Property Tax Calculator Franklin County Ohio

Unpaid Current Taxes 000. Checking the Franklin County property tax due date.

1930 Tudor Ashtabula Oh 325 000 Historic Homes Old House Dreams House Styles

1930 Tudor Ashtabula Oh 325 000 Historic Homes Old House Dreams House Styles

The last countywide reappraisal in Franklin County was in 2017.

Property tax calculator franklin county ohio. Our Franklin County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Indiana and across the entire United States. This tool is updated after our office receives the effective tax rates from the State each year. 123 Main Parcel ID Ex.

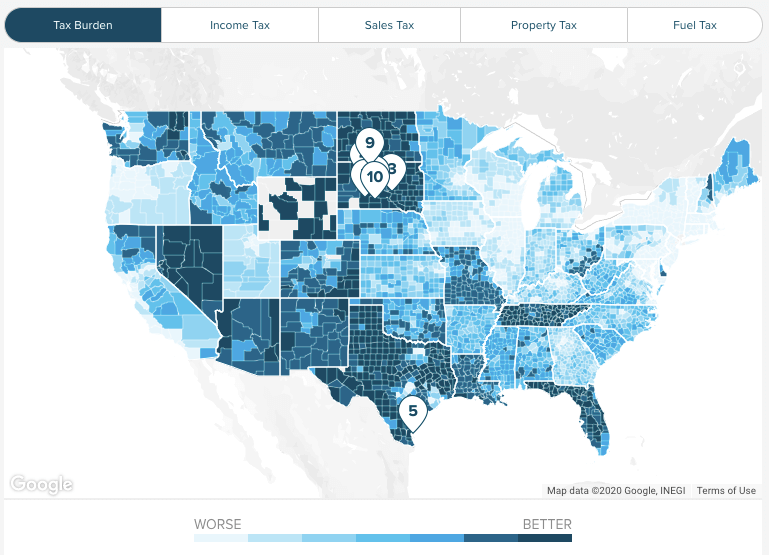

Our Ohio Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Ohio and across the entire United States. Similarly Ohios statewide sales tax rate is 575 but when combined with county sales tax rates ranging from 075 up to 225 the total average rate is 717. Penalty and Interest 000.

373 South High Street 26th FloorThe Franklin County Assessors Office is located in Columbus Ohio. Franklin County is located in central Ohio and contains the state capital Columbus. The Franklin County Treasurer makes every effort to produce and publish the most current and accurate information possible.

Taxes for a 100000 home in Columbus - 100000 x 148 148000. Special Assessment Amount 4711. Penalty and Interest 000.

The County assumes no responsibility for errors. Your property tax bill. On average the county has the third-highest property tax rate in Ohio with an average effective rate of 205.

Unpaid Current Taxes 000. Penalty and Interest 000. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

Overview of Ohio Taxes. Yearly median tax in Franklin County The median property tax in Franklin County Ohio is 2592 per year for a home worth the median value of 155300. Thanks for visiting our site.

Estimate Property Tax Our Franklin County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Ohio and across the entire United States. In Franklin County that fee is 3 per every 1000 of the sale price with a 3 minimum and a 050 per parcel transfer tax. The assessors office is located in the same building as the Franklin.

Calculate Your Tax This is only an estimated tax. Penalty and Interest 000. Multiply the market value of the property by the percentage listed for your taxing district.

Transfer Tax Conveyance Fee Calculator Throughout Ohio there is a Transfer Tax and Conveyance fee on real property and manufactured homes. For the correct tax amount please call the Franklin County Treasurer at 509-545-3518 Estimated taxes payable for 2019. For all filers the lowest bracket applies to income up to 22150 and the highest bracket only applies to income above 221300.

Unpaid Current Taxes 000. Ohio has a progressive income tax system with six tax brackets. Search for a Property Search by.

A simple percentage used to estimate total property taxes for a property. The information on this web site is prepared from the real property inventory maintained by the Franklin County Auditors Office. Tax rates are established for the next year by the State of Ohio Department of Taxation.

This calculator does not take into consideration any special assessments charges or CAUV related to specific properties. Unpaid Current Taxes 000. In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property.

Rates range from 0 to 4797. Special Assessment Amount 000. King County Washington Property Tax Calculator Show 2015 Show 2016 Show 2017 Show 2018 Show 2019 Show 2020 Places Receiving the Most Value for Their Property Taxes.

Columbus is the county seat of Franklin County where most local government offices are located. The Ohio Department of Taxation is dedicated to providing quality and responsive service to you our individual and business taxpayers our state and local governments and the tax practitioners in Ohio. In-depth Franklin County OH Property Tax Information.

Franklin County collects on average 167 of a propertys assessed fair market value as property tax. Alone that would place Ohio at the lower end of states with an income tax but many Ohio municipalities also charge income taxes some as high as 3. Users of this data are notified that the primary information source should be consulted for verification of the information contained on this site.

There are more than 600 Ohio cities and villages that add a local income tax in addition to the. John Smith Street Address Ex.

Stuff You Should Know Real Property Taxes In Ohio Waller Financial Planning Group

Stuff You Should Know Real Property Taxes In Ohio Waller Financial Planning Group

The Official Site Of The Cuyahoga County Fiscal Officer

The Official Site Of The Cuyahoga County Fiscal Officer

Local Property Tax Rates Rising Faster Than Inflation News The Columbus Dispatch Columbus Oh

Local Property Tax Rates Rising Faster Than Inflation News The Columbus Dispatch Columbus Oh

Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy

Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy

Not All Senior Citizens Still Qualify For Ohio Property Tax Discounts Homestead Savings Calculator Cleveland Com

Not All Senior Citizens Still Qualify For Ohio Property Tax Discounts Homestead Savings Calculator Cleveland Com

Timeline To The Closing Table Explained Kate Ladwig Enid Ok Realtor Coldwell Banker Rea Real Estate Infographic Mortgage Marketing Real Estate Marketing

Timeline To The Closing Table Explained Kate Ladwig Enid Ok Realtor Coldwell Banker Rea Real Estate Infographic Mortgage Marketing Real Estate Marketing

Ruby Drive Infrastructure Developments Get Green Light Surfky News Budgeting Development Hopkins County

Ruby Drive Infrastructure Developments Get Green Light Surfky News Budgeting Development Hopkins County

Indiana Property Tax Calculator Smartasset

Indiana Property Tax Calculator Smartasset

Your New Home May Be Closer Than You Think Old Houses Moving News

Your New Home May Be Closer Than You Think Old Houses Moving News

These 8 Waterparks In Alabama Are Pure Bliss For Anyone Who Goes There In 2020 Water Park Alabama Travel Red Bay

These 8 Waterparks In Alabama Are Pure Bliss For Anyone Who Goes There In 2020 Water Park Alabama Travel Red Bay

Franklin County Property Tax Records Franklin County Property Taxes Oh

Franklin County Property Tax Records Franklin County Property Taxes Oh

Indiana Income Tax Calculator Smartasset

Indiana Income Tax Calculator Smartasset

Saratoga County Property Tax Records Saratoga County Property Taxes Ny

Saratoga County Property Tax Records Saratoga County Property Taxes Ny

10 Things You Need To Know About Your Property Tax Bill Entertainment Life The Columbus Dispatch Columbus Oh

10 Things You Need To Know About Your Property Tax Bill Entertainment Life The Columbus Dispatch Columbus Oh

Ohio Property Tax Calculator Smartasset

Ohio Property Tax Calculator Smartasset

Franklin County Auditor Tax Estimator

Franklin County Auditor Tax Estimator

Https Apps Franklincountyauditor Com Content Informals Understandingpropertyvalueandpropertytax Pdf

Focus On The Essence Of Your Business Let Us Take Care Of The Rest Get Your Free Trial Today Www Eats365pos Food Smoked Salmon And Eggs Gourmet Recipes

Focus On The Essence Of Your Business Let Us Take Care Of The Rest Get Your Free Trial Today Www Eats365pos Food Smoked Salmon And Eggs Gourmet Recipes