Who Pays Insurance On A Land Contract

The buyer may want to pay to have a policy of title insurance issued on the property subject to the land contract. However the buyer does get to deduct them from his or her taxes.

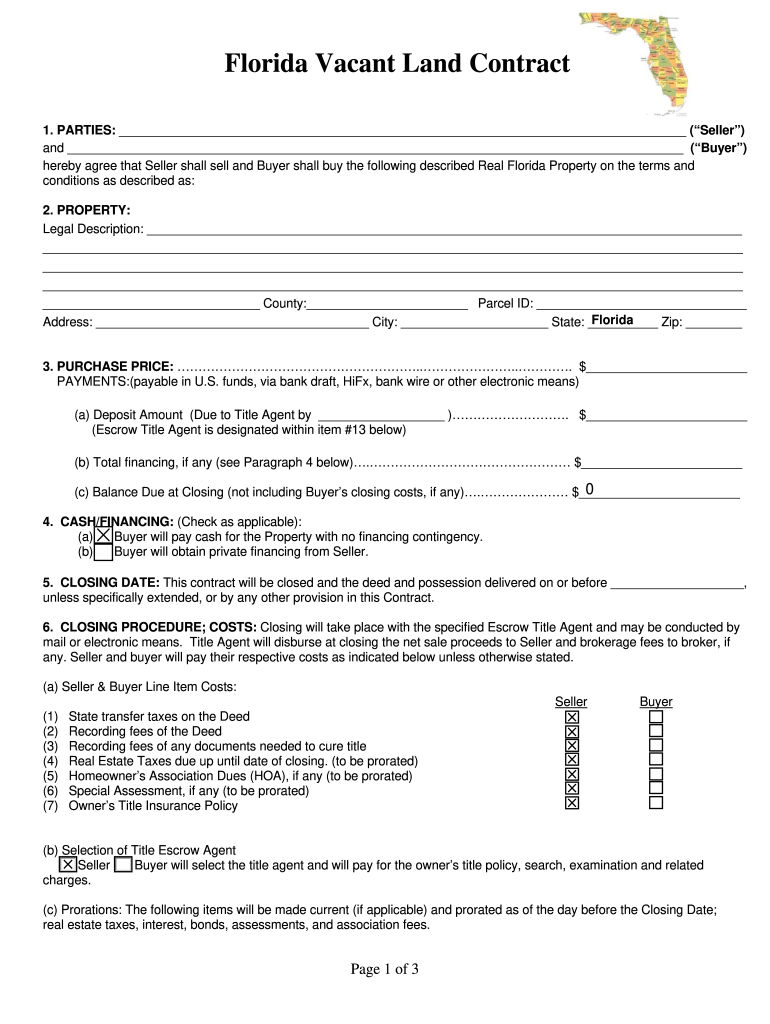

Free Printable Real Estate Purchase Agreement Pdf Real Estate Contract Real Estate Forms Purchase Agreement

Free Printable Real Estate Purchase Agreement Pdf Real Estate Contract Real Estate Forms Purchase Agreement

Title insurance benefits the buyer or the buyers lender and thus it is up to the buyer to purchase.

Who pays insurance on a land contract. Or maybe you purchased the empty piece of land next to the parcel your house sits on to prevent someone. The buyer gives the seller a down payment for the home or piece of land and the seller acts as. Mortgage title insurance is always paid for at the time of closing.

It covers such responsibilities as who will maintain the home pay for insurance and property taxeswhich is generally the buyer. A land contract may be used when the seller finances the buyers purchase of the property. You also need some kind of clause that the amount can be increased if taxes andor insurance goes up.

Pros Cons of a Land Contract. The land contract buyer pays the seller in installments and receives a deed when all payments have been made. A buyer is usually responsible for maintaining adequate insurance on property subject to a land contract and oftentimes is required to name the seller as the insured.

Owners title insurance can be paid for after closing but is usually taken care of by then. The land contract also indicates which party pays the taxes and insurance on the home. This total amount due including principal taxes and insurance paid by Land Contract Holder Seller.

Maybe you want to use the land for fishing or hunting. Vacant Land InsuranceThere are a number of reasons why you may own a piece of undeveloped land. Be sure to include in the contract whoever is responsible for carrying insurance on the property.

Perhaps you found a great piece of property that you are planning on building a house on one day. The buyer gains access to the home but the seller maintains the legal title until the buyer pays off the loan. Provided that the mortgage by its terms does not prohibit assumption.

The land contract can state the principal portion of the payments as well as the interest rate portion. The agreement explains the parties rights and responsibilities and sets forth an installment payment plan and how property taxes insurance and any other issues will be handled. Vacant Land Insurance Policy Information.

The contract stipulates the purchase price the down payment and payment arrangements between the buyer and the seller. If at the time this Contract is executed the Seller is purchasing the Premises on a land contract the Seller covenants and agrees to meet all obligations of that contract as they mature and produce evidence thereof to. The installment sales contract spells out the sales price the amount of down payment interest rate amount of monthly or periodic payments and the duties of each of the parties.

Taxes and property insurance. A land contract is a form of seller financing. Make sure the land contract forms spell out how much of the payment is principal and interest and also how much is for taxes and insurance.

It is similar to a mortgage but rather than borrowing money from a lender or bank to buy real estate the buyer makes payments to the real estate owner or seller until the purchase price is paid in full. A common way land contract sellers breach the contract is by refusing to transfer title of the home when the buyer pays off the contract balance. The buyer can hire a title agency to run a land record search and discover any potential interests attached to the property that may interfere with buyer obtaining a clean title from seller.

A land contract is a real estate transaction in which a buyer finances a property by making installment payments to the seller. Vendor late fees and all other amounts due to payoff the land contract on the above listed property on today date is. Clarify who pays insurance.

SELLER TO PERFORM PRIOR LAND CONTRACT. When this happens the buyer can file a quiet title complaint in circuit court. On a land contract the buyer is responsible for property taxes insurance and mortgage interest although these will usually be paid through the seller.

With more land contracts in use recently a land contract refresher is in order. _____ Annual interest rate on the land contract is _____. Buying real estate through a land contract is fairly straightforward.

Also the buyer can pay one set amount each month and you dont have to keep checking if its been paid. However the buyer does get to deduct them from his or her taxes. If however your land contract is structured as such that the deed does not transfer until you have paid the property off in full you will need to carry renters insurance which of course will.

A land contract is drafted by the seller who usually acts as his or her own real estate agent. The seller as landlord On a land contract the buyer is responsible for property taxes insurance and mortgage interest although these will usually be paid through the seller.

Home Buying Cheat Sheet Seiler Home Group First Home Buyer Home Buying Home Buying Checklist

Home Buying Cheat Sheet Seiler Home Group First Home Buyer Home Buying Home Buying Checklist

One Of The Steps In Buying A Home Is To Have A Title Search Completed Prior To Closing Many First Time Buyers May Not Have H Title Insurance Title Home Buying

One Of The Steps In Buying A Home Is To Have A Title Search Completed Prior To Closing Many First Time Buyers May Not Have H Title Insurance Title Home Buying

Real Estate For Sale By Owner Contract Template Contract Template Maryland Real Estate Real Estate Forms

Real Estate For Sale By Owner Contract Template Contract Template Maryland Real Estate Real Estate Forms

Is The Seller Or Buyer Responsible For Insurance On A Land Contract

Is The Seller Or Buyer Responsible For Insurance On A Land Contract

Reasons Why Hiring A Title Company Is Important In 2020 Title Insurance Title Company

Reasons Why Hiring A Title Company Is Important In 2020 Title Insurance Title Company

What Kind Of Insurance Do You Need As A Vacant Land Owner Otterstedt Insurance Agency

What Kind Of Insurance Do You Need As A Vacant Land Owner Otterstedt Insurance Agency

Simple Real Estate Purchase Agreement Pdf Purchase Agreement Real Estate Contract Real Estate Forms

Simple Real Estate Purchase Agreement Pdf Purchase Agreement Real Estate Contract Real Estate Forms

Land Contracts Everything You Need To Know Pros And Cons

Land Contracts Everything You Need To Know Pros And Cons

Land Contract Fill Out And Sign Printable Pdf Template Signnow

Land Contract Fill Out And Sign Printable Pdf Template Signnow

Real Estate 63254 How To Justify Real Estate Agent Commissions Real Estate Agent Real Estate Estate Agent

Real Estate 63254 How To Justify Real Estate Agent Commissions Real Estate Agent Real Estate Estate Agent

Precedent No 16 2017 Al On Recognizing A Transfer Agreement Of Land Use Rights As The

Precedent No 16 2017 Al On Recognizing A Transfer Agreement Of Land Use Rights As The

Buyer Or Seller Who Pays For Closing Costs And Title Insurance

Buyer Or Seller Who Pays For Closing Costs And Title Insurance

Auto Insurance Protects You Against Financial Loss If You Have An Accident It Is A Contract Between You And The Insurance Company Car Insurance Insurance Auto

Auto Insurance Protects You Against Financial Loss If You Have An Accident It Is A Contract Between You And The Insurance Company Car Insurance Insurance Auto

Pin On Top Real Estate Articles

Pin On Top Real Estate Articles

Contract Infographics Google Search Process Infographic Ideas Templates Real Estate Infographic Real Estate Postcards Customer Journey Mapping

Contract Infographics Google Search Process Infographic Ideas Templates Real Estate Infographic Real Estate Postcards Customer Journey Mapping

Land Contracts Vs Mortgages What Independent Agents Should Know

Land Contracts Vs Mortgages What Independent Agents Should Know

First Time Seller Tips Understanding Closing Costs Real Estate Tips Real Estate Buyers Home Buying

First Time Seller Tips Understanding Closing Costs Real Estate Tips Real Estate Buyers Home Buying

Land Contract Michigan Fill Out And Sign Printable Pdf Template Signnow

Land Contract Michigan Fill Out And Sign Printable Pdf Template Signnow

Buying A Home Using Land Contract Pennlive Com

Buying A Home Using Land Contract Pennlive Com