Capital Gains Tax Rate Property Nsw

Remember short-term capital gains from. Capital Gains Tax Calculator Values.

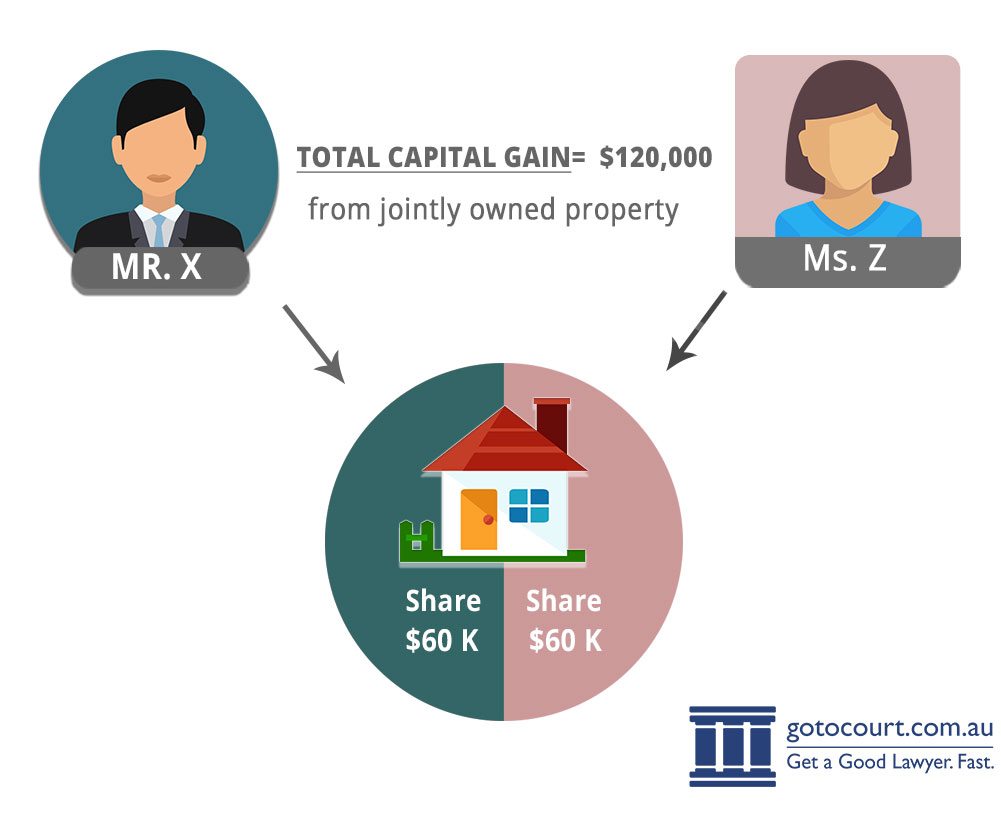

Pin On Capital Gains Tax Valuations

Pin On Capital Gains Tax Valuations

If you are single you wouldnt have to pay any capital gains tax if your total income is below 40400.

Capital gains tax rate property nsw. If you realize long-term capital gains from the sale of collectibles such as precious metals coins or art they are taxed at a maximum rate of 28. That lowers the taxable gain to AUD37500. In that case youre not eligible for any discounts explained below and simply pay a 30 tax on your capital gains.

You can further reduce the capital gains tax from investment property by 50 because youve owned the property for more than 12 months. If you sell the property now for net proceeds of 350000 youll owe long-term capital gains tax on your 100000 net profit plus depreciation recapture on 90900 which is taxed at your marginal. You pay tax on your capital gains which forms part of your income tax and is not considered a separate tax though its referred to as CGT.

Main Residence Your main residence is exempt from capital gains tax as long as there is a dwelling on the property. The three long-term capital gains tax rates of 2019 havent changed in 2020 and remain taxed. Importantly CGT is part of your income tax and not a standalone tax as the name might suggest.

If youre in the third tax bracket your tax rate will be 37 of the AUD37500 taxable gain. The tax rate would increase to 15 percent for total income between 40401 and 445850 and. Theyre taxed at lower rates than short-term capital gains.

You need to report capital gains and losses in your income tax return and pay tax on your capital gains. Sourced from the Australian Tax Office. If you own the asset for longer than 12 months you will pay 50 of the capital gain.

Main place of residence You can avoid paying CGT if you sell a dwelling thats considered your main place of. Those tax rates for long-term capital. The long-term capital gains rate is below the tax rate youll pay on most other income.

Meanwhile self-managed super funds apply a 333 discount to their capital gain and pay 15 tax on the remainding amount. 12 Months Property Ownership If you are an Australian resident and have owned the property for more than 12 months you are able to claim a 50 discount on the capital gains tax payable. Long-term capital gains are gains on assets you hold for more than one year.

Sales of real estate and other types of assets have their own specific form of capital gains and are governed by their own. If an asset is held for at least one year then any gain is first discounted by 50 per cent for individual taxpayers or by 333 per cent for superannuation funds. In fact long-term capital gains are taxed at either 0 15 or 20 depending on your income and the.

If you sell a capital asset such as real estate or shares you usually make a capital gain or a capital loss. While self-managed super funds only attract a one-third discount for CGT the standard tax rate for funds is only 15 per cent meaning the maximum CGT rate is 10 per cent. Here are the long-term capital gains tax brackets for 2020 and 2021.

Long-term capital gains taxes apply to profits from selling something youve held for a year or more. This is the difference between what it cost you to acquire the asset and what you receive when you dispose of it. These rates are typically much lower than the ordinary income tax rate.

Depending on your regular income tax bracket your tax rate for long-term capital gains could be as low as 0. Instead of taxing it at your regular income tax rate they tax it at the lower long-term capital gains tax rate 15 for most Americans. Even taxpayers in the top income tax bracket pay long-term capital gains rates that are nearly.

The easiest way to lower your capital gains taxes is simply to own the asset whether real estate or stocks for at least a year. Capital Gains Tax CGT was introduced in Australia in 1985 and applies to assets you sell that were acquired since then though there are exceptions. How do I calculate capital gains tax.

If you own the asset for less than 12 months you will have to pay 100 of the capital gain at your income tax rate. Property is exempt from capital gains tax if it was purchased before 20 September 1985. Which is lower than most peoples marginal tax rate.

If you sell stocks mutual funds or other capital assets that you held for at least one year any gain from the sale is taxed at either a 0 15 or 20 rate.

Capital Gains Tax Valuers Office In Sydney Www Valuersoffice Com Au Capital Gain Capital Gains Tax Capital Assets

Capital Gains Tax Valuers Office In Sydney Www Valuersoffice Com Au Capital Gain Capital Gains Tax Capital Assets

The Capital Gains Tax Property 6 Year Rule 1 Simple Rule To Avoid Cgt Duo Tax Quantity Surveyors

The Capital Gains Tax Property 6 Year Rule 1 Simple Rule To Avoid Cgt Duo Tax Quantity Surveyors

Flipping Houses Rehabbing Blog Posts Biggerpockets Investing Flipping Houses Blog Posts

Flipping Houses Rehabbing Blog Posts Biggerpockets Investing Flipping Houses Blog Posts

Distressed Properties Report Distressed Property Property Report Property

Distressed Properties Report Distressed Property Property Report Property

How To Save Capital Gains Tax On Property Sale Capital Gain Capital Gains Tax Tax

How To Save Capital Gains Tax On Property Sale Capital Gain Capital Gains Tax Tax

License Exam Tutor Real Estate Exam Real Estate License Exam

License Exam Tutor Real Estate Exam Real Estate License Exam

How To Calculate Capital Gains Tax Cgt On Investment Property

How To Calculate Capital Gains Tax Cgt On Investment Property

Commercial Property Lease Or Buy Analysis Calculator Investment Analysis Rental Property Management Commercial Property

Commercial Property Lease Or Buy Analysis Calculator Investment Analysis Rental Property Management Commercial Property

Real Estate Trends Bubble By Teo Nicolais Real Estate Trends Bubble By Teo Nicolais Sim Real Estate Trends Real Estate Investing Books Real Estate Marketing

Real Estate Trends Bubble By Teo Nicolais Real Estate Trends Bubble By Teo Nicolais Sim Real Estate Trends Real Estate Investing Books Real Estate Marketing

Brisbane Real Estate Agents Valuations Qld Real Estate Agents Property Valuation Property Melbourne

Brisbane Real Estate Agents Valuations Qld Real Estate Agents Property Valuation Property Melbourne

Real Estate Course Prep Get Your Bc Real Estate License Or Bc Mortgage Broker License Professional Teacher Real Estate License Commercial Realtor Real Estate

Real Estate Course Prep Get Your Bc Real Estate License Or Bc Mortgage Broker License Professional Teacher Real Estate License Commercial Realtor Real Estate

How To Calculate Capital Gains On Sale Of Gifted Property Examples

How To Calculate Capital Gains On Sale Of Gifted Property Examples

Calculating Capital Gains Tax Cgt In Australia

Calculating Capital Gains Tax Cgt In Australia

How To Calculate Capital Gains Tax H R Block

How To Calculate Capital Gains Tax H R Block

How To Calculate Capital Gains Tax Cgt Echoice Guides

How To Calculate Capital Gains Tax Cgt Echoice Guides

With Our Experienced Conveyancers We Will Ensure That We Are The Best Conveyancing Company In Melbourne When It Comes To Ser House Deeds Mortgage Loan Officer Mortgage Assistance

With Our Experienced Conveyancers We Will Ensure That We Are The Best Conveyancing Company In Melbourne When It Comes To Ser House Deeds Mortgage Loan Officer Mortgage Assistance

Rental Investment Property Record Keeping Spreadsheet Investment Property Investing Real Estate Investing Flipping

Rental Investment Property Record Keeping Spreadsheet Investment Property Investing Real Estate Investing Flipping

Strata101 If You Own A Strata Titled Property In Victoria You Automatically Become Part Of The Owners Corporation For That Corporate Strata S Corporation

Strata101 If You Own A Strata Titled Property In Victoria You Automatically Become Part Of The Owners Corporation For That Corporate Strata S Corporation