How To Work Out Yield On Commercial Property

7 yield 1429 8 yield 125. An office or retail space gained full HMO planning consent and converted it to a purpose-built 12 bedroom house of multiple occupancy then youre argument for a commercial or yield-based valuation is strong.

Commercial Property Valuation Using The Profits Method

Commercial Property Valuation Using The Profits Method

Lets say a commercial property sold in the neighborhood youre looking at for 500000 with an annual income of 90000.

How to work out yield on commercial property. There are a number of different methods by which investors work out rental yield for an investment property. Divide it by the propertys purchase price or current market value. Net rental yield Annual rental income - annual expenses total property cost x 100.

Calculating the gross yield of a property is pretty simple. Divide the result of the first step by the propertys value. Because ROI is a profitability ratio the profit.

Annual rental income 5000 Purchase price 100000. Yield calculations are worked out by dividing the annual rental income on a property by how much it cost to buy. Capital Value Annual Rental Income Yield x 100.

Rental yield Monthly rental income x 12 Property value. Net rental yield 26000 - 4000 950000 x 100. Add another calculator to compare the rental yield of two different properties.

And then finally you multiply the result of the second step by 100. The simplest way is to take the yearly rental income and divide that by the purchase price costs. How to calculate yield Take the yield and divide it into 100 to produce the yield multiplier eg.

To calculate take the Annual rental income Weekly rent x 52 weeks and divide by the Property value. Take the monthly rental income amount or expected rental income and multiply it by 12. If youve bought a commercial property eg.

In numerical terms this is. Property value 600000 and expected rent 500 a week. Gross rental yield 400 x 52 450000 x 100.

The following formula can be used to calculate the rental yield on an investment property. Sum up your total annual rent that you would charge a tenant Divide your annual rent by the value of the property Multiply that figure by 100 to get the percentage of your gross rental yield. Use this calculator to work out the rental yield percentage based off your property value weekly rent and annual expenses including rates insurance and maintenance.

Gross rental yield annual rental income property value x 100 For example if you are charging 400 a week and paid 450000 for your home the calculation would be 400 x 52 weeks divided by 450000 multiplied by 100. Then multiply this number by 100. For example a property investment with a weekly rental income of 500 has an annual rental income of 26000.

If a commercial property is being let for say one hundred and fifty thousand pounds per annum and an approximate yield across nearly identical properties is identified at around 6 per cent this would mean that. Weve broken down how you use this formula to calculate rental yield below. Its equation is the net operating income divided by the cap rate.

Keeping an eye on the property market can help you understand the implications of a rise or fall in prices on your rental yield. To calculate its GRM we divide the sale price by the annual rental. Calculating your gross yield.

Its the annual rental income divided by the purchase price. Annual rental income weekly rental income x 52 property value x 100 rental yield. There are two ways to work out your property yield.

How do you calculate yield. 26000 500 x 52 weeks annual rental income 600000 property value x 100. Deduct the propertys ongoing costs and costs of vacancy ie lost rent from the propertys annual rental.

Multiply this figure by 100 to get the percentage. Take the gross rental income per annum and deduct expenses. You then multiply this by 100 to give you the percentage.

Gross yield annual rental income weekly rental x 52 property value x 100. The cap rate is defined as a propertys net annual rental income divided by the current value of the property. To calculate the profit or gain on any investment first take the total return on the investment and subtract the original cost of the investment.

In this valuation approach the value of the commercial property depends on its potential income and its cap rate. Net rental yield 232. Heres how to calculate gross rental yield.

How To Calculate The Numbers Net Yield And ROI On A Rental Property Real Estate Investing - A step by step guide to help you calculate the numbers on an i. Then you take that figure and multiply it by 100 to get a percentage.

Gated Community Developer Template Efinancialmodels Financial Modeling Real Estate Development Projects Real Estate Advertising

Gated Community Developer Template Efinancialmodels Financial Modeling Real Estate Development Projects Real Estate Advertising

How To Get Started Real Estate Investing With Just 500 Wholesale Real Estate Real Estate Investing Rental Property Real Estate Investment Trust

How To Get Started Real Estate Investing With Just 500 Wholesale Real Estate Real Estate Investing Rental Property Real Estate Investment Trust

Find Verified Mumbai Office Buildings Office Spaces Retail Property Shops Showroom Commercial Property For Rent Commercial Office Space Commercial Property

Find Verified Mumbai Office Buildings Office Spaces Retail Property Shops Showroom Commercial Property For Rent Commercial Office Space Commercial Property

Rental Property Analysis Spreadsheet Investment Property Real Estate Rentals Rental Property Management

Rental Property Analysis Spreadsheet Investment Property Real Estate Rentals Rental Property Management

Rental Investment Property Record Keeping Spreadsheet Investment Property Investing Real Estate Investing Flipping

Rental Investment Property Record Keeping Spreadsheet Investment Property Investing Real Estate Investing Flipping

Understanding The Gross Rent Multiplier In Commercial Real Estate

Understanding The Gross Rent Multiplier In Commercial Real Estate

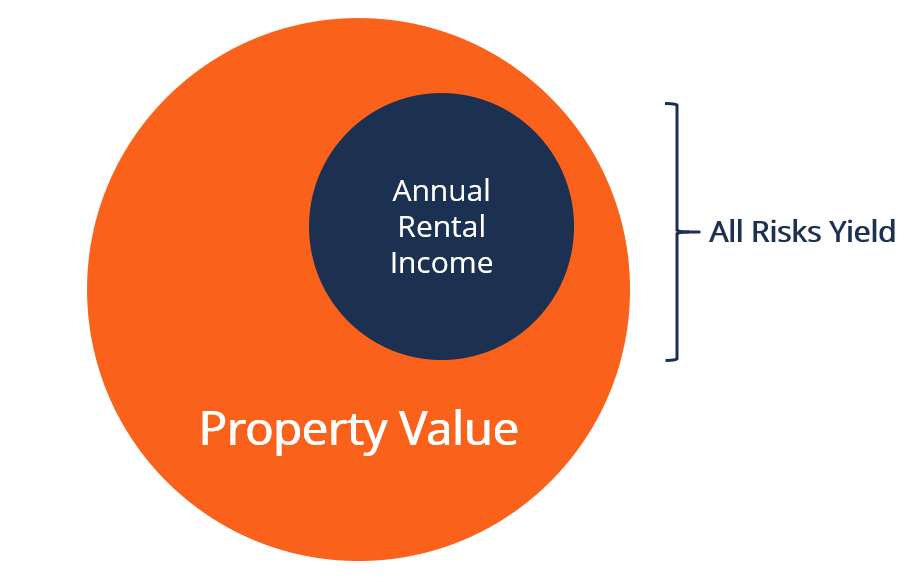

All Risks Yield Overview How To Calculate Good Vs Bad Ary

All Risks Yield Overview How To Calculate Good Vs Bad Ary

Best Crowdfunding Sites For Real Estate In 2020 Crowdfunding Real Estate Investment Trust Real Estate

Best Crowdfunding Sites For Real Estate In 2020 Crowdfunding Real Estate Investment Trust Real Estate

Property Yield Calculating Property Yields Return On Investment

Property Yield Calculating Property Yields Return On Investment

Does An Inverted Yield Curve Spell Doom For Cre Globest Yield Curve Real Estate Tips Energy Prices

Does An Inverted Yield Curve Spell Doom For Cre Globest Yield Curve Real Estate Tips Energy Prices

Excel Model Template For Commercial Real Estate Invesments Best Investment Apps Excel Spreadsheets Templates Excel Templates

Excel Model Template For Commercial Real Estate Invesments Best Investment Apps Excel Spreadsheets Templates Excel Templates

Https Www Creconsult Net Wp Content Uploads 2020 02 One Million Buyers Jpg Reach One Million Buyers Reach 1 000 In 2020 Commercial Real Estate Investing Real Estate

Https Www Creconsult Net Wp Content Uploads 2020 02 One Million Buyers Jpg Reach One Million Buyers Reach 1 000 In 2020 Commercial Real Estate Investing Real Estate

Catylist Search Commercial Property Listings Commercial Property Commercial Commercial Real Estate

Catylist Search Commercial Property Listings Commercial Property Commercial Commercial Real Estate

Streitwise Offers An Easy Way To Invest In Commercial Real Estate Accredited And Non Accredit Real Estate Investing Investing Commercial Real Estate Investing

Streitwise Offers An Easy Way To Invest In Commercial Real Estate Accredited And Non Accredit Real Estate Investing Investing Commercial Real Estate Investing

Why Do You Earn Higher Yield In Commercial Rentals Than Residential In India Real Estate Investment Trust Real Estate Investment Fund Real Estate Investing

Why Do You Earn Higher Yield In Commercial Rentals Than Residential In India Real Estate Investment Trust Real Estate Investment Fund Real Estate Investing

Commercial Real Estate Valuation Model Efinancialmodels Commercial Real Estate Commercial Real Estate Broker Real Estate Training

Commercial Real Estate Valuation Model Efinancialmodels Commercial Real Estate Commercial Real Estate Broker Real Estate Training

Buy And Rent Real Estate Model Template Efinancialmodels Real Estate Financial Real Estate Investing

Buy And Rent Real Estate Model Template Efinancialmodels Real Estate Financial Real Estate Investing

In India The Most Popular Cities Are Delhi Noida And Gurgaon And People Want To Invest In Commercial Property Commercial Property For Sale Property Marketing

In India The Most Popular Cities Are Delhi Noida And Gurgaon And People Want To Invest In Commercial Property Commercial Property For Sale Property Marketing