Property Tax Records Fulton County Ga

To search for a tax bill select your property type personal property or real estate then select the information you want to enter. 1 April 1 Real and Business Personal Property Appeals.

Fulton County Board Of Assessors

The Fulton County Tax Commissioner is responsible for collecting property taxes on behalf of Fulton County Government two school systems and some city governments.

Property tax records fulton county ga. Alpharetta Service Center 11575 Maxwell Road Alpharetta GA 30009. Local state and federal government websites often end in gov. State of Georgia government websites and email systems use georgiagov or gagov at the end of the address.

Tax refund after lien sale Read More Contact Us 141 Pryor St. In some counties property tax returns are filed with the county tax commissioner and in other counties returns are filed with the county board of tax assessors. Alpharetta Service Center 11575 Maxwell Road Alpharetta GA 30009.

SW Atlanta GA 30303 404-612-4000 customerservicefultoncountygagov. Fulton County Government Center 141 Pryor Street Suite 1018 Atlanta GA 30303-3487. All documents processed by the Fulton County Real Estate Division are processed within four weeks of receipt.

Millage Rate and Taxpayer Savings. The Fulton County Clerk of Superior Magistrates Courts Real Estate Division is responsible for recording and indexing all Fulton County real estate deeds lien filings plats surveys condominium floor plans military discharges partnerships trade names and Uniform Commercial Code filings UCC. The State Revenue Commissioner is responsible for ensuring that property in Georgia is assessed uniformly and equally between and within the counties.

After entering your information click Search. You may select from parcel ID account number or street address. Coweta County Board of Commissioners - 22 East Broad Street Newnan GA 30263.

If you are having trouble with your search try reading our Search Tips. Search Property Records - TAX ASSESSOR 770 254-2601. SEE Detailed property tax report for 2478 Ozark Trl SW Fulton County GA.

After entering your information click Search. Georgia does not have a statewide property tax. Homestead Special Exemptions Learn about homestead exemptions on the Exemptions page Business Aircraft Marine Property Returns Jan 1 April 1.

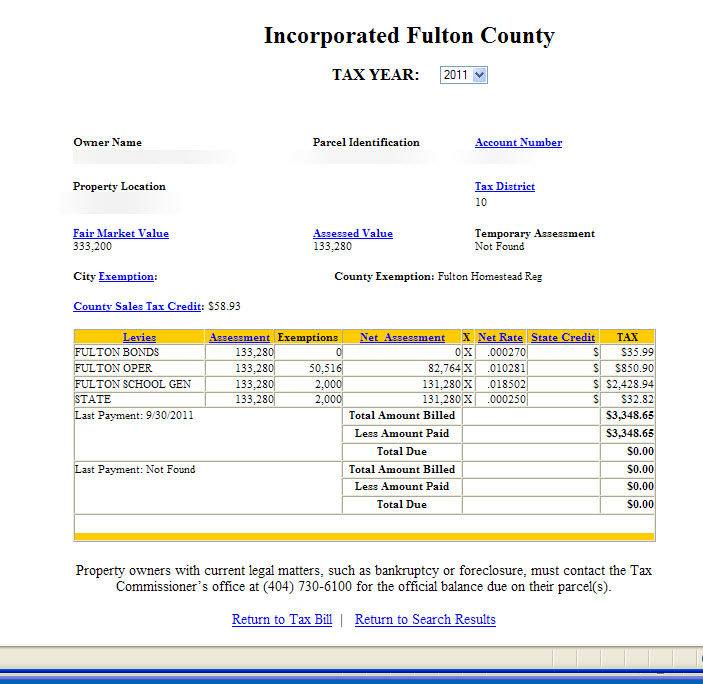

The Tax Commissioner takes the appraised value and the exemption status provided by the Board of Tax Assessors along with the millage rates set by the Board of Commissioners and other Governing Authorities to calculate taxes for each property and mails bills to owners at the addresses provided by the Board of Tax Assessors. Fulton County Sheriffs Tax Sales are held on the first Tuesday of each month between the hours of 10 am. The Fulton County Tax Commissioner is responsible for collecting property taxes on behalf of Fulton County Government two school systems and some city governments.

South Service Center 5600 Stonewall Tell Road Suite 224 College Park GA 30349. South Service Center 5600 Stonewall Tell Road Suite 224 College Park GA 30349. The gov means its official.

Except when the first Tuesday of the month falls on a legal holiday in which case the sale is held the next business day. You can find out the property taxes for your property or. Fulton County is committed to helping property owners understand their rights and responsibilities throughout the property tax process.

Real Property Returns Jan. Property tax returns must be filed with the county tax office between January 1 and April 1 of each year. The Tax Commissioner takes the appraised value and the exemption status provided by the Board of Tax Assessors along with the millage rates set by the Board of Commissioners and other Governing Authorities to calculate taxes for each property and mails bills to owners at the addresses provided by the Board of Tax Assessors.

The Fulton County Board of Assessors reserves the right when circumstances warrant to take an additional 180 days pursuant to OCGA. The Board of Assessors issues an annual notice of assessment for each property in Fulton County. North Service Center 7741 Roswell Road NE Suite 210 Atlanta GA 30350.

A tax sale is the sale of a Tax Lien by a governmental entity for unpaid property taxes by the propertys owner. Home Contact BOC Meeting Schedule Translate. To search for a tax bill select your property type personal property or real estate then select the information you want to enter.

The City of Alpharetta Finance Department is responsible for the billing and collection of property taxes for our municipality and relies solely on the Fulton County Board of Assessors for tax information that pertains to property owners fair market and assessed values and propertybilling addresses. Property Taxes - Fulton County Georgia. North Service Center 7741 Roswell Road NE Suite 210 Atlanta GA 30350.

Coweta County GA Website Home Menu. You may select from parcel ID account number or street address. Property owners can view their property assessment online.

Search for Tax Bill. Fulton County Government Center 141 Pryor Street Suite 1018 Atlanta GA 30303-3487. You should check with your county tax office for verification.

The Tax Commissioner takes the appraised value and the exemption status provided by the Board of Tax Assessors along with the millage rates set by the Board of Commissioners and other Governing Authorities to calculate taxes for each property and mails bills to owners at the addresses provided by the Board of Tax Assessors. Change of Mailing Address Real Property Property Data Verification. 48-5-311 e3B to review the appeal of assessments of property value or exemption denials.

Fulton County Issues Property Tax Assessment Notices Reporter Newspapers

Fulton County Issues Property Tax Assessment Notices Reporter Newspapers

Alpharetta Georgia Property Tax Calculator Millage Rate Homestead Exemptions

Alpharetta Georgia Property Tax Calculator Millage Rate Homestead Exemptions

Https Www Fultoncountyga Gov Media Departments Worksource Select Fulton Fulton Ga Wioa Plan Update 2020 Thru 2023 Draft Ashx

Ga Summons Fill Out And Sign Printable Pdf Template Signnow

Ga Summons Fill Out And Sign Printable Pdf Template Signnow

Time For A Better Fulton County Tax Commissioner

Time For A Better Fulton County Tax Commissioner

Http Agendaminutes Fultoncountyga Gov Sirepub View Aspx Cabinet Published Meetings Fileid 286870

Https Www Fultoncountyga Gov Media Departments Finance Benefits 2021 Open Enrollment Forms And Resources Department Hr Liaison Contact List Ashx

Fulton County Tax Commissioner Home Property Taxes Solid Waste Motor Vehicles Press Release Message From The Tc Recent Article From The Tc Tax Matters The Economy And Your Taxes Tax Allocation Districts In Fulton County The Supreme Court

Fulton County Tax Commissioner Home Property Taxes Solid Waste Motor Vehicles Press Release Message From The Tc Recent Article From The Tc Tax Matters The Economy And Your Taxes Tax Allocation Districts In Fulton County The Supreme Court

Fulton County Ga Hallock Law Llc Property Tax Appeals

Fulton County Ga Hallock Law Llc Property Tax Appeals