How To Dispose Of An Asset Journal Entry

The gain or loss is calculated as the net disposal proceeds minus the assets carrying value. Record the disposal by.

The Bookkeeping Ledgers Make Up Part Of The Accounts They Are Still Used Today Part Of The Computerised System Includ Accounting Basics Bookkeeping Accounting

The Bookkeeping Ledgers Make Up Part Of The Accounts They Are Still Used Today Part Of The Computerised System Includ Accounting Basics Bookkeeping Accounting

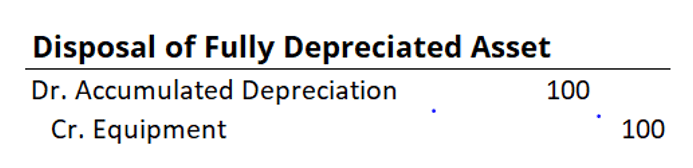

This is a common situation when a fixed asset is being scrapped or given away because it is obsolete or no longer in use and there is no resale market for it.

How to dispose of an asset journal entry. The journal entry of fixed asset write-off is a simple one if its net book value has become zero. Debit all accumulated depreciation and credit the fixed asset. And of course dont hesitate to reach out to us via social if you need any more help.

Writing off the accumulated depreciation. Balance Sheet as of Aug 2619 after above JE has been posted. To create a disposal journal go to Fixed assets Journal entries Fixed assets journal and then on the Action Pane select Lines.

Balance Sheet The balance sheet is one of the three fundamental financial statements. When you sell a company owned vehicle this decreases your Fixed Assets. If the asset is fully depreciated then that is the extent of the entry.

Let me show you how to enter a journal entry for the sale. To fully dispose of the asset dont enter a value in either the Debit field or the Credit field. Recording the gain or loss if any.

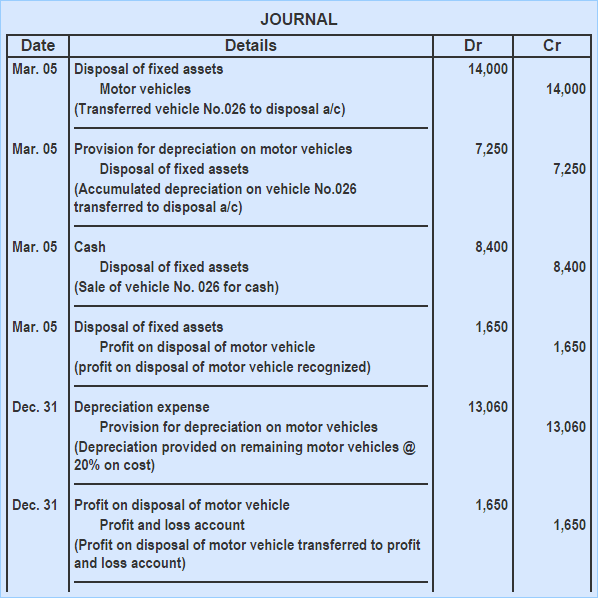

Below is the journal entry for disposal of fixed assets with zero net book value. And thats how you book a fixed assets journal entry. When a depreciable asset is disposed of an entry is made to recognize any unrecorded depreciation expense up to the date of the disposition and then the assets cost and accumulated depreciation are removed from the respective general ledger accounts.

In other words the cost of the fixed asset equals its accumulated depreciation. The journal entry records. In the Account column add the Bank Account you want to record the sale.

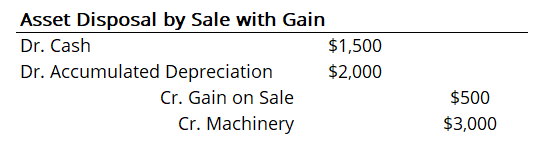

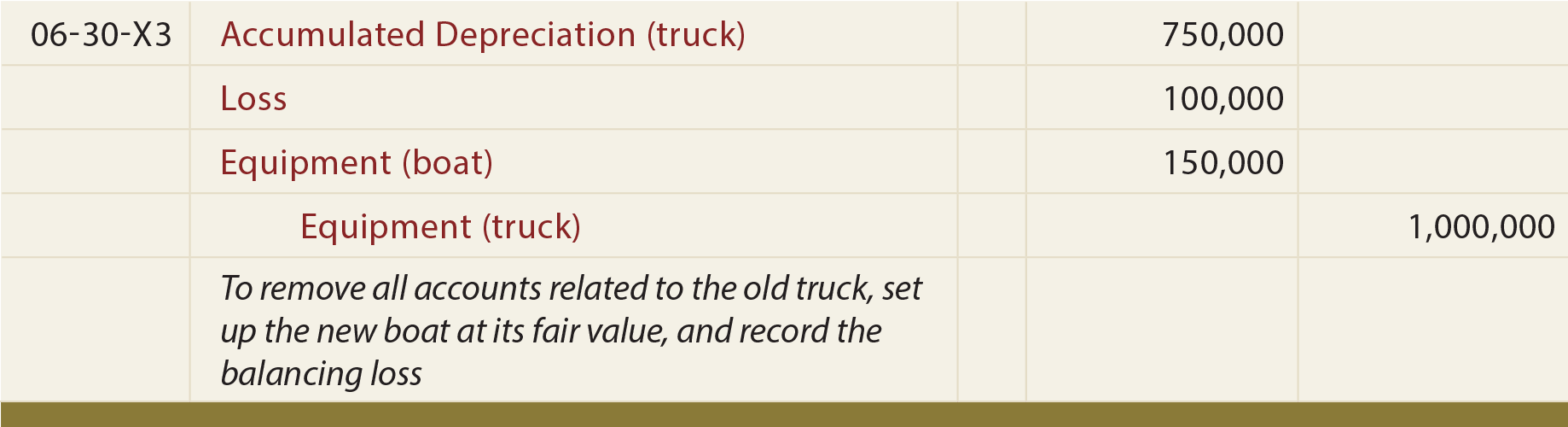

The fixed asset sale is one form of disposal that the company usually seek to use if possible. Any remaining difference between the two is recognized as either a gain or a loss. Fixed Asset Trade In Journal Entry.

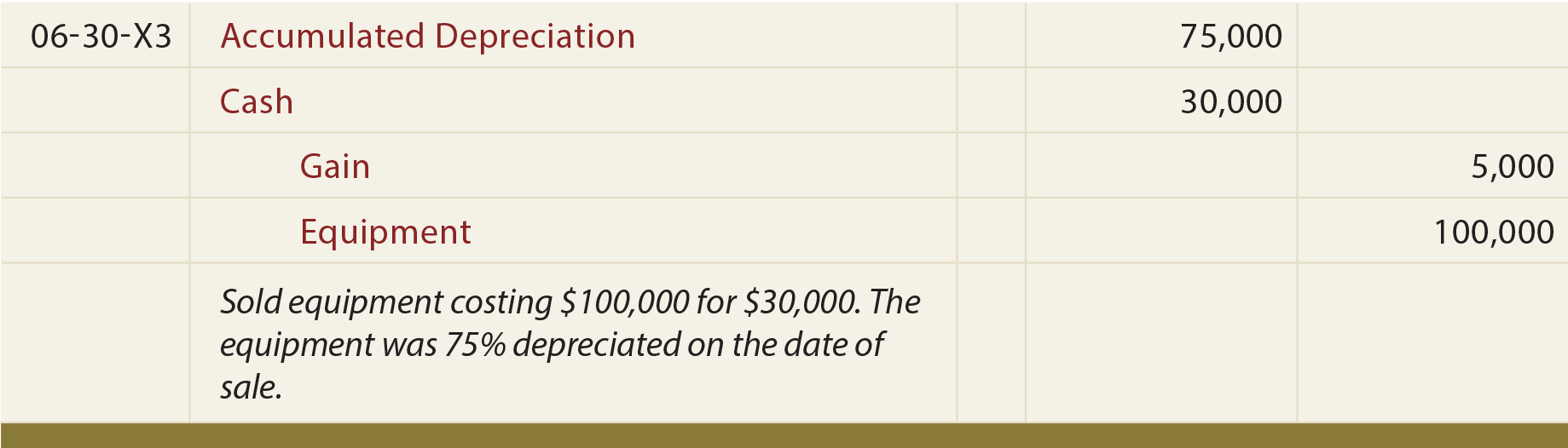

The disposal of fixed assets with zero net book value is also called discarding assets. Defining the Entries When Selling a Fixed Asset. Since it was exchanged for fair value of 5000 and had a net book value of 6000 17000 11000 the loss on disposal must have been 1000.

Recording any consideration usually cash received or paid or to be received or paid. Fixed Asset Sale Journal Entry Overview. Create an initial journal line and fill in the fields as necessary.

The fixed assets depreciation expense must be recorded up to the date of the sale. The fixed assets cost and the updated accumulated depreciation must be removed. Journal Entry to post sale of computer asset on 082619.

The account is sometimes called the disposal account gainslosses on disposal account or sales of assets account. Also if a company disposes of assets by selling with gain or loss the gain and loss should be reported on the income statement. The fixed asset trade in transaction is shown in the accounting records with the following bookkeeping entries.

Writing off the assets cost. Click on Make General Journal Entries. General ledger entries are not made for additional books if any are set up.

Select Disposal scrap and then select a fixed asset ID. These statements are key to both financial modeling and accounting. Here are the options for accounting for the disposal of assets.

In business the company may decide to dispose of the fixed asset before the end of its estimated life when the fixed asset is no longer useful due to it has physically deteriorated or become obsolete. Debit cash for the amount received debit all accumulated depreciation debit the loss on sale of asset account and credit the fixed asset. Add the amount 1470000 in the Debit column.

Note here is a balance sheet as of 073119 showing two Fixed Assets accounts with balances. The disposal of fixed assets account is an income statement account and is being used to hold all gains losses and write offs of fixed assets as they are disposed of. Disposal of Fixed Assets.

No proceeds fully depreciated. Choose a field to read a short description of the field or link to more information. When a fixed asset or plant asset is sold there are several things that must take place.

The cash received must be recorded. When you dispose of an asset item by scrapping it a journal entry is automatically posted for it when you process the disposal in Asset Management Disposal Processing. What entry is made when selling a fixed asset.

As the fixed asset is fully depreciated thus the company needs to derecognize the assets from its Balance Sheet. Gain on Asset Disposal. The disposal of fixed assets journal entry would be as follows.

As you study this section remember these common procedures accountants use to record the disposal of plant assets. Asset cannot be sold it can make the journal entry for the writing off by debiting the accumulated depreciation account and crediting the fixed asset account. Depreciable assets are disposed of by retiring selling or exchanging them.

A company may need to de-recognize a fixed asset either upon sale of the asset to another party or when the asset is no longer operational and is disposed of. To post a disposal from the fixed asset GL journal Choose the icon enter FA GL Journals and then choose the related link. The journal entry for this disposal is straightforward.

In this case if the company discards the asset completely eg. In this case reverse any accumulated depreciation and reverse the original asset cost. As soon as the balance in the vehicle asset account is at 000 it should no longer show up on your balance sheet.

By removing a capital asset. We have more how-tos when it comes to booking journal entries which can be found right here. Disposal of fixed assets is accounted for by removing cost of the asset and any related accumulated depreciation and accumulated impairment losses from balance sheet recording receipt of cash and recognizing any resulting gain or loss in income statement.

Go to the Company menu.

Post G L Journal Entries To Fixed Assets

Post G L Journal Entries To Fixed Assets

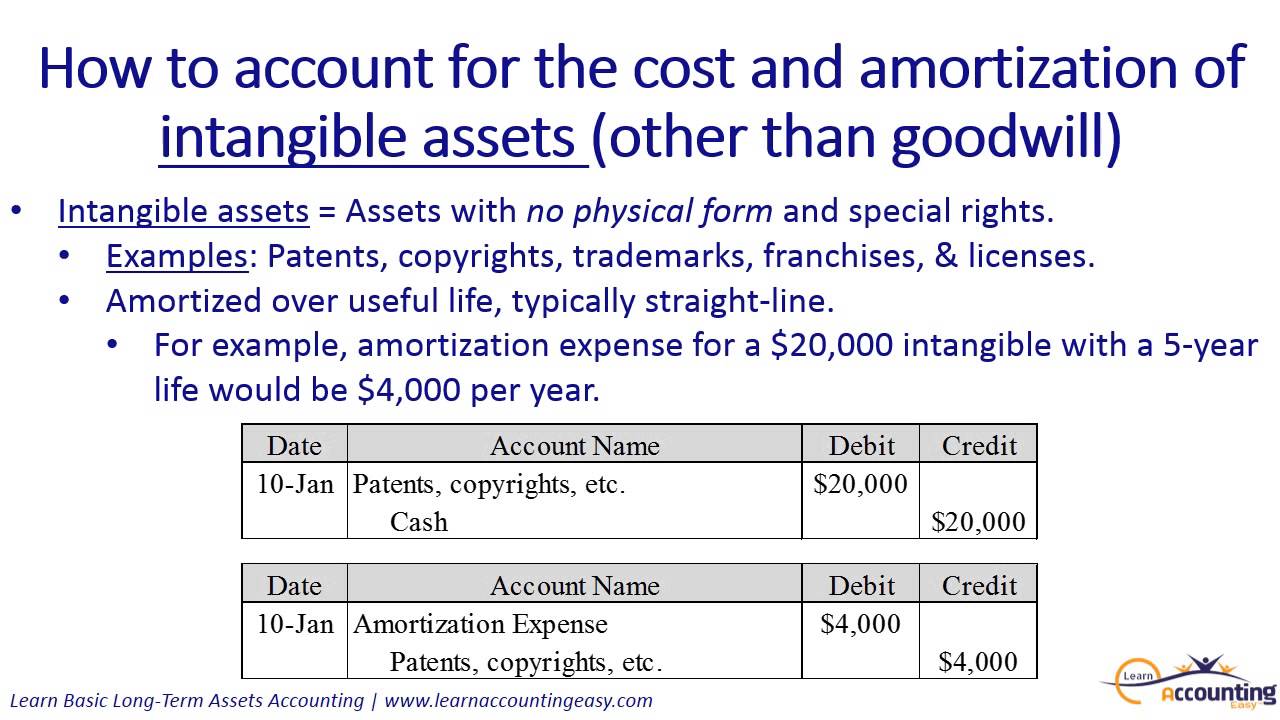

Intangible Assets Financial Accounting

Intangible Assets Financial Accounting

Investment Services Balance Sheet And Income Statement Profit And Loss Statement Investment Services Investing

Investment Services Balance Sheet And Income Statement Profit And Loss Statement Investment Services Investing

Asset Disposal Definition Journal Entries Financial Statements

Asset Disposal Definition Journal Entries Financial Statements

Fixed Asset Trade In Double Entry Bookkeeping

Fixed Asset Trade In Double Entry Bookkeeping

Learn Microsoft Excel Fixed Asset Record With Straight Line Depreciation Learning Microsoft Fixed Asset Microsoft Excel

Learn Microsoft Excel Fixed Asset Record With Straight Line Depreciation Learning Microsoft Fixed Asset Microsoft Excel

Acct 2010 Ch 7 Lo4 Disposal Of Plant Assets Financial Accounting Journal Entries Disposable

Acct 2010 Ch 7 Lo4 Disposal Of Plant Assets Financial Accounting Journal Entries Disposable

Fully Depreciated Asset Overview Calculation Examples

Fully Depreciated Asset Overview Calculation Examples

Adjusting Entries For Asset Accounts Accountingcoach Accounting Accounts Receivable Income Statement

Adjusting Entries For Asset Accounts Accountingcoach Accounting Accounts Receivable Income Statement

What Is The Difference Between Fixed Asset Write Off And Disposal Wikiaccounting

What Is The Difference Between Fixed Asset Write Off And Disposal Wikiaccounting

Trading Profit And Loss Account And Balance Sheet Finance And Accounting Simplified Accounting Period Accounting Period Calendar

Trading Profit And Loss Account And Balance Sheet Finance And Accounting Simplified Accounting Period Accounting Period Calendar

Asset Disposal Account Http Www Svtuition Org 2014 09 Asset Disposal Account Html Accounting Education Cost Accounting Learn Accounting

Asset Disposal Account Http Www Svtuition Org 2014 09 Asset Disposal Account Html Accounting Education Cost Accounting Learn Accounting

Fixed Asset Retirement And Disposal Crash Course In Accounting And Financial Statement Analysis Second Edition Book

Accounting For Asset Exchanges Principlesofaccounting Com

Accounting For Asset Exchanges Principlesofaccounting Com

Pin By Do Thanh On Assets In 2020 Document Management System Resource Management Preventive Maintenance

Pin By Do Thanh On Assets In 2020 Document Management System Resource Management Preventive Maintenance

Depreciation And Disposal Of Fixed Assets Examples Play Accounting

Depreciation And Disposal Of Fixed Assets Examples Play Accounting

Disposal Of Pp E Principlesofaccounting Com

Disposal Of Pp E Principlesofaccounting Com

Sample Chart Of Accounts For Manufacturing Company Chart Accounts Example For Manufacturing Chart Of Accounts Small Business Accounting Accounting

Sample Chart Of Accounts For Manufacturing Company Chart Accounts Example For Manufacturing Chart Of Accounts Small Business Accounting Accounting

Journal Entries For Retirements And Reinstatements Oracle Assets Help

Journal Entries For Retirements And Reinstatements Oracle Assets Help