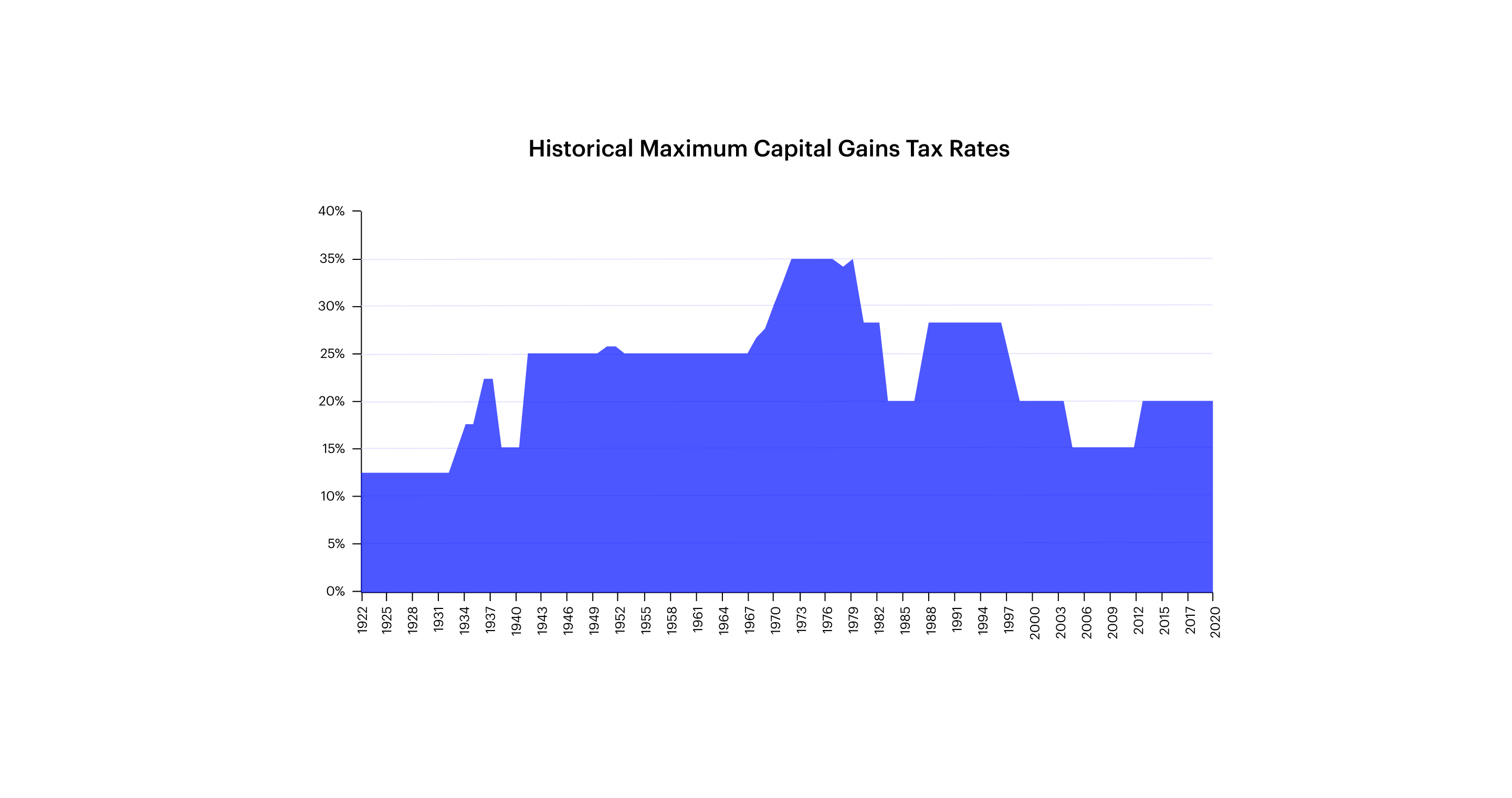

The Missouri Property Tax Credit Claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate taxes or rent they have paid for the year. Additional State Capital Gains Tax Information for Missouri The Combined Rate accounts for Federal State and Local tax rate on capital gains income the 38 percent Surtax on capital gains and the marginal effect of Pease Limitations which results in a tax rate increase of 118 percent. Capital gains tax is the tax levied on capital assets that sell for a profit.

Depending on your regular income tax bracket your tax rate for long-term capital gains could be as low as 0. The credit is for a maximum of 750 for renters and 1100 for owners who owned and occupied their home. Calculate the capital gains tax on a sale of real estate property equipment stock mutual fund or bonds.

Even though Missouri has 10 tax. The median property tax in Missouri is 126500 per year for a home worth the median value of 13970000. Information and online services regarding your taxes.

That will look like 279 11416 x054 89546 Using this formula you will owe 89546 in capital gains taxes in Missouri for the 2020 tax year. Long-term capital gains are gains on assets you hold for more than one year. Long-term capital gains are taxed at more favorable rates.

The tax rate you must pay varies based on your total taxable income but the tax rates for 2020 are between 10 and 37. Long-Term Capital Gains are gains on assets you have held longer than one year. Counties in Missouri collect an average of 091 of a propertys assesed fair market value as property tax per year.

The first step towards understanding Missouris tax code is knowing the basics. Theyre taxed at lower rates than short-term capital gains. Based on the Taxpayer Relief Act of 1997 1 if you are single you will pay no capital gains tax on the.

In 2017 that rate is between 10 and 396 of your profit but most people pay around 25. The Missouri Department of Revenue Taxation Division administers Missouri tax law. The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property.

In general youll pay higher taxes on property youve owned for less than a year. This is because short-term capital gains are taxed at the same rate as ordinary income. On the other hand long-term capital gains receive favorable tax.

Paying Capital Gains Tax on Sale of Primary Residence A. There are various methods of reducing capital gains tax including tax-loss. How does Missouri rank.

If you buy a home and sell that asset in a year or less this is classified as a short-term capital gain for capital gains tax purposes. The three long-term capital gains tax rates of 2019 havent changed in 2020 and remain taxed at a rate of 0 15 and 20. Which rate your capital gains will be taxed depends on your taxable.

Includes short and long-term Federal and State Capital Gains Tax Rates for 2020 or 2021. Additional State Income Tax Information for Missouri. Unlike your primary residence you will likely face a capital gains tax if you sell for a profit.

Click the tabs below to explore. Missouri has one of the lowest median property tax rates in the United States with only fifteen states collecting a lower median property tax than Missouri. The actual credit is based on the amount of real.

When a person buys a home and lives in that home as their primary residence for 2 out of the last 5 years that homeowner is entitled to exempt up to 250000 of profit gain from any federal income taxes. If your home sale produces a short-term capital gain it is taxable as ordinary income at whatever your marginal tax bracket is. It can jump to 20 if your combined income exceeds this amount.

Youll multiply this number by the Missouri capital gainincome tax rate and add 279. Instead all gains get taxed at whatever rate youd pay on the rest of your income. Missouri has a progressive tax system but the brackets are extremely small.

How To Reduce Or Avoid Capital Gains Tax On Property Or Investments

How To Reduce Or Avoid Capital Gains Tax On Property Or Investments

State Taxation As It Applies To 1031 Exchanges

State Taxation As It Applies To 1031 Exchanges

How To Avoid Capital Gains Tax When Selling Property Finder Com

How To Avoid Capital Gains Tax When Selling Property Finder Com

Tax Implications Of Selling Commercial Real Estate 2021 Guide Property Cashin

Tax Implications Of Selling Commercial Real Estate 2021 Guide Property Cashin

How Long Term Capital Gains Stack On Top Of Ordinary Income Tax

How Long Term Capital Gains Stack On Top Of Ordinary Income Tax

How To Calculate Capital Gains Tax H R Block

How To Calculate Capital Gains Tax H R Block

Capital Gains Tax Calculator Estimate What You Ll Owe

Capital Gains Tax Calculator Estimate What You Ll Owe

A Guide To Capital Gains Tax On Real Estate Sales Millionacres

A Guide To Capital Gains Tax On Real Estate Sales Millionacres

Income Types Not Subject To Social Security Tax Earn More Efficiently

Income Types Not Subject To Social Security Tax Earn More Efficiently

12 Ways To Beat Capital Gains Tax In The Age Of Trump

12 Ways To Beat Capital Gains Tax In The Age Of Trump

Tax Law For Selling Real Estate Turbotax Tax Tips Videos

Tax Law For Selling Real Estate Turbotax Tax Tips Videos

2020 2021 Capital Gains Tax Rates And How To Minimize Them Nasdaq

2020 2021 Capital Gains Tax Rates And How To Minimize Them Nasdaq

Capital Gains Tax Brackets 2021 What They Are And Rates

Capital Gains Tax Brackets 2021 What They Are And Rates

How To Avoid Capital Gains Taxes When Selling Your House 2020

How To Avoid Capital Gains Taxes When Selling Your House 2020

How High Are Capital Gains Taxes In Your State Tax Foundation

How High Are Capital Gains Taxes In Your State Tax Foundation

New 2016 Tax Incentive Enhancements Mo Tax Accountant Tax Accountant Tax Payment Capital Gains Tax

New 2016 Tax Incentive Enhancements Mo Tax Accountant Tax Accountant Tax Payment Capital Gains Tax

Capital Gains Tax Calculator Real Estate 1031 Exchange

Capital Gains Tax Calculator Real Estate 1031 Exchange