Property Tax Rate Hillsborough County

Hillsboroughs central location between the nations largest and fifth largest metropolises has allowed the town to grow steadily into the large diverse municipality it is today. Hillsborough County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax collections.

Which Tampa Bay County Pays The Highest Property Taxes Lawnstarter

Which Tampa Bay County Pays The Highest Property Taxes Lawnstarter

If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Hillsborough County Tax Appraisers office.

Property tax rate hillsborough county. This includes real estate and tangible personal property the equipment machinery and fixtures of businesses. Tampa Bay Property Taxes Tax rate Tax bill Average home value. Welcome to the Hillsborough County Tax Collectors website.

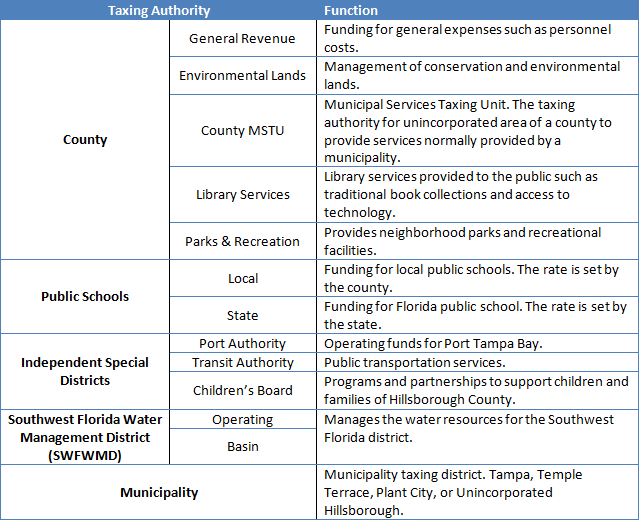

Hillsborough Township is part of Somerset County located in the center of New Jersey. According to Florida Statute 197122 all property owners have the responsibility to know the amount of tax due and to pay the taxes before April 1. Taxes are assessed by the Property Appraiser as of January 1 of each year and levied in Hillsborough County by the taxing authorities.

Services Hours General Office Hours 800 am. Tax collectors also process and issue refunds for overpayment of property taxes. In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property.

Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Apply for Business Tax account Run a Business Tax report Run a Central Assessment report Run a Real Estate report Run a Tangible Property report Get bills by email. A tax deed may be sold if the property owner has not paid all back taxes interest and fees within two years. Hillsborough County collects on average 109 of a propertys assessed fair market value as property tax.

Title Tag Registration. Taxes are normally payable beginning November 1 of that year. If a property tax bill is not paid by the following March 31 the tax collector sells a tax certificate on that property in order to collect the unpaid taxes.

Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Apply for Business Tax account Edit Business Tax account Run a Business Tax report Run a Central Assessment report Run a Real Estate report Run a Tangible Property report Get bills by email. Driver License where applicable. The township is situated 52 miles from Manhattan and 55 miles from downtown Philadelphia.

The well-being of our customers and employees is of the utmost importance. Welcome to the Hillsborough County Tax Collectors online office where we strive to provide Hillsborough County citizens with the best customer service possible. The municipalities in Hillsborough County who have an ordinance allowing the exemption to apply on the taxes levied to that municipality are.

The median property tax on a 19890000 house is 216801 in Hillsborough County. The median property tax in Hillsborough County Florida is 2168 per year for a home worth the median value of 198900. The median property tax also known as real estate tax in Hillsborough County is 216800 per year based on a median home value of 19890000 and a median effective property tax rate of 109 of property value.

The Hillsborough County Property Appraiser is an elected official charged with the duty and responsibility to appraise all of the property in the County. In-depth Hillsborough County NH Property Tax Information. Hillsborough County Tax Collectors Office.

City of Tampa up to 50000 Unincorporated Hillsborough County up to 50000 and Temple Terrace up to 25000. Search all services we offer. Tangible Property Tax Payment.

The median property tax on a 19890000 house is 192933 in Florida. We have been in contact with health officials and assure you we are closely monitoring the Coronavirus and taking recommended precautions.

Private Investors Hard Money Land Loans In Hillsborough County Hard Money Loans Hard Money Lenders Money Lender

Private Investors Hard Money Land Loans In Hillsborough County Hard Money Loans Hard Money Lenders Money Lender

What Is Florida S Sales Tax Discover The Florida Sales Tax Rate For 67 Counties

What Is Florida S Sales Tax Discover The Florida Sales Tax Rate For 67 Counties

University Mall Is Moving Forward With A Comprehensive Plan Amendment To Redevelop Its Property Into A Mix Hillsborough County This Or That Questions Mixed Use

University Mall Is Moving Forward With A Comprehensive Plan Amendment To Redevelop Its Property Into A Mix Hillsborough County This Or That Questions Mixed Use

Hillsborough Commission Keeps Property Tax Rate Flat But 2020 Budget Grows To 6 62 Billion

Hillsborough Commission Keeps Property Tax Rate Flat But 2020 Budget Grows To 6 62 Billion

2020 Best Places To Buy A House In Hillsborough County Fl Niche

2020 Best Places To Buy A House In Hillsborough County Fl Niche

Hillsborough County Issues Fines For Nightly Airbnb Rentals

Hillsborough County Issues Fines For Nightly Airbnb Rentals

Property Tax Portability Tampa Fl Hillsborough County Pinellas The Tampa Real Estate Insider

Property Tax Portability Tampa Fl Hillsborough County Pinellas The Tampa Real Estate Insider

October Housing Stats Hillsborough County Real Estate Marketing Hillsborough

October Housing Stats Hillsborough County Real Estate Marketing Hillsborough

Hillsborough County Property Appraiser Property Info Greenbelt Agriculture

Hillsborough County Property Appraiser Property Info Greenbelt Agriculture

Home Hillsborough County Tax Collector

Home Hillsborough County Tax Collector

The First Step To Creating A Spending Plan Is To Come Up With Some Smart Financial Goals Make Sure They Are Specific Me Financial Goals Financial Smart Goals

The First Step To Creating A Spending Plan Is To Come Up With Some Smart Financial Goals Make Sure They Are Specific Me Financial Goals Financial Smart Goals

Hillsborough County Property Appraiser Downloads Maps Data

Hillsborough County Property Appraiser Downloads Maps Data

Hillsborough County Property Appraiser Our Office Budget Tax Roll Stats

Hillsborough County Property Appraiser Our Office Budget Tax Roll Stats

Off Market Rental In Tampa For Sale 2910 Missouri Ave Tampa Fl 33619 Single Family 2 Bedrooms Rental Property Property Outdoor Structures

Off Market Rental In Tampa For Sale 2910 Missouri Ave Tampa Fl 33619 Single Family 2 Bedrooms Rental Property Property Outdoor Structures

New Hampshire Property Tax Calculator Smartasset

New Hampshire Property Tax Calculator Smartasset

نکاتی که در خرید ملک باید بدانیم Home Maintenance Checklist Home Buying Home Loans

نکاتی که در خرید ملک باید بدانیم Home Maintenance Checklist Home Buying Home Loans

Hillsborough Property Appraiser Seeks Property Tax Relief For Covid 19 Wusf Public Media

Hillsborough Property Appraiser Seeks Property Tax Relief For Covid 19 Wusf Public Media