Property Gains Tax Ky

The states average effective property tax rate is 083. Effective January 1 2018 the following deductions were eliminated and can no longer be used to reduce Kentucky income.

The previous rate brackets have been replaced with a flat 5 tax rate.

Property gains tax ky. Further your resident state will generally tax all of your income but will allow a credit for the tax paid to the other state. Keep in mind a deed cannot be recorded unless the real estate transfer tax has been collected. This is because short-term capital gains are taxed at the same rate as ordinary income.

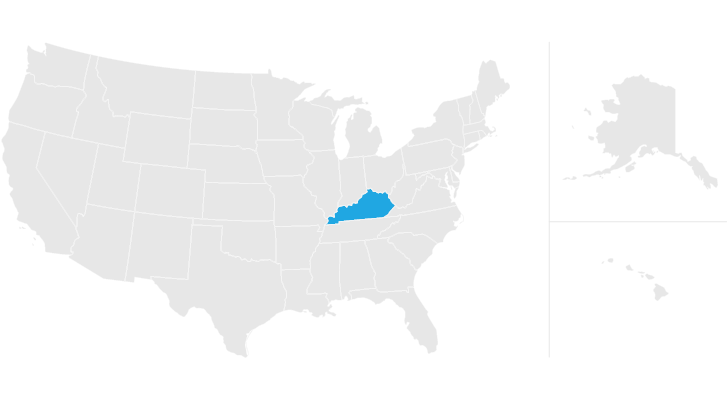

Explanation of the Property Tax Process. Long-term capital gains are gains that are realized at least a year after you originally purchased the asset in question. The typical homeowner in Kentucky pays just 1257 annually in property taxes around half the national median.

If youre selling a property you need to be aware of what taxes youll owe. Unlike your primary residence you will likely face a capital gains tax if you sell for a profit. When ownership in Kentucky is transferred an excise tax of 50 for each 500 of value or fraction thereof is levied on the value of the property.

Use this calculator to estimate your capital gains tax. The 0 bracket for long-term capital gains is close to the current 10 and 12 tax brackets for ordinary income while the 15 rate for gains corresponds somewhat to the 22 to 35 bracket levels. The tax rate is about 15 for people filing jointly and incomes totalling less than 480000.

It can jump to 20 if your combined income exceeds this amount. The table below provides the mean amount of property taxes paid in 2012 as well as property tax as a mean percentage of home value for 2014 in Kentucky and neighboring states. Say for example your resident state tax rate is 5 percent.

Counties in Kentucky collect an average of 072 of a propertys assesed fair market value as property tax per year. Premiums paid for health insurance coverage. 046 - 40 - 01 - 007.

Kentucky has one of the lowest median property tax rates in the United States with only seven states collecting a lower median property tax than Kentucky. 1310 Louisville KY 40222 Kentucky Planning Partners Advice for Life. This rate would apply to people who earn more than 406750 in 2014.

9300 Shelbyville Road Suite. For tax years beginning on or after January 1 2018. Millions faithfully file their 1040 forms each April.

Use this calculator to estimate your capital gains tax. But some things about federal income taxes may surprise you. The median property tax in Kentucky is 84300 per year for a home worth the median value of 11780000.

In 2017 that rate is between 10 and 396 of your profit but most people pay around 25. If youve lived in a property for at least two of the last five years capital gains tax on the sale of that property is exempt up to 250000 for single filers and 500000 for married couples. Calculate the capital gains tax on a sale of real estate property equipment stock mutual fund or bonds.

In general youll pay higher taxes on property youve owned for less than a year. The Facts About Income Tax. A full-year resident of Kentucky files Form 740 and a person who moves into or out of Kentucky during the year or is a full-year nonresident files Form 740-NP.

Read on to learn about capital gains tax for primary residences second homes investment properties. Property taxes in in Kentucky are relatively low. Gain on the sale of real property is generally taxed in the state the property is located.

Click the Search Tips button for tips on how to use the property tax search. In an effort to assist property owners understand the administration of the property tax in Kentucky this website will provide you with information that explains the various components of the property tax system. The tax rate is five 5 percent and allows itemized deductions and certain income reducing deductions as defined in KRS 141019.

The rate for short-term capital gains is equal to your regular income tax rate. For homeowners who think their property taxes are too high there are ways to appeal. City of Covington Kentucky.

Includes short and long-term Federal and State Capital Gains Tax Rates for 2020 or 2021. The maximum long-term capital gains rate at the present time is 20 percent. Capital Gains Tax Estimator.

The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property. How to Appeal Your Property Taxes. Property tax rates can vary substantially from locality to locality within a state.

For example the sale of a 200000 home would require a 200 transfer tax to be paid. The credit is generally limited to your resident state tax rate. When you sell a car for more than you paid youll need to report that gain to the Internal Revenue Service.

When you sell a property for more than you paid its called a capital gain. - - -.

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Tax Implications Of Selling Commercial Real Estate 2021 Guide Property Cashin

Tax Implications Of Selling Commercial Real Estate 2021 Guide Property Cashin

Cornering The Market Rental Income Advisors Rental Income Capital Gains Tax Property Investor

Cornering The Market Rental Income Advisors Rental Income Capital Gains Tax Property Investor

How To Calculate Capital Gains Tax H R Block

How To Calculate Capital Gains Tax H R Block

What Are The Tax Implications Of Selling A Rental Property Northern Virginia Property Managementnorthern Virginia Property Management

What Are The Tax Implications Of Selling A Rental Property Northern Virginia Property Managementnorthern Virginia Property Management

State Taxation As It Applies To 1031 Exchanges

State Taxation As It Applies To 1031 Exchanges

12 Ways To Beat Capital Gains Tax In The Age Of Trump

12 Ways To Beat Capital Gains Tax In The Age Of Trump

Kentucky Estate Tax Everything You Need To Know Smartasset

Kentucky Estate Tax Everything You Need To Know Smartasset

Do You Have To Pay Capital Gains Tax On Property Sold Out Of State

Do You Have To Pay Capital Gains Tax On Property Sold Out Of State

Capital Gains Tax Calculator Estimate What You Ll Owe

Capital Gains Tax Calculator Estimate What You Ll Owe

Kentucky Tax Law Changes What You Need To Know Kentucky Tax Law Changes What You Need To Know

Kentucky Tax Law Changes What You Need To Know Kentucky Tax Law Changes What You Need To Know

How To Avoid Capital Gains Tax When Selling Property Finder Com

How To Avoid Capital Gains Tax When Selling Property Finder Com

Cook County Il Property Tax Calculator Smartasset

Cook County Il Property Tax Calculator Smartasset

Capital Gains Tax Brackets For Home Sellers What S Your Rate Tax Brackets Capital Gains Tax Capital Gain

Capital Gains Tax Brackets For Home Sellers What S Your Rate Tax Brackets Capital Gains Tax Capital Gain

How High Are Capital Gains Taxes In Your State Tax Foundation

How High Are Capital Gains Taxes In Your State Tax Foundation

What Is The Tax Penalty For Reselling A House Within 2 Years Upnest

What Is The Tax Penalty For Reselling A House Within 2 Years Upnest

State Tax Levels In The United States Wikipedia

State Tax Levels In The United States Wikipedia

خيال النجار إلى موقع Jersey Capital Gains Tax Cabuildingbridges Org

خيال النجار إلى موقع Jersey Capital Gains Tax Cabuildingbridges Org

How To Reduce Or Avoid Capital Gains Tax On Property Or Investments Capital Gains Tax Capital Gain Investing

How To Reduce Or Avoid Capital Gains Tax On Property Or Investments Capital Gains Tax Capital Gain Investing