Property Tax Rate Jefferson Parish

2016 Jefferson Parish Assessors Office. In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property.

Http Snaprealtynola Com Wp Content Uploads 2017 11 Jefferson Parish Tax Info 3 17 Pdf

Its duties also include organizing and directing annual tax sales.

Property tax rate jefferson parish. The calculator will automatically apply local tax rates when known or give you the ability to enter your own rate. For a nationwide comparison of each states highest and lowest taxed counties see median property tax by stateTo find detailed property tax statistics for any county in Louisiana click the countys name in the data table above. The calculator is clever its designed to give you property tax estimates for New Orleans area parishes and even has special assessments noted for particular subdivisions.

The total assessed value of all property in the parish which also includes utilities and certain commercial fixtures and equipment was 396 billion up about 3 from 383 billion. If a Homestead Exemption HEX is in place you would then subtract 7500 75000 HEX x 10 from the assessed value to get the taxable amount. Estimate your Louisiana Property Taxes Use this Louisiana property tax calculator to estimate your annual property tax payment.

Keep in mind that the tax commissions list does not include additional property taxes collected in municipalities. Millages Wards. Jefferson Parish Located in southeast Louisiana adjacent to the city of New Orleans Jefferson Parish has a property tax rate of 052.

To find an estimate of your yearly taxes you start by multiplying the current Market Value by 10. The median property tax also known as real estate tax in Jefferson Parish is 75500 per year based on a median home value of 17510000 and a median effective property tax rate of 043 of property value. In-depth Jefferson Parish LA Property Tax Information.

Property Maintenance Zoning Quality of Life Public Information Office Public Works Purchasing Risk Management. Planning Main Line 504 736-6320 Fax 504 731-4560. The Property Tax Divisions primary function is to collect property taxes on real estate and moveable property based on the assessed value as determined by the Jefferson Parish Assessors Office.

The median property tax in Louisiana is 24300 per year for a home worth the median value of 13540000. The median property tax in Jefferson Parish Louisiana is 755 per year for a home worth the median value of 175100. If you are seeking certification of taxes paid for the purposes of an act of sale re-financing or to comply with other legal requirements please click the Tax Research Certificate button below to order one online or contact the Bureau of Revenue and Taxation 504 363-5710 for a tax research certificate.

This rate is based on a median home value of 180500 and a median annual tax payment of 940. Yenni Building 1221 Elmwood Park Blvd Suite 601 Jefferson LA 70123 Phone Numbers. Jefferson Parish DebitCredit Card Postings.

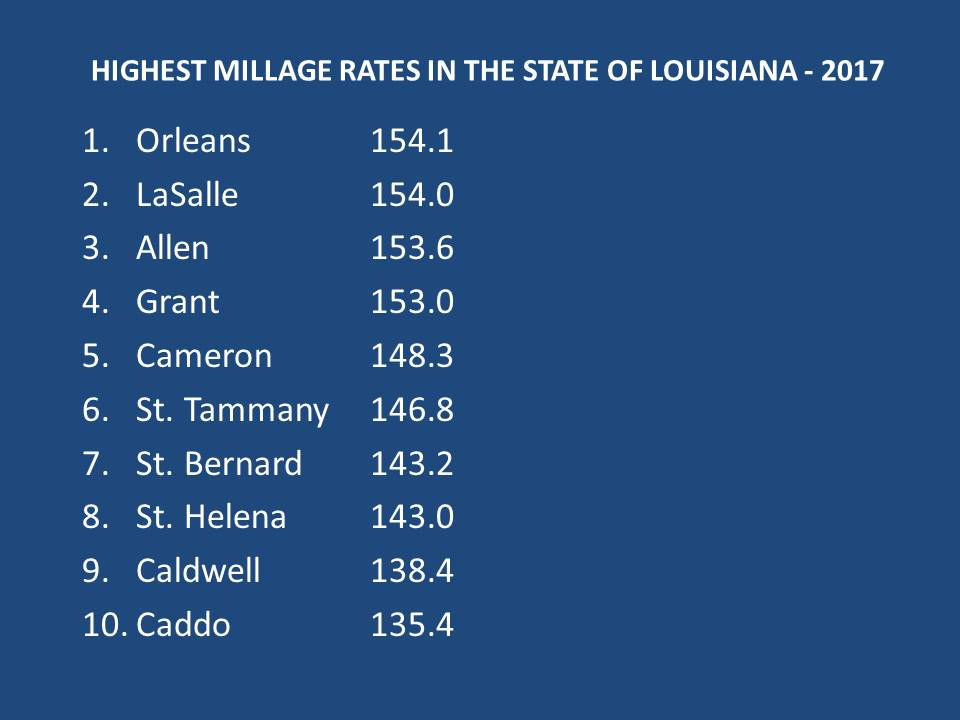

This gives you the assessment on the parcel. Orleans Parish topped the list with a millage rate of 1541 with St. Jefferson Parish collects on average 043 of a propertys assessed fair market value as property tax.

In May Jefferson Parish voters passed a millage in May allowing a 79 million 10-year property tax to raise funds for teachers and other employees. Tammany the next highest in the metro area at 1468 mills followed by St. View Pay Water Bill.

The Jefferson Parish Assessors Office determines the taxable assessment of property. Counties in Louisiana collect an average of 018 of a propertys assesed fair market value as property tax per year. Use this New Orleans property tax calculator to estimate your annual property tax payment.

Bernard at 1432 the report shows. Working Hours Monday Friday. The tax rate is the sum of the individual millage that were approved by voters for such purposes as fire protection law enforcement education recreation and other functions of parish government.

Property Tax Calculator Trieu Law Llc

Property Tax Calculator Trieu Law Llc

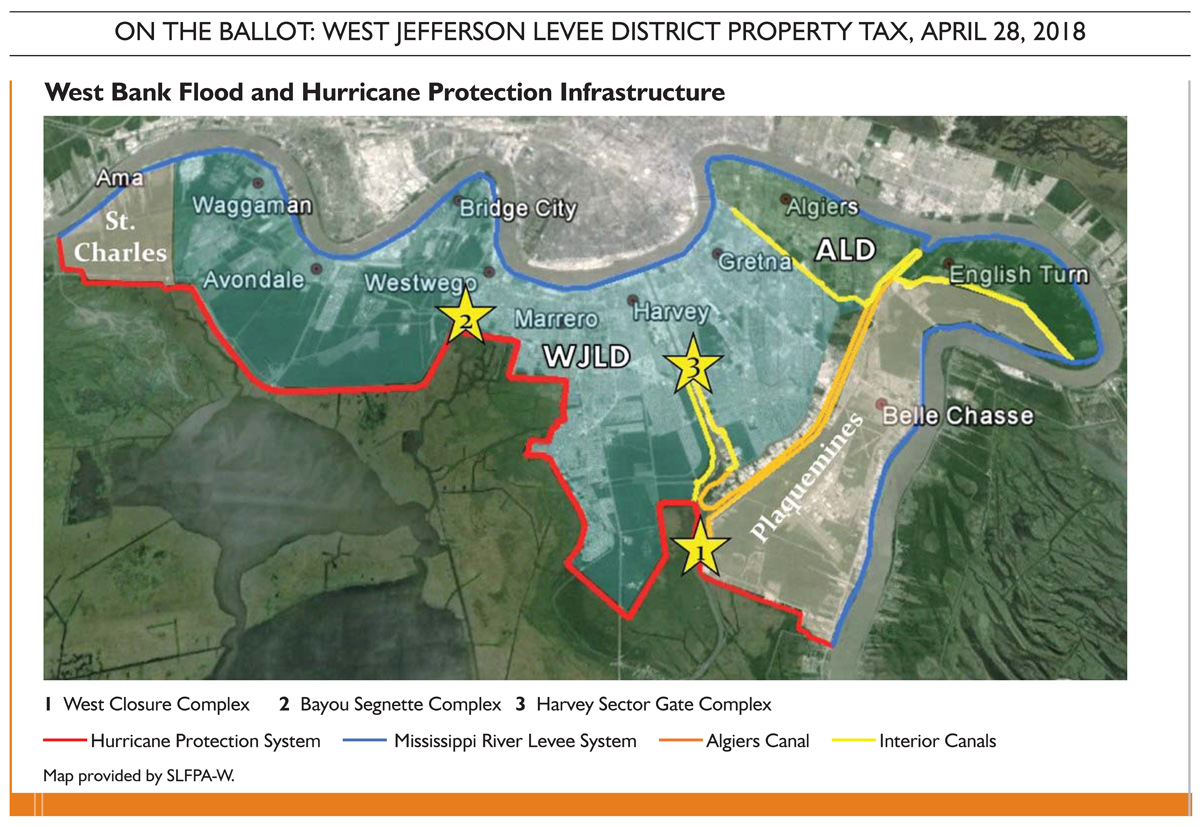

On The Ballot West Jefferson Levee District Millage

On The Ballot West Jefferson Levee District Millage

Louisiana Property Taxes By County 2021

10 Louisiana Parishes With The Highest Property Tax Rates 3 Are In Metro New Orleans

10 Louisiana Parishes With The Highest Property Tax Rates 3 Are In Metro New Orleans

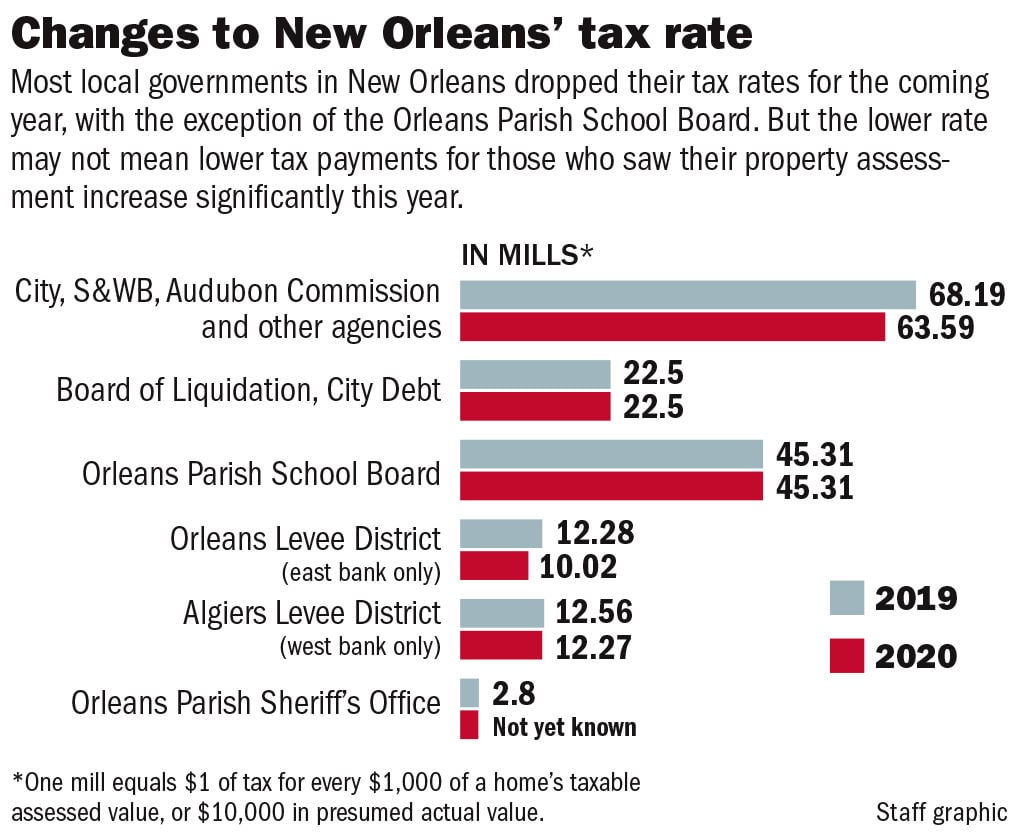

Taxes In New Orleans All But Set Property Owners Can Expect A Slight Dip In Rates Local Politics Nola Com

Taxes In New Orleans All But Set Property Owners Can Expect A Slight Dip In Rates Local Politics Nola Com

Jefferson Parish Assessor S Office Tax Estimate

Https Www Jedco Org Wp Content Uploads 2012 03 Economic Profile Pdf

10 Louisiana Parishes With The Highest Property Tax Rates 3 Are In Metro New Orleans Archive Nola Com

10 Louisiana Parishes With The Highest Property Tax Rates 3 Are In Metro New Orleans Archive Nola Com

Few Increases For 2019 Jefferson Parish Property Tax Rates So Far News Nola Com

Few Increases For 2019 Jefferson Parish Property Tax Rates So Far News Nola Com

2020 Best Places To Buy A House In Jefferson Parish La Niche

2020 Best Places To Buy A House In Jefferson Parish La Niche

Https Jefferson Parish Government Azureedge Net Documents Departments Accounting Comprehensive Annual Financial Reports Cafr2015 Pdf

Louisiana Property Tax Calculator Smartasset

Louisiana Property Tax Calculator Smartasset

Real Estate Property Tax Calculator Southern Title

Real Estate Property Tax Calculator Southern Title

Home Ownership Matters Jefferson Parish Voters Agree To Raise Property Taxes To Increase Teacher Wages Improve Schools

Home Ownership Matters Jefferson Parish Voters Agree To Raise Property Taxes To Increase Teacher Wages Improve Schools

Jefferson Parish Louisiana Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Jefferson Parish Louisiana Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Kenner Sets Property Tax Rates For 2019 Business News Nola Com

Kenner Sets Property Tax Rates For 2019 Business News Nola Com