Property Taxes In Clinton County Ohio

1st Half February 14 2021 2nd Half July 20 2021 Manufactured Homes Due Dates. If any of the links or phone numbers provided no longer work please let us know and we will update this page.

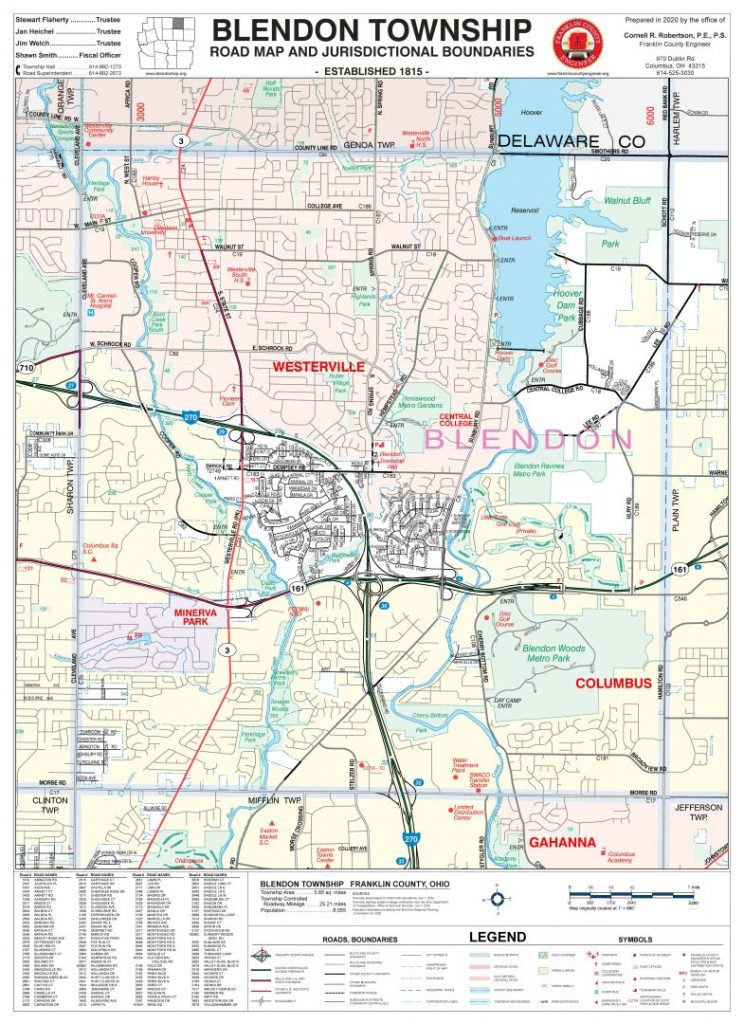

Township Maps Franklin County Engineer S Office

Township Maps Franklin County Engineer S Office

Tax bills will be mailed by April 15th.

Property taxes in clinton county ohio. Thank you for visiting the Clinton County Auditors website. ADMINISTRATIVE NOTICE The deadline to purchase dog tags for 2021 has been extended to March 31 2021. The mailing will include both the May and the November taxes due.

Beginning tax year 2020 for real property and tax year 2021 for manufactured homes total income is definedas modifiedadjusted gross income which is comprised of Ohio adjusted gross income plus any busi-ness income deducted on Schedule A line 11 of your Ohio IT 1040. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Clinton County Tax Appraisers office. Delaware County collects the highest property tax in Ohio levying an average of 373200 148 of median home value yearly in property taxes while Monroe County has the lowest property tax in the state collecting an average tax of 69200 08 of.

The exemption which takes the form of a credit on property tax bills allows qualifying homeowners to exempt up to 25000 of the market value of their homes from all local property taxes. The median property tax on a 12560000 house is 170816 in Ohio. Clinton County Village Tax Rate Click the links below to display the Property Tax Rates.

The median property tax in Clinton County Ohio is 135900 All of the Clinton County information on this page has been verified and checked for accuracy. Clinton County Property Tax For 2020. Real Estate Taxes Due Dates.

Clinton Countys Citizen Transparency site provides financial transparency to the public with easy access to Clinton Countys expenditure revenue budget and payroll information for the current fiscal year as well as a historical view of previous years. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. All bids for properties start at 23 appraisal value exception tax sales and any second sales offered due to previous no.

The money collected from real estate taxes helps fund local government including schools townships and the county. The exact property tax levied depends on the county in Ohio the property is located in. Your tax bill is based on the tax rate multiplied by your property valuation.

For detailed information such as sales data and payment history please visit the County Auditors website. The median property tax on a 12560000 house is 135648 in Clinton County. These records can include Clinton County property tax assessments and assessment challenges appraisals and income taxes.

For example through the homestead exemption a home with a market value of 100000 is billed as if it is worth 75000. Come cannot exceed the amount set by law. Property Tax Information Tax statements are mailed once annually in August.

Final date to pay delinquent 2019 or prior year taxes on residential agricultural vacant and commercial properties to avoid foreclosure under In Rem foreclosure process. Clinton County Property Records are real estate documents that contain information related to real property in Clinton County Ohio. Clinton County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Clinton County Ohio.

Please save your tax coupons for the November payment. Taxes may be paid in one lump sum on or before September 30th or may be paid in two 2 installments by September 30th and March 31st each year. 1st Half March 1 2021 2nd Half July 31 2021 Treasurer Quick Links.

With a 2010 population of 42040 Clinton County in Southern Ohio typifies a growing community answering the challenges of merging rural and urban ideals with mutual respect and the core values of yesterday. Taxes mailed to all property owners in 14 towns of Clinton County. Situated in one of Ohios growth regions Clinton County Ohio is where rural and urban ideas mix offering unique opportunities for enriching your quality of life.

Ohio Attorney Generals Office 1-800-282-0515 Ohio Supreme Court wwwsupremecourtohiogov Clinton County Sheriffs Office Sheriffs Sales Clinton County Courthouse 1st Floor- Veterans Hallway. To begin using the system click on the site links or simply use the Quick Search feature at the top of the page.

Map Of Huron County Ohio Showing The Farms Original Lots In Each Township With Names Of Proprietors Also Plans Of Villages Business Directory Library Of Congress

Equestrian Estate For Sale In Brown County Ohio Nature Lovers Paradise Nestled On 80 83 Acres Spectacular Log Ho Stone Fireplace Log Homes Equestrian Estate

Equestrian Estate For Sale In Brown County Ohio Nature Lovers Paradise Nestled On 80 83 Acres Spectacular Log Ho Stone Fireplace Log Homes Equestrian Estate

Cuba Clinton County Ohio Wikipedia

Cuba Clinton County Ohio Wikipedia

Clinton County Ohio Treasurer S Office

Clinton County Ohio Treasurer S Office

How Healthy Is Clinton County Ohio Us News Healthiest Communities

How Healthy Is Clinton County Ohio Us News Healthiest Communities

County Of Summit Executive Summit County Ohio Executive Office

County Of Summit Executive Summit County Ohio Executive Office

Vinton County Ohio 1901 Map Mcarthur Allensville Zaleski Hamden Eagle Mills New Plymouth Wilkesville Arbaugh Radcliff Dunda Map Vinton County Map

Vinton County Ohio 1901 Map Mcarthur Allensville Zaleski Hamden Eagle Mills New Plymouth Wilkesville Arbaugh Radcliff Dunda Map Vinton County Map

Jefferson Township Franklin County Ohio Wikipedia

Jefferson Township Franklin County Ohio Wikipedia

Second Half Real Estate Tax Bills Mailed Wilmington News Journal

Second Half Real Estate Tax Bills Mailed Wilmington News Journal

Madison Township Vinton County Ohio Wikipedia

Madison Township Vinton County Ohio Wikipedia

National Register Of Historic Places Listings In Licking County Ohio Wikipedia

National Register Of Historic Places Listings In Licking County Ohio Wikipedia

Horse Property For Sale In Madison County Ohio Calling All Horse Lovers Here Is Your Opportunity To Hav Washington Court House Horse Property Horse Facility

Horse Property For Sale In Madison County Ohio Calling All Horse Lovers Here Is Your Opportunity To Hav Washington Court House Horse Property Horse Facility

Topographical Map Of Ross County Ohio Library Of Congress

Choosedeerfield Deerfield Township Ohio The Benefits Of Mason Without The Income Tax Deerfield Township Ohio

Choosedeerfield Deerfield Township Ohio The Benefits Of Mason Without The Income Tax Deerfield Township Ohio

Real Estate For Sale Listingid 36668461 Durand Mi 48429 House Styles Real Estate Durand

Real Estate For Sale Listingid 36668461 Durand Mi 48429 House Styles Real Estate Durand