Is There A Capital Gains Tax In Virginia

In 2018 the IRS condensed Form 1040 significantly. Obviously Ill pay the federal capital gains tax rate regardless but is it possible to ensure I pay the lower Michigan rate.

How To Avoid Capital Gains Taxes When Selling Your House 2020

How To Avoid Capital Gains Taxes When Selling Your House 2020

Capital gains from the sale of a home for example in Virginia are taxed as regular income which means they will likely face the top rate of 575.

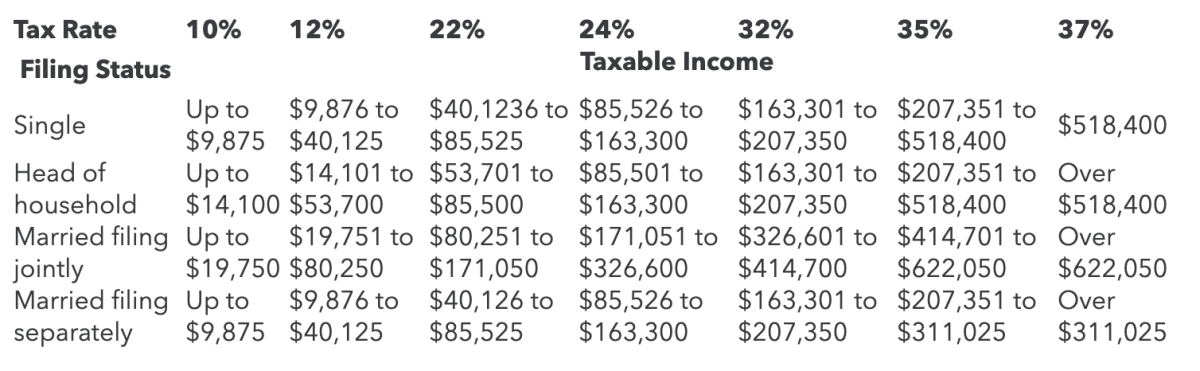

Is there a capital gains tax in virginia. Last tax season you did not directly report. The IRS answered this question directly saying It is an income tax Every state revenue department in the country all 49 states other than Washington treat capital gains taxes as income taxes. Unlike the Federal Income Tax Virginias state income tax does not provide couples filing jointly with expanded income tax brackets.

You may still need to pay the federal estate tax though. Virginia collects a state income tax at a maximum marginal tax rate of spread across tax brackets. Use HomeGains Capital Gains Calculator to determine if your gain is tax free or how much capital gains tax is owed from the sale of a property.

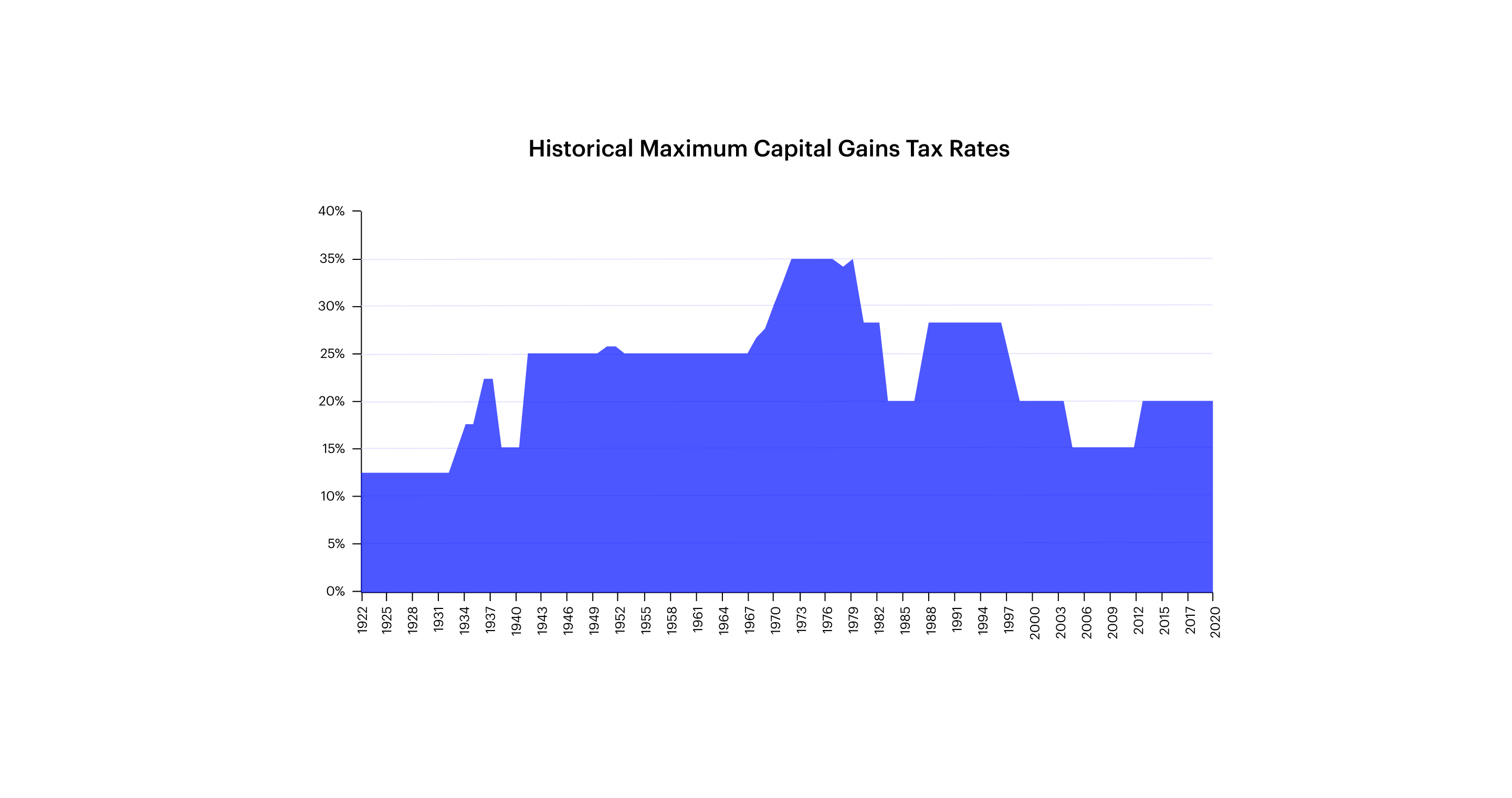

But historically there is no obvious connection between tax rates on capital gains and economic growth at the national level tax policy expert Leonard Burman notes. When you dig into your tax return for reporting 2020 income youll notice that Form 1040 has changed yet again. Capital Gains Tax Breaks Dont Drive State Economic Growth.

If you live in the house for two of the five year prior to the sale you can exclude up to 250000 500000 for a married couple in profits from taxation. For example if you bought a house years ago at 200000 and sold it for 300000 youd pay a percentage of your 100000 profit or capital gains to the government. Proponents of a capital gains tax need to be honest and call it what it is an income tax.

The state excise tax on regular gas in Virginia is 2120 cents per gallon which is the 15th-lowest in the nation. The current federal limit on how much profit you can make on the sale of your principal residence that you have held for at least 2 years before you pay capital gains tax is 500000 for a married. Virginias maximum marginal income tax rate is the 1st highest in the United States ranking directly below Virginias.

It has since been phased out. Putting capital gains reporting back on Form 1040 was a wise move by the IRS. This is great news if your house hasnt appreciated more than.

There are times where the 1031 could be very advantageous but you have to weigh the situation youre in says Eisenberg. The first and easiest way to lower your capital gains burden is to take advantage of the capital gains tax exemption. IRS Restoration Of Capital Gains To The Body Of Form 1040.

The Capital Gains Tax Exemption. The incoming leader of the Senate tax-writing committee said one of his goals is to raise tax rates on capital gains to ensure wealthy Americans pay their fair share of taxes. The capital gains tax rate is 425 in Michigan and Virginia is 575.

What is a capital gains tax. If Washington did adopt a capital gains tax moreover one wonders whether state officials would maintain their insistence that its an excise tax for purposes of the state and local tax deduction. West Virginia Estate Tax.

There is no honest debate. Home Blog How to avoid capital gains taxes when selling your house updated for 2021 How to avoid capital gains taxes when selling your house updated for 2021 By Andrew C. Virginia DHCD - OPPORTUNITY ZONES OZ Opportunity Zones are a federal economic development and community development tax benefit established as part of the 2017 Tax Cuts and Jobs Act available to investors with capital gains designed to encourage long-term private investment in low-income urban suburban and rural census tracts.

Proponents of capital gains tax breaks often argue that they spur economic growth by encouraging investment. How is the capital gain tax for the state handled. If I sell the stock in 2021 would I pay state capital gains in Michigan or Virginia.

Currently the maximum capital gains rate is 20. There is a generous tax break available to everyone. Imposing an income tax however will throw away what Washingtons.

That means that the tax wont apply to the first 250000 of your capital gains. To clarify Johanna there are no capital gains taxes payable within an RESP so your deferred capital gains on investments like your bank stocks in your RESP are irrelevant. Up until 2005 there was an estate tax based on the federal estate tax.

To finance the health-care plan he would 1 increase the top marginal income tax rate on long-term capital gains to 396 percent for taxpayers earning more than 1 million annually and 2 eliminate a tax expenditure. For singles the current exemption is 250000. Proponents of maintaining a relatively low capital gains tax rate argue that lower rates make investing more accessible to more people and stimulate economic growth.

When you buy a house and later sell it the profit is subject to capital gains taxes. When determining federal tax liability taxpayers can deduct property taxes plus their choice of income or sales taxes up to a new cap of 10000. Tax Season 2021 has begun.

Capital gains tax rates have fallen in recent years after peaking in the 1970s. There is no estate tax in West Virginia. Estates and inheritances are no longer taxed at the state level in West Virginia.

Virginia Capital Gains Tax. December 26 2020 23 min read 334 Comments. Democratic presidential candidate and former Vice President Joe Biden recently released a health-care plan that according to his campaign would cost 750 billion over a decade.

Also consider what could happen to capital gains tax rates in the future. A capital gains tax is a fee that you pay to the government when you sell your home or something else of value for more than you paid for it.

2020 2021 Capital Gains Tax Rates And How To Minimize Them Nasdaq

2020 2021 Capital Gains Tax Rates And How To Minimize Them Nasdaq

Can Capital Gains Push Me Into A Higher Tax Bracket

Can Capital Gains Push Me Into A Higher Tax Bracket

How To Calculate Capital Gains Tax On Real Estate Investment Property

How To Calculate Capital Gains Tax On Real Estate Investment Property

12 Ways To Beat Capital Gains Tax In The Age Of Trump

12 Ways To Beat Capital Gains Tax In The Age Of Trump

How High Are Capital Gains Taxes In Your State Tax Foundation

How High Are Capital Gains Taxes In Your State Tax Foundation

The Capital Gains Tax And Inflation Econofact

The Capital Gains Tax And Inflation Econofact

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Your Helpful Guide To Capital Gains Tax Rates And Losses For 2020 Capital Gains Tax Capital Gain Tax Time

Your Helpful Guide To Capital Gains Tax Rates And Losses For 2020 Capital Gains Tax Capital Gain Tax Time

What Capital Gains Taxes Do I Pay When I Sell My Home

What Capital Gains Taxes Do I Pay When I Sell My Home

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

How To Reduce Or Avoid Capital Gains Tax On Property Or Investments Capital Gains Tax Capital Gain Investing

How To Reduce Or Avoid Capital Gains Tax On Property Or Investments Capital Gains Tax Capital Gain Investing

Capital Gains Rates Before And After The New Tax Law Kwc Virginia Accounting Firm

Capital Gains Rates Before And After The New Tax Law Kwc Virginia Accounting Firm

A Guide To Short Term Vs Long Term Capital Gains Tax Rates Thestreet

A Guide To Short Term Vs Long Term Capital Gains Tax Rates Thestreet

Flipping Houses Taxes Flipping Houses Buying A Rental Property Capital Gain

Flipping Houses Taxes Flipping Houses Buying A Rental Property Capital Gain

The Beginner S Guide To Capital Gains Tax Infographic With Images Capital Gains Tax Capital Gain Investment Companies

The Beginner S Guide To Capital Gains Tax Infographic With Images Capital Gains Tax Capital Gain Investment Companies

Capital Gains Tax Calculator Estimate What You Ll Owe

Capital Gains Tax Calculator Estimate What You Ll Owe

Capital Gains Tax Brackets 2021 What They Are And Rates

Capital Gains Tax Brackets 2021 What They Are And Rates

How To Calculate Capital Gains Tax H R Block

How To Calculate Capital Gains Tax H R Block