How To Calculate Terminal Value Of A Property

You can find the terminal value in one of three ways. Terminal value is calculated by dividing the last cash flow forecast by the difference between the discount rate and terminal growth rate.

Discount Rate Formula How To Calculate Discount Rate With Examples

Discount Rate Formula How To Calculate Discount Rate With Examples

This thesis has the aim to find out how the practice in DCF valuation compares to the current state of literature.

How to calculate terminal value of a property. Here the terminal value equals the constant cash flow divided by the discount rate. In this video on Terminal Value we are going to learn this topic in detail including its formula examples and calculation in Excel𝐖𝐡𝐚𝐭 𝐢𝐬 𝐓𝐞𝐫𝐦𝐢. One is to assume a liquidation of the firms assets in the terminal year and estimate what others would pay for the assets that the firm has accumulated at that point.

The formula for calculating the perpetual growth terminal value is. 1344 10 1310 2. Calculate the estimated terminal value of the property at the end of its holding period.

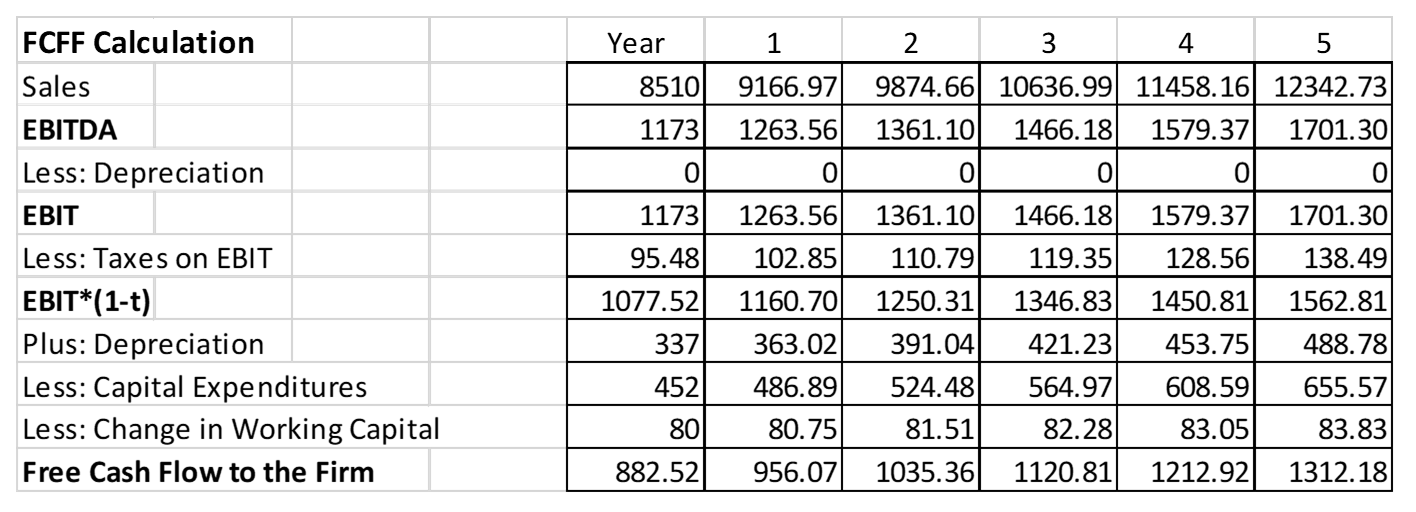

5 years NOI for year 5. Free Cash Flow Calculation. CV_ 1 rt where CV is the current value of the real estate property r is the discount rate and t is the terminal year.

To assume that the cashflowsin the. You can use the current rate of inflation for the discount rate. The terminal value calculation estimates the value of the.

Determine the terminal value of the asset. Special attention should be given in assuming the growth rates discount rate and multiples like PE. Calculate the terminal value by assuming that the property increases in value by a constant annual rate until the terminal year.

You can also assume a constant cash flow into perpetuity starting in the terminal year. Terminal Value is an important concept in estimating Discounted Cash Flow as it accounts for more than 60 80 of the total companys worth. 9 estimated holding period.

The entire subject of DCF valuation is very broad and the combination of all the different components would exceed. This tutorial discusses how terminal value of an asset is calculated along with tax and how to include this in net present value and IRR calculation. Now divide that net operating income by the capitalization rate to get the current value result.

The first of these is the liquidation value. The terminal value of a property worth 10 million now in 10 years will be 1344 million if the expected inflation rate is 3 per cent. Terminal value calculations differ between several renowned authors.

The value of an investment at the end of its holding period. You can use the salvage resale value which can simply be the book value of the asset in the terminal year. Calculate the Present Value of the Explicit Period FCFF Calculate the Value of the Company period beyond the Explicit Period Enterprise Value Present Value Explicit Period FCFF Present Value TV Find Equity Value of the Firm after deducting Net Debt.

The terminal value formula is. The other two approaches value the firm as a going concern at the time of the terminal value estimation. In particular the resale price can be estimated using the following direct income capitalization formula.

Perpetuity Growth Rate Terminal Growth Rate Since horizon value is calculated by applying a constant annual growth rate to the cash flow of the forecast period the implied perpetuity growth rate is how much the free cash flow of the company grows until perpetuity with each forthcoming year. To calculate the value of an asset in the growth period we follow the same steps as before discounting each annual cash flow back to its present value. Lets say your comparable sold for 250000.

TV FCFn x 1 g WACC g. Following are the general steps to be followed in valuation. First we need to calculate Free Cash Flow to the FirmThis is a very crucial step for finding out terminal value as based on the fifth years Cash flow we will calculate Terminal Value.

To calculate residual earnings. Determine the capitalization rate from a recent comparable sold property. To value the asset in the stable period we use the terminal value.

In the context of commercial real estate the terminal value of an investment property is often estimated by applying a terminal cap rate to its projected net operating income NOI at the time of sale or the year following sale. The term exit cap rate or terminal cap rate refers to the rate used to calculate the resale price of a property by capitalizing its expected Net Operating Income NOI at the end of the planned holding period. To calculate the terminal value we have three different options.

Resale Price NOI at Time of SaleExit Cap Rate. Youve determined that the propertys NOI after deducting applicable expenses is 50000. 100500 NOI for year 6.

Discounted cash flow DCF a valuation method used to estimate the value of an investment based on its future cash flows is often used in evaluating real estate investments.

The Income Approach To Real Estate Valuation

The Income Approach To Real Estate Valuation

Salvage Value Formula Calculator Excel Template

Salvage Value Formula Calculator Excel Template

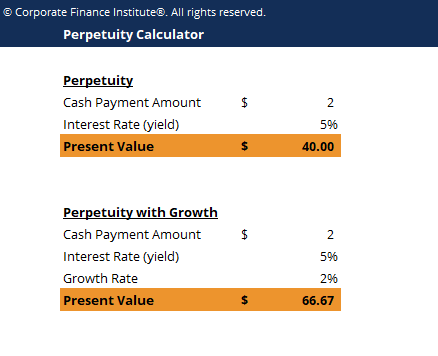

Perpetuity Definition Formula Examples And Guide To Perpetuities

Perpetuity Definition Formula Examples And Guide To Perpetuities

Argus Enterprise Google Search Budgeting Enterprise Lease

Argus Enterprise Google Search Budgeting Enterprise Lease

Explaining The Dcf Valuation Model With A Simple Example

Explaining The Dcf Valuation Model With A Simple Example

Chemical Properties Alkenes 10 Structural Formula Chemical Property Physical And Chemical Properties

Chemical Properties Alkenes 10 Structural Formula Chemical Property Physical And Chemical Properties

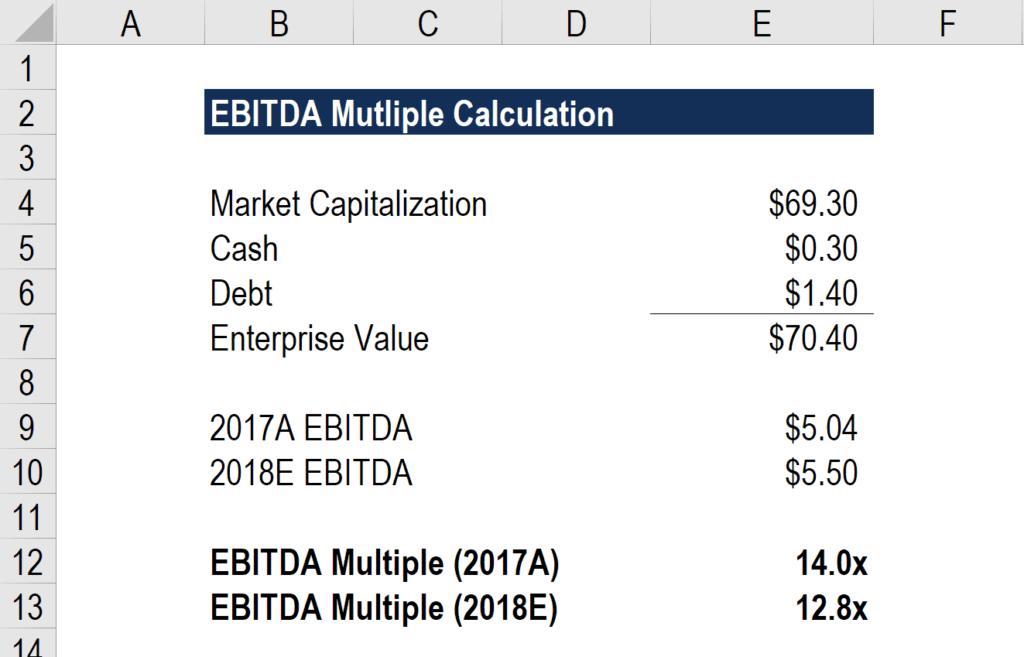

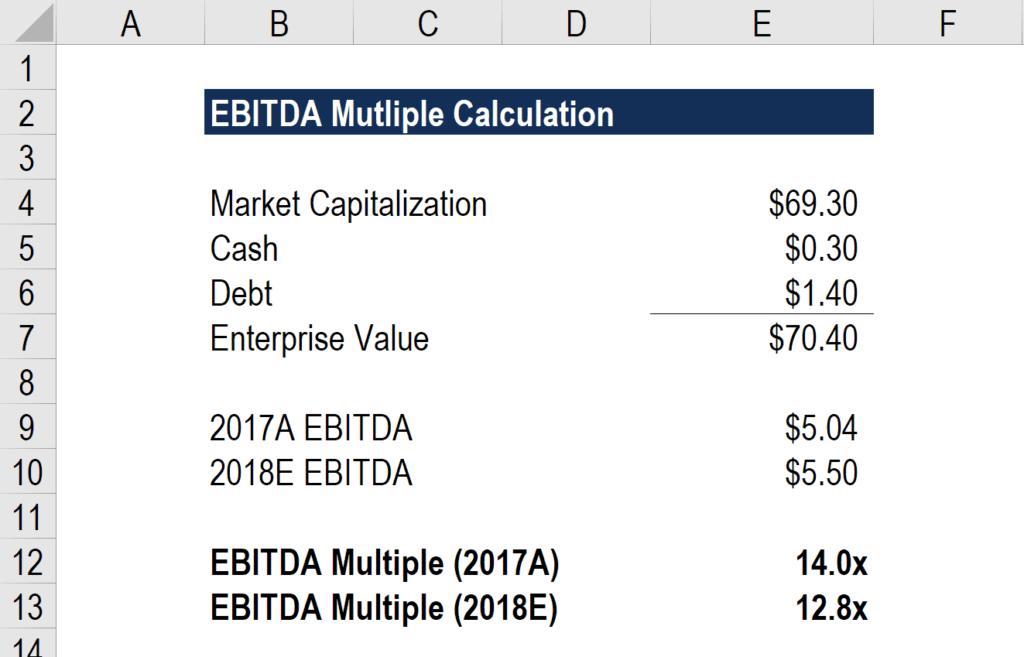

Ebitda Multiple Formula Calculator And Use In Valuation

Ebitda Multiple Formula Calculator And Use In Valuation

Ground Lease Valuation Model Adventures In Cre

Ground Lease Valuation Model Adventures In Cre

Discounted Cash Flow Valuation Template Cash Flow Statement Cash Flow Enterprise Value

Discounted Cash Flow Valuation Template Cash Flow Statement Cash Flow Enterprise Value

The Complete Step By Step Guide On How To Calculate Terminal Value Click To Read The Full Article On Website Htt Investing Strategy Investing Start Investing

The Complete Step By Step Guide On How To Calculate Terminal Value Click To Read The Full Article On Website Htt Investing Strategy Investing Start Investing

Learn How To Calculate Inventory Turnover Wip Inventory Rawmaterial Finishedgoods Inventory Turnover Lean Six Sigma Value Investing

Learn How To Calculate Inventory Turnover Wip Inventory Rawmaterial Finishedgoods Inventory Turnover Lean Six Sigma Value Investing

Intrinsic Value Formula In 2020 Enterprise Value Intrinsic Value Financial Analysis

Intrinsic Value Formula In 2020 Enterprise Value Intrinsic Value Financial Analysis

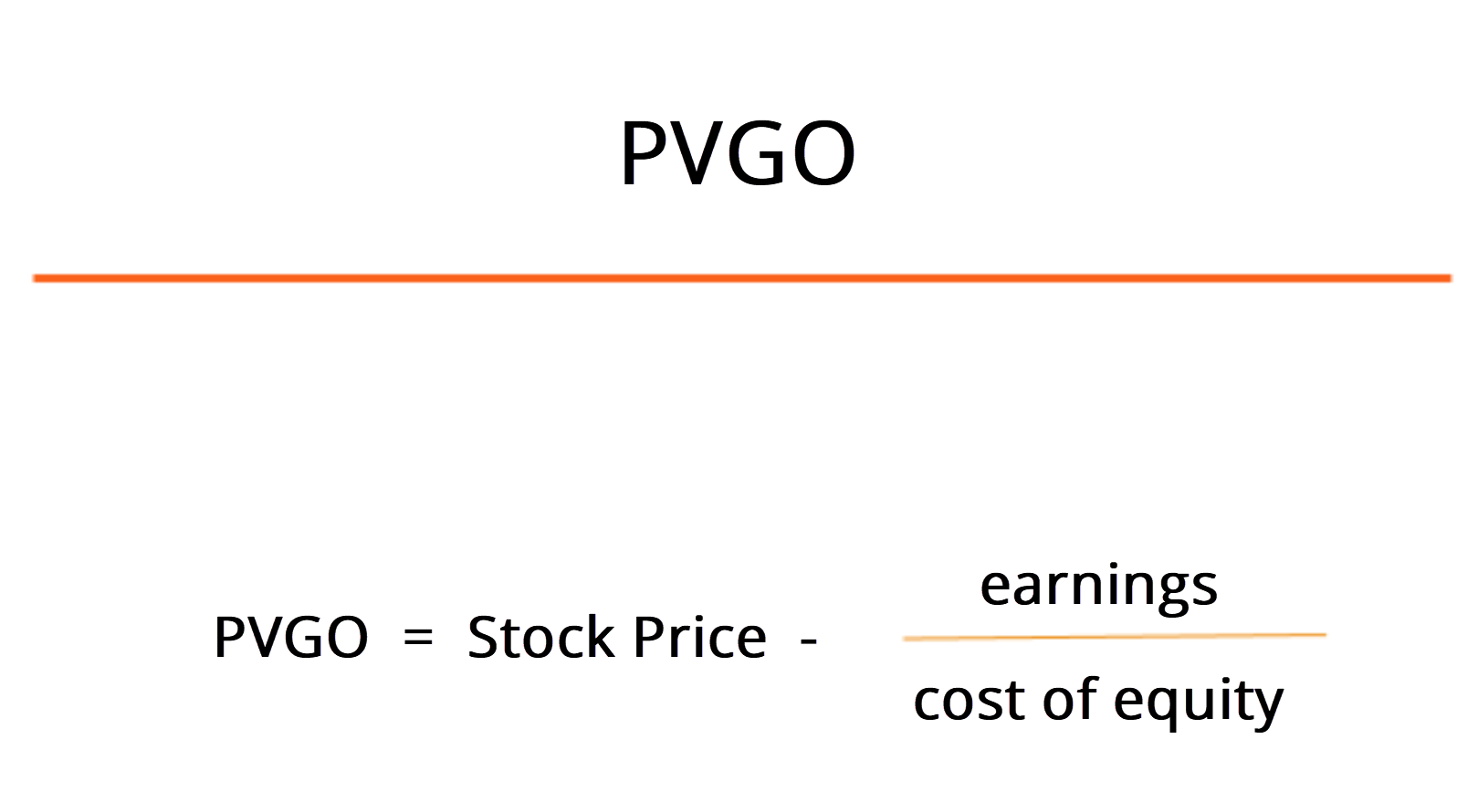

Pvgo Present Value Of Growth Opportunities Formula Examples

Pvgo Present Value Of Growth Opportunities Formula Examples

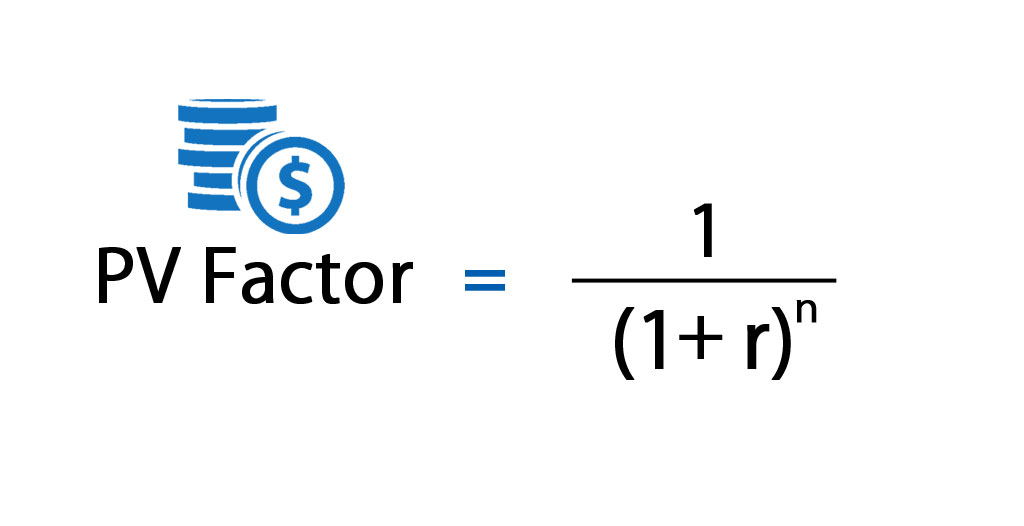

Present Value Factor Formula Calculator Excel Template

Present Value Factor Formula Calculator Excel Template

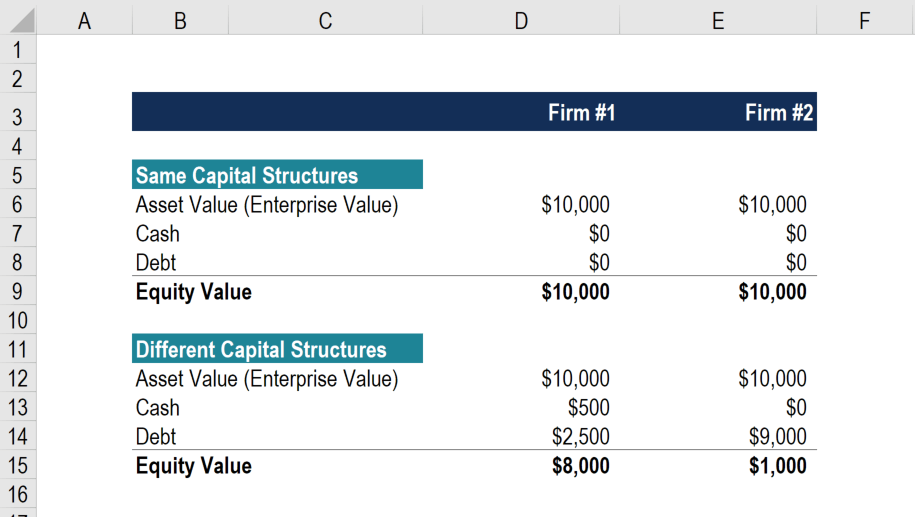

Enterprise Value Vs Equity Value Complete Guide And Examples

Enterprise Value Vs Equity Value Complete Guide And Examples

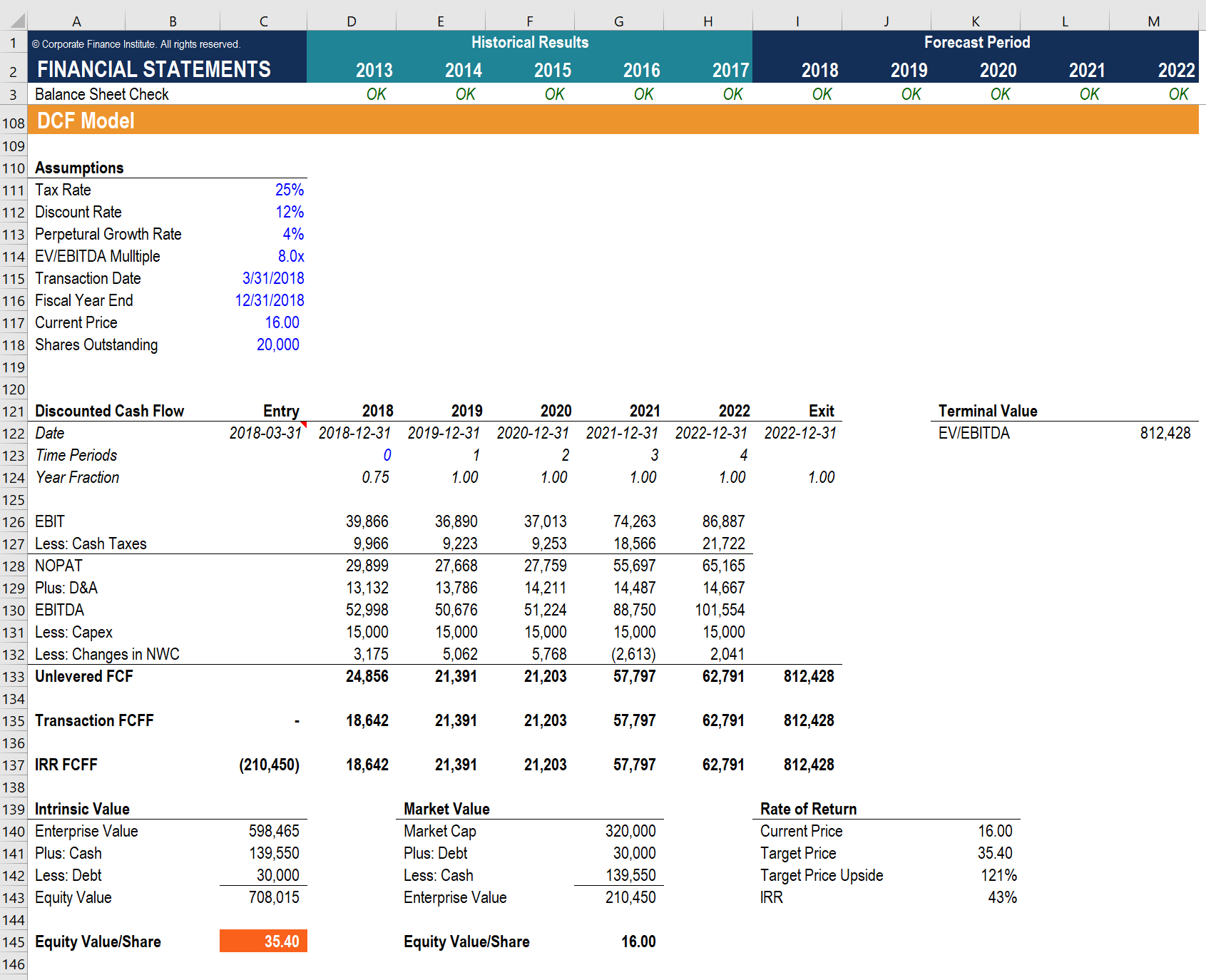

How To Calculate Terminal Value In A Dcf Analysis

How To Calculate Terminal Value In A Dcf Analysis

Rms Value Average Value Peak Value Peak Factor Form Factor In Ac Rms Root Mean Square Ohms Law

Rms Value Average Value Peak Value Peak Factor Form Factor In Ac Rms Root Mean Square Ohms Law

Dcf Terminal Value Formula How To Calculate Terminal Value Model

Dcf Terminal Value Formula How To Calculate Terminal Value Model