Knoxville Tn Personal Property Tax

This website provides tax information for the City of Knoxville ONLY. County Property Tax Rate.

930 Osprey Point Ln Knoxville Tn 37922 Mls 1043463 Zillow Refinance Amortization Schedule C Mortgage Amortization Real Estate Photographer Home Mortgage

930 Osprey Point Ln Knoxville Tn 37922 Mls 1043463 Zillow Refinance Amortization Schedule C Mortgage Amortization Real Estate Photographer Home Mortgage

County assessors of property appraise real estate for assessment purposes and assess tax on tangible personal property used or held for use in business.

Knoxville tn personal property tax. 865-215-2362 Please return by. The countys average effective property tax rate is 067. 24638 per 100 assessed value.

Failure to file the signed schedule by March 1 of the tax year will result in a forced assessment in. In Tennessee only businesses pay personal property taxes not individuals or private citizens. Questions regarding information provided here can.

Mailing Address Knox County Trustee PO. Delinquent Property Tax Sale. County Appraisal Calculate.

Pay at Area Banks. Knoxville TN 37902-2405 Phone. Pay at Area Banks.

If you have questions or concerns about your Knox County property tax please contact me or my staff. The property taxes are collected by county trustees. TN 37243-9034 6157412775 To Report Fraud Waste Abuse.

Important - There is a 255 processing fee 200 minimum charge for taxes paid with a credit or debit card. In addition there is a state single article tax rate of 275 which is discussed later in this text. It is not assessed against the stock or inventory of a business neither the materials used in making a product nor the finished products.

Property Assessor City County Building Suite 204 400 Main Street Knoxville TN 37902. Monday - Friday. In the city of Knoxville the total millage rate is 45838 mills.

400 Main Street Knoxville TN 37902. Box 70 Knoxville TN 37901 Phone. The county commission and city governing bodies determine local property tax rates.

Monday - Friday 8. Keep my Tennessee Home. Tax collecting officials.

212 per 100 assessed value. Farragut Town Hall 2nd Floor 11408 Municipal Center Drive Farragut TN 37934. Of each tax year.

The Department of Revenue does not collect property tax. Assessment Tax Rate. In lieu of detailing total acquisition cost TCA.

VmHomeInit vmHomeerrorMessage. These fees are not retained by Metropolitan Government. This website provides tax information for the City of Knoxville ONLY.

Personal property and the selling of certain taxable services amusements and digital products specified in the law. The same exemptions apply to tangible personal property as they do to real estate. Estimated Tax Commercial Property.

Box 70 Knoxville TN 37901 Phone. Tangible personal property taxable services amusements and digital products specifically intended for resale. 925 7 state 225 local City Property Tax Rate.

The Clerk and Master will open the bidding process with the total due on the property for delinquent taxes through the 2012 tax year interest penalty fees and other cost associated with the sale owed to the City of Knoxville Tennessee and Knox County Tennessee. There is a 100 processing fee for taxes paid with an E-Check. In Tennessee only businesses pay personal property taxes not individuals or private citizens.

City of Knoxville Revenue Office. Tangible Personal Property is filed by a All partnerships corporations other business associations not issuing stock and individuals operating for profit as a business or profession including manufacturers except those whose property is entirely assessable by the Comptroller of the Treasury per Tennessee Code Annotated TCA 67-5-903. This is a state program funded by appropriations authorized by the General Assembly.

Tennessee state law provides for property tax relief for low-income elderly and disabled homeowners as well as disabled veteran homeowners or their surviving spouses. Submit a report online here or call the toll-free hotline at 18002325454. 67-5-903b permits a.

Compared with Tennessees other densely populated counties property tax rates in Knox County are relatively low. To Make Government Work Better. Questions regarding information provided here can be answered by calling 865-215-2084 or email at citytaxofficeknoxvilletngov.

Property Tax Resources Assessment Information for Each County Property Tax Rates. To a location outside Tennessee is exempt from personal property taxation. Mailing Address Knox County Trustee PO.

Exterior Small Front Yard Landscaping Ideas Design Awesome Design About Small Front Yard Landsca Front Yard Design Front Garden Design Small Yard Landscaping

Exterior Small Front Yard Landscaping Ideas Design Awesome Design About Small Front Yard Landsca Front Yard Design Front Garden Design Small Yard Landscaping

986 Meadowlark Dr Laguna Beach Ca 92651 Mls Oc20205032 Zillow In 2020 Custom Kitchens Design Indoor Outdoor Living Outdoor Remodel

986 Meadowlark Dr Laguna Beach Ca 92651 Mls Oc20205032 Zillow In 2020 Custom Kitchens Design Indoor Outdoor Living Outdoor Remodel

The Lights Luxury Homes Dream Houses Mansions Luxury Homes

The Lights Luxury Homes Dream Houses Mansions Luxury Homes

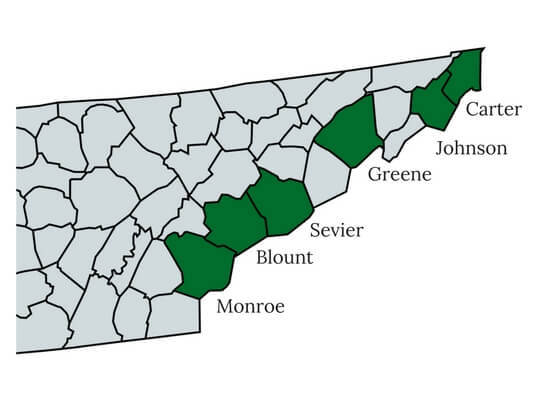

The Tennessee Counties With The Lowest Property Tax Rates

The Tennessee Counties With The Lowest Property Tax Rates

Tax Sale Trustee Knox County Tennessee Government

Tax Sale Trustee Knox County Tennessee Government

Us Home Construction Jumps 15 7 Percent In July Home Construction Home Construction

Us Home Construction Jumps 15 7 Percent In July Home Construction Home Construction

Titusville Fl 32780 1962 Single Family 3 2 1 622 Sq Ft Real Estate Auction Real Estate Auction Real Estate New Property

Titusville Fl 32780 1962 Single Family 3 2 1 622 Sq Ft Real Estate Auction Real Estate Auction Real Estate New Property

Windy Hill A Former Civil War Hospital Located On Nine Acres In Brownsville Tennessee Built In 1830 Three Bedrooms Antebellum Home Acre Building A House

Windy Hill A Former Civil War Hospital Located On Nine Acres In Brownsville Tennessee Built In 1830 Three Bedrooms Antebellum Home Acre Building A House

How To Calculate Your Tax Bill

How To Calculate Your Tax Bill

Pin On Fort Loudoun Lake Tennessee

Pin On Fort Loudoun Lake Tennessee

Mcclung Axe Co Knoxville Tn Single Bit Axe Head Restored Jersey Pattern Axe Head Restoration Pattern

Mcclung Axe Co Knoxville Tn Single Bit Axe Head Restored Jersey Pattern Axe Head Restoration Pattern

Earl Worsham Residence C 1925 Knowville Tn Barbermcmurry Architects Architect Mansions Residences

Earl Worsham Residence C 1925 Knowville Tn Barbermcmurry Architects Architect Mansions Residences

Maryville Home For Sale Maryville House Styles Real Estate

Maryville Home For Sale Maryville House Styles Real Estate

Graborchard Tennessee Crab Orchard Tn Crab Orchard Hotel 1880 Photo Picture Image Crab Orchard Family Tree Template Crossville

Graborchard Tennessee Crab Orchard Tn Crab Orchard Hotel 1880 Photo Picture Image Crab Orchard Family Tree Template Crossville

1938 Old Dogwood Trail Real Estate House Prices Loudon

1938 Old Dogwood Trail Real Estate House Prices Loudon

7 Deerwood Birmingham Al Stone Mansion Mansions Mediterranean Homes

7 Deerwood Birmingham Al Stone Mansion Mansions Mediterranean Homes

Tennessee Property Tax Calculator Smartasset

Tennessee Property Tax Calculator Smartasset

Real Estate Capital Gains When Selling A Home Capital Gain Real Estate Real Estate Investing

Real Estate Capital Gains When Selling A Home Capital Gain Real Estate Real Estate Investing