Property Damage Settlement Taxable

Payments for damage to reputation defamation of character or libel. Some settlement recipients may need to make estimated tax payments if they expect their tax to be.

How Personal Injury Settlements Are Taxed In 2020

How Personal Injury Settlements Are Taxed In 2020

Luckily not all settlements are taxable.

Property damage settlement taxable. Go to Less Common Income Miscellaneous Income and Other reportable income enter other reportable income in the Search Box and Select Jump to other reportable income Continue to the screen Other Taxable Income. Now suppose that the payer issues a 1099 anyway but it is not reportable income. Under this doctrine if a settlement or award payment represents damages for lost profits it is generally taxable as ordinary income.

If the proceeds were given solely to compensate you for property damage that is not taxable income and you will enter the amount on line 21 of your return and then take it out as a negative to show the IRS. The tax basis is usually the original cost of the property plus any improvements less any depreciation for business use. Are attorney fees deductible.

Nearly every employment case has a wage component. The rules are full of exceptions and nuances so be careful how settlement awards are taxed especially post-tax reform. X punches Y thus committing the tort of battery.

Proceeds received to for loss in value of property would only be taxable if the amount is higher than your adjusted basis in the property as the excess would be considered income. An insurance payment for property damage is considered compensation to restore your. No taxable gain or loss is recognized.

If the settlement is less than your adjusted basis you would reduce your basis in the property by the proceeds amount you receive. X sets foot on Ys property thus committing the tort of trespass but causing no personal injury. If you have personal property that has sustained damageor has been completely destroyedby any of the following four categories of events you may be able to deduct a portion of your loss.

In most employment settlements employer and employee. Not taxable with exceptions If a taxpayer receives compensation for property damage the taxpayer must reduce his or her tax basis in the property by the amount of the settlement or compensation. Accrued interest paid on damages.

For the most part insurance settlements for property damage and physical injuries are not taxable income. The money you receive isnt taxed. These are NOT wages.

Property Damage Harm to property is taxable only to the extent the recovery exceeds the basis of the property. 8 If the recovery is smaller than the basis of the property and the property remains in the plaintiffs possession the basis is reduced by the amount of the recovery. If you sue someone for causing you personal physical injury or physical sickness any damages or settlement you receive to compensate you for your medical expenses lost wages and pain suffering and emotional distress is not included in income.

Damage award payment to reimburse for medical expenses when it comes to emotional distress if the expense was deducted for tax purposes. Determine if any taxable lawsuit award or settlement proceeds are unreported. It is better to give one party a lump sum settlement for equity interest.

Recoveries for physical injuries and physical sickness are tax-free but. Similarly a settlement or award payment received from an employer for lost wages and damages would likewise generally be ordinary income. The taxable amounts received will depend on how the lawsuit proceeds were labeled.

Thus Gilmores origin of the claim doctrine assesses the tax consequence of a damage or settlement payout based on the origin and character of the claim with respect to which such an expense was incurred and not the potential resulting consequences. The nature of the settlement is for damage to property which reduces the basis and is not taxable according to IRS Publication 4345 which talks about tax guidance for legal settlements. If part was DESIGNATED as attorneys fees those are taxable.

Enter the description as Cost of Damages and the amount as a negative number. However many types of payout that you may receive as a result of a legal settlement are taxable whether the case is ultimately settled in or out of court. For instance when the couple has a home with a mortgage it is common for one party to keep the house and pay the other spouse the equity as a property settlement.

Punitive damages are taxable and should be reported as Other Income on line 21 of Form. In employment cases damages are usually taxable and usually at least partially as wages. Just like a normal insurance settlement compensation for medical bills and repair of property are not taxed in a lawsuit.

1040 Schedule 1 even if the punitive damages were received in a settlement for personal physical injuries or physical sickness.

Putting The Plug On Inter Floor Leakages Flooring Infographic Leaks

Putting The Plug On Inter Floor Leakages Flooring Infographic Leaks

Is A Personal Injury Law Settlement Taxable Austin Crash Lawyer

Is A Personal Injury Law Settlement Taxable Austin Crash Lawyer

Are Lawsuit Settlements Taxable Tax Consequences Of A Legal Settlement Florin Roebig Trial Attorneys

Are Lawsuit Settlements Taxable Tax Consequences Of A Legal Settlement Florin Roebig Trial Attorneys

Is A Mesothelioma Settlement Taxable Mesothelioma Mesothelioma Mesothelioma Awareness Class Action Lawsuits

Is A Mesothelioma Settlement Taxable Mesothelioma Mesothelioma Mesothelioma Awareness Class Action Lawsuits

Are Compensatory Or Punitive Damages Taxable Stoy Law Group Pllc

Are Compensatory Or Punitive Damages Taxable Stoy Law Group Pllc

Eliot Lopian Common Hoa Rules Eliot Lopian Common Hoa Rules Real Estate House Styles Eliot

Eliot Lopian Common Hoa Rules Eliot Lopian Common Hoa Rules Real Estate House Styles Eliot

Disputed Account Settlement Agreement Template Accounting Agreement Debt Settlement

Disputed Account Settlement Agreement Template Accounting Agreement Debt Settlement

Income Tax Questions Tds On Buying A Flat From Nri Property Management Stock Images Free Tax Questions

Income Tax Questions Tds On Buying A Flat From Nri Property Management Stock Images Free Tax Questions

Income Tax Tips For Landlords Ehow Income Tax Federal Income Tax Tax Deductions

Income Tax Tips For Landlords Ehow Income Tax Federal Income Tax Tax Deductions

Https Www Littler Com Files Taxation And Reporting Of Settlement Payments For Employment Related Law Pdf

Flow Chart Law School Studying Law Family Law

Flow Chart Law School Studying Law Family Law

Is My Wrongful Death Settlement Compensation Taxable

Is My Wrongful Death Settlement Compensation Taxable

Be Sure To Report Any Injury You Sustain In The Workplace To Your Supervisor Or Manager So You Can Settle The Situatio Workplace Accident Workplace Infographic

Be Sure To Report Any Injury You Sustain In The Workplace To Your Supervisor Or Manager So You Can Settle The Situatio Workplace Accident Workplace Infographic

Irs Taxes Legal Settlements But Some Are Capital Gain

Irs Taxes Legal Settlements But Some Are Capital Gain

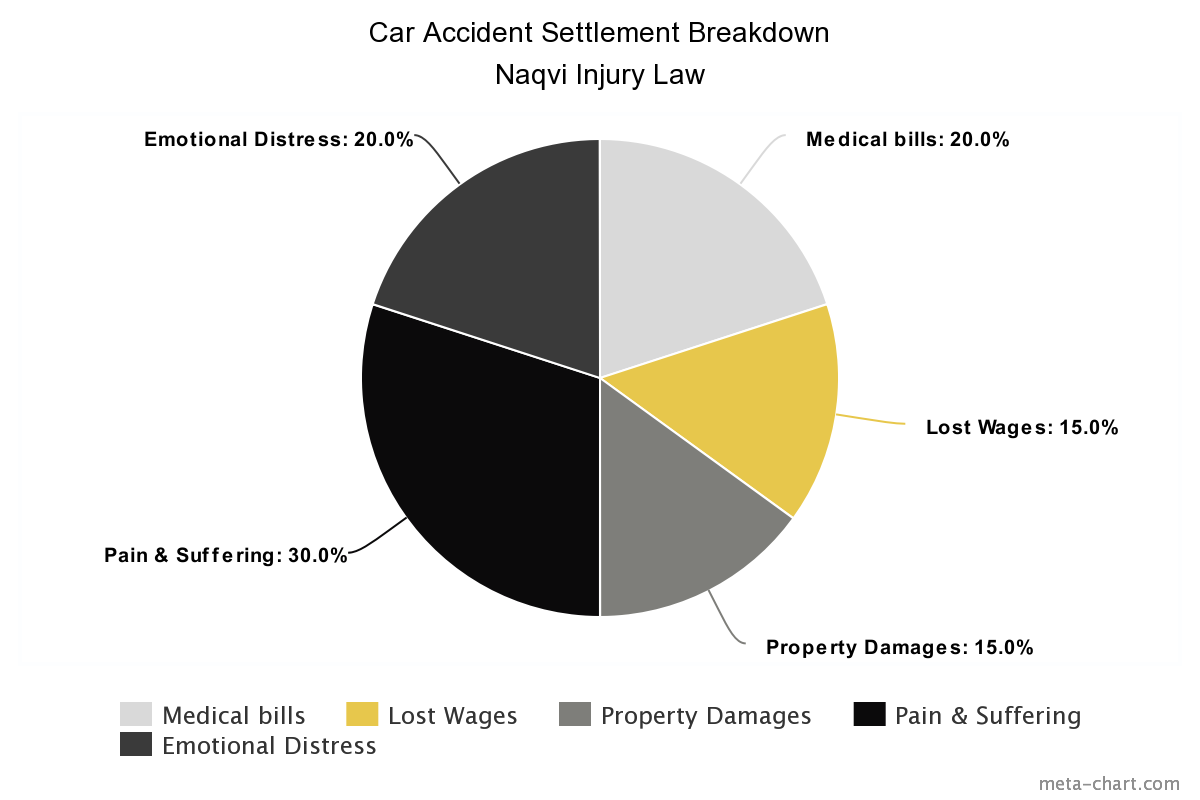

Are Auto Accident Settlements Taxable Naqvi Injury Law

Are Auto Accident Settlements Taxable Naqvi Injury Law

The Right To Damages And Recovery If Possession Delayed Legal Services Delayed Possession

The Right To Damages And Recovery If Possession Delayed Legal Services Delayed Possession

Tax Law Offices Of David W Klasing Awards And Settlements

Tax Law Offices Of David W Klasing Awards And Settlements

Free 9 Retirement Speech In Pdf Ms Word Retirement Speech Speech Retirement

Free 9 Retirement Speech In Pdf Ms Word Retirement Speech Speech Retirement

Los Angeles County Personal Injury Attorney At Compass Law Group Pc Will Spill The Beans On Which Types Personal Injury Attorney Personal Injury Injury Lawyer

Los Angeles County Personal Injury Attorney At Compass Law Group Pc Will Spill The Beans On Which Types Personal Injury Attorney Personal Injury Injury Lawyer