Property Taxes For Franklin County Ohio

The County assumes no responsibility for errors in the information and does not guarantee that the. The information on this web site is prepared from the real property inventory maintained by the Franklin County Auditors Office.

Township Places Fire Levy On May Ballot Canal Winchester Sidewalk Repair Parks Department

Township Places Fire Levy On May Ballot Canal Winchester Sidewalk Repair Parks Department

Search for a Property Search by.

Property taxes for franklin county ohio. Please note that the Franklin County Treasurers Office collects real estate taxes for the previous year during the current year. Beginning tax year 2020 for real property and tax year 2021 for manufactured homes total income is defined as modified adjusted gross income which is compromised of Ohio Adjusted Gross Income plus business income from line 11 of Schedule A of the Ohio Schedule A. The Franklin County Treasurer makes every effort to produce and publish the most current and accurate information possible.

We would like to show you a description here but the site wont allow us. In-depth Franklin County OH Property Tax Information. Assessed Value 35 of Market Land Value.

123 Main Parcel ID Ex. Yearly median tax in Franklin County The median property tax in Franklin County Ohio is 2592 per year for a home worth the median value of 155300. The real estate tax collection begins with the assessment of the real estate parcels in Franklin County.

The median property tax in Ohio is 183600 per year for a home worth the median value of 13460000. Franklin County collects on average 167 of a propertys assessed fair market value as property tax. Search for a Property Search by.

Tax Summary 100 Value. In-depth Franklin County OH Property Tax Information. The information on this web site is prepared from the real property inventory maintained by the Franklin County Auditors Office.

Total Income is that of the owner and the owners spouse for. If either January 20th or June 20th occurs on a weekend the due date will be changed to the next business day following the 20th. Assessed Value 35 of Market Land Value.

Ohio law requires counties to revalue all real property every six years with an update at the three year midpoint as ordered by the Tax Commissioner of the State of Ohio. John Smith Street Address Ex. The information on this web site is prepared from the real property inventory maintained by the Franklin County Auditors Office.

In order to determine the tax bill your. Cheryl brooks sullivan. The only changes to a propertys value outside of the three year cycle.

Real Estate property taxes are due semi-annually each January 20th and June 20th. Users of this data are notified that the primary information source should be consulted for verification of the information contained on this site. Users of this data are notified that the primary information source should be consulted for verification of the information contained on this site.

Franklin County Treasurer and Auditors offices say they are unsure when county residents can expect to know their 2021 property tax rates and bills. Assessed Value 35 of Market Land Value. ServiceI expresslywaive the confidentialityprovisions of the Ohio RevisedCode includingORC570321and 574718which may otherwise prohibit disclosure and agree to hold the Ohio tax commissioner and county auditor harmless with respect to the limited disclosures herein.

10 Things You Need To Know About Your Property Tax Bill Entertainment Life The Columbus Dispatch Columbus Oh

10 Things You Need To Know About Your Property Tax Bill Entertainment Life The Columbus Dispatch Columbus Oh

Https Apps Franklincountyauditor Com Content Informals Understandingpropertyvalueandpropertytax Pdf

Franklin County Property Tax Records Franklin County Property Taxes Oh

Franklin County Property Tax Records Franklin County Property Taxes Oh

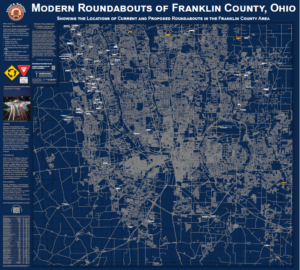

Tax Map Department Franklin County Engineer S Office

Tax Map Department Franklin County Engineer S Office

Maps Franklin County Engineer S Office

Maps Franklin County Engineer S Office

How Healthy Is Franklin County Ohio Us News Healthiest Communities

How Healthy Is Franklin County Ohio Us News Healthiest Communities

Franklin County Benefits And Wellness Home

Franklin County Benefits And Wellness Home

Map Of Franklin Co Ohio Library Of Congress

Franklin County Ohio Treasurer Payments

Franklin County Ohio Treasurer Payments

Map Of Warren County Ohio School Districts Google Search Warren Ohio Warren County Ohio

Map Of Warren County Ohio School Districts Google Search Warren Ohio Warren County Ohio

Jerome Village Ohio Dublin Ohio Union County Ohio Real Estate

Jerome Village Ohio Dublin Ohio Union County Ohio Real Estate

Kroger Buys Macy S Location At Ua S Kingsdale Kroger Macys Kroger Co

Kroger Buys Macy S Location At Ua S Kingsdale Kroger Macys Kroger Co

Hixson 1930 S Franklin County Plat Maps

Hixson 1930 S Franklin County Plat Maps

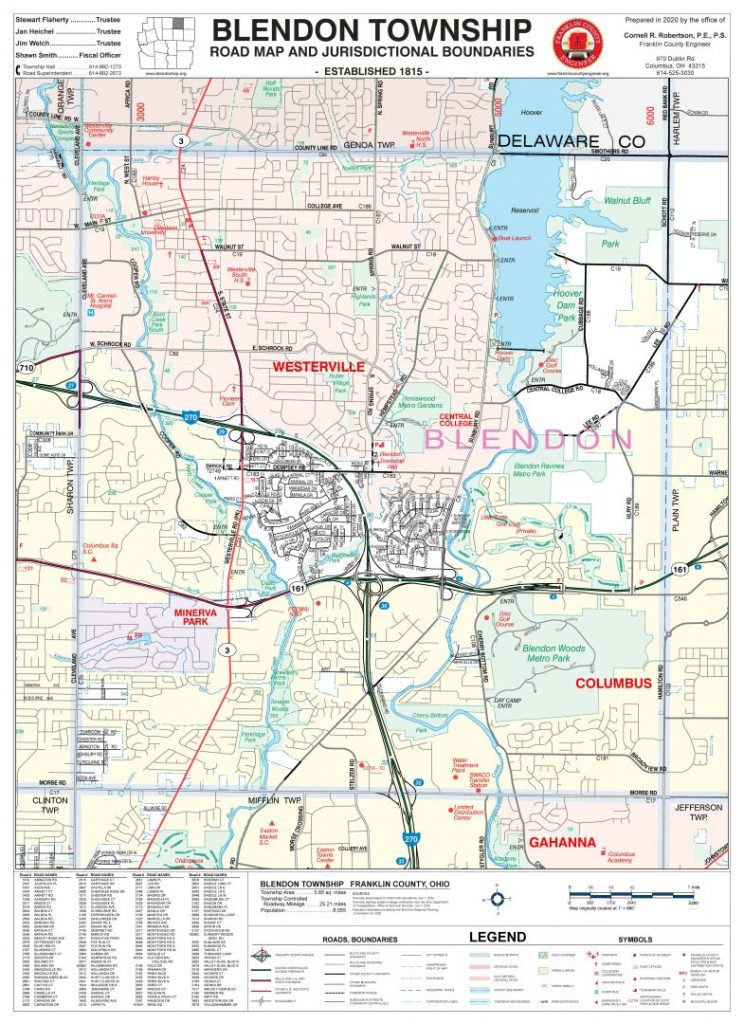

Township Maps Franklin County Engineer S Office

Township Maps Franklin County Engineer S Office