Capital Gains Tax Ireland Inherited Property

You sold the house in an arms length transaction. Lets say the child in the example you cite ends up having to pay 20000 in federal income taxes on the 100000 in profits on the sale of the home.

How To Reduce Or Avoid Capital Gains Tax On Property Or Investments

How To Reduce Or Avoid Capital Gains Tax On Property Or Investments

You sold the house to an unrelated person.

Capital gains tax ireland inherited property. Report the sale on Schedule D Form 1040 Capital Gains and Losses and on Form 8949 Sales and Other Dispositions of Capital Assets. This can be up to 40 but it depends on the various allowances available to the estate. You and your siblings didnt use the property for personal purposes.

Death is not an occasion of charge for capital gains tax purposes. But this might also depend on other allowances. If you were to sell the property there could be huge capital gains taxes.

Taxable gains occur from selling. There are other rates for specific types of gains. The Section 121 Exclusion allows a taxpayer to exclude up to 250000 500000 for joint returns of the capital gain from the sale if they live in the property for at least two of the five years before the sale.

For example suppose you inherit a house that was purchased years ago for 150000 and it is now worth 350000. You may receive gifts and inheritances up to a set value over your lifetime before having to pay CAT. In fact the average estate pays just 6 in inheritance tax.

If you or your spouse gave the property to the decedent within one year before the decedents death see Publication 551 Basis of Assets. If youve already paid a tax on the home that was likely inheritance tax not to be confused with capital gains. In Ireland capital acquisitions tax CAT is payable if the donor in this case your stepmother or the beneficiary is Irish resident or the subject of the gift or inheritance is situated in.

The child could have avoided paying those taxes entirely if the parent had simply kept ownership of the home and the child had. Wait One Year Before Selling Inherited Property. Once due it is charged at the current rate of 33 valid from 6 December 2012.

For example a property worth 600000 inherited by one child will incur a tax bill of 95700 33 per cent of 600000-310000 while a property worth 100000 left by someone with. Capital Gains on Inherited Property An inherited asset you sell for more than the basis is taxed as a capital gain including investments and personal property. A liability to Capital Gains tax does not arise on death.

Regarding capital gains on inherited property and losses you can claim a capital loss on inherited property if you sold it and all of these are true. How to Avoid Paying Capital Gains Tax on Inherited Property. Currently the tax rate is 15.

However this relief does not apply if the property was acquired by gift or inheritance. CAT is a tax on gifts and inheritances. Capital Gains Tax Rules for Inherited Property When inheriting property such as a home or other real estate the capital gains tax kicks in if you sell that asset at a higher price point than the person you inherited it from paid for it.

Gains made on the disposal of property acquired between 7 December 2011 and 31 December 2014 and held for more than 4 years but less than 7 years are exempt from CGT. If you sell the property for more than your basis you have a taxable gain. Consequently there is no capital gains tax on inherited property on deathIf the value of the estate after reliefs and exemptions exceeds the nil rate band for inheritance tax purposes inheritance tax will be payable on the excess.

When you inherit an asset you are treated as receiving the asset at the market value at the date of death for the purposes of CAT and CGT. When inheriting property such as a home or other real estate the capital gains tax kicks in if you sell that asset at a higher price point than the person you inherited it from paid for it. But if his tax basis had been the same as his mothers 75000 then he would have owed capital gains tax on his gain of 125000 on the same transaction.

Capital gains on the other hand are the tax paid from the profit you make from selling an inherited property. That means that two-thirds of any. Most of the time it is up to 40 of the entire value of the property at the time of inheritance.

Likewise its possible to claim a capital loss deduction if you end up selling the property at a loss. In other words the inherited home must be your primary residence. Fortunately when you inherit property the propertys tax basis is stepped up which means the basis would be the current value of the property.

CAPITAL ACQUISTIONS PAYMENT DEADLINES You must pay and file your CAT liability by 31st October. You should also bear in mind that capital gains tax is levied at 33 per cent and that the first 1270 of any capital gain in a given year is exempt as well. The rate of CGT is 33 for most gains.

Dlf Capital Greens Delhi S Most Amazing Home Address Commercial Property Lucknow Smart Home

Dlf Capital Greens Delhi S Most Amazing Home Address Commercial Property Lucknow Smart Home

Budget 2020 And Nris Genuine Taxpayers Need Not Worry In 2020 Budgeting Legal Services Income Tax Return

Budget 2020 And Nris Genuine Taxpayers Need Not Worry In 2020 Budgeting Legal Services Income Tax Return

Tax Implications For Nris Who Want To Sell Property In India

Tax Implications For Nris Who Want To Sell Property In India

1 Tds Rate Chart Fy 2019 20 Ay 2019 20 Notes To Tds Rate Chart Fy 2019 20 Ay 2020 21 No Tds On Gst As Chart Rate Taxact

1 Tds Rate Chart Fy 2019 20 Ay 2019 20 Notes To Tds Rate Chart Fy 2019 20 Ay 2020 21 No Tds On Gst As Chart Rate Taxact

Capital Gains Tax In France On Property Blevins Franks Advice

Capital Gains Tax In France On Property Blevins Franks Advice

How To Report Rental Income On Foreign Property A Guide For Expats

How To Report Rental Income On Foreign Property A Guide For Expats

Transfer Sale Proceeds Of Inherited Property Money Transfer 5 Ways

Transfer Sale Proceeds Of Inherited Property Money Transfer 5 Ways

Changes To Capital Gains Tax For Landlords And Second Homes Legal Advice Tees Law

Changes To Capital Gains Tax For Landlords And Second Homes Legal Advice Tees Law

Selling An Inherited Property And Capital Gains Tax Yopa Homeowners Hub

Selling An Inherited Property And Capital Gains Tax Yopa Homeowners Hub

Tax On Real Estate Sales In Canada Madan Ca

Tax On Real Estate Sales In Canada Madan Ca

How High Are Capital Gains Taxes In Your State Tax Foundation

How High Are Capital Gains Taxes In Your State Tax Foundation

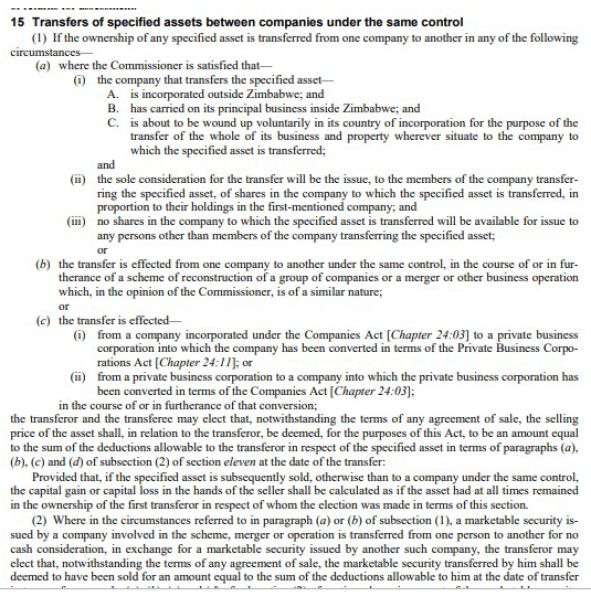

Capital Gains Tax Tax Zimbabwe

Capital Gains Tax Tax Zimbabwe

Steps To Take In Calculating Capital Gains For Selling Foreign Property

Steps To Take In Calculating Capital Gains For Selling Foreign Property

Here S The Formula For Paying No Federal Income Taxes On 100 000 A Year Marketwatch Federal Income Tax Income Tax Income

Here S The Formula For Paying No Federal Income Taxes On 100 000 A Year Marketwatch Federal Income Tax Income Tax Income

Biden Tax Plan And 2020 Year End Planning Opportunities

Biden Tax Plan And 2020 Year End Planning Opportunities

How Should Capital Be Taxed Bastani 2020 Journal Of Economic Surveys Wiley Online Library

How Should Capital Be Taxed Bastani 2020 Journal Of Economic Surveys Wiley Online Library