Nyc Property Tax Veterans Exemption

This exemption is for any veteran who has served at least 90 days of active duty during wartime. The property must be the primary residence of the owner who qualifies for the exemption.

Https Www Stlawco Org Sites Default Files Veterans Nystaxdata Veterans 20q 26a 20tax 20exemptions 2004 08 Pdf

The taxing jurisdiction may opt to allow the exemption in instances where title to residential property is in the name of a Gold Star Parent defined as the parent of a child who died in the line of duty while serving in the U.

Nyc property tax veterans exemption. Both residences must be located in New York State. Some properties such as those owned by religious organizations or governments are completely exempt from paying property taxes. Exemptions may apply to school district taxes.

A property tax break for seniors who own one- two- or three-family homes condominiums or cooperative apartments. This exemption is called the Alternative Veterans Exemption. Requirements for Alternative Veterans Benefit.

The application must be received within 30 days of the purchase of the new. 11-1021 of the Administrative Code of the City of New York. For instructions see Form RP-458-a-I Instructions for Form RP-458-a Application for Alternative Veterans Exemption from Real Property Taxation File the form with your municipal assessor.

Do not file any exemption applications with the NYS Department of Taxation and Finance or with the Office of Real Property Tax Services. Applicants for the Alternative Veterans exemption must have served in one of the following conflicts. Veterans can receive one of the three following exemptions.

Most exemptions are offered by local option of the taxing jurisdiction municipality county or school district. Thanks to changes in city and state law the SCHE and DHE Disabled Homeowners Exemption tax breaks are now available to homeowners with a combined annual income of 58399 or less. If you received a Veterans Exemption on a property and can show proof that your previous residence was granted the exemption you may be able to transfer the exemption to a new property.

Armed Forces during a time of war. Transfer of Veterans Exemption. Both residences must be located in New York State.

A veteran who served during one of the Qualified Service periods of war or conflict The spouse of a qualified veteran. The City of New York offers tax exemptions and abatements for seniors veterans clergy members people with disabilities and other homeowners. Army Navy Air Force Marines and Coast Guard.

See our Municipal Profiles for your local assessors mailing address. A disabled veteran in New York may receive one of three different property tax exemptions on hisher primary residence. Parents of soldiers who died in the line of duty Gold Star parent can get a reduction to their property tax.

The Veterans Exemption helps veterans and their family members reduce their property taxes. You must complete a Veterans Exemption Application and show proof that your previous residence was granted the exemption. Disclosure is requested to facilitate the processing of real property income and expense data.

SECTION 2 - Property Tax Exemptions or Abatements STAR - Basic or Enhanced Veterans. The deadline in most communities is March 1please confirm the date with your assessor. Obtaining a veterans exemption is not automatic If youre an eligible veteran you must submit the initial exemption application form to your assessor.

Disclosure by lessees is voluntary. If you received a Veterans Exemption at your previous residence and have moved you may be able to transfer the exemption to the new property. From To Gulf War.

An 100 percent disabled veteran will receive a full property tax exemption. There are three different property tax exemptions available to veterans who have served in the U. THE CURRENT VETERANS EXEMPTION LAW State law provides that Nassau County veterans applying for the first time for a Veterans Real Property Tax Exemption shall receive an exemption based on the type of service they rendered to their country during wartime.

Exemption applications must be filed with your local assessors office. The exemption applies to county city town and village taxes. Such data including any Social Security Numbers.

Others are partially exempt such as veterans who qualify for an exemption on part of their homes and homeowners who are eligible for the School Tax Relief STAR program. Honorably discharged veterans in Connecticut may qualify for a property tax exemption of 1500 from the total assessed value of the home which must be a primary residence. Apply online by March 16th for benefits to begin on July 1.

These benefits can lower your property tax bill. These benefits can lower your property tax bill. Qualified Veterans spouses or their un-remarried surviving spouses.

Use Form RP- 458-a Application for Alternative Veterans Exemption from Real Property Taxation. Armed Forces including veterans who have served in the US. There are three different property tax exemptions available to Veterans who have served in the United States Armed Forces.

Veterans Property Tax Exemption NYC Department of Finance. If you are a qualifying veteran but not enrolled you must apply by March 15 2020 to begin receiving the exemption and extended benefits beginning on July 1 2020. Applicants must submit the Form DD-214.

To be eligible the property must be your primary residence and you must be.

Https Www1 Nyc Gov Assets Taxcommission Downloads Pdf Tc600pe Pdf

Https Www1 Nyc Gov Portal Apps 311 Literatures Dof Homeowners Exemption Application General 11 26 2013 Pdf

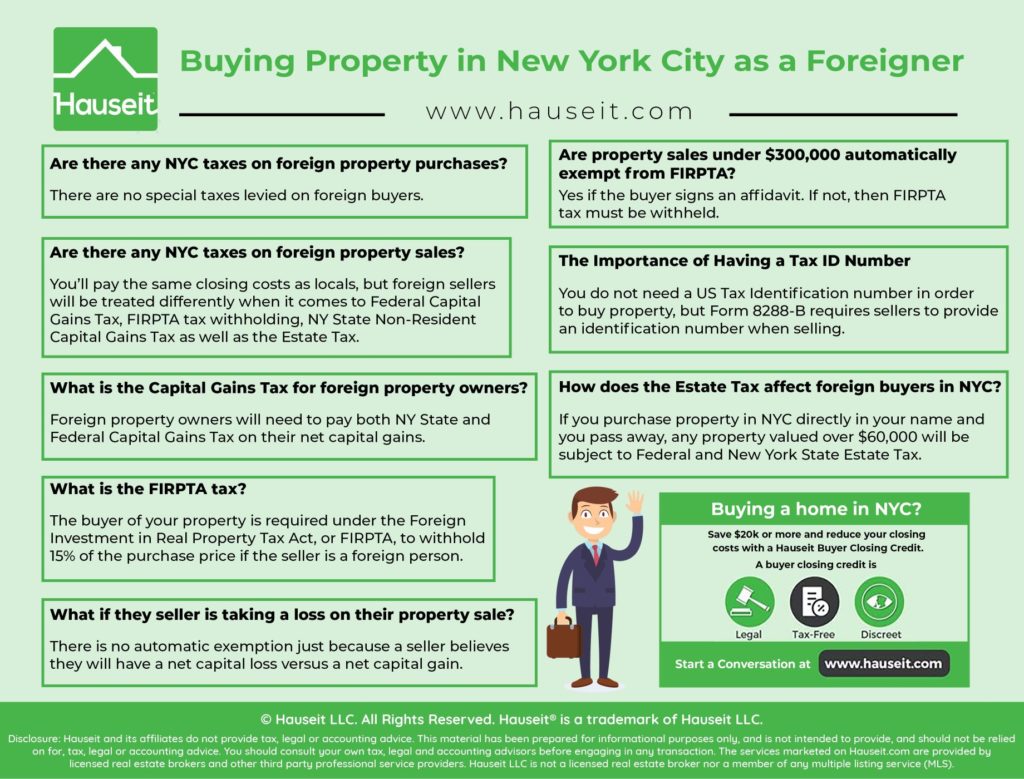

Buying Property In New York City As A Foreigner Hauseit Nyc

Buying Property In New York City As A Foreigner Hauseit Nyc

Http Www Cynthiaramirez Nyc Uploads 1 1 8 7 118704813 Class 1 Guide 1 Pdf

Https Www1 Nyc Gov Assets Finance Downloads Pdf Taxpayer Advocate Ota Property Reference Card Pdf

Https Www1 Nyc Gov Assets Finance Downloads Pdf Reports Reports Property Tax Nyc Property Fy20 Pdf

Https Www1 Nyc Gov Assets Finance Downloads Pdf Lien Sale 2016 Checklist Pdf

It S Easy To Apply For Property Tax Exemptions Fnyhc

It S Easy To Apply For Property Tax Exemptions Fnyhc

Audit Report On The New York City Department Of Finance S Administration Of The Veterans Exemption Programs Office Of The New York City Comptroller Scott M Stringer

Audit Report On The New York City Department Of Finance S Administration Of The Veterans Exemption Programs Office Of The New York City Comptroller Scott M Stringer

Https Www1 Nyc Gov Assets Finance Downloads Pdf Lien Sale 2018 Checklist 2018 Pdf

Https Www1 Nyc Gov Assets Finance Downloads Pdf Press Release 2019final Liensale Extensionpressrelease Pdf

Http Arc Riverdale Com Wp Content Uploads 2015 05 Coop Condo Property Tax Guide Pdf

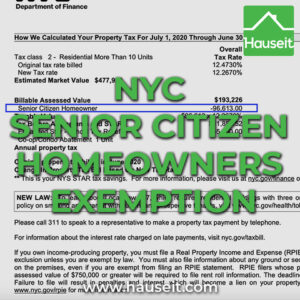

What Is The Nyc Senior Citizen Homeowners Exemption Sche

What Is The Nyc Senior Citizen Homeowners Exemption Sche