How To Calculate Capital Gain Tax On Property In Pakistan

Calculating capital gains tax on your foreign rental property. Depending on your income level your capital gain will be taxed federally at either 0 15 or 20.

Income Tax Form Ay 3 3 3 Brilliant Ways To Advertise Income Tax Form Ay 3 3 Income Tax Income Tax Return Tax Forms

Income Tax Form Ay 3 3 3 Brilliant Ways To Advertise Income Tax Form Ay 3 3 Income Tax Income Tax Return Tax Forms

The capital gains tax rate in Ontario for the highest income bracket is 2676.

How to calculate capital gain tax on property in pakistan. Income from Other Sources. A rate of 20 is levied as a tax on capital gains generated through the sale of a property. The tax brackets for each province vary so you may be paying different amounts of capital gain tax depending on which province you live in.

Lets discuss it in detail. The gain will be calculated by deducting the cost from the consideration received. The above withholding tax of Rs75000- is adjustable against the tax liability on all type of income including capital gain.

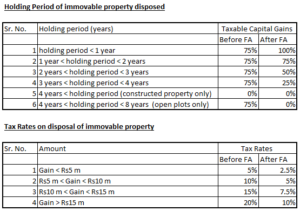

According to the IRS the tax rate on most net capital gain is no more than 15 for most taxpayers. Capital gains tax CGT is the levy you pay on the capital gain made from the sale of that asset. The Federal Board of Revenue FBR has made significant changes in the Income Tax Ordinance 2001 through the Finance Act 2020 for taxation of the capital gain on the disposal of immovable property.

Only after individuals are clear about these concepts and their associated calculations they can proceed to calculate the Long-term capital gain in the property. Kinds of tax on sale of property in Pakistan. Capital gain tax shall be payable 5 on capital gain of Rs2500000 ie.

2020 long-term capital gains taxes can range from 0 to 20 based on your tax bracket and filing status. According to the Pakistan finance act 2017 capital gain tax can only be levied when the property is sold within the first three years after the purchase. Your basis is the purchase price adjusted for improvements depreciation and other adjustment items.

Purchaser do not pay any Capital gains tax. The property is directly and jointly owned by husband and wife. For a comprehensive breakdown of property taxes you can check out our blog on understanding property tax rates in Pakistan.

Capital gains taxes. The fair market value FMV at the time the donor made the gift. Days or more in the tax year.

The calculator on this page is designed to help you estimate your projected long-term capital gains tax obligation based on the income made from your assets as well as the nuances of your financial circumstances. It applies to property shares leases goodwill licences foreign currency contractual rights and personal use assets purchased for more than 10000. Capital gains tax is only applicable on the seller.

Answer The first step in how to calculate long-term capital gains tax is generally to find the difference between what you paid for your property and how much you sold it foradjusting for commissions or fees. Capital gains tax on property CGT was also levied in the previous year at 10. During the first year the tax is 10 in the second year it is 75 and in the third year the tax rate falls to 5.

How is Long-Term Capital Gain Tax Calculated. Long term capital gains can be determined by calculating the difference between the sale price of the house and the indexed acquisition cost of the house provided the sale of the house has taken place after three years from the date of purchase of the house. If the FMV of the property at the time of the.

The adjusted cost basis to the donor just before the donor made the gift to you. When it comes to taxes on sale of property in Pakistan there is Capital Gains Tax which needs to be paid on the gain of profits. This means that if you earn 2000 in total capital gains then you will pay 53520 in capital gains tax.

In arriving at effective capital gains tax rates the Global Property Guide makes the following assumptions. To figure out the basis of property you receive as a gift you must know three amounts. Is present in Pakistan for a period of or periods amounting in aggregate to one hundred and twenty days or more in the tax year and in the four years preceding the tax year has been in Pakistan for a period of or.

This is generally true only if you have owned and used your home as your main residence for at least two out of the five years prior to the sale. Subtract that from the sale price and you get the capital gains. They have owned it for 10 years.

If the holding period is more than one year but does not exceed eight years in the case of open plot or four years in the case of constructed property 75 of the gain will be taxed. Read on to learn about capital gains tax for primary residences second homes investment properties. My brother is a non filer.

Capital gains tax on property CGT is paid on the difference between your buying price and your selling price. The amount of any gift tax paid on Form 709 United States Gift and Generation-Skipping Transfer Tax Return. When you sell your primary residence 250000 of capital gains or 500000 for a couple are exempted from capital gains taxation.

Think of basis as an adjusted purchase price. It is their only source of capital gains in the country. If youre selling a property you need to be aware of what taxes youll owe.

If your foreign property isnt your primary residence it is considered an investment and is subject to standard capital gains tax rates. When calculating your capital gain you must first calculate your basis in the capital asset before subtracting it from the sales proceeds to determine the tax owed. Also the tax brackets change every year.

The return for tax year 2017 relevant to the financial year 2016-17.

The Aquatic Mall Aquatic Marine Theme Water

The Aquatic Mall Aquatic Marine Theme Water

Fbr Not To Tax Annual Property Rent Income Of Up To Rs0 2 Million

Fbr Significantly Changes The Taxation Of Capital Gains On Disposal Of Immovable Property Profit By Pakistan Today

Fbr Significantly Changes The Taxation Of Capital Gains On Disposal Of Immovable Property Profit By Pakistan Today

World S Tallest Aquarium Aquarium Aquatic Take Video

World S Tallest Aquarium Aquarium Aquatic Take Video

Taxseason2019 Gearup2 0 Aaotaxdein Filing Taxes Tax Services Economic Analysis

Taxseason2019 Gearup2 0 Aaotaxdein Filing Taxes Tax Services Economic Analysis

Wordpress Error Plots For Sale Buying Property Lahore Pakistan

Wordpress Error Plots For Sale Buying Property Lahore Pakistan

The Worst States For Taxes Tax Deductions Travel Nursing Pay Travel Nursing

The Worst States For Taxes Tax Deductions Travel Nursing Pay Travel Nursing

All You Need To Know About Real Estate Taxes In Budget 2019 20 Graana Com Blog

All You Need To Know About Real Estate Taxes In Budget 2019 20 Graana Com Blog

Property Taxes Pakistan Property Tax Estate Tax Capital Gains Tax

Property Taxes Pakistan Property Tax Estate Tax Capital Gains Tax

How To Submit Income Tax Return Fbr Pakistan 2019 File Tax Return Step Filing Taxes Income Tax Tax Return

How To Submit Income Tax Return Fbr Pakistan 2019 File Tax Return Step Filing Taxes Income Tax Tax Return

Calculating Capital Gains Tax On Property Cgt Myth Busting

Calculating Capital Gains Tax On Property Cgt Myth Busting

Income Tax Return Form 8 Pakistan Why Is Income Tax Return Form 8 Pakistan So Famous Income Tax Income Tax Return Tax Forms

Income Tax Return Form 8 Pakistan Why Is Income Tax Return Form 8 Pakistan So Famous Income Tax Income Tax Return Tax Forms

Comparison Between Fcnr Nre Nro Account Managing Finances Finance Finance Bank

Comparison Between Fcnr Nre Nro Account Managing Finances Finance Finance Bank

Understanding Proprety Tax Rates In Pakistan Zameen Blog

Understanding Proprety Tax Rates In Pakistan Zameen Blog

Tax On Sale Of Property In Pakistan How To Calculate Capital Gain Tax On Property Ty 2020 21 Youtube

Tax On Sale Of Property In Pakistan How To Calculate Capital Gain Tax On Property Ty 2020 21 Youtube

Top Tax Consultants In Lahore Pakistan Global Tax Consultants Tax Return Tax Software Tax Preparation

Top Tax Consultants In Lahore Pakistan Global Tax Consultants Tax Return Tax Software Tax Preparation

Customer Review Filing Taxes Tax Services Tax

Customer Review Filing Taxes Tax Services Tax

Irs Tax Problems And How To Easily Get Them Resolved Today Irs Taxes Tax Preparation Income Tax Return

Irs Tax Problems And How To Easily Get Them Resolved Today Irs Taxes Tax Preparation Income Tax Return