Property Plant And Equipment Recognition Criteria

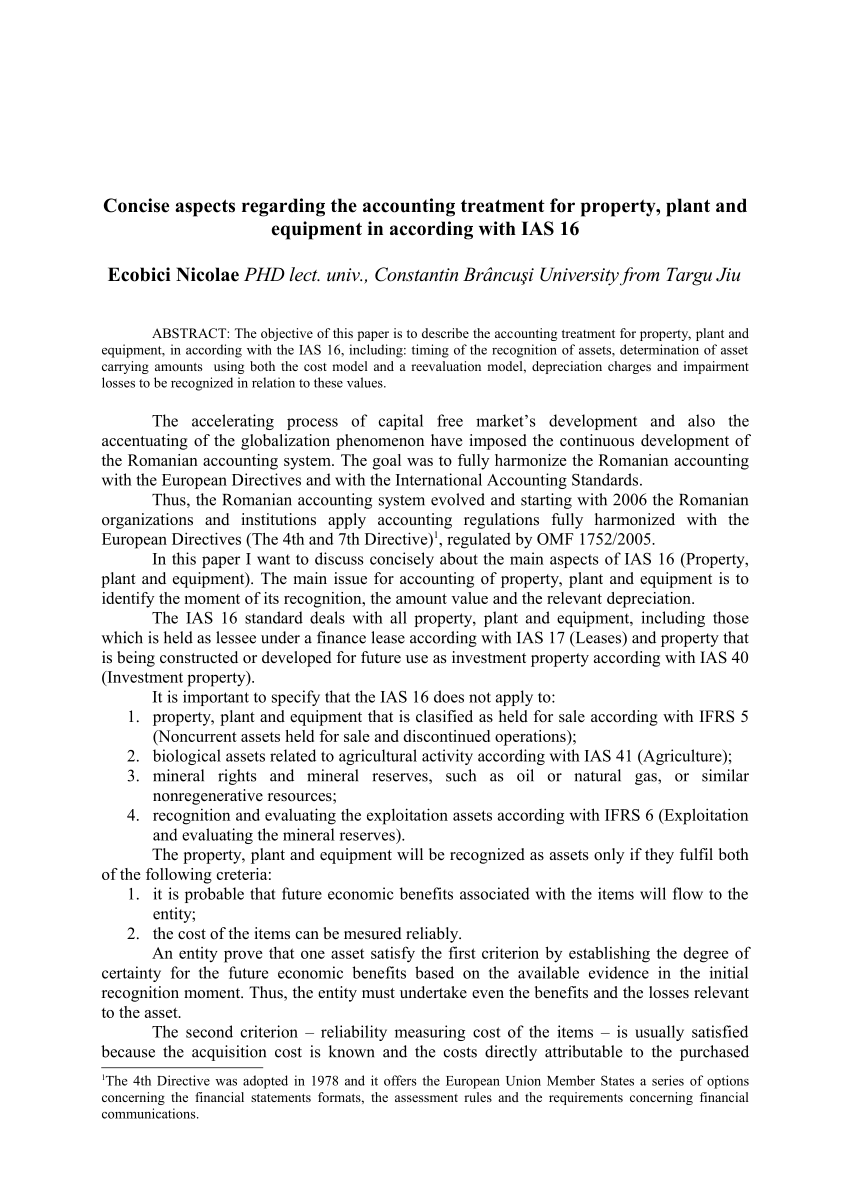

The cost of an item of property plant and equipment is recognised as an asset if and only if. An item of property plant and equipment that qualifies for recognition as an asset shall be measured at its cost.

The Matching Principle In Accounting Accounting Masterclass In 2020 Master Class Accounting Principles

The Matching Principle In Accounting Accounting Masterclass In 2020 Master Class Accounting Principles

The cost of the item can be measured reliably.

/ExxonLongtermAssets2018-5c5485414cedfd0001efdb2c.jpg)

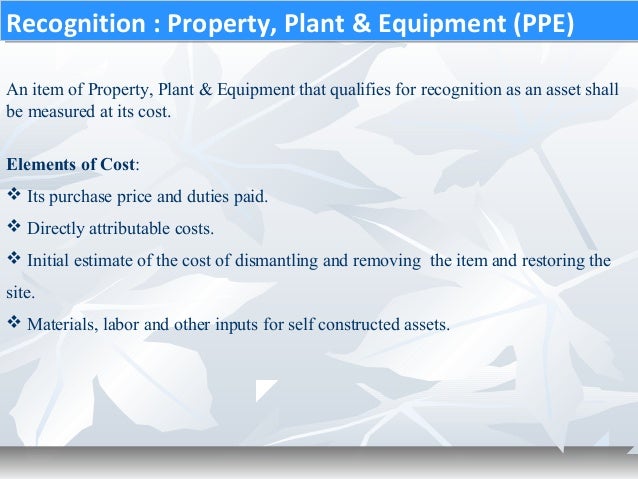

Property plant and equipment recognition criteria. Is recognised as an asset if and only if. Property Plant and Equipment recorded in Defense Property Accountability System DPAS and c ensuring that new acquisitions meeting IUID criteria have valid IUID labels and that the UIIs are. Identify criteria for the application of component-based approach.

The balance sheet is one of five financial statements that report the entitys financial. Those assets included cash account receivables cares computer equipment land building and any other resources that control by the entity. Explain the recognition criteria of property plant and equipment Determine the initial recognition initial measurement at cost of property plant and equipment.

1 It is probable that future economic benefits associated with the asset will flow to the entity. It is probable that future economic benefits. An asset is defined as a resource.

The cost of an item of property plant and equipment comprises. IAS 16 Property Plant and Equipment requires impairment testing and if necessary recognition for property plant and equipment. Recoverable amount is the higher of an assets fair value less costs to sell and its value in use.

Associated with the item will flow to the entity. Are expected to be used during more than one period. And b The cost of the asset to the entity can be measured reliably.

5 The cost of an item of property plant and equipment shall be recognised as an asset if and only if. Include decommissioning dismantling restoration costs Show the relevant accounting entries for initial costs and disclosure in the statement of profit or loss and other comprehensive income and statement of financial position. And b the cost of the item can be measured reliably.

Understand the proper accounting treatment under the component-based. Such items of property plant and equipment qualify for recognition as assets because they enable an enterprise to derive future economic benefits from related assets in excess of what could be derived had those items not been acquired. The costs of day-to-day servicing of an asset are.

The example of those fixed assets include. An item of property plant or equipment shall not be carried at more than recoverable amount. IAS 16 Property Plant and Equipment requires impairment testing and if necessary recognition for property plant and equipment.

This Standard deals with the accounting treatment of Property Plant Equipment including the guidance for the main issues related to the recognition measurement determination of carrying value depreciation charges any impairment loss and de-recognition aspects for the property plant equipment in the financial statements of an entity. Assets are resources that control by the entity and those resources are expected to have the economic inflow into the entity in the future. A It is probable that future economic benefits associated with the asset will flow to the entity.

According to IAS 16 this comprises. Explain the relevant accounting entries of subsequent costs. It is probable that future economic benefits associated with the item will flow to the entity.

For an item of PPE to be recognized recorded in financial statements it has to first meet the definition of asset and then the recognition criteria. Are held for use in the production or supply of goods or services for rental to others or for administrative purposes are expected to be used during more than one period IAS. Initial recognition An item of property plant and equipment should be recognised as an asset when.

Identify the type of costs which should and should not be included in the value of property plant and equipment at the time of initial recognition. Recoverable amount is the higher of an assets fair value less costs to sell and its value in use. Are held for use in the production or supply of goods or services for rental to others or for administrative purposes.

Property plant and equipment should initially be measured at its cost. Property plant and equipment are tangible items that. The recognition of property plant and equipment depends on two criteria.

These recognition criteria apply to subsequent expenditure as well as costs incurred initially. Para 6 of IAS 16 defines property plant and equipment as follows. This means that it is expected that cash flows or cash savings will be generated to a business from the use of the asset.

Its purchase price including import duties non-refundable purchase taxes after deducting trade discounts and rebates. An item of property plant and equipment should be recognised as an asset only when. Recognition criteria for property plant and equipmentThe cost of an item of property plant and equipment shall be recognized as an asset if and only if.

The cost of an item of property plant and equipment. 1 Recognition of property plant and equipment. It is probable that future economic benefits associated with the item will flow to the University.

A it is probable that future economic benefits associated with the item will flow to the entity. Understand the definition of property plant and equipment. An item may be an asset but if it fails the recognition criteria it will not be recorded as entitys asset in its statement of financial position.

What assets constitute property plant and equipment. An item of property plant or equipment shall not be carried at more than recoverable amount.

Derecognition Of Property Plant Equipment Cfa Level 1 Analystprep

Derecognition Of Property Plant Equipment Cfa Level 1 Analystprep

Distinguish Between Tangible And Intangible Assets Principles Of Accounting Volume 1 Financial Accounting

Distinguish Between Tangible And Intangible Assets Principles Of Accounting Volume 1 Financial Accounting

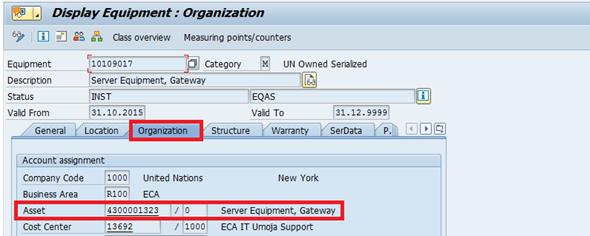

Pdf Concise Aspects Regarding The Accounting Treatment For Property Plant And Equipment In According With Ias 16

Pdf Concise Aspects Regarding The Accounting Treatment For Property Plant And Equipment In According With Ias 16

/dotdash_Final_Capital_Expenditures_vs_Revenue_Expenditures_Whats_the_Difference_2020-01-160a38c63f364966bfc46acc4b6b2917.jpg) How Do Capital And Revenue Expenditures Differ

How Do Capital And Revenue Expenditures Differ

Ias 16 Property Plant Equipment Ppe

Ias 16 Property Plant Equipment Ppe

The Need For A Conceptual Framework And The Characteristics Of Useful Information Archives Accounting Masterclass Conceptual Framework Conceptual Framework

The Need For A Conceptual Framework And The Characteristics Of Useful Information Archives Accounting Masterclass Conceptual Framework Conceptual Framework

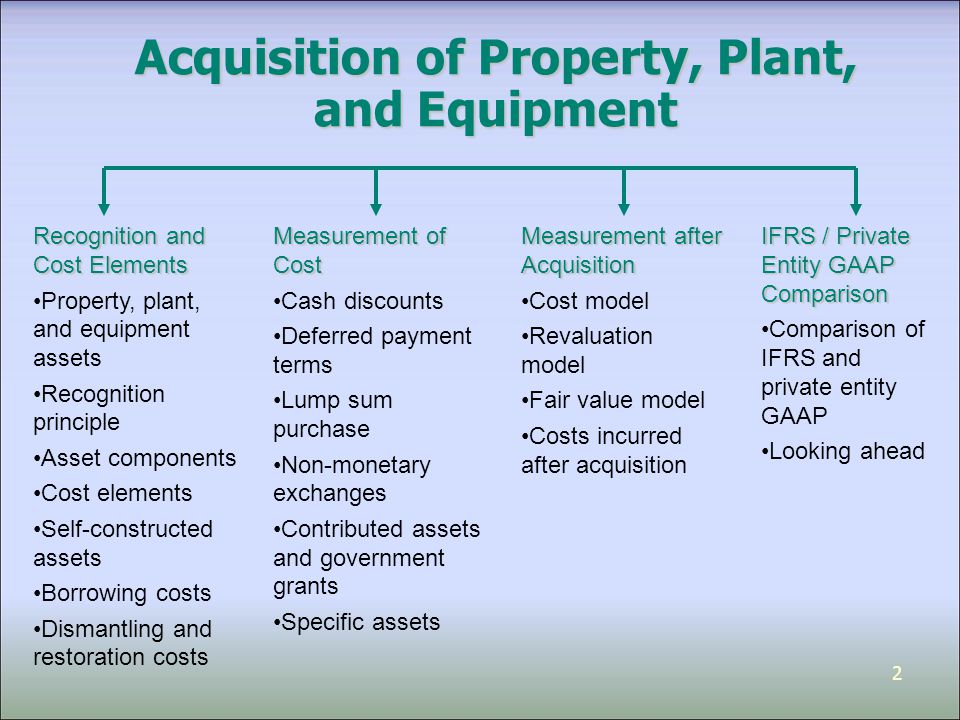

Chapter 10 Acquisition Of Property Plant And Equipment Ppt Video Online Download

Chapter 10 Acquisition Of Property Plant And Equipment Ppt Video Online Download

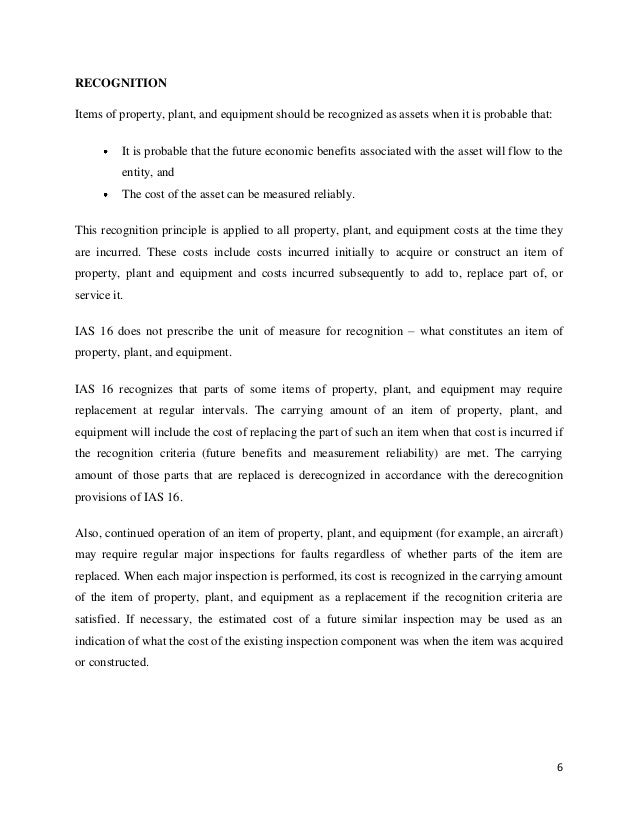

Property Plant And Equipment Ias 16 Assignment

Property Plant And Equipment Ias 16 Assignment

Us Gaap Vs Ifrs Examples Pdf Cheat Sheet Wall Street Prep

Us Gaap Vs Ifrs Examples Pdf Cheat Sheet Wall Street Prep

Https Assets Kpmg Com Content Dam Kpmg In Pdf 2017 09 Aau Sept Ch4 Pdf

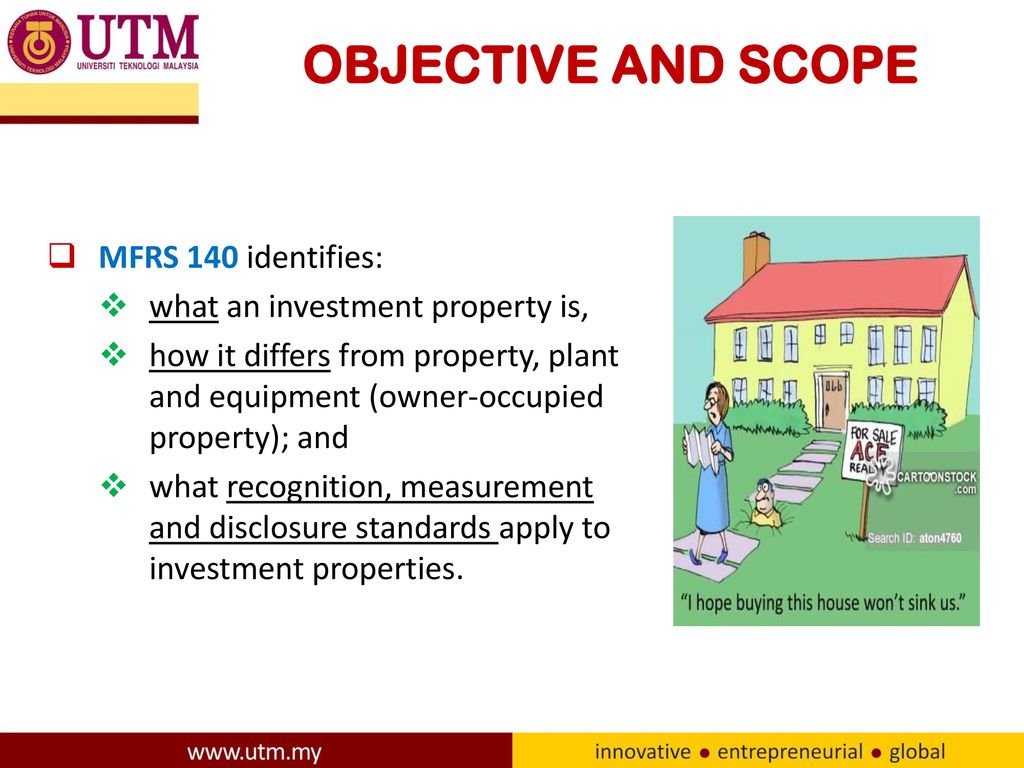

Mfrs 140 Investment Property Ppt Download

Mfrs 140 Investment Property Ppt Download

Ind As 16 Property Plant And Equipment Property Walls

Ind As 16 Property Plant And Equipment Property Walls

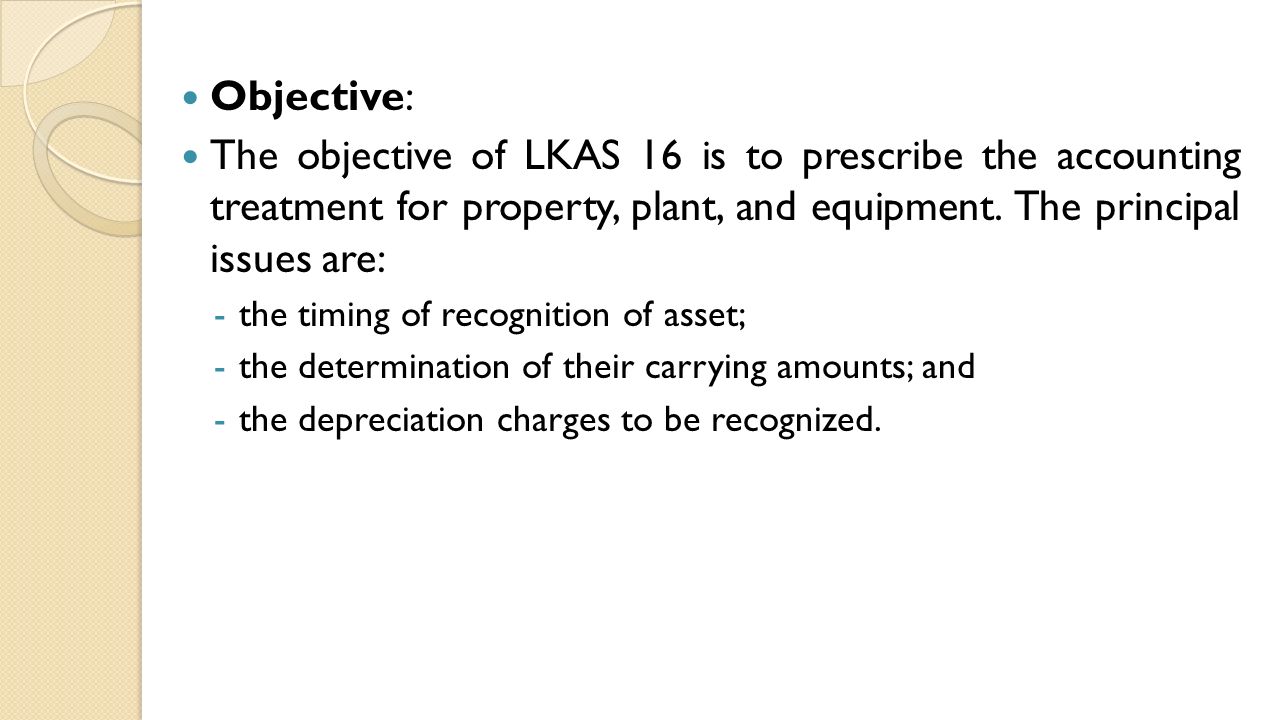

The Institute Of Chartered Accountants Of Sri Lanka Ppt Video Online Download

The Institute Of Chartered Accountants Of Sri Lanka Ppt Video Online Download

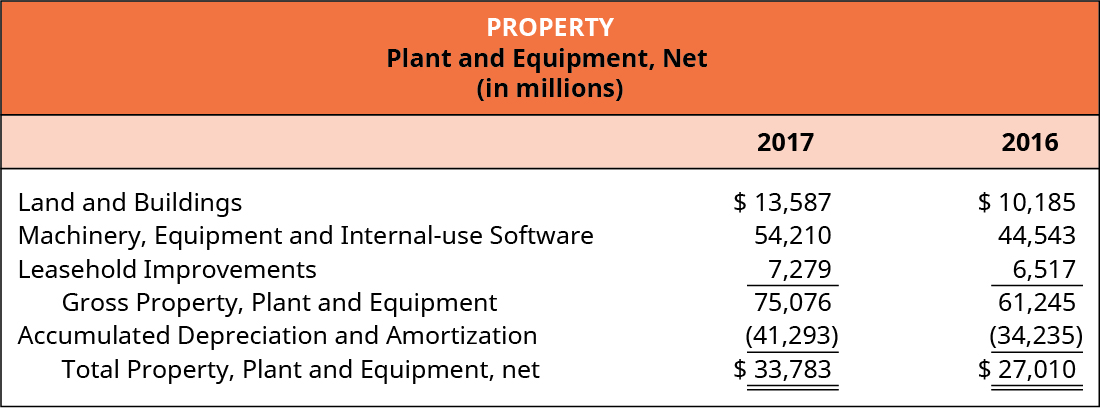

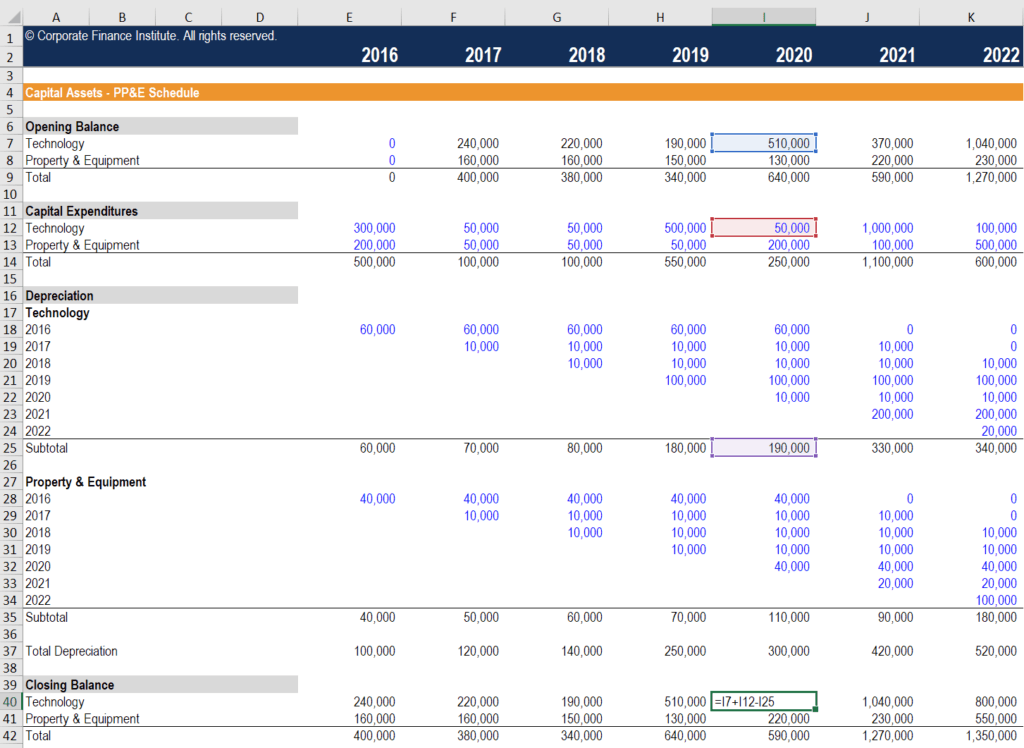

Pp E Property Plant Equipment Overview Formula Examples

Pp E Property Plant Equipment Overview Formula Examples

As 10 Accounting Standard On Property Plant Equipment Quickbooks

As 10 Accounting Standard On Property Plant Equipment Quickbooks

Https Policy Ucop Edu Doc 3410279

Mgt220 Chapter 10 Property Plant And Equipment Accounting Model Basics Team Study