Alabama Vehicle Property Tax Calculator

The tax must be paid at the time of sale by Georgia residents or within. Alabama Property Tax Rates.

These Are The States With The Lowest Costs Of Living Cost Of Living Retirement Locations Financial Literacy Lessons

These Are The States With The Lowest Costs Of Living Cost Of Living Retirement Locations Financial Literacy Lessons

This calculator can estimate the tax due when you buy a vehicle.

Alabama vehicle property tax calculator. Counties in Alabama collect an average of 033 of a propertys assesed fair market value as property tax per year. The values published by the Department of Revenue in the Alabama Uniform Motor Vehicle Assessment Schedule for. Property Tax sets the standards and procedures for equalization of property values in the counties and ensures property is taxed uniformly throughout the state.

Vehicle tax or sales tax is based on the vehicles net purchase price. The Vehicle Valuation Section is primarily responsible for providing market values to each county in Alabama. Property tax rates are represented in mills a unit equal to one tenth of a percent so 1 equals 10 mills.

If the city resident buys a vehicle from a dealer in a neighboring city and the dealer fails to collect city sales tax then the city resident will pay city use tax at the time of vehicle registration. However rates could be higher depending on where in Alabama you live or work as local governments can also collect income taxes ranging from 0 to 2. As a way to measure the quality of schools we analyzed the math and readinglanguage arts proficiencies for every school district in the country.

Although there isnt an Alabama car tax calculator on their website the states Department of Revenue site has a wealth of information on sales and use tax including brochures and pamphlets like the one linked above on Consumers Use Tax. Only vehicle registration tag fees are listed in the following schedules. 401K is taken from my paycheck.

Alabama has the second lowest average effective property tax rate in the country and its income tax rates range from just 2 to 5 lower than most other states that have an income tax. Its fairly simple to calculate provided you know your regions sales tax. The median property tax in Alabama is 39800 per year for a home worth the median value of 11960000.

Tangible personal property is taxable to businesses for Alabama property tax purposes. According to Act1999-363 STARS Act if back taxes are owed on a motor vehicle they must be paid before the owner can register the vehicle. If you are unsure call any local car dealership and ask for the tax rate.

Not ALL STATES offer a tax and tags calculator. For vehicles that are being rented or leased see see taxation of leases and rentals. The Alabama Department of Revenue website can be accessed via this link.

The yearly Ad Valorem or Property Tax is based on the values assigned by the State of Alabama Department of Revenue. May I use that amount also to deduct my tax to be paid. These applications must be mailed to the Motor Vehicle Division.

For 2020 the statewide millage is 65 along with local rates charged by counties school districts and municipalities. In addition all other motor vehicle title registration IFTA and IRP transactions must be submitted electronically. This calculator can help you estimate the taxes required when purchasing a new or used vehicle.

I have this Alabama Department of Revenue - Motor Vehicle Registration Tag and Tax Receipt. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Alabama local counties cities and special taxation districts. The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state.

Dealership employees are more in tune to tax rates than most government officials. The Alabama Legislature amended this law to include county and municipal sales and use tax on boat purchases effective on and after July 1 1994. An ad valorem tax lien attaches to a vehicle on 1 the date an individual permanently brings the vehicle into Alabama 2 the date the vehicle is sold from a dealers inventory or 3 the date a vehicle is sold by an individual or organization that is exempt from ad valorem taxes or 4 upon the date a motor vehicle otherwise becomes.

Prorated tag fees 1 month -11 months are only allowed for newly acquired vehicles and vehicles registered for the first time in Alabama. First we used the number of households median home value and average property tax rate to calculate a per capita property tax collected for each county. Alabama collects a 2 state sales tax rate on the purchase of vehicles which includes off-road motorcycles and ATVs.

These values are used by the county tag offices to calculate the ad valorem taxes on motor vehicles. For most vehicles ad valorem property tax and local issuance fees will also apply. Anytime you are shopping around for a new vehicle and are beginning to make a budget its important to.

See below for states that do and dont offer these services In addition CarMax offers a free tax and tag calculator for some states only. How can I get the info over total amount paid the whole last year. Alabama has one of the lowest median property tax rates in the United States with only one states collecting a lower median property tax than Alabama.

May I use that. Total rates vary depending on the location of the property. Aircraft and avionics equipment is taxable for business personal property in the State of Alabama as well as motor vehicle add-on equipment.

Including city and county vehicle sales taxes the total sales tax due will be between 3375 and 4 of the vehicles purchase price. For additional questions or to schedule an appointment please contact the Motor Vehicle Division at 334-242-9000 or and submit a request. Our purpose is to supervise and control the valuation equalization assessment of property and collection of all Ad Valorem taxes.

Ad valorem taxes on motor vehicles are assessed and collected forward on a current basis to coincide with the collection of. This tax is based on the value of the vehicle.

2231 Penn Place 310 North Saint Paul Mn 55109 5664993 Image1 Edina Realty Real Estate Realty

2231 Penn Place 310 North Saint Paul Mn 55109 5664993 Image1 Edina Realty Real Estate Realty

The Year In Housing The Middle Class Can T Afford To Live In Cities Anymore House City House Styles

The Year In Housing The Middle Class Can T Afford To Live In Cities Anymore House City House Styles

New Hampshire Property Tax Calculator Smartasset

New Hampshire Property Tax Calculator Smartasset

The Most And Least Expensive U S States To Rent A Home Vivid Maps Rent Apartment Cost Low Income Housing

The Most And Least Expensive U S States To Rent A Home Vivid Maps Rent Apartment Cost Low Income Housing

![]() Georgia New Car Sales Tax Calculator

Georgia New Car Sales Tax Calculator

Do You Know Someone Searching For A New Home Tag Them Here Because This Could Be The End Of Their Search House Styles Big Houses New Kitchen Cabinets

Do You Know Someone Searching For A New Home Tag Them Here Because This Could Be The End Of Their Search House Styles Big Houses New Kitchen Cabinets

Teenage Millionaire Binary Options Trader Buys A Gold Bentley At 18 Tags Binary Options Bentley Binary Buys Gold Millionaire Option Binary Options Gold

Teenage Millionaire Binary Options Trader Buys A Gold Bentley At 18 Tags Binary Options Bentley Binary Buys Gold Millionaire Option Binary Options Gold

Housters Property Management Android App Playslack Com Property Management For The Next Generation Of Mobile Lan Property Management Being A Landlord Rent

Housters Property Management Android App Playslack Com Property Management For The Next Generation Of Mobile Lan Property Management Being A Landlord Rent

5 States With No Property Tax In 2018 Mashvisor

5 States With No Property Tax In 2018 Mashvisor

Sample Codicil To Last Will And Testament Wikihow Last Will And Testament Tem Will And Testament Last Will And Testament Gender Reveal Invitations Template

Sample Codicil To Last Will And Testament Wikihow Last Will And Testament Tem Will And Testament Last Will And Testament Gender Reveal Invitations Template

Regions Bank Website 3 Things Nobody Told You About Regions Bank Website In 2020 Map States This Or That Questions

Regions Bank Website 3 Things Nobody Told You About Regions Bank Website In 2020 Map States This Or That Questions

How Many People Make More Than 150 000 In Every Us State Business Insider Income Household Income Oil Jobs

How Many People Make More Than 150 000 In Every Us State Business Insider Income Household Income Oil Jobs

Florida Car Sales Tax Everything You Need To Know

Florida Car Sales Tax Everything You Need To Know

Elyria S Proposed Loan Program On Hold Lorain County Lorain County Proposal Loan

Elyria S Proposed Loan Program On Hold Lorain County Lorain County Proposal Loan

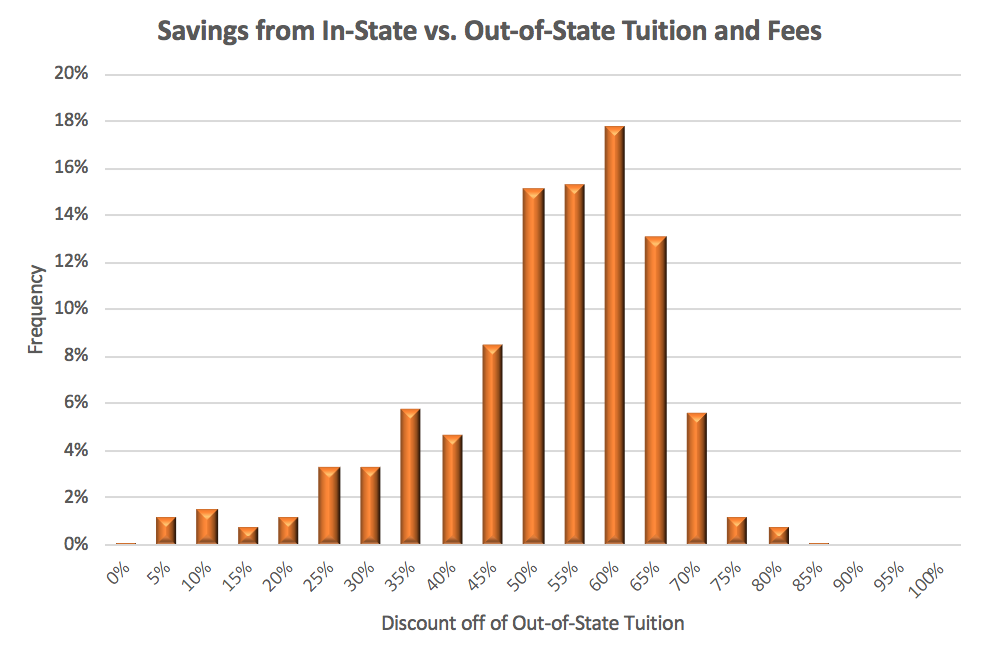

State Residency Requirements For In State Tuition

State Residency Requirements For In State Tuition

Car Tax By State Usa Manual Car Sales Tax Calculator

Car Tax By State Usa Manual Car Sales Tax Calculator

Car Buyers Beware Cheapest And Most Expensive States For Unexpected Fees Car Buying Car Buyer Car

Car Buyers Beware Cheapest And Most Expensive States For Unexpected Fees Car Buying Car Buyer Car

How Green Is Your State Vivid Maps Map Power Map Cartography Map

How Green Is Your State Vivid Maps Map Power Map Cartography Map

Truck Drivers Trip Sheet Template Awesome Trucking Pany Forms And Envelopes Custom Printing Peterainsworth Excel Templates Book Template Templates

Truck Drivers Trip Sheet Template Awesome Trucking Pany Forms And Envelopes Custom Printing Peterainsworth Excel Templates Book Template Templates