Property Plant And Equipment Classification

These assets are commonly referred to as the companys fixed assets or plant assets. A class of property plant and equipment means a grouping of assets of a similar nature or function in the United Nations operations that is shown as a single item for the purpose of disclosure in.

Recoverable amount is the higher of an assets fair value less costs to sell and its value in use.

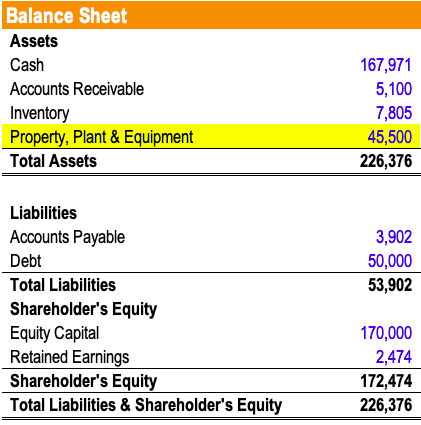

Property plant and equipment classification. That are owned by the company. Property plant and equipment PPE are the long-term tangible assets that a company owns. It is the second long term asset section after current assets.

Assets like property plant and equipment PPE are tangible assets. Assets are generally classified in three ways. The University of Illinois System adds equipment to inventory that in general has a useful life of more than one year and a unit value equal to or greater than 1000.

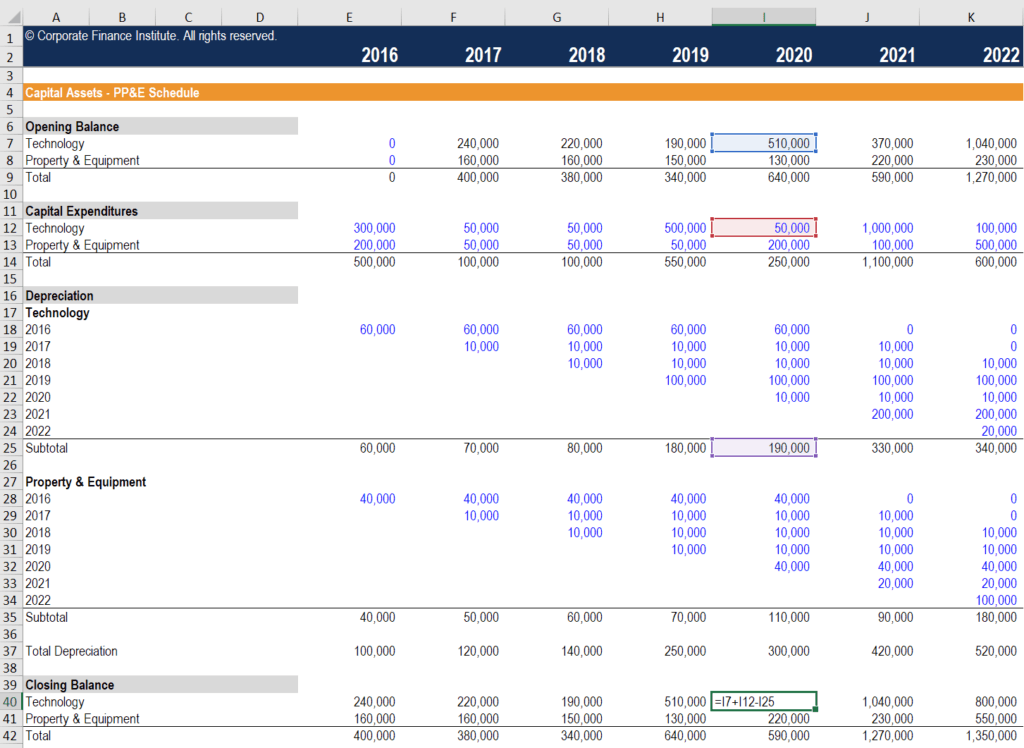

PPE Property Plant and Equipment PPE Property Plant and Equipment PPE Property Plant and Equipment is one of the core non-current assets found on the balance sheet. Classifying property is an important first step of many Property Accounting procedures. PPE is impacted by Capex.

Included are land buildings leasehold improvements equipment furniture fixtures delivery trucks automobiles etc. Land on which warehouse sits b. Intangible assets such as patents copyrights and goodwill are not included in this class of assets.

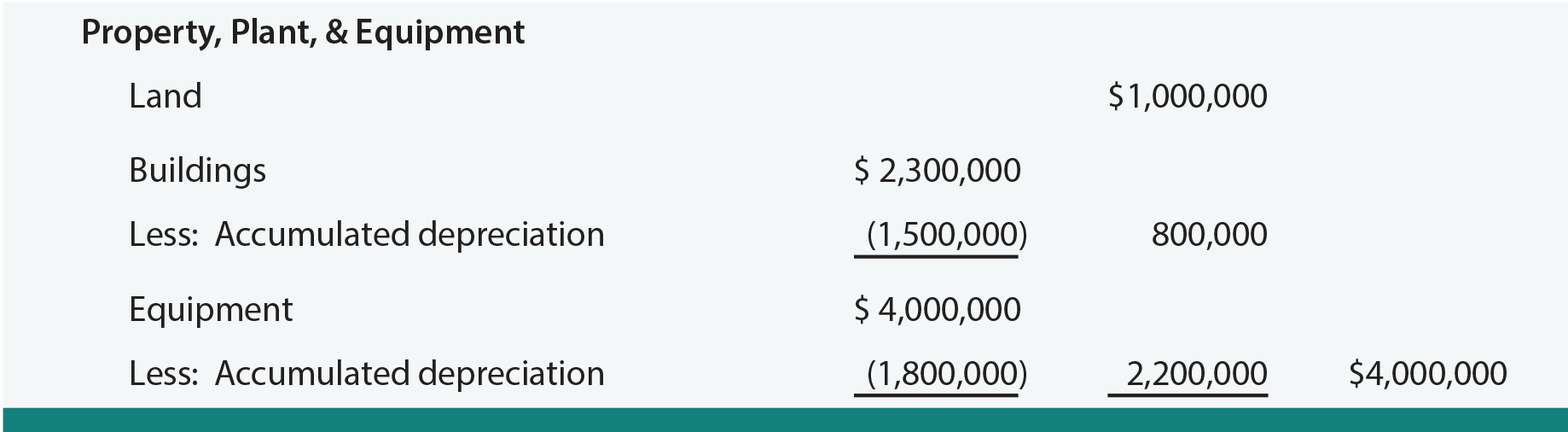

Parking lot used by visitors d. Impairment of property plant and equipment intangible assets and investments accounted for using the equity method B61. Generally the property plant and equipment assets are reported at their cost followed by a deduction for the accumulated depreciation that applies to all of these assets except land which is not depreciated.

Property Plant and Equipment PPE is a non-current tangible capital asset shown on the balance sheet of a business and is used to generate revenues and profits. An item of property plant or equipment shall not be carried at more than recoverable amount. One of the most popular methods is classification according.

PPE which includes trucks machinery factories and land allow a. The property plant and equipment PPE exists and owned by the business organization. Tools such as the Federal Supply Classification system also known as the NATO Codification System and the United Nations Standard Products and Services Code contain the breadth of Property Plant.

Property plant and equipment definition A major classification on the balance sheet. Property plant and equipment PPE are long-term assets vital to business operations and not easily converted into cash. PPE Property Plant and Equipment PPE Property Plant and Equipment PPE Property Plant and Equipment is one of the core non-current assets found on the balance sheet.

They are most often fixed assets. IAS 16 Property Plant and Equipment requires impairment testing and if necessary recognition for property plant and equipment. The PPE addition are authentic and it is recorded properly at its cost while such costs are being able to distinguish from the repairs and maintenance expenses.

____Salvage value is deducted for the initial computation of depreciation expense in all of the following methods with the exception of a. PPE is impacted by Capex. _____Which of the following should not be included in the plant assets property plant and equipment classification.

Firstly property plant and equipment is a class of assets which includes tangible assets only. Depreciation of property plant and equipment is recognized as an expense in the income statement in the relevant classification of expense by function. Secondly the assets termed as property plant and equipment are held for the purpose of use.

3 PPE refers to long-term assets such as equipment that is vital to a companys operations and has a definite physical. Property plant and equipment are tangible assets meaning they are. Property plant and equipment is the long-term asset or noncurrent asset section of the balance sheet that reports the tangible long-lived assets that are used in the companys operations.

However placing a value on the property may need to be done simultaneously. In the light of Polish balance sheet law the rules for entering property plant and equipment in the books as well as the rules for their measurement and revaluation are set forth in Article 3 Article 31 and Article 32 of the Act with Article 3 1 15 of the Polish Accounting Act defining fixed assets as property plant and equipment and equivalent assets with anticipated useful lives of longer than a year complete operational and intended to be used for the entitys needs. Land held for investment.

Building housing corporate headquarters c. Graphic arts production means the production of tangible personal property for wholesale or retail sale or lease by means of printing including ink jet printing by one or more of the processes described in Groups 323110 through 323122 of Subsector 323 Groups 511110 through 511199 of Subsector 511 and Group 512230 of Subsector 512 of the. PPE plays a key part in the financial planning and analysis of a companys operations and future expenditures especially with regards to capital expenditures.

What Costs Are Included In Property Plant Equipment Principlesofaccounting Com

What Costs Are Included In Property Plant Equipment Principlesofaccounting Com

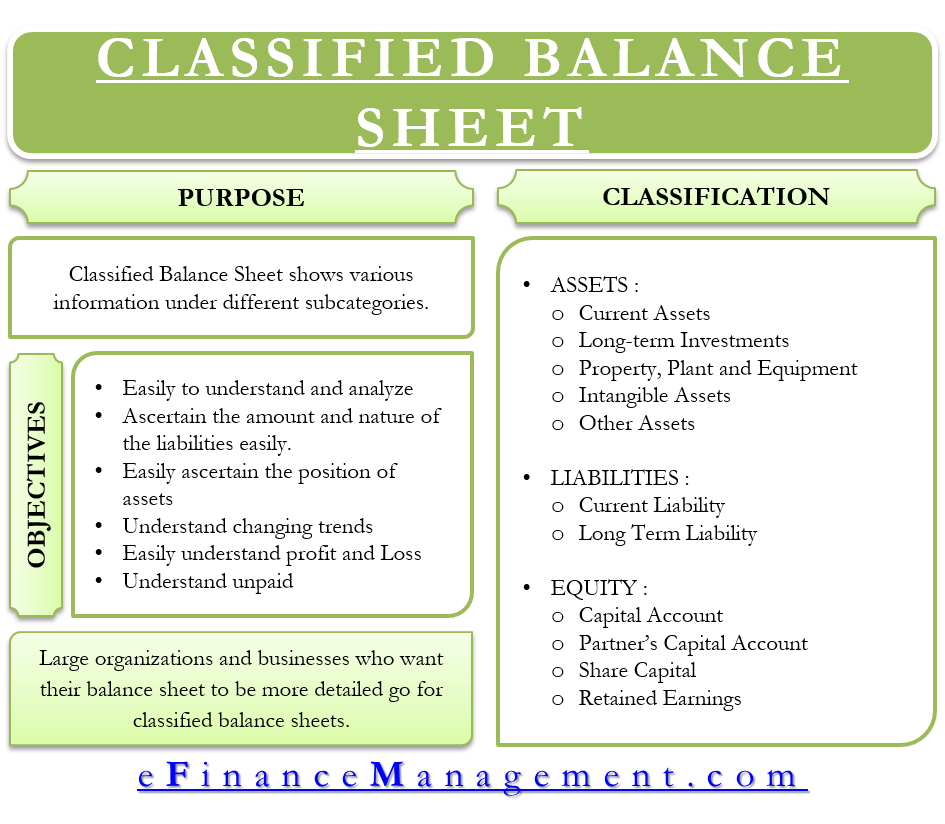

Classified Balance Sheet Meaning Importance Format And More

Classified Balance Sheet Meaning Importance Format And More

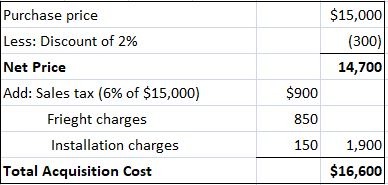

How To Measure The Acquisition Cost Of Property Plant And Equipment Play Accounting

How To Measure The Acquisition Cost Of Property Plant And Equipment Play Accounting

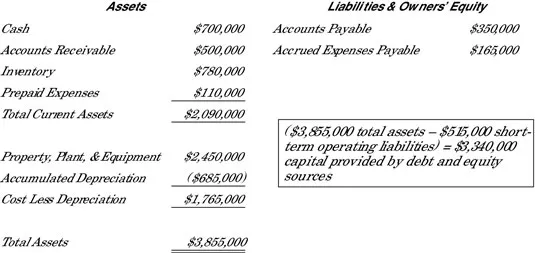

What Are Fixed Assets A Simple Primer For Small Businesses Freshbooks Resource Hub

What Are Fixed Assets A Simple Primer For Small Businesses Freshbooks Resource Hub

Acc 640 Auditing Module 7 1 Discussion Accounts Payable And The Payment Cycle Accounts Payable Accounting Cycle

Acc 640 Auditing Module 7 1 Discussion Accounts Payable And The Payment Cycle Accounts Payable Accounting Cycle

Financial Accounting And Financial Management Textbook Pdf Accounting Masterclass In 2020 Financial Management Financial Accounting Accounting

Financial Accounting And Financial Management Textbook Pdf Accounting Masterclass In 2020 Financial Management Financial Accounting Accounting

/trucks-80b2f89674414a0bb2a1f42f28b8ef88.jpg) What Is Property Plant And Equipment Pp E

What Is Property Plant And Equipment Pp E

:max_bytes(150000):strip_icc()/GettyImages-1167496026-1825e1c54d4e4db095bacb9dd03590f2.jpg) What Is Property Plant And Equipment Pp E

What Is Property Plant And Equipment Pp E

Derecognition Of Property Plant Equipment Cfa Level 1 Analystprep

Derecognition Of Property Plant Equipment Cfa Level 1 Analystprep

Fixed Assets Definition Characteristics Examples

Fixed Assets Definition Characteristics Examples

Ifrs 5 Non Current Assets Held For Sale And Discontinued Operations Bookkeeping And Accounting Deferred Tax Hold On

Ifrs 5 Non Current Assets Held For Sale And Discontinued Operations Bookkeeping And Accounting Deferred Tax Hold On

Financial Accounting Standards Ias 28 Investments In Associates And Joint Investing Financial Instrument Insurance Fund

Financial Accounting Standards Ias 28 Investments In Associates And Joint Investing Financial Instrument Insurance Fund

Image Exhibit 2 2 What Are Values Management Business Portfolio

Image Exhibit 2 2 What Are Values Management Business Portfolio

Solved I Need Help With This Problem Please Prepare A Pr Chegg Com

Solved I Need Help With This Problem Please Prepare A Pr Chegg Com

Pp E Property Plant Equipment Overview Formula Examples

Pp E Property Plant Equipment Overview Formula Examples

Https Policy Ucop Edu Doc 3410279

Pin On Financial Accounting Standards

Pin On Financial Accounting Standards

Ias 37 Provisions Contingent Liabilities And Contingent Assets Time Value Of Money Financial Instrument Financial Statement

Ias 37 Provisions Contingent Liabilities And Contingent Assets Time Value Of Money Financial Instrument Financial Statement

:max_bytes(150000):strip_icc()/dotdash_Final_Property_Plant_and_Equipment_PPE_Sep_2020-01-dd61e2f2fdb7481d81e95bc90b5c61d8.jpg) Property Plant And Equipment Pp E Definition

Property Plant And Equipment Pp E Definition

/ExxonLongtermAssets2018-5c5485414cedfd0001efdb2c.jpg)