Nyc Property Tax Mill Rate

Below are property tax rates since 2002. Mill Rates A mill is equal to 100 of tax for each 1000 of assessment.

Chemung County Property Tax Records Chemung County Property Taxes Ny

Chemung County Property Tax Records Chemung County Property Taxes Ny

The average effective property tax rate in the Big Apple is just 088 more than half the statewide average rate of 169.

Nyc property tax mill rate. 2020 School District Tax Rates. In New York City property tax rates are actually fairly low. Multiply Taxable Value by the Tax Rate example Class 1 X 20385 20385 Your Taxes.

Property tax rates imposed by school districts tend to be the highest at an average of 1764 per each 1000 in assessed value as of 2019. Class 3 - 12826. 2020 Municipal County Tax Rates.

If you need earlier rates e-mail our office at. Tax rate 50 per 1000 of taxable assessed value Tax bill for property with a taxable assessment of 150000 7500 Equalization rates are necessary to calculate tax rates for counties. City of New York.

The Department of Finance DOF administers business income and excise taxes. Tax rates in each county are based on combination of levies for county city town village school district and certain special district purposes. Learn how to Calculate Your Annual Property Tax.

Your property tax rate is based on your tax class. The millage rate is the amount per 1000 of assessed value thats levied in taxes. New York City and Nassau County have a 4-class property tax system.

Because they include multiple municipalities and for school districts because most cross municipal boundaries. The median property tax in New York is 375500 per year for a home worth the median value of 30600000. Property Tax Rates for Tax Year 2021.

There are four tax classes. Class 2 - 12473. 2019 Municipal County Tax Rates.

For example a property with an assessed value of 50000 located in a municipality with a mill rate of 20 mills would have a property tax bill of 1000 per year. 2015-02-27-kr-House of theJPG Kevin Rivoli Property tax rates vary wildly depending where you live in New York state. Class 2 - 12267.

Class 1 - 21167. Most local governments in the United States impose a property tax also known as a millage rate as a principal source of revenue. The amount of property tax owed depends on the appraised fair market value of the property as determined by the property tax assessor.

For New York City tax rates reflect levies for general city and school district purposes. For example on a 300000 home a millage rate of 0003 will equal 900 in taxes owed 0003 x 300000 assessed value 900. Property Tax Bills Bills are generally mailed and posted on our website about a month before your taxes are due.

Class 1 - 21045. We do not mail you a Property Tax Bill if your property taxes are paid through a bank or mortgage servicing company or if you have a zero balance. Millage rates are expressed in tenths of a penny meaning one mill is 0001.

Class 4 - 10694. 2021 All Rights Reserved NYC is a trademark and service mark of the City of New York. Property Tax Rates for Tax Year 2020.

This tax may be imposed on real estate or personal propertyThe tax is nearly always computed as the fair market value of the property times an assessment ratio times a tax rate and is generally an obligation of the owner of the property. New York property tax rates are set by local governments and they therefore vary by location. Counties in New York collect an average of 123 of a propertys assesed fair market value as property tax per year.

Percentage of Home Value Median Property Tax in Dollars A property tax is a municipal tax levied by counties cities or special tax districts on most types of real estate - including homes businesses and parcels of land. The tax rates are listed below. 2019 City Town Tax Rates.

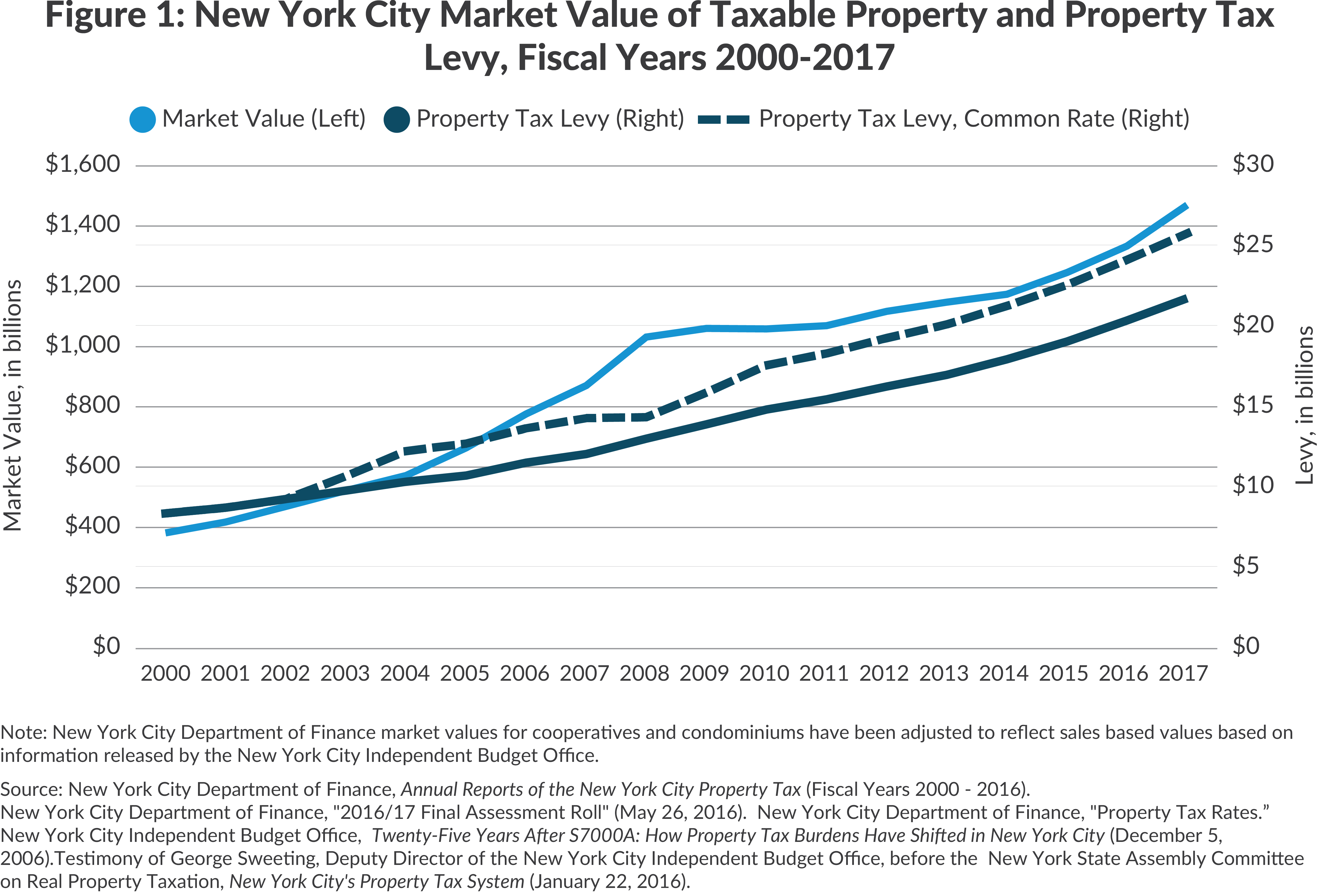

DOF also assesses the value of all New York City properties collects property taxes and other property-related charges maintains property records administers exemption and abatements and collects unpaid property taxes and other property-related charges through annual lien sales. 2020 Village Tax Rates. 2020 Special District Tax Rates.

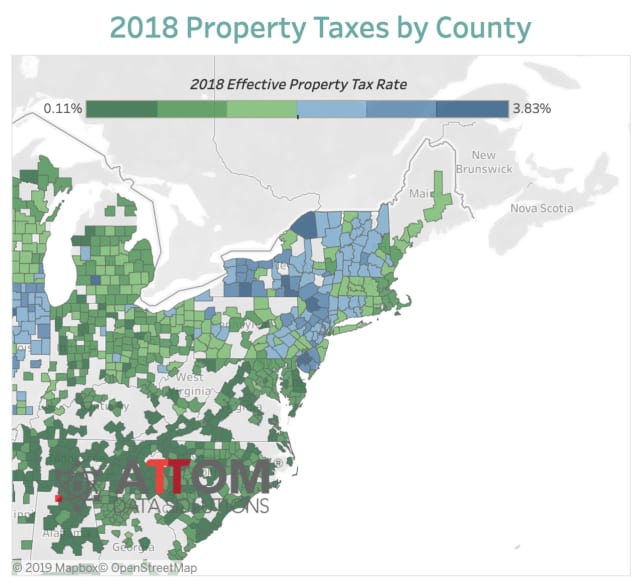

Type 2021 tax rates town net town tax rate net county tax rate county services total tax rate. In fact many New York counties outside of New York City have rates exceeding 250 which is more than double the national average of 107. Enter the Taxable Value from the Notice.

2020 City Town Tax Rates. To calculate the property tax multiply the assessment of the property by the mill rate and divide by 1000. 2019 School Tax Rates.

New York has one of the highest average property tax rates in the country with only three states levying higher property taxes. As used in property tax 1 mill is equal to 1 in property tax levied per 1000 of a propertys assessed value. We made a searchable database of property tax rates per 1000 of a homes.

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Https Www Lincolninst Edu Sites Default Files Pubfiles 50 State Property Tax Study 2016 Full Pdf

Property Taxes By State Why We Should All Embrace Higher Property Taxes

Property Taxes By State Why We Should All Embrace Higher Property Taxes

New Hampshire Property Tax Calculator Smartasset

New Hampshire Property Tax Calculator Smartasset

New York S Death Tax The Case For Killing It Empire Center For Public Policy

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Hartford S Exorbitant Commercial Property Tax Curbs Economic Growth

Hartford S Exorbitant Commercial Property Tax Curbs Economic Growth

Rockland County Property Tax Records Rockland County Property Taxes Ny

Rockland County Property Tax Records Rockland County Property Taxes Ny

The Tax Rate On A 2 Million Home In Each U S State Mansion Global

The Tax Rate On A 2 Million Home In Each U S State Mansion Global

Property Tax Map Reforming Government

Property Tax Map Reforming Government

Pin By Margaret Almira On My Own Following Online Puzzles Nyc Guide Dating

Pin By Margaret Almira On My Own Following Online Puzzles Nyc Guide Dating

New York City Property Taxes Cbcny

New York City Property Taxes Cbcny

How Will Rising Prices In Australia Affect My Property Taxes Mansion Global

How Will Rising Prices In Australia Affect My Property Taxes Mansion Global

Reduce Reliance On Local Property Taxes The Fourth Regional Plan

Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy

Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy

Westchester County Property Tax Records Westchester County Property Taxes Ny

Westchester County Property Tax Records Westchester County Property Taxes Ny

Pin On Real Estate Investing Tips

Pin On Real Estate Investing Tips