Property Capital Gains Tax Calculator South Africa

Yes No Not sure Get SARS Tax Dates and Deadlines in your Inbox. Capital gains tax CGT isnt classed as a separate tax but forms part of income tax.

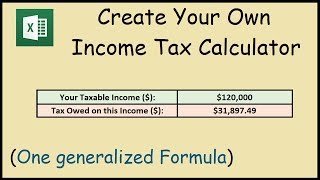

How To Create An Income Tax Calculator In Excel Youtube

How To Create An Income Tax Calculator In Excel Youtube

The taxable gain as per the calculation above on the primary residence must be included.

Property capital gains tax calculator south africa. Capital Gains Tax Calculator 2021 Author. The CGT rate can range from 72 to 18 depending on the tax bracket youre in. Instituted in South Africa on 1 October 2001 this date is considered the valuation date and only gains made on a property from this date are liable for CGT.

Capital gains are taxed at a lower effective tax rate than ordinary income. Marcel Roos Last modified by. Working out your capital gain.

Assume that the annual marginal rate of tax on income is 41 which is applied to the R424 000 then the capital gains tax will be R173 840. For further guidance on this issue please consult your Tax Consultant or Financial Advisor. R26 666 x 40 R10 666 is added to Sarahs taxable income and will be taxed at her marginal rate of tax.

The same goes with property investments when you record a profit or gain after selling your investment property you are expected to paying your share of capital gains tax. If we assume her marginal tax rate is 36 then approximately R3 840 capital gains tax will be payable ie. Calculate Capital Gains Tax on property.

If you have Capital Gains Tax to pay. Capital gains tax CGT was introducedin South Africa with effect from 1 October 2001 referred to as the valuation date and applies to the disposal of an asset on or after that date. This means that while any individual selling a property is liable for CGT the value on which CGT will be calculated will be based on the value of the property as at 1.

The usual high-income tax suspects California New York Oregon Minnesota New Jersey and Vermont have high taxes on capital gains too. A portion of your capital gain gets added to your other income for that tax year and youre taxed in your tax bracket your combined earnings for that tax year are taxed. SARS Capital Gains Tax Calculator Work out the Capital Gains Tax Payable on the disposal of your Asset.

This means that while any individual selling a property is liable for CGT the value on which CGT will be calculated will be based on the value of the property as at 1 October 2001. Have you disposed of an asset this year. It is therefore important to note that if you are a South African resident and own a property in any foreign country you will be liable for CGT in South Africa when the.

This is by far the most comprehensive accurate residential property investment forecast solution for the South African residential property market. You must report and pay any Capital Gains Tax on most sales of UK property within 30 days. The template incorporates variable monthly interest rates an unlimited number of ad hoc bond repayments variable annual capital growth rates and property income tax capital gains tax calculations.

This means that 40 of the gain ie. The taxable gain as per the calculation above on the primary residence must be included. It came into effect in South Africa on 1 October 2001 this date is considered the valuation date and only gains made on a property from this date are liable for CGT.

However the good news is this Capital Gains Tax Calculator will help you find the result as well as estimate the financial value of deferring those taxable gains through a 1031 like-kind exchange. When you make a profit in any business the government takes a share of the gains you make by charging you with tax. Internationally such a tax is not uncommon with many of South Africas trading partners having implemented CGT decades ago.

A resident as defined in the Income Tax Act 58 of 1962 is liable for CGT on assets located both in and outside South Africa. DO I HAVE TO PAY. Using the Capital Gains Tax Calculator.

Capital Gains Tax Death is a capital gains tax event and therefor a calculation of the capital gains tax payable by the deceased estate needs to be completed. A non-resident is liable to CGT only on immovable property in South Africa or assets of a permanent establishment branch in South. Below is more information about the capital gains tax and how to use this calculator.

1162014 125655 PM Other titles. CGT Calculator Tax table Individual No CGT CalculatorPrint_Area TaxEntity Company. Capital gains tax CGT is not a separate tax but forms part of income tax.

Capital Gains Taxes on Property. In South Africa CGT is not a flat rate. A capital gain arises when you dispose of an asset on or after 1 October 2001 for proceeds that exceed its base cost.

A good capital gains calculator like ours takes both federal and state taxation into account. New Hampshire and Tennessee dont tax income but do tax dividends and interest. Capital Gains Tax came into effect on 1 October 2001 and applies to all South African residents for tax purposes and foreign citizens who own fixed property in South Africa.

South Africa Site secured by Comodo Security. R10 666 x 36. Introduced in South Africa with effect from1 October 2001 aka the valuation date Capital Gains Tax is a levy charged by the South African Revenue Service SARS on the disposal of an asset on or after this valuation date.

Assume that the annual marginal rate of tax on income is 41 which is applied to the R424 000 then the. The inclusion rate for capital gains is 40 for individuals.

Seven Steps To Heaven Taxation

Seven Steps To Heaven Taxation

Guide To Know About Capital Gains Tax And Selling Property In South Africa Capital Gains Tax Tax Preparation Tax Preparation Services

Guide To Know About Capital Gains Tax And Selling Property In South Africa Capital Gains Tax Tax Preparation Tax Preparation Services

Ways To Get Car Finance For Blacklisted People In South Africa Car Finance Car Finance

Ways To Get Car Finance For Blacklisted People In South Africa Car Finance Car Finance

How To Calculate Your Income Tax In 5 Simple Steps 2021

How To Calculate Your Income Tax In 5 Simple Steps 2021

How To Calculate Income Tax Tax Calculations Explained With Example By Yadnya Youtube

How To Calculate Income Tax Tax Calculations Explained With Example By Yadnya Youtube

Capital Gains Tax Calculator Real Estate 1031 Exchange

Capital Gains Tax Calculator Real Estate 1031 Exchange

How To Clear Your Name From Blacklist In South Africa Names Clear Bad Credit

How To Clear Your Name From Blacklist In South Africa Names Clear Bad Credit

Taxable Income Formula Examples How To Calculate Taxable Income

Taxable Income Formula Examples How To Calculate Taxable Income

Capital Gains Tax The Basics Contador Accountants

How To Calculate Capital Gains Tax H R Block

How To Calculate Capital Gains Tax H R Block

Capital Gains Tax Individuals Part 2 Acca Taxation Tx Uk Youtube

Capital Gains Tax Individuals Part 2 Acca Taxation Tx Uk Youtube

This Is A Short List Of The Taxes Your Business Could Be Liable For Business Types Of Taxes Tax

This Is A Short List Of The Taxes Your Business Could Be Liable For Business Types Of Taxes Tax

Capital Gains Tax Rate Types And Calculation Process

Capital Gains Tax Rate Types And Calculation Process