How To Calculate Property Yield Uk

This is a good measure of a propertys potential return but remember if you are. It is calculated by dividing your annual rental income by the total value of the property including initial purchase and any improvements that you have made or need to carry out in the future.

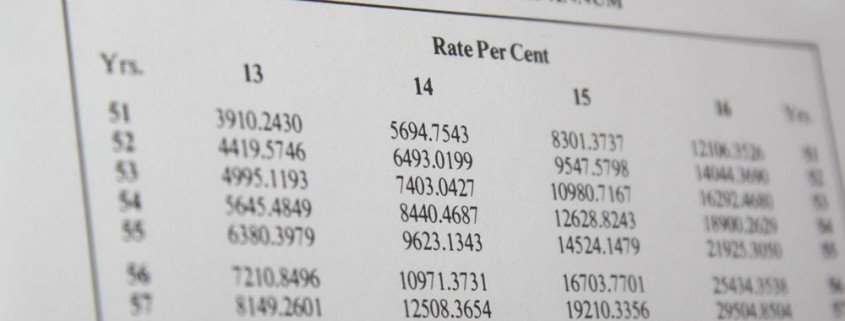

Parry S Valuation And Investment Tables For Property Investment Appraisals

Parry S Valuation And Investment Tables For Property Investment Appraisals

How To Calculate.

How to calculate property yield uk. Use our rental yield calculator below and discover what your rental yield will be by entering the price of your property and the rent you will be charging your tenant. To calculate the yield on a rental property youll need to divide the annual rental income by the price of the property and then multiply this by 100. Buy-to-let Property Profit and Tax Calculator.

Gross yield is calculated by dividing a propertys annual rental income by the property value as follows. Then divide this by the property value. Finally multiply the figure by 100 to get the percentage.

It essentially takes the cost of the property and compares it to the income you expect to earn from it each year. Calculate yield ROI profit required investment stamp duty available mortgage and more. Gross yield monthly rental x 12 property value x 100 Net yield monthly rental x 12 less running costs and expenses property value x 100.

Divide your gross rental income by the value of the property and then multiply it by 100 to get a percentage of your yield. This is a good measure of a propertys potential rental return but of course it is not the be-all-and-end-all of your calculation. Gross Yield Annual Rent Property Value.

Multiply your monthly rental income by 12 to get your annual rental income. Using this tool enter an investment property purchase price and rent per week or month and you will see the annual rental yield. Annual rent property value x 100 So if the annual rent you expect to make on a property is 12 x 892 pcm the UK average as of January 2017 10704 And that figure is then divided by 216750 the average cost of a house in the UK as of September 2016 x 100 the gross yield will be 49.

Rental yield Monthly rental income x 12 Property value Weve broken down how you use this formula to calculate rental yield below. Net yield is Investment return after expenses. Gross Yield Gross yield as its name suggests is the income return on an investment before expenses are deducted.

For example if you bought a buy-to-let property for 400000 and receive 1500 a month in rent to give an annual rental income of 18000 12 x 1500 the gross rental yield is. You calculate a commercial property rental yield by dividing the annual income by the propertys value and then multiplying that figure by 100. Simply enter the propertys value and the monthly rent and it will deliver the total annual rent and the yield.

First find your annual rental income for that property. It is useful to get an initial flavour of a deal but I certainly wouldnt advocate using it in isolation as it doesnt factor in any ongoing costs. Gross yield is the Investment return before expenses.

As a whole the average UK rental yield sits at 353 so anything over that amount can be considered overperforming. Dont forget to exclude anything from your annual rental income that you regularly spend on the properties or their maintenance or your yield percentage wont be accurate. In property investing the annual rental yield that you receive from your investment property is one of the most important factors in determining your total return.

So if your property was bought for 200000 and you charge 10000 per year in rent for this youd have a rental yield of 5. Rental yield is the financial return you are able to achieve on a rental property. Gross yield is the most simple of the yield calculations.

So if your annual rental income was 12000 and the property was valued at 200000 your rental yield would be six per cent. Use our handy graphic below as a reminder. Take the monthly rental income amount or expected rental income and multiply it by 12 Divide it by the propertys purchase price or current market value.

Rental yields can change from postcode to postcode so its important to keep researching investment locations to see. Rental yields can be impacted by a wide variety of different things and as such no one yield is the same. Divide your annual rental income by the property value and then multiply it by 100 to get your yield percentage.

You can calculate gross rental yield by dividing a years total rent by the purchase price of the property and multiplying by 100. Calculate Your Rental Yield. Updated for the 8th July 2020 - 31st March 2021 SDLT temporary reduction or holiday.

Dont forget to deduct everything you frequently spend on the properties or their upkeep from your annual rental income or your yield percentage wont be correct. To calculate your gross rental yield just follow these three steps.

How To Calculate Property Development Profit Propertydata

How To Calculate Property Development Profit Propertydata

Rental Yield Calculator Buy To Let Rental Return Calculator

Rental Yield Calculator Buy To Let Rental Return Calculator

Buy To Let Mortgage Guide For Landlords And Property Investors

Buy To Let Mortgage Guide For Landlords And Property Investors

Taxation Rules For Landlords 2018 2019 Update Homelet

Taxation Rules For Landlords 2018 2019 Update Homelet

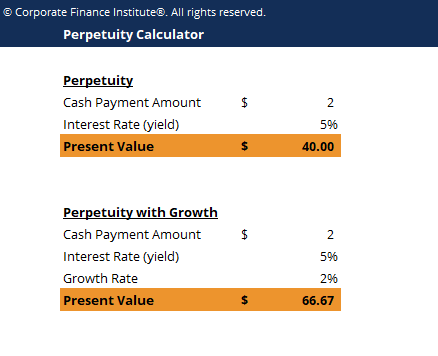

Years Purchase Of A Reversion To A Perpetuity Investment Calculator

Years Purchase Of A Reversion To A Perpetuity Investment Calculator

How To Calculate Your Gross Yield Net Yield And Roi Property Geek Investing Mortgage Payment Property Marketing

How To Calculate Your Gross Yield Net Yield And Roi Property Geek Investing Mortgage Payment Property Marketing

Perpetuity Definition Formula Examples And Guide To Perpetuities

Perpetuity Definition Formula Examples And Guide To Perpetuities

3 Ways To Work Out A Rental Yield Wikihow

3 Ways To Work Out A Rental Yield Wikihow

What Is A Good Rental Yield And Why Is It Important Rwinvest Property Investor Finance Advice Buying Investment Property

What Is A Good Rental Yield And Why Is It Important Rwinvest Property Investor Finance Advice Buying Investment Property

Real Estate Investment Market Analysis Lecture 1 Introduction Value Worth Applications Methods Tony Key Professor Real Estate Economics Room 5087 Ppt Download

Real Estate Investment Market Analysis Lecture 1 Introduction Value Worth Applications Methods Tony Key Professor Real Estate Economics Room 5087 Ppt Download

Rental Yield Calculator Investments Made Simpler Propertydata

Rental Yield Calculator Investments Made Simpler Propertydata

What Is A Good Rental Yield Investment Advice For Landlords

What Is A Good Rental Yield Investment Advice For Landlords

Calculating The Rental Yield To Find The Best Btl Investment

Calculating The Rental Yield To Find The Best Btl Investment

Calculate Your Rental Yield Now Being A Landlord Rental Investment Property

Calculate Your Rental Yield Now Being A Landlord Rental Investment Property

Free Rental Yield Calculator By Landlord Vision

Free Rental Yield Calculator By Landlord Vision

Property Yield Calculating Property Yields Return On Investment

Property Yield Calculating Property Yields Return On Investment

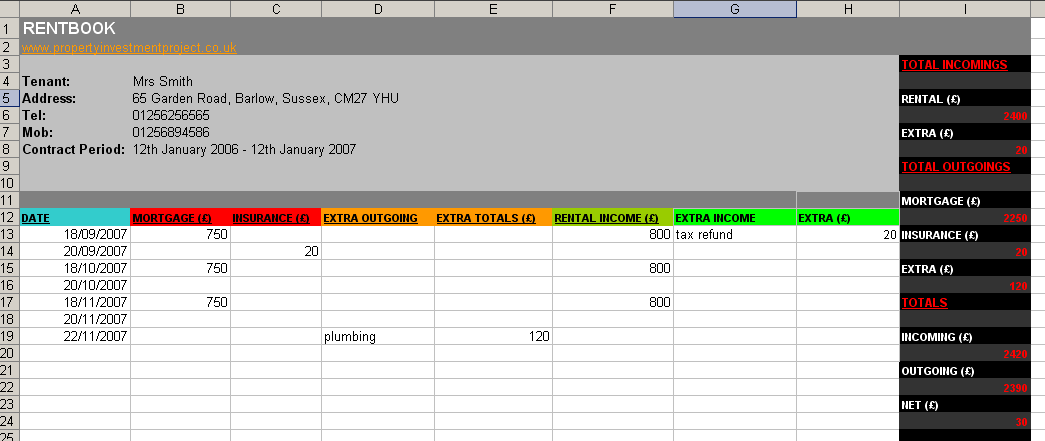

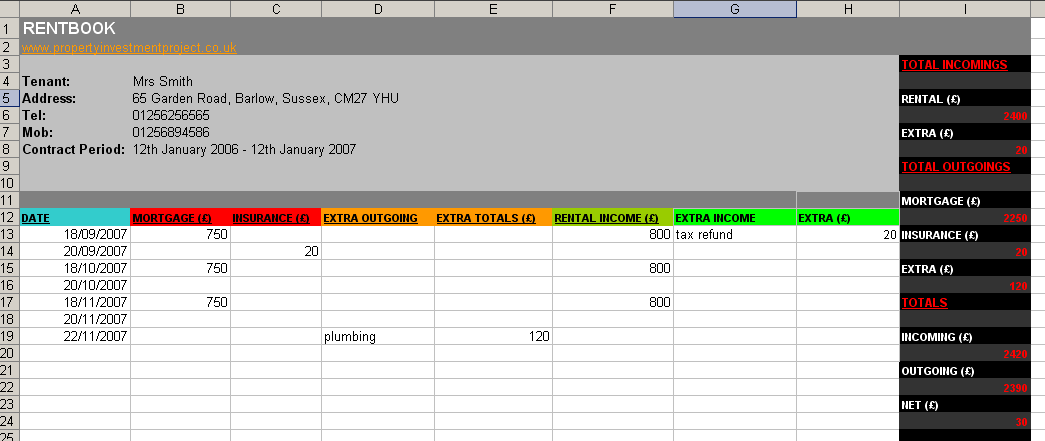

Free Landlord Expenses Spreadsheet Calculating Profit Loss

Free Landlord Expenses Spreadsheet Calculating Profit Loss

Commercial Real Estate Prime Yields 2020 Statista

Commercial Real Estate Prime Yields 2020 Statista