Property Taxes In Delaware County Ohio

These records can include Delaware County property tax assessments and assessment challenges appraisals and income taxes. Thank you Delaware County Auditor.

Best Places To Live In Delaware County Ohio

Best Places To Live In Delaware County Ohio

The median property tax in Delaware County Ohio is 3732 per year for a home worth the median value of 252700.

Property taxes in delaware county ohio. County auditors will also be able to verify MAGI using a web-based application for those who file Ohio income tax returns. In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property. DELAWARE COUNTY AUDITOR 145 N.

However due to the constantly changing nature of tax information the Delaware County Auditors Office makes no warranties expressed or implied concerning the accuracy completeness reliability or suitability of this tax information. The estimate does not include specific tax rate adjustments such as the 20 mill floor guarantee mandated by the State of Ohio. Delaware County collects on average 148 of a propertys assessed fair market value as property tax.

Legal DisclaimerPublic information data is furnished by this office and must be accepted and used by the recipient with the understanding that this office makes no warranties expressed or implied concerning the accuracy completeness reliability or suitability of this data. DTE Form 105H may be provided to applicants who have not filed an Ohio income tax return. Remember that the property owner is responsible for paying their real estate taxes by the due date whether a tax bill is received or not.

The calculation is intended to assist taxpayers in making informed decisions with respect to the property taxes affecting their property. Property Rates of Taxation Annually the Auditor prepares the General Tax list and duplicate. DTE Form 105H is a tool for auditors to estimate Ohio income.

Image Mate Online is Delaware Countys commitment to provide Our Clients with easy access to real property information. Delaware County with the cooperation of SDG provides access to RPS data tax maps and photographic images of properties. The more detailed therefore the fewer parcels will display.

Delaware County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Delaware County Ohio. 003 MUNCIE Owner Name. The median property tax on a 25270000 house is 373996 in Delaware County.

It is not intended to be a substitute for filing an income tax return. In-depth Delaware County OH Property Tax Information. Delaware County officials today announced they have received approval from Ohio Tax Commissioner Jeffrey McClain and the Ohio Department of Taxation for an extension of property-tax payment deadlines in the county.

If you know the address of the property enter the street number as many letters of street name as you wish. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Delaware County Tax Appraisers office. Delaware OH 43015 740 833-2900 auditorcodelawareohus Thank you for your interest in your local county government.

Second half real estate taxes in Delaware County are billed in. 600 SUPERIOR AVENUE EAST SUITE 1810 CLEVELAND OH 44114. The median property tax on a 25270000 house is 343672 in Ohio.

Historic Courthouse 91 North Sandusky Street Delaware Ohio 43015 Map It. SPARTECH POLYCOM INC SPARTECH CORPORATION Property Address. Here in the Auditors website we have tried to take advantage of the internet to give better access to the functions of the auditors office.

When finished click the Continue button and you will be asked to review the information for accuracy before your payment is processed. The deadline for real-property tax collections has been moved from July 10 2020 to Aug. Tax maps and images are rendered in many different formats.

Delaware County has one of the highest median property taxes in the United States and is ranked 85th of the 3143 counties in order of median property taxes. The Delaware County Auditors office makes every effort to provide accurate and timely information. 1401 E MEMORIAL DR MUNCIE 47302 Mailing Address.

The display will include every parcel in Delaware County that matches your selection criteria. Please complete the form below. 2020 PAYABLE 2021 Parcel No.

If you feel you should have received your tax bill and have not contact the Delaware County Treasurers Office at 740 548-7313 ext.

Map The Most And Least Tax Friendly States Yahoo Finance Best Places To Retire Retirement Locations Map

Map The Most And Least Tax Friendly States Yahoo Finance Best Places To Retire Retirement Locations Map

Jerome Village Ohio Dublin Ohio Union County Ohio Real Estate

Jerome Village Ohio Dublin Ohio Union County Ohio Real Estate

Delaware County Rents Most Affordable In Nation Delaware County Rent National

Delaware County Rents Most Affordable In Nation Delaware County Rent National

Exploring Almost Forgotten Gravesites In The Great State Of Ohio Spotlighting Cincinnati S Mount Washington Cemetery Mount Washington Cincinnati Washington

Exploring Almost Forgotten Gravesites In The Great State Of Ohio Spotlighting Cincinnati S Mount Washington Cemetery Mount Washington Cincinnati Washington

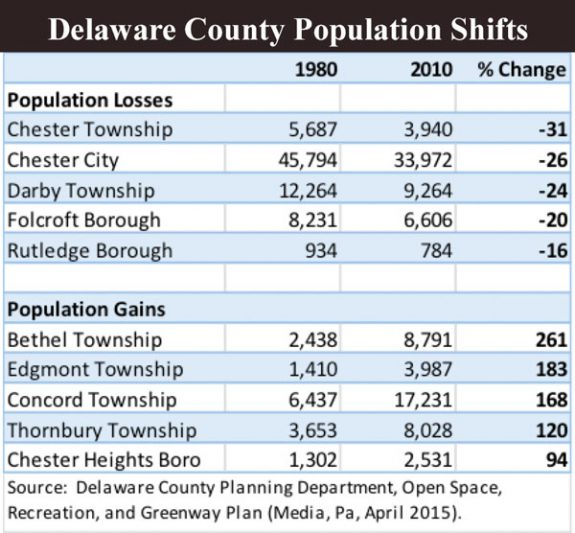

Encyclopedia Of Greater Philadelphia Delaware County Pennsylvania

Encyclopedia Of Greater Philadelphia Delaware County Pennsylvania

States With The Highest And Lowest Property Taxes Social Studies Worksheets Property Tax States

States With The Highest And Lowest Property Taxes Social Studies Worksheets Property Tax States

Horse Property For Sale In Madison County Ohio Calling All Horse Lovers Here Is Your Opportunity To Hav Washington Court House Horse Property Horse Facility

Horse Property For Sale In Madison County Ohio Calling All Horse Lovers Here Is Your Opportunity To Hav Washington Court House Horse Property Horse Facility

Delaware County Chamber Of Commerce Starting Your Business In Delaware County

Delaware County Property Tax Records Delaware County Property Taxes Ny

Delaware County Property Tax Records Delaware County Property Taxes Ny

Delaware County Property Tax Records Delaware County Property Taxes Pa

Delaware County Property Tax Records Delaware County Property Taxes Pa

Learn How A Move To De Could Save More Of Your Retirement Income Tax Delaware Retirement Benefits

Learn How A Move To De Could Save More Of Your Retirement Income Tax Delaware Retirement Benefits

Need Retirement Inspiration Delaware S Tax Benefits Are Sure To Impress Learn More At Noble S Pond Tax Delaware Estate Tax

Need Retirement Inspiration Delaware S Tax Benefits Are Sure To Impress Learn More At Noble S Pond Tax Delaware Estate Tax

Delaware County Pa Historical Photos Google Search Delaware County County Delaware

Delaware County Pa Historical Photos Google Search Delaware County County Delaware

1780 Map Of Chester County Pa Chester County Chester County Pa Family History

1780 Map Of Chester County Pa Chester County Chester County Pa Family History

1866 Genoa Township Genoa Delaware County Township

1866 Genoa Township Genoa Delaware County Township